QUOTE(PJusa @ Oct 19 2015, 11:10 AM)

you need to have their hybrid account. they have 3 tiers standard (0.5% cashback i think), platinium (higher) and premier. CS normal condition is to have 100k with them or be priority customer. nothing else. i used to be priority banking customer with them until i swapped funds because frankly priority banking had zero benefits besides dedicated parking at section 13 to me. i called them complained about the loss in cashback and they suggested based on the spending pattern can change to VI if I want to. But this also gives next to no benefits to me, esp. since only the principal card is entitled for PP entries. do the CS suggested i check with my branch to upgrade the debit card to premier which pays 2% flat for up to max. of 9000 RM. this almost always covers my monthly expenditure and if i want i can retain the CC FOC in case i need it. since my hybrid account normally has enough money and i only use CC for points and CB (now that MAS no longer flies to Germany) this seemed like the best idea after some brainstorming with them this morning. i dont know how flexible they will be but since we spend around 150k every year with their card and have been long term customers they might be willing to cut me some slack. of course i also informed them that i might just switch banks alltogether i they dont cook up a solution for me that i like - my loyalty to a specific bank is next to zero

In that case, I would counter recommend you other solutions which may be a more effective solution for your case.

Deposits/Fixed Deposits

- Consider FD offers from Maybank, Public Bank, RHB Bank and MACH (sub of HongLeong bank). They generally offers >3.5% p.a. return for your FD.

- For MACH, the FD allows early withdrawal which will not affect the undrawn amount. So you get to enjoy high interest FD and flexibility of partial FD withdrawal.

- For PPL, you may consider VI or Signature cards from Maybank that offers not just the principle, but also the supplementary card holders access to PPL, Green Market in Malaysia.

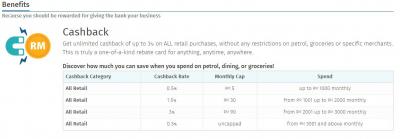

- Maybank Signature card also gives you 5% cashback on groceries and petrol everyday, up to a cap of RM88 per month.

This post has been edited by laymank: Oct 19 2015, 03:00 PM

Jan 22 2015, 02:20 PM

Jan 22 2015, 02:20 PM

Quote

Quote 0.0766sec

0.0766sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled