This topic was locked.

If you own VISA or MasterCard, must see !

http://forum.lowyat.net/topic/686634 chen9wei were asking how to buy stock in US.

chin20350 answered

http://www.interactivebrokers.com.hk/en/main.php to further elaborate :-

But i prefer

http://www.interactivebrokers.comor

http://www.thinkorswim.com many singaporean use

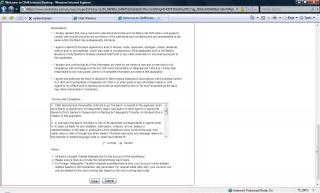

http://optionsXpress.comPretty simple, fill up the online forms, print out, sign and fax to them.

Then TT the money to them, and you can start buying.

** DO THIS ON YOUR OWN RISK **

i paid RM4xxx.xx to learn about all these.

If you are serious, do your homework, evaluate the course out there... and choose one that you are comfortable with.

Rather than get crashed in the market without know how to drive your car properly.

---------------

also

SKY1809 were asking about this...

>>

You said you bought the shares at US $ 6x.xx but do not hesitate to recommend to forumers to buy at current price of US $ 84 ?

What is the logic behind. What is your target price and why ?

Investors rushed to buy TMI shares at rm 7.75 thinking much lower than DIGI .

These investors are suffering today.

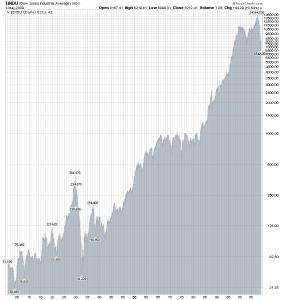

A lot of credit card holders in US are in serious troubles today. They are facing actions from banks. Visa's business, bulk of them are from US ( as per above data ).

The writer is bullish , what I believe could have bought lot of Visa shares.

>>>>

As a good netizen ... one should be responsible to what he wrote.

I like to answer your questions.

1. Which sentence did i ask anyone to buy at 84? Did you intepret the msg wrongly?

2. It is a pure analysis and statement post.

3. I just said it has an upside of USD200~300 easily within 2 years time.

4. Guys here i believe have the intelligent to evaluate themselves what they want to do with their hard earn money.

5. I am purely sharing of what i learned thru my course, where KLSE is nothing compare to NASDAQ and US Market.

6. Cannot company TMI/DIGI with V/MA. One is apple and another is orange.

7. Do your homework before comment. Visa business have a huge economic MOAT. They are transcation fee based biz. They do not carry debt and risk. Banks carring the risk of CC holder default. They make money thru processing the transcations. Sure win biz.

I might be wrong.. but we are here to discuss and learn.

You all are taiko... with 898 post...

I am a newbie...but willing to share and learn and grow together

Yoroshiku Onegaishimasu...

Cheers,

shrimphead

** in case reader wondering what is Economic MOAT. Check out here www.investopedia.com/terms/e/economicmoat.asp

****

Pls do not judge ppl by what you think...

Why you think ppl intension is ABC.

That is you that is thinking ABC, not necessary that person is thinking about ABC. He might be thinking about abc, or 123, whatever...

Pls allow and give people a benefit of doubt first...

Dec 18 2007, 01:39 AM, updated 18y ago

Dec 18 2007, 01:39 AM, updated 18y ago

Quote

Quote

0.1956sec

0.1956sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled