Can see USD and MYR vast difference in my portfolio 😅 Whatever I invested in past 6 months grown weaker in MYR compared to USD growth

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Dec 11 2020, 09:56 PM Dec 11 2020, 09:56 PM

Return to original view | Post

#1

|

Senior Member

2,610 posts Joined: Aug 2011 |

Can see USD and MYR vast difference in my portfolio 😅 Whatever I invested in past 6 months grown weaker in MYR compared to USD growth

|

|

|

|

|

|

Dec 16 2020, 12:53 PM Dec 16 2020, 12:53 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Dec 16 2020, 01:02 PM Dec 16 2020, 01:02 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(GrumpyNooby @ Dec 16 2020, 12:55 PM) This is under Transfer menu not under Withdrawal menu. Ah yea, I asked before, they classify as transfer because it's "within" SA, so it's technically transfering between portfolios since Simple is another investment portfolio, just low risk. IDK if it's different for Singapore version, but Malaysia version is like this.When I did a full withdrawal request, it only allows to go the designated bank account. Withdraw then is direct to bank account le. This post has been edited by DragonReine: Dec 16 2020, 01:02 PM |

|

|

Dec 16 2020, 01:06 PM Dec 16 2020, 01:06 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Dec 17 2020, 03:08 PM Dec 17 2020, 03:08 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(necrox77 @ Dec 17 2020, 02:56 PM) I just opened 6.5% portfolio for short term investment (7 month) and withdraw it. Anyone can share your 6.5% result? Hmm, 7 months is really not great for investment regular SA portfolios regardless of risk index because unit values can change a lot during 7 months and it's not long enough to really see the effects of compound interest. Did you manage to get any profit?Is it better to put into my 16% only portfolio than take it out when the time I need it or just put it in StashAway simple. Initial investment is around Rm4k. Thank you in advance if you want to withdraw in less than two years and use it for something, better to save in Simple, at least it's better than most fixed deposit. If you REALLY want to take risk you can invest in 16% portfolio, but chances of making a loss within that short period of time is quite high, which is not good if you're planning to pay for something using that money. This post has been edited by DragonReine: Dec 17 2020, 03:14 PM Quazacolt and WhitE LighteR liked this post

|

|

|

Dec 18 2020, 11:24 AM Dec 18 2020, 11:24 AM

Return to original view | IPv6 | Post

#6

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(backspace66 @ Dec 17 2020, 07:02 PM) Better check all the transaction in your portfolio especially the last few weeks, seems like some weird stuff is going on where they are selling the same ETF on one day only to buy it again the next day at HIGHER price. So far my transaction normal, no fast sell/buy like you mentioned, my units owned still tally (no changes in no. of units).What did their customer service say to you? |

|

|

|

|

|

Dec 18 2020, 02:57 PM Dec 18 2020, 02:57 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(kabal82 @ Dec 18 2020, 11:59 AM) may i know whether "Auto re-optimisation" is recommended or not? If you want to make it as passive as possible and don't want to think too hard. Spend less time to check and re-optimizate your portfolio.at the moment, the default is enabled I have it auto enabled and it only re-optimizated once earlier this year for me for a few portfolios. SA generally doesn't re-optimizate too often, because with currency changes and you'll lose money in long run. This post has been edited by DragonReine: Dec 18 2020, 04:55 PM |

|

|

Dec 18 2020, 04:54 PM Dec 18 2020, 04:54 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(tsutsugami86 @ Dec 18 2020, 03:38 PM) SAMY always do rebalance (if you continue DCA, they can rebalance your portfolio during purchase of ETF), only re-optimisation once earlier this year. QUOTE(GrumpyNooby @ Dec 18 2020, 04:13 PM) My mistake, sorry 😅😅 I meant re-optimization.https://www.stashaway.my/r/rebalancing-reop...on-at-stashaway |

|

|

Dec 26 2020, 09:27 PM Dec 26 2020, 09:27 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

2,610 posts Joined: Aug 2011 |

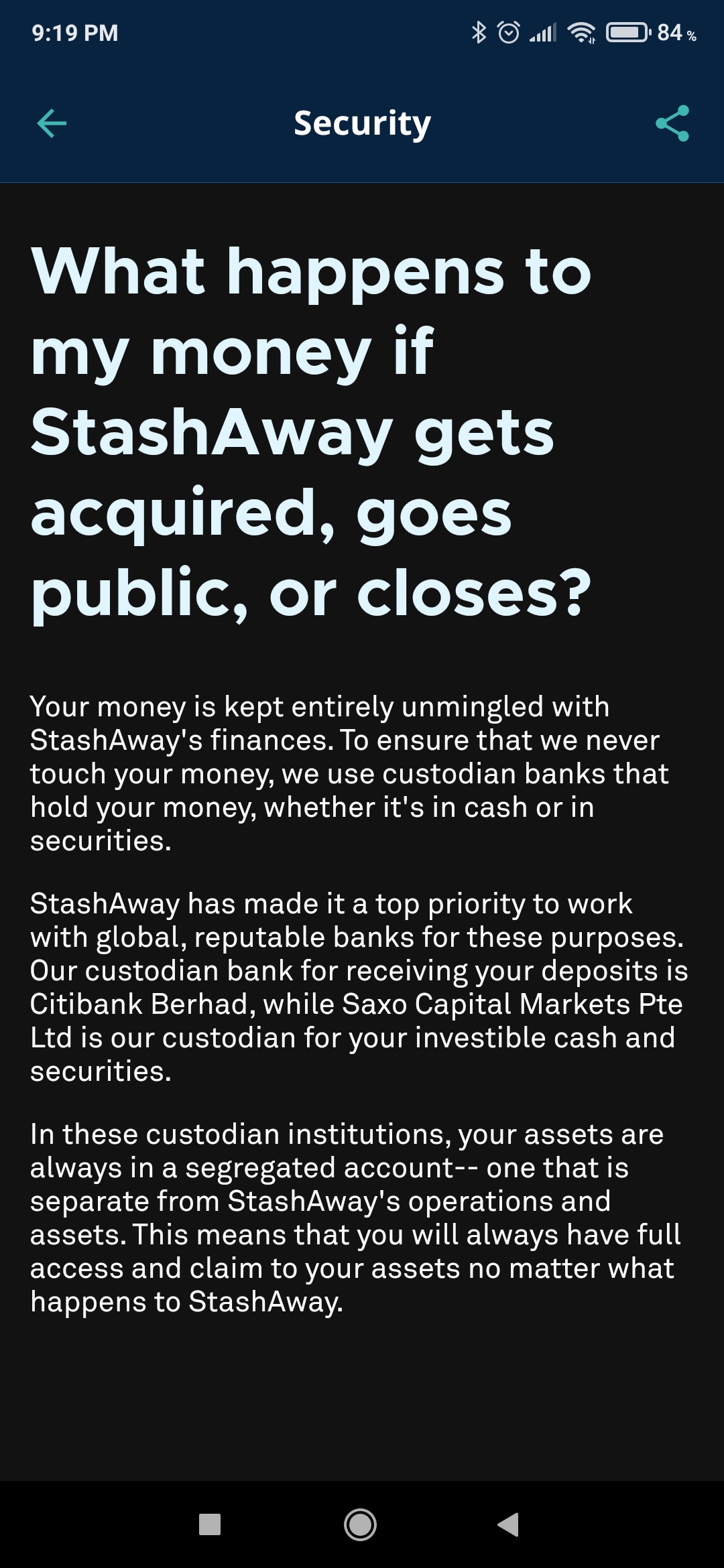

QUOTE(Oklahoma @ Dec 26 2020, 12:39 PM) Ok apologies. Anyhow how's your experience with stashaway? I put 36% risk, so far so good. PIDM only protects savings and current account deposits. Investments aren't protected, I placed all my hard earned money in stashaway, is it wise? SA if closed or acquired, their trustee will "refund" to you by selling your units and returning the value to you.  Investment in only high risk portfolio is risky, that's all. You won't lose all your money, but you must be prepared that if one day you need to withdraw money and that portfolio isn't doing well, you may lose a significant percentage of what you've invested. If you're going to invest only in the 36% portfolio, it may require several years before you see any significant gains as compound interest works its magic. This post has been edited by DragonReine: Dec 30 2020, 10:18 PM |

|

|

Dec 30 2020, 10:15 PM Dec 30 2020, 10:15 PM

Return to original view | Post

#10

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Jan 13 2021, 03:53 PM Jan 13 2021, 03:53 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(ironman16 @ Jan 13 2021, 03:43 PM) :confused: :confused: :confused: This one is 10th Jan update.mine just updated 5 minute ago What's New - Liked dark mode? We just went even darker with AMOLED. It's available if you're feeling adventurous and experimental with true blacks. - Many of you wanted to know the status of your deposits. We can't say we blamed you. So this update should make things a bit clearer. |

|

|

Jan 15 2021, 11:43 AM Jan 15 2021, 11:43 AM

Return to original view | IPv6 | Post

#12

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Jan 15 2021, 11:46 AM Jan 15 2021, 11:46 AM

Return to original view | IPv6 | Post

#13

|

Senior Member

2,610 posts Joined: Aug 2011 |

based on observation, SAMY are relatively conservative traders, so unless they see solid data that can convince them to invest in BTC, they most likely won't put it in their products

|

|

|

|

|

|

Jan 15 2021, 11:56 AM Jan 15 2021, 11:56 AM

Return to original view | IPv6 | Post

#14

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(GrumpyNooby @ Jan 15 2021, 11:48 AM) The TLDR version of government stance on crypto+digital gold is that1) it's not recognised as legal tender (i.e. can't use it as official medium of payment) 2) it's NOT illegal (means they allow you to trade/invest/mine crypto) no indication that it'll be banned in Malaysia so far |

|

|

Jan 21 2021, 07:53 PM Jan 21 2021, 07:53 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Jan 29 2021, 11:31 AM Jan 29 2021, 11:31 AM

Return to original view | IPv6 | Post

#16

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(GrumpyNooby @ Jan 29 2021, 10:18 AM) DCA is mostly a psychological trick to make you less emotional about ups and downs in market Some people are scared about investing in one large lump sum because of the risks and scared of sudden drop. Then DCA may reduce that anxiety. Some people don't want to think about timing the market, so they use DCA to make things automated. Although mathematically and real-world observation shows that lump sum, on average, gives better returns than DCA, some people cannot or will not take that what they may view as a giant risk. Both get you to your goals if you give your investments enough time, just one might be slower than the other. This post has been edited by DragonReine: Jan 29 2021, 11:32 AM joshtlk1 liked this post

|

|

|

Jan 29 2021, 01:48 PM Jan 29 2021, 01:48 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(KingArthurVI @ Jan 29 2021, 01:23 PM) I opened an account and deposited some money a few days ago, I just noticed my current weight for my portfolio is weighted 100% towards cash in USD. How many days does it normally take for SA to fully invest this cash into the assets shown in the pie chart? Thanks. 1-2 business days after that cash has been converted to USD for investment portfolioThis post has been edited by DragonReine: Jan 29 2021, 01:50 PM KingArthurVI liked this post

|

|

|

Feb 3 2021, 07:21 PM Feb 3 2021, 07:21 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(rexus @ Feb 3 2021, 07:11 PM) How would StashAway compare with investing in ETFs directly via a broker? StashAway main selling point is how little thinking power is required, provided you trust StashAway management+AI technology Just thinking out loud: StashAway charges 0.8% annual fee (for first RM50,000) while some ETFs (VTI, VOO) have low expense ratio in the region of 0.04%. StashAway annual fee seems to absorb all transaction charges while independent investment will be subject to brokerage fee, etc. Flexibility in terms of choice of ETFs, of course you can't choose what you hold in StashAway. Prior work needed, more due diligence would be required for independent investments. If you have direct access to ETFs in USA via a brokerage, would you still go with StashAway? personally I choose StashAway precisely because easy to get diverse portfolio with US exposure without the need to choose and pick individual ETFs, and fees are relatively low |

|

|

Feb 3 2021, 11:24 PM Feb 3 2021, 11:24 PM

Return to original view | Post

#19

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(123azerty @ Feb 3 2021, 11:07 PM) Hi, I am new to StashAway because I’m starting to think about personal finance planning. Would anyone open to share how much (%) of your salary you save in fd/bank and how much (%) of your salary you put into StashAway... 10% conditional high interest savings account, 20% in StashAway. Bonuses/extra money all goes to StashAway.Thanks a lot! I also invest in UTs through EPF. |

|

|

Feb 3 2021, 11:26 PM Feb 3 2021, 11:26 PM

Return to original view | Post

#20

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Daniel Joseph @ Feb 3 2021, 11:22 PM) I just created stashaway account but I cannot pick the high risk portfolio (risk level 36) because the system has deemed your profile unsuitable. They will most likely ask you to go through their academy module on personal financing and investment basics on SAMY app. Have to watch the videos before they allow change on Malaysia app.I already email them to change it to high risk, will they change it? This post has been edited by DragonReine: Feb 3 2021, 11:26 PM |

| Change to: |  0.4243sec 0.4243sec

0.53 0.53

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 06:36 PM |