What are the best stock to invest in NYSE. Pls Share.

Thx

Investing in US stocks, Does anyone know how?

|

|

Apr 2 2009, 09:43 AM Apr 2 2009, 09:43 AM

Return to original view | Post

#1

|

Junior Member

982 posts Joined: Apr 2008 |

Very interesting Thread.

What are the best stock to invest in NYSE. Pls Share. Thx |

|

|

|

|

|

Apr 3 2009, 01:23 AM Apr 3 2009, 01:23 AM

Return to original view | Post

#2

|

Junior Member

982 posts Joined: Apr 2008 |

|

|

|

Apr 3 2009, 01:29 AM Apr 3 2009, 01:29 AM

Return to original view | Post

#3

|

Junior Member

982 posts Joined: Apr 2008 |

|

|

|

Apr 4 2009, 03:44 PM Apr 4 2009, 03:44 PM

Return to original view | Post

#4

|

Junior Member

982 posts Joined: Apr 2008 |

QUOTE(danmooncake @ Apr 3 2009, 12:28 PM) FAS is better if you're bullish. Already up 50% for last 30 days. D Thank You and to the rest too.But, tread careful, IMO, financial sector may not have bottom yet.. eventho a lot of people call DJIA at 6500 was the absolute bottom. The M2M rules aren't clear yet and the toxic assets re-purchased with private equity - not exactly sure if the banks/mortgage companies are willing to sell them on the penny on dollar. Good luck! |

|

|

Apr 10 2009, 08:05 AM Apr 10 2009, 08:05 AM

Return to original view | Post

#5

|

Junior Member

982 posts Joined: Apr 2008 |

Been Targeting UYG and BAC for some time. Sadly both did not reach my target price and now they are even more far off

|

|

|

Apr 10 2009, 06:15 PM Apr 10 2009, 06:15 PM

Return to original view | Post

#6

|

Junior Member

982 posts Joined: Apr 2008 |

QUOTE(danmooncake @ Apr 10 2009, 10:30 AM) Well, you didn't buy some on Wednesday night? The pullback was the opportunity man! When it comes to buying stocks I am very cautious.Learned some good lesson in my early startup but sometimes being over cautious also not good.Yesterday was best day for financial. Every bank stocks were up.. Wells Fargo has the best run of them all with over 30%. It seems the bottoming process already began. Don't wait at the sidelines to wait for the lowest to get in.. nobody knows when the bottom will in and it is always a rear-view mirror. I have to take some profits today, selling some of my positions in UCO, FCX and HAL. We shall play again next week.. Investing in like BAC doesn't need to be an expert. In a few years time it can go up like 30-40 and above. Probably I set the target too low...sad... I bought Resorts and Proton almost at the lowest price and making some good money now but when I compare to what I could have made of the US,its really pathetic and peanut money.... Looks like you are making very good money out there. congrats! |

|

|

|

|

|

Apr 13 2009, 08:20 PM Apr 13 2009, 08:20 PM

Return to original view | Post

#7

|

Junior Member

982 posts Joined: Apr 2008 |

QUOTE(dreams_achiever @ Apr 12 2009, 10:56 PM) Exactly. Once you start trade in US market (specifically US options), you find boring to trade in KLSE anymore..too slow, no volume(for some warrants), low volatility. Thanks for the advise, now waiting for pullback... Better move all capital to US and start trading there permanently Earn US dollars better than Ringgit Malaysia. The good things is we no need to stay there to earn USD..lolx |

|

|

Apr 14 2009, 07:48 AM Apr 14 2009, 07:48 AM

Return to original view | Post

#8

|

Junior Member

982 posts Joined: Apr 2008 |

|

|

|

Apr 14 2009, 07:52 AM Apr 14 2009, 07:52 AM

Return to original view | Post

#9

|

Junior Member

982 posts Joined: Apr 2008 |

QUOTE(dreams_achiever @ Apr 14 2009, 07:49 AM) Aikss..BAC (11), Citi up to 3.80 all bull market. At least you are making something.Regretted that i do bull call spread. Should long straight call only. Wrong strategy in this super bull run Miss alot of potential profits. This post has been edited by W.ROOK: Apr 14 2009, 07:53 AM |

|

|

Apr 17 2009, 05:36 PM Apr 17 2009, 05:36 PM

Return to original view | Post

#10

|

Junior Member

982 posts Joined: Apr 2008 |

QUOTE(danmooncake @ Apr 16 2009, 11:56 AM) Sorry, I do not know the banking rules in UK or Hong Kong. Hi D'cake,But, if you know the banks that you wanted to do business, feel free to call or email them. Today, with the Internet, it is relatively easy to talk to foreign banks/investments brokerage customer service rep and ask questions without being physically presence. For example: I managed to open an investment account with E-Trade without stepping a foot in US soil. Just through email and skype (for cheap phone calls). Added on April 16, 2009, 12:02 pm WRook: Hope you have monitoring and be able to pull the trigger last night for your UYG. It was the pullback opportunity that I've mentioned the other day..your UYG was definitely a BUY opportunity and towards the final hour of the trading day, the good news from Feds rallies the market, it pops up to over 8% gain. Btw, I am excited for my FAS! Sorry was away. Yeah there was a pullback but did not manage to buy. As I was gathering more info on UYG, found out that it is definitely not for long term. I am attracted to FAS as well but some of the investors says XLF is a safer bet. I want to invest in something for long term whereby, buy and put in a "frezzer" kind of thing. Do you have anything to share for a long term basis? Appreciate you kind reply. THX |

|

|

Jun 21 2009, 12:51 PM Jun 21 2009, 12:51 PM

Return to original view | Post

#11

|

Junior Member

982 posts Joined: Apr 2008 |

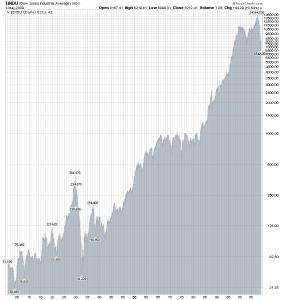

QUOTE(normanTE @ Jun 20 2009, 09:27 PM) syong: hi norman,the reason bac poor dividend with highest value 60-70 usd no doubt bac is a dividend counter but inview of current TARP bac need some time to digest what he had eaten.. please remember bac do not have permanent capital loss like citigroup or aig. it have better potential than anyone. march i am looking at bcs barclays, bought 1000share.. i think this is a good counter as well for 1/2 speculative and 1/2 investment purpose. i bought bac at 3.7usd 1000share and another 1000share at 5usd., 500 share at 11.5usd i am holding them thru thick and thin. i believe my effort will be paid off by the time i pass on to my son or daughter. good luck with all the investment. 50 counter are just nice; 5 counter =reit 5counter=energy 10 counter = banking+finance + insurance 10 counter= consumer staples eg pep,ko,bkc,mcd,yum,kft, 10 counter=industrial product ge gd,lmt,ford,dd, dow 5counter=gaming industry lvs,mgm,dis 5counter= raw material bhp, riotinto, alcoa, only new investor will own one to two counter, believe me i been like that before..trust me you will understand at some point of time. not everyone can manage huge portfolio like 50 .. try 10 then 25 or 35 .. this come with experience. Added on June 20, 2009, 9:31 pmactually i am adding another 5 more portfolio health product: merk,gsk, pfe,azn, abbott You got a big portfolio there. It is very true you know, "The rich gets Richer" By looking at your holdings which are mainly Blue Chips I am very sure there are plenty of money to come in the future. The current downturn represents a great opportunity to invest. We don't know for sure if the market has reach it's bottom but in the long run..... Just look at the Dow's Graph. Attached thumbnail(s)

|

|

|

Sep 5 2009, 09:04 AM Sep 5 2009, 09:04 AM

Return to original view | Post

#12

|

Junior Member

982 posts Joined: Apr 2008 |

Wah you guys really active in the US market, In and Out.....

Me more of Buy and keep and once hit the target will chop off, something like Uncle style but me not an Uncle yet. Anyway just to share my holdings: BAC,XLF,TBSI and SBLK All giving positive returns except SBLK. Now keeping any eye on LYG...any comment or Red flags? |

|

|

Sep 5 2009, 08:30 PM Sep 5 2009, 08:30 PM

Return to original view | Post

#13

|

Junior Member

982 posts Joined: Apr 2008 |

QUOTE(danmooncake @ Sep 5 2009, 09:32 AM) Hey Rook, Thanks for the good piece of advise.Looks like you're long. The only ones I like in your holdings are BAC and XLF. But, how come they're like this: BAC = financials TBSI = financials XLF = financial ETF SBLK = shipping/transportation Whoa! I think you're way overweight in financials... If you buy XLF, don't buy BAC or TBSI because they are already covered by XLF. Same goes for LYG..(financials again). Remember to diversify.. Financials and Shipping co's cause these are two sectors battered to rock bottom prices. Kind of risky but there is no economy without financials isn't it. Actually TBSI is also another shipping co. 3-5years down the road hopefully with of course lots of luck too, we might have lots lots of $$$ in the bank! |

|

Topic ClosedOptions

|

| Change to: |  0.0205sec 0.0205sec

0.23 0.23

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 01:07 AM |