Transactions incurred will be converted to Ringgit Malaysia using US Dollars as the base currency on the date the item is received and/or processed at such exchange and at such time as may be determined by VISA International/MasterCard Worldwide at its absolute discretion plus administration cost which is to be imposed by the card issuing bank. The exchange may differ from the rate in effect on the date of the transaction due to market fluctuations. Such rate imposed shall be final and conclusive and the Cardmember shall bear all exchange risks, losses, commission and other bank charges which may thereby be incurred.

Rates are below:

Local Banks

- Maybank VISA/MasterCard : 1%

- Maybank American Express with Maybank logo on top : 2.5%

- American Express : 0.5% + 2.5%

- CIMB Bank : 1%

- Public Bank : 1.25%

- RHB Bank :

- AmBank :

- Hong Leong Bank VISA/MasterCard: 1%

- EON Bank : 1%

- Affin Bank :

- Alliance : 1%

Foreign Banks

- HSBC : 1.25%

- OCBC bank : 1%

- Standard Chartered : 1%

- UOB Bank : 1%

- Citibank : 1%

Exchange rate estimator :

http://corporate.visa.com/pd/consumer_serv...er_ex_rates.jsp

Mastercard Global Forex Rates

[url=http://www.oanda.com/convert/classic?user=americanexpress]

[url=https://www.fx4you.com/australia/americanexpress/converter/convert.cfm]

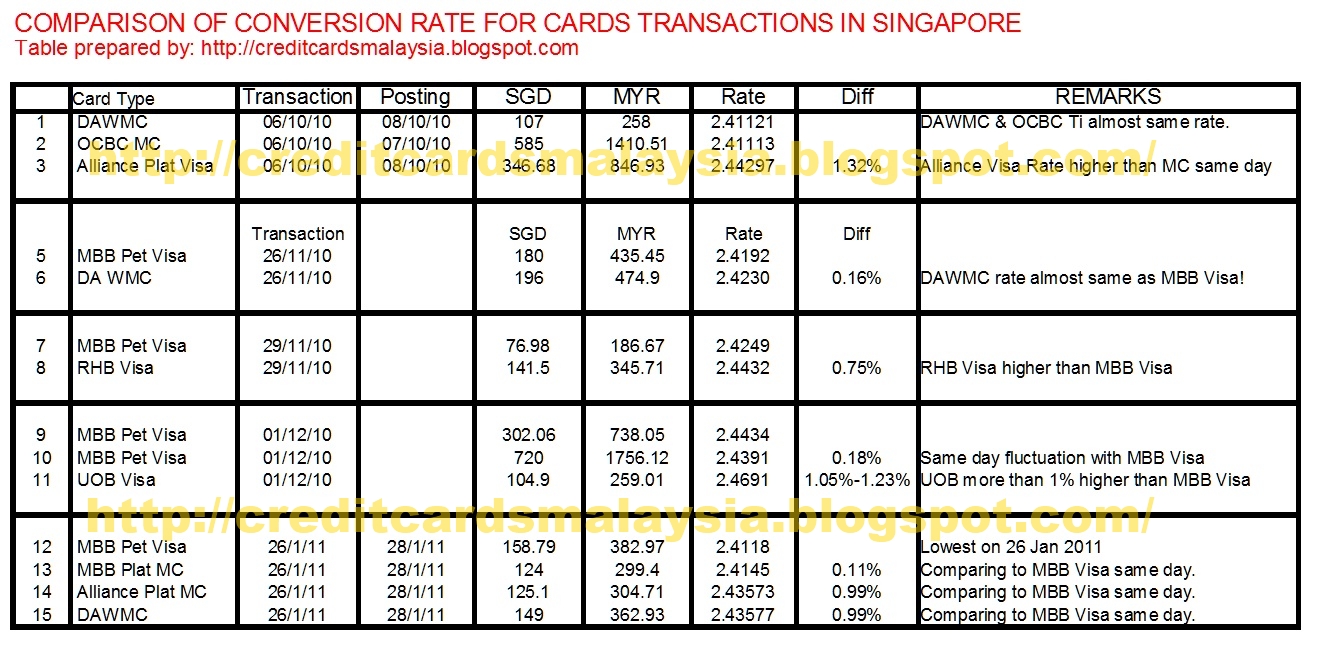

Please post all your foreign transactions here so we can compare the rates. Kindly include the

- transaction date

- amount charged in foreign currency

- amount billed in MYR

- final exchange rate

From users posted rate by various credit card issuers

QUOTE(KeSToN @ Mar 13 2017, 11:49 PM)

for AmBank rates,

via https://forum.lowyat.net/index.php?showtopi...post&p=83434015

Local Banks

- Maybank2C VISA/MasterCard : 2.26% (~ 1% + 1.25%)

- Maybank2C AMEX : 2.5%

- Maybank American Express with Maybank logo on top : 2.8-3%

- American Express : 2.8 -3%

- CIMB Bank : (cashback plat) 2.53% (should be ~ 1% + 1.5%)

- CIMB BANK (MC) 2%

- Public Bank : 1.25%, (visa signature) 1.0125%

- RHB Bank : (master plat) 1.02%

- AmBank : visa - 2.0 to 2.2%, (MC) - 1%

- Hong Leong Bank VISA/MasterCard:

- EON Bank :

- Affin Bank :

- Alliance :

- Aeon: (gold) 1.5% (watami) 0.8-1.2%

Foreign Banks

- HSBC : (visa plat) 2.27% (should be ~ 1% + 1.25%)

- OCBC bank :

- Standard Chartered :

- UOB Bank : (YOLO) 2.5%

- Citibank : 1% + 1.4% (= 2.414%)

(if SGD, it is just 0.5%. surprising)

This post has been edited by MilesAndMore: Mar 29 2017, 04:48 PMvia https://forum.lowyat.net/index.php?showtopi...post&p=83434015

Local Banks

- Maybank2C VISA/MasterCard : 2.26% (~ 1% + 1.25%)

- Maybank2C AMEX : 2.5%

- Maybank American Express with Maybank logo on top : 2.8-3%

- American Express : 2.8 -3%

- CIMB Bank : (cashback plat) 2.53% (should be ~ 1% + 1.5%)

- CIMB BANK (MC) 2%

- Public Bank : 1.25%, (visa signature) 1.0125%

- RHB Bank : (master plat) 1.02%

- AmBank : visa - 2.0 to 2.2%, (MC) - 1%

- Hong Leong Bank VISA/MasterCard:

- EON Bank :

- Affin Bank :

- Alliance :

- Aeon: (gold) 1.5% (watami) 0.8-1.2%

Foreign Banks

- HSBC : (visa plat) 2.27% (should be ~ 1% + 1.25%)

- OCBC bank :

- Standard Chartered :

- UOB Bank : (YOLO) 2.5%

- Citibank : 1% + 1.4% (= 2.414%)

(if SGD, it is just 0.5%. surprising)

Apr 21 2011, 08:17 PM, updated 6y ago

Apr 21 2011, 08:17 PM, updated 6y ago

Quote

Quote

0.2208sec

0.2208sec

0.76

0.76

6 queries

6 queries

GZIP Disabled

GZIP Disabled