QUOTE(langstrasse @ Aug 1 2021, 03:12 PM)

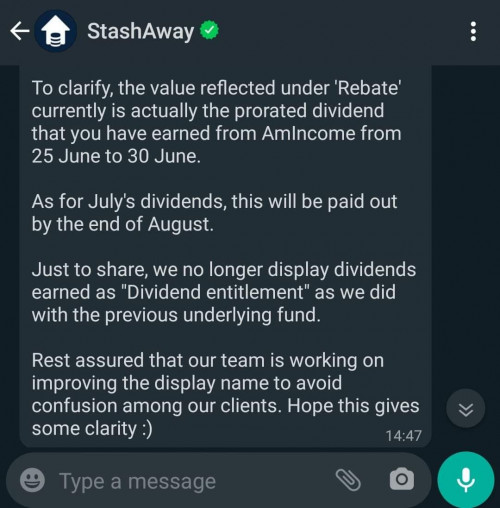

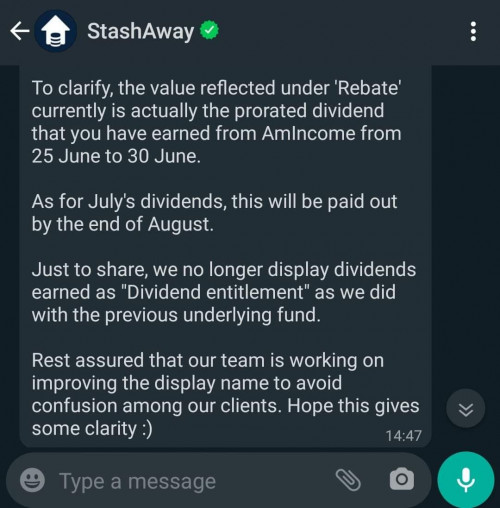

Here's an update regarding July's dividend. Found this on FB. Apparently we'll only get it by the end of August.

This post has been edited by cucumber: Aug 4 2021, 12:01 PM

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Aug 4 2021, 11:59 AM Aug 4 2021, 11:59 AM

Show posts by this member only | IPv6 | Post

#15341

|

Junior Member

821 posts Joined: Jun 2005 |

QUOTE(langstrasse @ Aug 1 2021, 03:12 PM) Here's an update regarding July's dividend. Found this on FB. Apparently we'll only get it by the end of August. This post has been edited by cucumber: Aug 4 2021, 12:01 PM nugget_piece, MUM, and 1 other liked this post

|

|

|

|

|

|

Aug 4 2021, 01:10 PM Aug 4 2021, 01:10 PM

|

Junior Member

932 posts Joined: Jul 2005 |

Very enlightening listening to Amoi talking about stashaway reoptimization. Especially the 14th minute about some special conditions if you have more than 2 house or a car loan... etc.. what amoi deemed as "Hidden Malaysia stashaway portfolio" Oklahoma liked this post

|

|

|

Aug 4 2021, 04:07 PM Aug 4 2021, 04:07 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

QUOTE(DragonReine @ Aug 4 2021, 11:19 AM) This is dangerous. Ironically, the ideal use case for stashaway is for those who do not want to study investing. To say that investing in SAMY = no need to study investing is blind confidence, which is about as intelligent and sensible as playing 4D to win big. You must and should read about SA's approach and their underlying funds for portfolios, and invest in SA if you believe that SA's approach to investments align with your needs and preferences, not just main tikam think past performance = future performance. if you want genuinely mindless investment might as well park in EPF/SSPN, sure guaranteed dividend (whether high or low dividend is another problem lol) EPF/ASNB has currency risk. MYR depreciates you entire net worth tanks. Stashaway can mitigate that. |

|

|

Aug 4 2021, 04:10 PM Aug 4 2021, 04:10 PM

|

All Stars

14,929 posts Joined: Mar 2015 |

QUOTE(honsiong @ Aug 4 2021, 04:07 PM) Ironically, the ideal use case for stashaway is for those who do not want to study investing. EPF/ASNB has currency risk. MYR depreciates you entire net worth tanks. Stashaway can mitigate that. provided one understand and know of the expectations of the SRI he selected... |

|

|

Aug 4 2021, 04:56 PM Aug 4 2021, 04:56 PM

Show posts by this member only | IPv6 | Post

#15345

|

Senior Member

2,193 posts Joined: Feb 2012 |

Mine so far performing worse than EPF... But I give them 3 years to prove themselves jacksonpang liked this post

|

|

|

Aug 4 2021, 05:16 PM Aug 4 2021, 05:16 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(honsiong @ Aug 3 2021, 06:18 PM) Wah Singapore broker war is all out, another robo advisor endowus cut their single fund fee to half. WTF. FIGHT, FIGHT, FIGHT The biggest SG robos are stashaway and endowus currently iirc. Both have > USD 1B AUM. Holy shit, I hope stashaway cut fees also. If SA can 0.4%<= flat fee I might actually give up DIY completely |

|

|

|

|

|

Aug 4 2021, 05:59 PM Aug 4 2021, 05:59 PM

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Aug 4 2021, 06:42 PM Aug 4 2021, 06:42 PM

Show posts by this member only | IPv6 | Post

#15348

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Aug 4 2021, 08:12 PM Aug 4 2021, 08:12 PM

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(honsiong @ Aug 4 2021, 04:07 PM) Ironically, the ideal use case for stashaway is for those who do not want to study investing. This is where it becomes a dividing point between what is "mindless" investing. Making the assumption here that it's investing for long term/retirement instead of medium term of course. EPF/ASNB/SSPN etc. easy enough for the average Malaysian, returns decent enough to live modestly (not luxuriously).EPF/ASNB has currency risk. MYR depreciates you entire net worth tanks. Stashaway can mitigate that. I would advise SA to people who can stomach the risk AND believes SA can do well. For people who are afraid of volatility, not confident of China market, want shariah compliance etc., SA might not be best choice. It's also a question of trust in SA's portfolio composition, like some didn't like gold exposure etc. Ultimately still need to do due diligence, and do some continuous observation over time. Cannot be buta² dump money in expecting to do okay je. |

|

|

Aug 4 2021, 11:32 PM Aug 4 2021, 11:32 PM

Show posts by this member only | IPv6 | Post

#15350

|

Senior Member

3,495 posts Joined: Jan 2003 |

|

|

|

Aug 5 2021, 08:47 AM Aug 5 2021, 08:47 AM

|

Junior Member

53 posts Joined: Sep 2005 |

guys...out of curiosity, since stashaway have the function to view out earning from two type of currency , how do know,how much exactly did we make profit? as sometimes i notice the variation % of profit shows quite a different in both currency

|

|

|

Aug 5 2021, 08:51 AM Aug 5 2021, 08:51 AM

Show posts by this member only | IPv6 | Post

#15352

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Merubin @ Aug 5 2021, 08:47 AM) guys...out of curiosity, since stashaway have the function to view out earning from two type of currency , how do know,how much exactly did we make profit? as sometimes i notice the variation % of profit shows quite a different in both currency I just looked at the MYR. As that should be what I think I will get if I redeem it.Just hope I am right. |

|

|

Aug 5 2021, 09:04 AM Aug 5 2021, 09:04 AM

Show posts by this member only | IPv6 | Post

#15353

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(Merubin @ Aug 5 2021, 08:47 AM) guys...out of curiosity, since stashaway have the function to view out earning from two type of currency , how do know,how much exactly did we make profit? as sometimes i notice the variation % of profit shows quite a different in both currency MYR, because at the end of the day you will sell your equity/ETFs to get back MYR, variation is different because MYR drops, when you sell your equity you earn more MYR. |

|

|

|

|

|

Aug 5 2021, 09:06 AM Aug 5 2021, 09:06 AM

Show posts by this member only | IPv6 | Post

#15354

|

Senior Member

3,495 posts Joined: Jan 2003 |

|

|

|

Aug 5 2021, 09:21 AM Aug 5 2021, 09:21 AM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

ASNB can tank also when the government is incompetant. DragonReine liked this post

|

|

|

Aug 5 2021, 10:54 AM Aug 5 2021, 10:54 AM

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Merubin @ Aug 5 2021, 08:47 AM) guys...out of curiosity, since stashaway have the function to view out earning from two type of currency , how do know,how much exactly did we make profit? as sometimes i notice the variation % of profit shows quite a different in both currency Only MYR matters because that's what you paid with and goes into your bank account.But bear in mind that MYR positive while USD negative is NOT a good thing; that means MYR currency has weakened considerably and your true net worth is likely to be impacted. This post has been edited by DragonReine: Aug 5 2021, 10:57 AM |

|

|

Aug 5 2021, 11:25 AM Aug 5 2021, 11:25 AM

|

Junior Member

527 posts Joined: Aug 2007 From: lost |

Saw the below remarks when updating the Stashaway app on playstore

WHAT’S NEW A release with no new features?! Why aren’t we working harder?! This release just has a few tweaks here and there to improve usability, discoverability, and feedback submissions.But we’ll leave you with a cliffhanger: We’ve got something BIG for you coming very, very, very soon. |

|

|

Aug 5 2021, 12:11 PM Aug 5 2021, 12:11 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(gooroojee @ Aug 4 2021, 06:42 PM) Feb this year, too early to assess... and lump sum has a risk of poor returns if timing is bad... I know Howdy frendo! Welcome to the ATH loss gang, we have about 4 members I think so far. This is the tracking portfolio I made, as you can see, we haven't really went up since February's ATH. For my main portfolio which I have consistently DCA'd daily, I am hovering around only ~2% loss up to last week, which is pretty good considering the China turmoil mess and me recovering the drop from ATH. Last week did drop me down to -7% all of a sudden, I don't really follow the news that much so I am not sure what happened. Keep in mind, everything I've said about is like within 5% - its basically nothing in terms of investing. Anyone that DIY on KWEB/ARK around the same period have suffered at least a 20% drop at the same time. This post has been edited by Hoshiyuu: Aug 5 2021, 12:42 PM |

|

|

Aug 5 2021, 12:19 PM Aug 5 2021, 12:19 PM

|

Junior Member

664 posts Joined: Oct 2017 |

QUOTE(honsiong @ Aug 4 2021, 04:07 PM) Ironically, the ideal use case for stashaway is for those who do not want to study investing. Got to agree to this.EPF/ASNB has currency risk. MYR depreciates you entire net worth tanks. Stashaway can mitigate that. Initially I started SA for this reason. Myr is dropping by the year. International etf pegged to usd at least another safety net. Unless myr decided to appreciate (judging by Malaysian politic turmoil, is highly unlikely) In fact alll the losses is in usd, but myr remain no loss to due to its depreciation. That said, still need to be careful of what SA allocation. Especially for Kweb. YES, everyone says buy the dip, kweb almost 50%, still don't go all in, allocate some to other platform or etf. |

|

|

Aug 5 2021, 02:22 PM Aug 5 2021, 02:22 PM

Show posts by this member only | IPv6 | Post

#15360

|

Junior Member

270 posts Joined: Sep 2019 |

QUOTE(gooroojee @ Aug 4 2021, 06:42 PM) Feb this year, too early to assess... and lump sum has a risk of poor returns if timing is bad... I know QUOTE(Hoshiyuu @ Aug 5 2021, 12:11 PM) Howdy frendo! Welcome to the ATH loss gang, we have about 4 members I think so far. Hi there matesss, lol  This is the tracking portfolio I made, as you can see, we haven't really went up since February's ATH. For my main portfolio which I have consistently DCA'd daily, I am hovering around only ~2% loss up to last week, which is pretty good considering the China turmoil mess and me recovering the drop from ATH. Last week did drop me down to -7% all of a sudden, I don't really follow the news that much so I am not sure what happened. Keep in mind, everything I've said about is like within 5% - its basically nothing in terms of investing. Anyone that DIY on KWEB/ARK around the same period have suffered at least a 20% drop at the same time.  |

| Change to: |  0.0310sec 0.0310sec

0.65 0.65

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 06:56 PM |