Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jul 21 2020, 08:21 PM Jul 21 2020, 08:21 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

269 posts Joined: Sep 2019 |

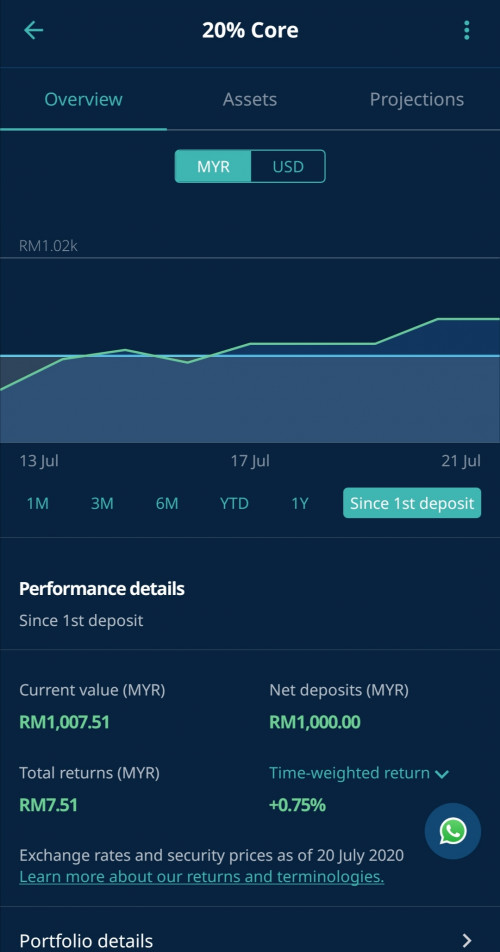

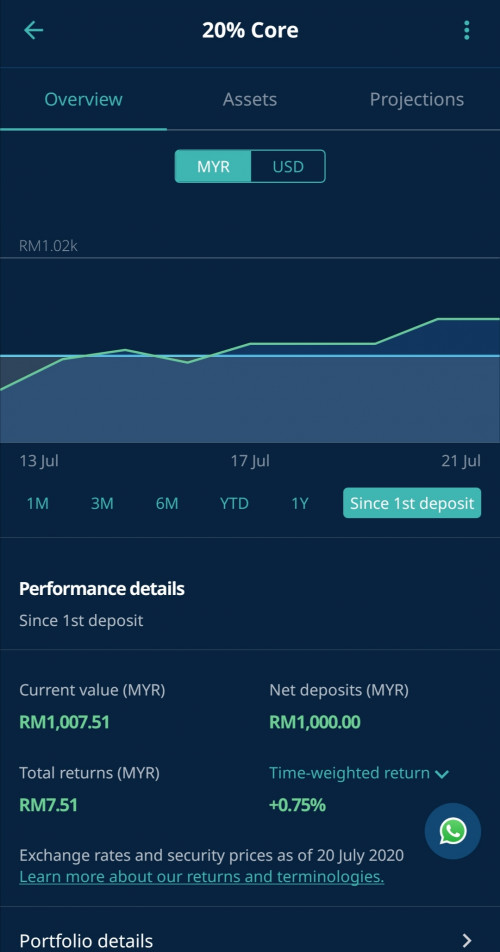

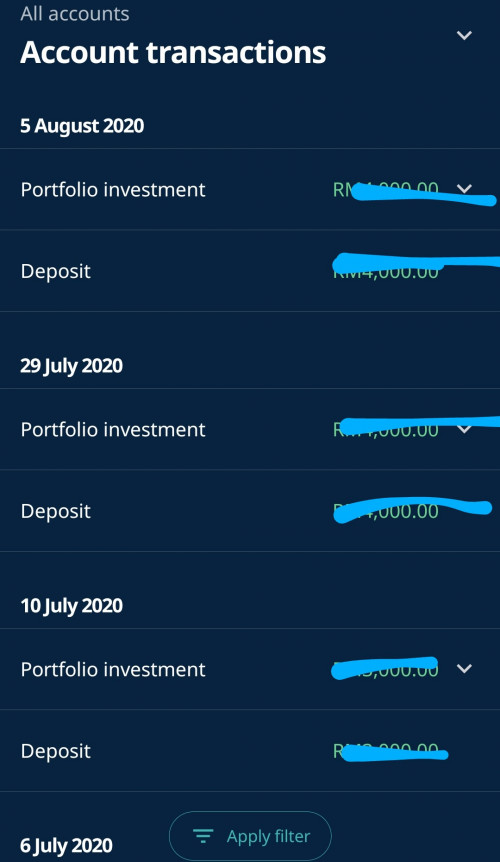

Hi all sifu, newbie here who just joined for 1 week.. so far feeling satisfying.. and planned to have direct debit few hundred every month afterward, accumulate and wait 5 years and see the outcome.. but I wanted to ask, let say if right now I want to withdraw all the amount I have (pic below), does it mean I might get less than my initial deposit amount because of conversion rate, charges, etc? Thanks in advance!

|

|

|

|

|

|

Jul 21 2020, 09:23 PM Jul 21 2020, 09:23 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(gundamsp01 @ Jul 21 2020, 09:15 PM) alot of factors need to be considered. Thanks for replying. Yes, i fully understand that definitely not receiving fully 1007 but isit possible to say, maybe up to 2% difference less than the current value, or maybe even more (and unpredictable) because when we place for withdrawal, it might take many hours to really sell off all assets?the value during the ur assets being sold, the conversion rate after they receive the payment from selling ur assets. even if SA stated that ur current value is 1007, it doesn't mean u can receive 1007 when it reaches ur acc |

|

|

Jul 21 2020, 09:27 PM Jul 21 2020, 09:27 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

269 posts Joined: Sep 2019 |

|

|

|

Jul 27 2020, 04:59 PM Jul 27 2020, 04:59 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

269 posts Joined: Sep 2019 |

holysxxt, I immediately removed my scheduled direct debit after saw your guys info. looks like better do it manually just to avoid these kind of things happened

|

|

|

Jul 27 2020, 05:26 PM Jul 27 2020, 05:26 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

269 posts Joined: Sep 2019 |

|

|

|

Jul 28 2020, 09:34 AM Jul 28 2020, 09:34 AM

Return to original view | IPv6 | Post

#6

|

Junior Member

269 posts Joined: Sep 2019 |

I seems like many people here still don't understand once you gave authorization for direct debit, it will never be stopped or flagged. It's the same theory for the paypal "scam" that existed for years.. you linked bank account to PayPal for convenient, then paypal kene hacked or what, they will just drain your bank account by using auto debit. you won't even receive any email for it and won't realize anything until you check your bank account.

|

|

|

|

|

|

Jul 29 2020, 04:00 PM Jul 29 2020, 04:00 PM

Return to original view | Post

#7

|

Junior Member

269 posts Joined: Sep 2019 |

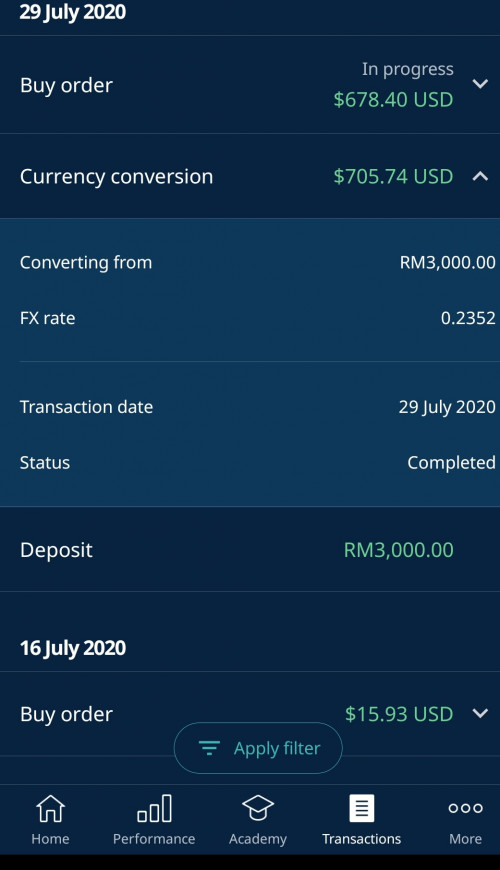

QUOTE(JLJQ @ Jul 29 2020, 02:22 PM) Hey guys, how long does it usually take for JomPay funds to reach our SA account? First time using JomPay since they have suspended direct debit feature for now. 7th July (Tues) - Jompay-ed8th July (Wed) - SA notify fund received 13th July (Mon) - Conversion + buy order |

|

|

Jul 30 2020, 10:18 AM Jul 30 2020, 10:18 AM

Return to original view | IPv6 | Post

#8

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(jacksonpang @ Jul 29 2020, 04:00 PM) 7th July (Tues) - Jompay-ed This time8th July (Wed) - SA notify fund received 13th July (Mon) - Conversion + buy order 28th July (Tues) - Jompay-ed 29th July (Wed) - SA emailed that received fund + conversion 30th July (Thu) - done buy order. This post has been edited by jacksonpang: Jul 30 2020, 10:28 AM |

|

|

Jul 30 2020, 12:26 PM Jul 30 2020, 12:26 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(tiramisu83 @ Jul 30 2020, 12:02 PM) QUOTE(Yzarc @ Jul 29 2020, 02:38 PM) For my case (Check on transactions tab): 10th June Deposit fund 11th June Received on SA 17th June Conversion + buy order QUOTE(jacksonpang @ Jul 29 2020, 04:00 PM) 7th July (Tues) - Jompay-ed 8th July (Wed) - SA notify fund received 13th July (Mon) - Conversion + buy order QUOTE(backspace66 @ Jul 29 2020, 08:48 PM) If anyone is curious, i managed to transfer by jom pay yesterday night, and the fund is transferred to SA this morning and the buy order is already in que for today. Just to clarify, the two previous transaction is slower by one working day. All other transaction was this fast except with those previous two.  QUOTE(jacksonpang @ Jul 30 2020, 10:18 AM) |

|

|

Aug 5 2020, 11:11 AM Aug 5 2020, 11:11 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

269 posts Joined: Sep 2019 |

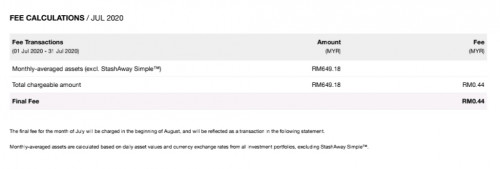

QUOTE(XHunTerx123 @ Aug 5 2020, 10:10 AM) Is this the fee been charged? Is alot For your referenceSorry because i'm new. Those fee already eat most of my primary money  XHunTerx123 liked this post

|

|

|

Aug 5 2020, 11:31 AM Aug 5 2020, 11:31 AM

Return to original view | IPv6 | Post

#11

|

Junior Member

269 posts Joined: Sep 2019 |

|

|

|

Aug 5 2020, 11:44 AM Aug 5 2020, 11:44 AM

Return to original view | IPv6 | Post

#12

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(encikbuta @ Aug 5 2020, 11:24 AM) I got a reply for my query on StashAway's fee. Hope this helps you guys as well because it sure did for me Which means for 1M amount, the effective annual fee rate is actually 0.49%Question (by Me): I have deposited a total of RM 46,500 in my account and it is currently valued at RM 53,200. Based on your pricing schedule here, am I already entitled for the discounted annual fee rate of 0.7%? Answer (from StashAway): Thanks for reaching out! To clarify, the annual fee rate is applied on a tiered basis i.e. - 0.8% for your first RM50,000 - 0.7% for the remaining RM3,200 Just calculated using phone calculator, lol.. |

|

|

Aug 5 2020, 11:54 AM Aug 5 2020, 11:54 AM

Return to original view | IPv6 | Post

#13

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(encikbuta @ Aug 5 2020, 11:24 AM) I got a reply for my query on StashAway's fee. Hope this helps you guys as well because it sure did for me Question (by Me): I have deposited a total of RM 46,500 in my account and it is currently valued at RM 53,200. Based on your pricing schedule here, am I already entitled for the discounted annual fee rate of 0.7%? Answer (from StashAway): Thanks for reaching out! To clarify, the annual fee rate is applied on a tiered basis i.e. - 0.8% for your first RM50,000 - 0.7% for the remaining RM3,200 QUOTE(yeeck @ Aug 5 2020, 11:48 AM) Thanks. The fees are charged on the amount deposited and not on the current value in the portfolio, right? |

|

|

|

|

|

Aug 6 2020, 10:24 PM Aug 6 2020, 10:24 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

269 posts Joined: Sep 2019 |

Hello, here is SAMY not insurance thread leh.

|

|

|

Aug 7 2020, 10:36 AM Aug 7 2020, 10:36 AM

Return to original view | IPv6 | Post

#15

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(backspace66 @ Aug 7 2020, 09:24 AM) A bit inconsistent for me,. Previous week, jom pay on 28th (night) and deposit in SA on 29th and invested (buy order executed) on the same day. Fuiyooo… your block very cincai, hahahahaAs for this week, jom pay on wednesday (morning) and the deposit appear on the same day but buy order only executed on Thursday. So my experience has always been like this in SA. A bit inconsistent but fast enough.  |

|

|

Aug 7 2020, 09:08 PM Aug 7 2020, 09:08 PM

Return to original view | IPv6 | Post

#16

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(bourse @ Aug 7 2020, 08:52 PM) I do use yahoo finance to check, there is small diff like 10 cents compare with SAMY (excl 1% cash). I did checked mine on google finance, no difference oh..have you track every single transaction follow like SAMY buy order unit and price? for a quick check: Yahoo finance > My Portfolio > My Watchlist > My Holdings > GLD > MARKET VALUE SAMY > Portfolios > My investment > Assets > Gold > Value (USD) MARKET VALUE and Value (USD) SHOULD be same figure. |

|

|

Dec 1 2020, 11:13 AM Dec 1 2020, 11:13 AM

Return to original view | IPv6 | Post

#17

|

Junior Member

269 posts Joined: Sep 2019 |

I'm just a newbie, any pro willing to share what's happening in the market this few months?

What I experienced is SA not performing since July (the month i joined) till now. Another huge drop today, so now back to negative. |

|

|

Dec 1 2020, 11:31 AM Dec 1 2020, 11:31 AM

Return to original view | IPv6 | Post

#18

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(Xenopher @ Dec 1 2020, 11:20 AM) You shouldn't judge the performance in so short time. Just DCA consistently and come back in few years time. At that time any 'huge drop' or 'huge increase' today will looks like nothing but a small bump. Understood that, been DCA 200 every week up till now, will still continue and observe anyway. Just curious how or when they will decide it's a good time for optimization. GLD is 20% of the portfolio and it lost 10% over last three months aka whole quarter already. JackMao liked this post

|

|

|

Dec 1 2020, 04:53 PM Dec 1 2020, 04:53 PM

Return to original view | IPv6 | Post

#19

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(WhitE LighteR @ Dec 1 2020, 11:55 AM) Your timing is unfortunate. I see. Thanks for the info. Seems like under some circumstances, "time the market" still have its own benefit. Nevermind then, i will still continue DCA and see how's the performance after 1 year.If u came in Apr or 2019 u will have a different view. In any case, investment should always be long term. Market has been trending sideways for past 3 months. Only starts to turn around in Nov. Gold is a hedge. So its moving opposite of risk on equity is not surprising. |

|

|

Dec 1 2020, 05:39 PM Dec 1 2020, 05:39 PM

Return to original view | IPv6 | Post

#20

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(lee82gx @ Dec 1 2020, 05:04 PM) relax, This is a long run. No, "Time the market" extremely useful if you think all you want to do is make 5, 10 or 20% and then cabut. But it is not repeatable. Even 1 year is too short, lah! The advise is to invest more than 3 years. But, yeah it is ok to monitor regularly and make corrections. Heck, I check my stashaway every day once or twice. Not that it changes my strategy or anything. Its just so convenient. My returns have also been eroded due to USD drop and minor corrections in the "Street". None of this changes anything, because : 1. Do you see a better thing out there? 2. Do I need to use the money? So those 2 are my criterias for exiting. QUOTE(Xenopher @ Dec 1 2020, 05:08 PM) 'Time the market' can only outperform 'Time in the market' if you can consistently 'Time the market' correctly, which historically no human managed to do so. Thanks for the sharing! I think I gained some knowledge from you two's reply. Tqvm.Just imagine if we are all now back to April time, most of the people would still cashing out all investments because most feared the market would drop further. Even if some invest during that time, a lot of people cashed out during May/June because many were seeing it as bull trap. You can look back those older posts yourself, whether in this thread or other investment forums/thread. Realistically no one can always time the market correctly. There are a lot of studies on this topic, and the finding is that even if we can time the market correctly most of the time, timing it wrong a few times already can make us underperformed compared to consistent DCA. |

| Change to: |  0.5705sec 0.5705sec

0.49 0.49

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 05:40 AM |