QUOTE(JoNe91 @ Nov 12 2024, 05:11 PM)

Hi All Sifus,

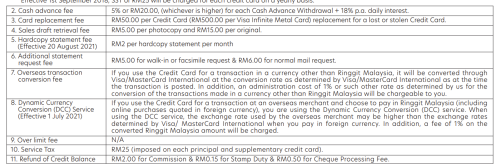

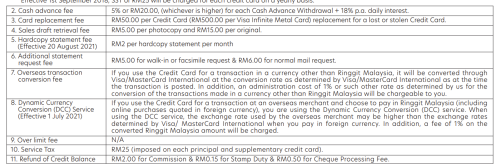

I have recently swiped a few transactions with UOB Prvi Elite card, and i have noticed that the conversion rate is a bit high, becuz the website only state like 1% admin fee, but i calculated it was like 2.2%. So i have called the UOB customer service and ask them how they charged it. They told me that on top of the 1% admin fee, the bank has charged a 1.22% fee (can't hear what she said it was called). However, i did ask her like how this rate is determined and whether it is stated on their website. She told me it's all depend on the bank and there is no way to check in advance, and no history for reference as well. She did show me where it was stated in their T&Cs.

" In addition, an administration cost of 1% or such other rate as determined by us for the conversion of the transactions made in a currency other than Ringgit Malaysia will be chargeable to you."

She said the 1.22% is that "such other rat as determined by us"

So they didn't really state like how much fee in the T&Cs, and they can charge whatever rate? I can't know what im being charged before i use the card? What if they charge like 5 or 10%

What if they charge like 5 or 10%

Correct. 1% is admin fees + extra fees till 2% plus. So far only rhb and PBB not charge 1%. Majority around 2% plus.I have recently swiped a few transactions with UOB Prvi Elite card, and i have noticed that the conversion rate is a bit high, becuz the website only state like 1% admin fee, but i calculated it was like 2.2%. So i have called the UOB customer service and ask them how they charged it. They told me that on top of the 1% admin fee, the bank has charged a 1.22% fee (can't hear what she said it was called). However, i did ask her like how this rate is determined and whether it is stated on their website. She told me it's all depend on the bank and there is no way to check in advance, and no history for reference as well. She did show me where it was stated in their T&Cs.

" In addition, an administration cost of 1% or such other rate as determined by us for the conversion of the transactions made in a currency other than Ringgit Malaysia will be chargeable to you."

She said the 1.22% is that "such other rat as determined by us"

So they didn't really state like how much fee in the T&Cs, and they can charge whatever rate? I can't know what im being charged before i use the card?

That why people use wise, GXBank, big pay for personal trip.

Just wonder, you did not use other cc before at overseas? It is standard rate till 2.5%

Bank love you to use at overseas coz they earn more

This post has been edited by ericlaiys: Nov 12 2024, 06:03 PM

Nov 12 2024, 06:00 PM

Nov 12 2024, 06:00 PM

Quote

Quote 0.0250sec

0.0250sec

0.72

0.72

6 queries

6 queries

GZIP Disabled

GZIP Disabled