QUOTE(soul78 @ Aug 3 2021, 11:57 AM)

Nothing in life has no risk???.. and nothing is guaranteed except death and taxes...

If you can't accept the risk, then go and get real psychical gold and keep in your secret hideout. That also there is a risk of people finding out where you stash it.

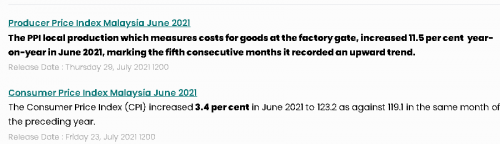

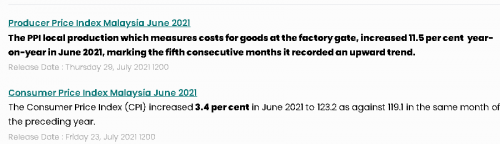

latest department of stats for June 2021 shows the CPI has raised... which is a general indicator for inflation as well.

Money market funds usually I use it to park temporary millions of dollars if at the moment i dont know what to do or where to allocate my funds and positions... i don't use it for long term as an investment tool.

if you want low risk... just reinvest back into EPF... whatever additional money you have... or any PRS savings scheme..

Me and wifey has been using stashaway and with proper DCA and risk portfolio... you can earn a good 12% APY above.. on time weighted returns... which to us is good enough..

Again this are risks which we're willing to take.. main thing is to diversify and not put all your eggs into one basket...

QUOTE(MUM @ Aug 3 2021, 12:03 PM)

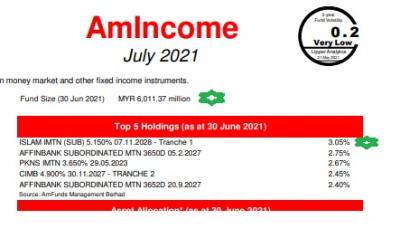

big chuck or not, depends on the max % of value the fund are allowed by its mandate to hold a particular debt papers.

and also how much % of the total probable income of the rest of the holdings to cover that defaulted papers...

example,...if the value of the defaulted papers is 40 million,

if the income of the rest of the holdings in that fund can covers 99% of it, then it is not big...

you need to calculates the total income of that fund from the annual/financial reports, then calculates the value in the top debt papers to determine if it is a big chuck or not....

btw, this big chuck or not is also subjective to many others,.....a 1% can be a big numbers to you but others may only says BIG if it is 10% (for they will see the rating of it too)....

annual report

https://www.aminvest.com/OurFunds/UnitTrust...rt/AmIncome.pdfQUOTE(lee82gx @ Aug 3 2021, 12:04 PM)

If you are lazy, then no one can help you. Its like learning to swim online.

No, many here who are successful actually have plenty of avenues to invest, including brokerage accounts to go for individual stocks, and even options, futures trading.

Another extreme example is using the Simple, which is actually classified as parking facility - yes, like parking your car in the parking lot while the operator pays you some money for the temporary use of your car. It can crash or suffer some dings, but usually it works out beneficial for both parties.

But ultimately your car (or your cash) if you park it there permanently will only ever get the 2.4% at most. If that is your idea of comfortable return then by all means go for it.

For most of us, it is just a side benefit while DCA or cash out from broad based ETF investment, which in the past can be from negative to 17-20% per annum returning.

QUOTE(MUM @ Aug 3 2021, 12:10 PM)

why put in SIMPLE when there is SSPN.

historical CAGR of SSPN had been BETTER than Simple....

Deposits in SSPN are guaranteed by Govt while SIMPLE has no guarantee of anything from anyone but fees from Amincome

Aug 3 2021, 11:15 AM

Aug 3 2021, 11:15 AM

Quote

Quote

0.0324sec

0.0324sec

0.38

0.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled