Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

soulreap

|

Sep 30 2025, 02:10 PM Sep 30 2025, 02:10 PM

|

New Member

|

Just want to ask opinion, I currently have ~5k in SRI 12% general portfolio. With the upcoming 8% SST on management fee in October, is it still worth to keep it there? Or would recommend to take out and put somewhere else?

This post has been edited by soulreap: Sep 30 2025, 02:10 PM

|

|

|

|

|

|

MUM

|

Sep 30 2025, 03:23 PM Sep 30 2025, 03:23 PM

|

|

QUOTE(soulreap @ Sep 30 2025, 02:10 PM) Just want to ask opinion, I currently have ~5k in SRI 12% general portfolio. With the upcoming 8% SST on management fee in October, is it still worth to keep it there? Or would recommend to take out and put somewhere else? What was the management fees rate (in %) before? If the previous rate was 0.8%, now + 8% = 0.864%? If yes, this 0.064% more expenses will made it not worth to continue with what you had been doing? |

|

|

|

|

|

onthefly

|

Oct 1 2025, 12:00 AM Oct 1 2025, 12:00 AM

|

|

QUOTE(soulreap @ Sep 30 2025, 02:10 PM) Just want to ask opinion, I currently have ~5k in SRI 12% general portfolio. With the upcoming 8% SST on management fee in October, is it still worth to keep it there? Or would recommend to take out and put somewhere else? can you share why u choose low SRI ? |

|

|

|

|

|

viktorherald

|

Oct 29 2025, 08:11 PM Oct 29 2025, 08:11 PM

|

Getting Started

|

Retrying my fortune in Stashaway, withdraw all since 2021

|

|

|

|

|

|

Jason

|

Oct 30 2025, 12:06 PM Oct 30 2025, 12:06 PM

|

|

Anybody put money in Simple? Does it give the % as indicated? Or its BS only

|

|

|

|

|

|

Relianne

|

Oct 30 2025, 12:29 PM Oct 30 2025, 12:29 PM

|

Getting Started

|

QUOTE(Jason @ Oct 30 2025, 12:06 PM) Anybody put money in Simple? Does it give the % as indicated? Or its BS only Yes been using Simple for a while now. I’d say returns are as per projected if not slightly higher. My October month return including dividend entitlement and rebates total to c. 3.59% p.a. Dividends typically paid out first half of the month. |

|

|

|

|

|

onthefly

|

Oct 31 2025, 12:43 AM Oct 31 2025, 12:43 AM

|

|

QUOTE(Jason @ Oct 30 2025, 12:06 PM) Anybody put money in Simple? Does it give the % as indicated? Or its BS only There are better MMF out there with higher %. Stashaway rate is comparable but justt slower But currently they have some promo for MMF |

|

|

|

|

|

Jason

|

Oct 31 2025, 10:28 AM Oct 31 2025, 10:28 AM

|

|

QUOTE(onthefly @ Oct 31 2025, 12:43 AM) There are better MMF out there with higher %. Stashaway rate is comparable but justt slower But currently they have some promo for MMF Which better mmf? |

|

|

|

|

|

buffa

|

Oct 31 2025, 11:58 AM Oct 31 2025, 11:58 AM

|

|

QUOTE(viktorherald @ Oct 29 2025, 08:11 PM) Retrying my fortune in Stashaway, withdraw all since 2021 May I know why go into Stashaway again? Why not use FSMOne diy RSP ETF? |

|

|

|

|

|

viktorherald

|

Oct 31 2025, 12:18 PM Oct 31 2025, 12:18 PM

|

Getting Started

|

QUOTE(buffa @ Oct 31 2025, 11:58 AM) May I know why go into Stashaway again? Why not use FSMOne diy RSP ETF? Actually I have footing in FSMOne but only in unit trust. How is your experience in the ETF side? |

|

|

|

|

|

buffa

|

Oct 31 2025, 12:28 PM Oct 31 2025, 12:28 PM

|

|

QUOTE(viktorherald @ Oct 31 2025, 12:18 PM) Actually I have footing in FSMOne but only in unit trust. How is your experience in the ETF side? ETF itself is great. Now we can RSP into various good and popular ETF in FSMOne, it is even better. You can try with some small amount with those popular ETF if you never invest before. It will be better than unit trust. |

|

|

|

|

|

Relianne

|

Nov 2 2025, 06:00 AM Nov 2 2025, 06:00 AM

|

Getting Started

|

QUOTE(buffa @ Oct 31 2025, 12:28 PM) ETF itself is great. Now we can RSP into various good and popular ETF in FSMOne, it is even better. You can try with some small amount with those popular ETF if you never invest before. It will be better than unit trust. MooMoo seems like a good option for ETFs? No fee and RSP also possible |

|

|

|

|

|

Medufsaid

|

Nov 2 2025, 08:01 AM Nov 2 2025, 08:01 AM

|

|

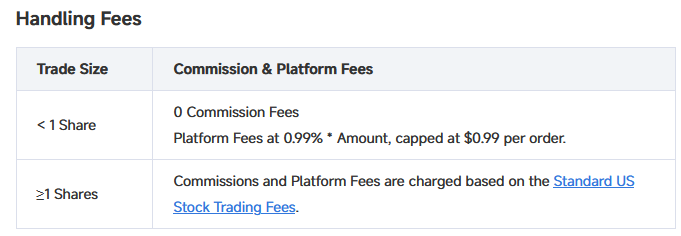

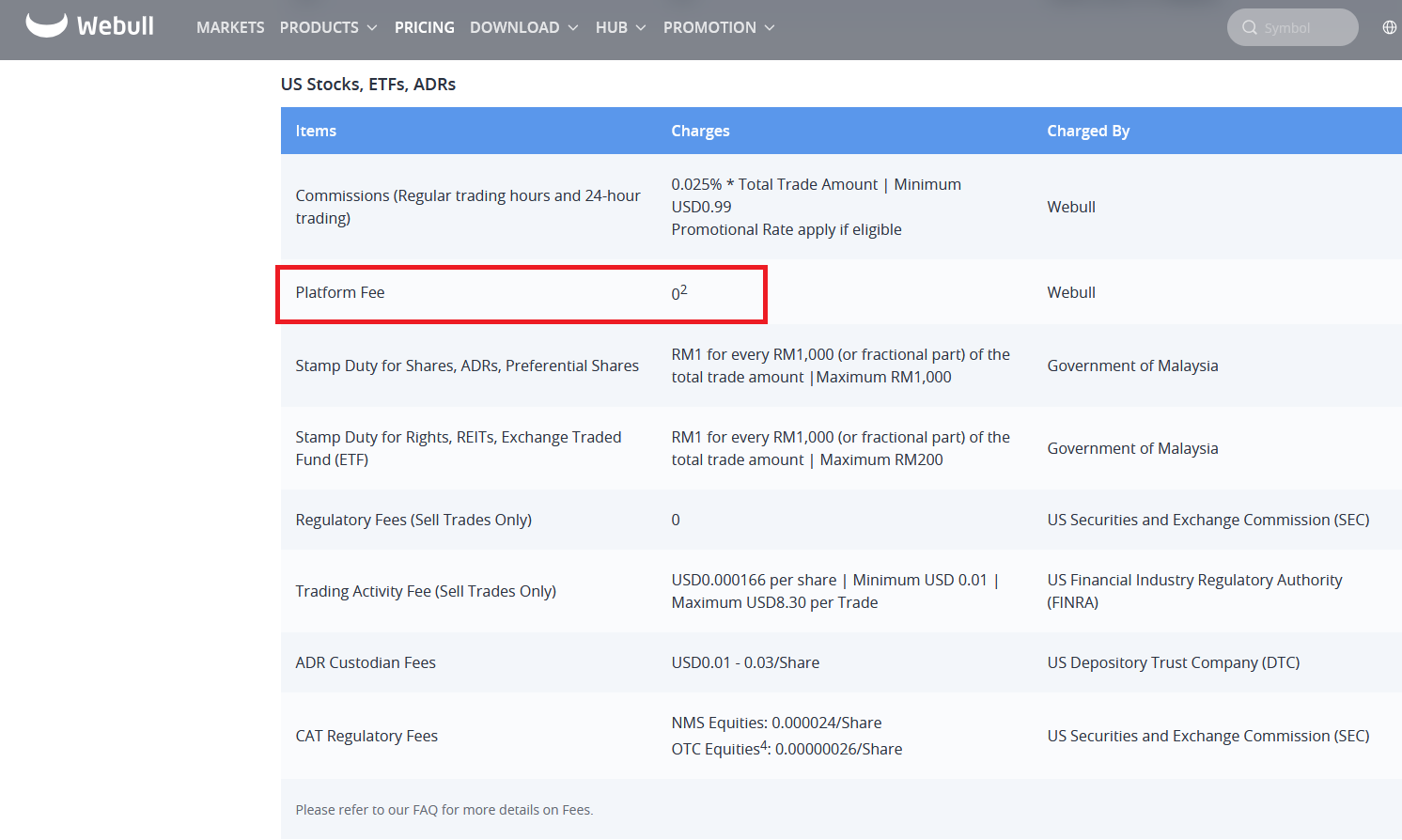

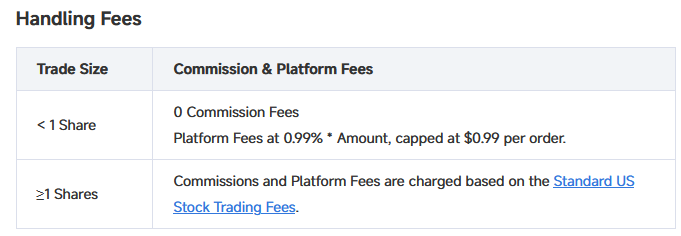

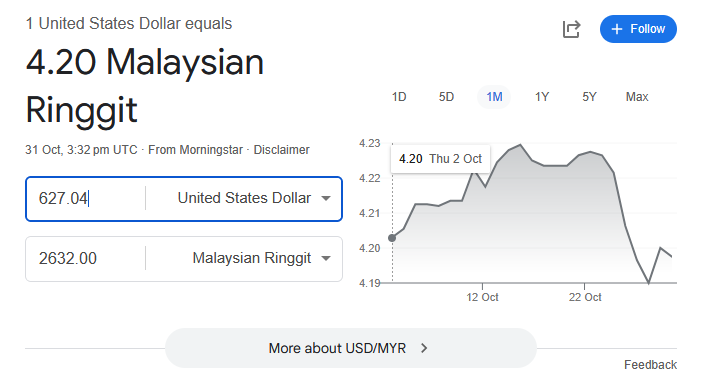

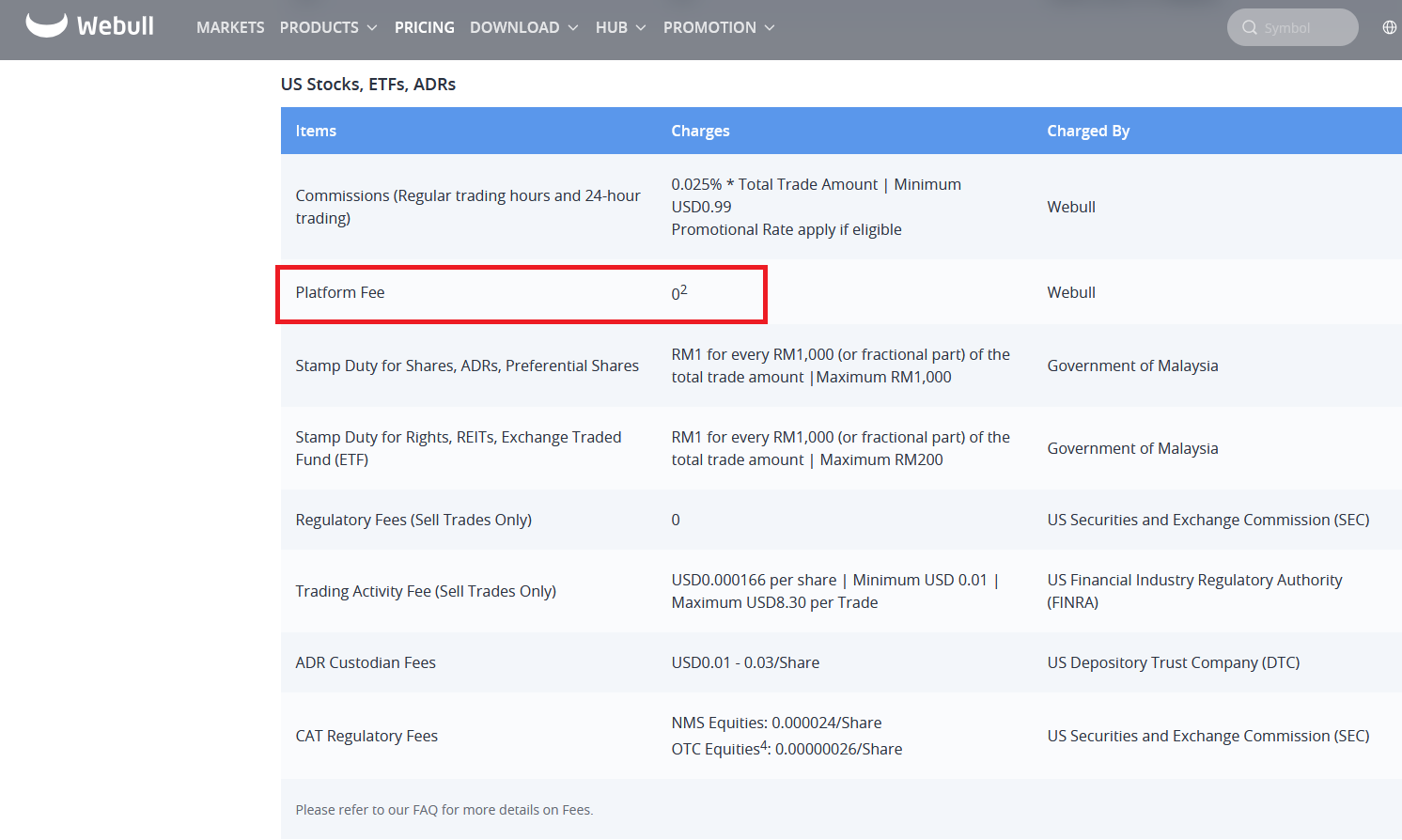

Relianne in moomoo there's "commission-commission" fee and "platform-commission" fee https://www.moomoo.com/my/support/topic9_217 . and also malaysian stamp duty.  very easy to disqualify yourself from the <1 share promo » Click to show Spoiler - click again to hide... « compare it with webull malaysia  This post has been edited by Medufsaid: Nov 2 2025, 08:18 AM This post has been edited by Medufsaid: Nov 2 2025, 08:18 AM

|

|

|

|

|

Sep 30 2025, 02:10 PM

Sep 30 2025, 02:10 PM

Quote

Quote

0.0253sec

0.0253sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled