Just a summary of the product

*This pic is outdated btw. Just lazy to change

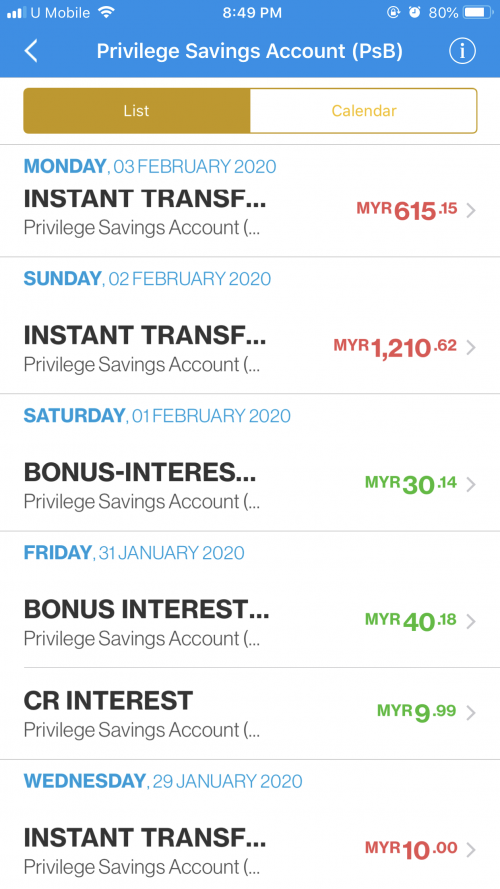

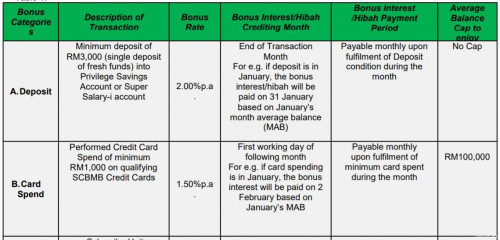

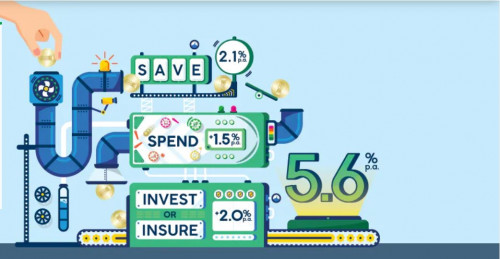

Base Bonus: 0.05% pa

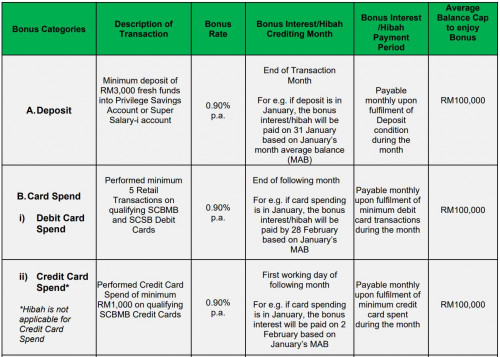

Save Bonus: 0.90% pa - Deposit RM 3,000 per month

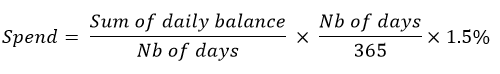

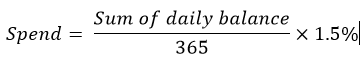

Spend Bonus: 0.90% pa (for debit card) & 0.90% pa (for credit card) - Spend a min of RM 1,000 on the credit card and min of 5 retail transaction on the debit card

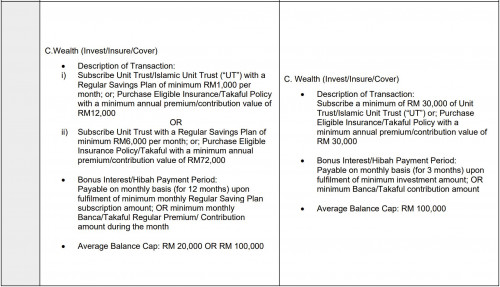

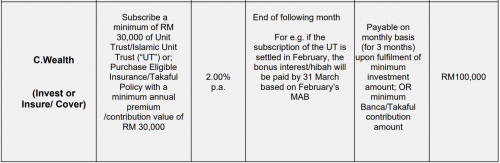

Invest Bonus: 2.0% pa - Subscribe a minimum of RM 30,000 of Unit Trust/Islamic Unit Trust (“UT”) or Purchase Eligible Insurance/Takaful Policy with a minimum annual premium/contribution value of RM 30,000

Campaign has been extended to 31st Jan 2022 with new T&C (Pls look at the latest edit below). All bonus interest cap is up to RM100,000 for each category

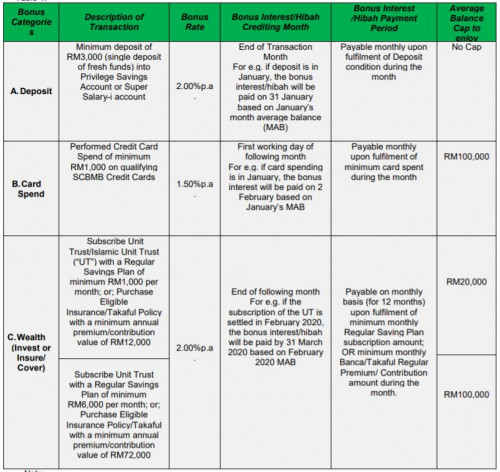

SCB has changed their TnC for the 2.0% bonus interest for the unit trust investment. As of Jan 2020, the 2.0% only applies on the balance in the account up to a maximum of RM20k only if you only invest RM1k a month.

It is only when investing RM6k a month that the 2.0% bonus interest wilo apply on max RM100k limit together with the other 2 bonus categories

More information: https://www.sc.com/my/deposits/psa/

Everyone talks about OCBC 360 giving 4.1%, but what about this?

Common Questions

1) Does the product require a debit card?

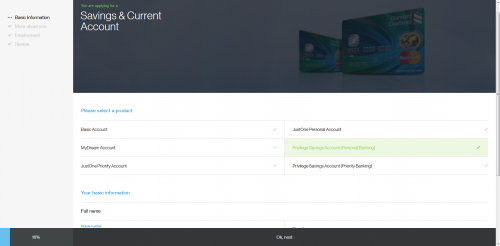

Yes. This is pretty much the standard for most high yielding account, including the Privilege$aver. The charge is RM8 per year. The card also is required if you want to setup the Internet banking function.

Existing SCB customers usually don't need a new card. It should just a switch of the debiting account would be enough.

2) Is the RM3k deposit spendable after depositing it into your account?

Yes. So as long as its a fresh fund, you can just spend the money after it's deposited. However, there doesn't appear to have a cooldown time mentioned in the TnC.

3) Does debit card spending entitle me for the bonus interest/profit

As of Feb 2021, yes. 0.90% p.a.

Feel free to suggest more common questions with answers about this account.

===================================================

EDIT: Why is the post reported for incorrect section? The OCBC360 tered, which talks about a similar product is on the same forum too.

EDIT 2: SCB appears to have not cut their rates even after BNM's OPR rate cut of 0.25%, which is kinda surprising as most major banks already begun chopping rates across their savings products. The closest competitor to this PrivilegeSaver, the OCBC360 has interestingly cut their rates by double the OPR cut, which is 0.50% to 3.60%.

So if you are able to deposit RM 3k into this product and spend a min of RM 1k on an SCB CC. You can earn up to 4.0% on your deposits. The additional 2% from insurance or UT investments of RM 1k monthly would probably be a bonus if you can afford it monthly.

EDIT 3: BNM has just cut their OPR again by 25 bps (0.25%) 3/3/2020. Expect to see SCB amending their TnC for this product in the near future. Maybe the rates might even get cut.

EDIT 4: Updates from Standard Chartered from the Movement Control Order (MCO)

Notification of Printed Paper Statements

Due to the Movement Control Order (MCO) announced by the Government, the printing of statements will be delayed. Normal service will resume upon the lifting of the MCO. Please expect delays in receiving your statement.

For Current Account, Savings Account and Credit Card customers, you can register for online banking in order to view your statements online.

Click here to learn more.

If you require any assistance, please do not hesitate to contact our client care centre at 1300 888 888 or +603 7711 8888 (if you are calling from overseas).

https://av.sc.com/my/content/docs/my-notifi...-statements.pdf

Revision of Investment Transaction Cut-off Time during Movement Control Order (MCO)

Thank you for entrusting your wealth and continue to bank with us. We are working hard to ensure all our services are available to you during the MCO with minimal disruption. All our branches will remain open under the revised operating hours from 9.30am to 3.00pm, Monday to Friday as safety measures to ensure the well-being of our clients and staff.

In line with the above move to work closely with the relevant authorities to reduce transmission risk, the Unit Trust Investment transaction cut-off time will also be revised accordingly. All duly completed unit trust transaction instruction(s) received on or before 11.00am will be process on the same Business Day. Submission after 11.00am will be processed the next Business Day. This will commence with effect from 25 March 2020 to 14 April 2020.

As precautionary measures, we encourage you to try our investment phone transaction capabilities or SC Mobile App where selected investment capabilities are conveniently available.

Should you require any assistance or clarification, please reach out to your respective Relationship Manager. Rest assured, additional precautionary measures are in place to safeguard your health when you visit us.

https://av.sc.com/my/content/docs/my-revisi...ut-off-time.pdf

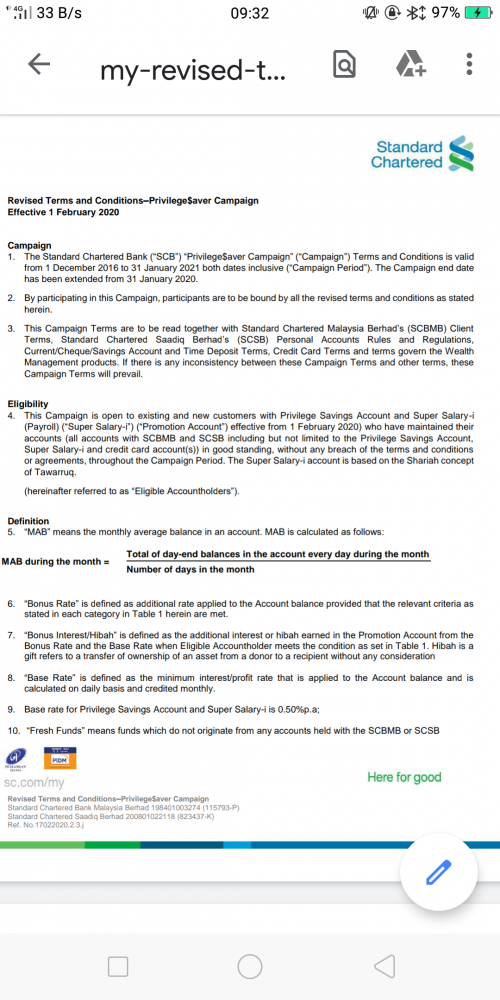

EDIT 5: Revision of Terms & Conditions of Privilege$aver Campaign

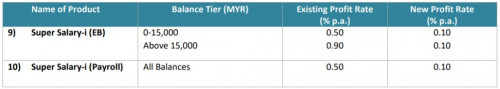

Please take note, effective 1 May 2020, base interest rate of Privilege Savings Account and base profit rate for SuperSalary-i will be revised as follows;

Clause 9

Base rate for Privilege Savings Account and SuperSalary-i is revised from 0.50% to 0.10% p.a.

Clause 14

Eligible Account holders can earn up to 5.60% p.a. (from 6.00% p.a.) in the promotion account based on total interest/return earned from the Base Rate and

total Bonus Rates on all Bonus Categories of Deposit, Card Spend and Wealth Management as seen in Table 1 above.

https://av.sc.com/my/content/docs/my-notice...ivilegeaver.pdf

Revised T&C for PSA:

https://av.sc.com/my/content/docs/my-privilegeaver-tnc.pdf

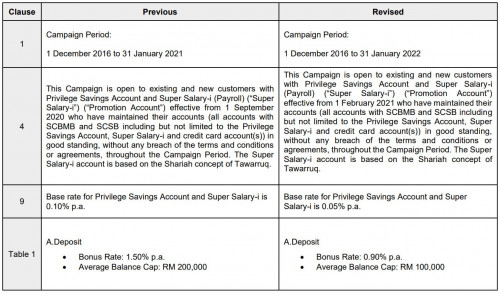

EDIT 6: Revision of Terms & Conditions of Privilege$aver Campaign

Interest drop again liao. Take note

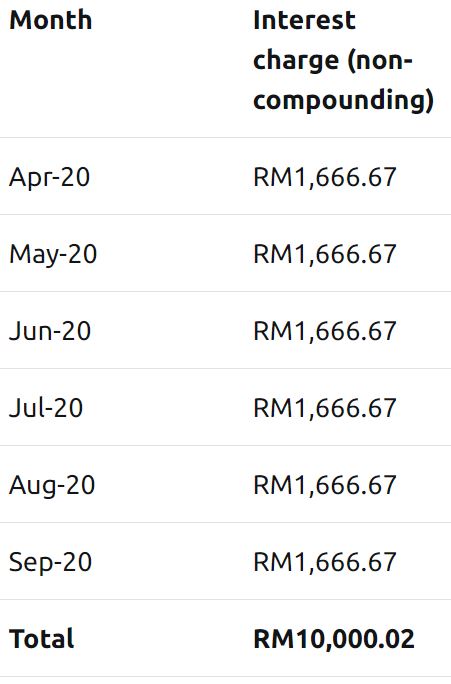

Please take note, effective 1 Sep 2020, Deposit Bonus Interest of Privilege Savings Account /Deposit Bonus Hibah of Super Salary-i and Credit Card Spend Bonus Interest will be revised as follows:

Clause 11

Table 1.

• Deposit Bonus Interest/Hibah will be revised from 2.00% p.a. to 1.50% p.a. with average balance cap of RM 200,000 during the month

• Credit Card Bonus Interest will be revised from 1.50% p.a. to 1.00% p.a.

[b]EDIT 7: Revision of Terms & Conditions of Privilege$aver Campaign

Revision to Privilege$aver Campaign Terms and Conditions

-1 Feb 2021- 31 Jan 2022

Interest drop again. I think most account holders will probably fly to other alternative high yielding accounts already

Dear Valued Clients,

Kindly be informed that the Terms and Conditions of Privilege$aver Campaign will be revised as follows effective 1 February 2021:

New PSA T&C: https://av.sc.com/my/content/docs/my-privilegesaver-tcs.pdf

Announcement link: https://av.sc.com/my/content/docs/my-revisi...ampaign-tcs.pdf

This post has been edited by Eurobeater: Jan 12 2021, 11:31 AM

Jan 16 2020, 08:49 AM, updated 5y ago

Jan 16 2020, 08:49 AM, updated 5y ago

Quote

Quote

0.3220sec

0.3220sec

0.28

0.28

6 queries

6 queries

GZIP Disabled

GZIP Disabled