Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

MGM

|

Feb 11 2020, 02:39 PM Feb 11 2020, 02:39 PM

|

|

QUOTE(Cookie101 @ Feb 11 2020, 02:16 PM) Not quite correct. You can opt of debit card if u already have cc. U can withdraw from your credit card by selecting current account. But please take note that. For PSA u won’t earn the 1.5% if u do not have a debit card. And their debit card is free. Thanks useful info. |

|

|

|

|

|

MGM

|

Feb 13 2020, 05:46 PM Feb 13 2020, 05:46 PM

|

|

QUOTE(gold_mine99 @ Feb 13 2020, 04:32 PM) May I know what is QB referring to? I dont have time to go branch and open account  Queensway mall Penang? |

|

|

|

|

|

MGM

|

Feb 23 2020, 11:02 AM Feb 23 2020, 11:02 AM

|

|

QUOTE(GrumpyNooby @ Feb 23 2020, 10:45 AM) SMS sent out on Friday indicating my debit card has been mailed out. Card arrived at mail box. Can't get it when opening account at branch.? |

|

|

|

|

|

MGM

|

Mar 3 2020, 03:53 AM Mar 3 2020, 03:53 AM

|

|

QUOTE(GrumpyNooby @ Mar 2 2020, 10:18 PM) This one is given upon fulfilling credit card spending of min RM 1k https://av.sc.com/my/content/docs/my-revise...er-campaign.pdfSuper salary-I also enjoys the same bonus interests? |

|

|

|

|

|

MGM

|

Mar 3 2020, 11:54 AM Mar 3 2020, 11:54 AM

|

|

QUOTE(LostAndFound @ Mar 3 2020, 11:41 AM) Yes, I'm using that and got those. I have been holding this Super Salary-I for many years n wasn't aware of this. OK time to start using it instead of opening a new account. The benefits end in 2021 too? This post has been edited by MGM: Mar 3 2020, 11:54 AM |

|

|

|

|

|

MGM

|

Mar 3 2020, 06:07 PM Mar 3 2020, 06:07 PM

|

|

QUOTE(LostAndFound @ Mar 3 2020, 01:00 PM) The name shown in website is:- Super Salary-i (Payroll) Account And yah benefits till 2021. Better than FD for that period. After checking my statement, mine is actually Super Salary (Payroll) Account, not the islamic one. Similar benefits? |

|

|

|

|

|

MGM

|

Mar 3 2020, 06:24 PM Mar 3 2020, 06:24 PM

|

|

QUOTE(GrumpyNooby @ Mar 3 2020, 06:19 PM) I think no Eligibility4. This Campaign is open to existing and new customers with Privilege Savings Account and Super Salary-i (Payroll) (“Super Salary-i”) (“Promotion Account”) effective from 1 February 2020) who have maintained their accounts (all accounts with SCBMB and SCSB including but not limited to the Privilege Savings Account, Super Salary-i and credit card account(s)) in good standing, without any breach of the terms and conditions or agreements, throughout the Campaign Period. The Super Salary-i account is based on the Shariah concept of Tawarruq. (hereinafter referred to as “Eligible Accountholders”) https://av.sc.com/my/content/docs/my-revise...er-campaign.pdfEven Super Salary-i has 2 variant Super Salary-i (EB) and Super Salary-i (Payroll). Yes scb specifically stated that so got to get privilegesaver |

|

|

|

|

|

MGM

|

Mar 9 2020, 12:13 PM Mar 9 2020, 12:13 PM

|

|

QUOTE(kart @ Mar 9 2020, 12:02 PM) LostAndFoundI already have several basic savings accounts, with no-annual-fee debit cards. Most of my disposable income is in Maybank M2U Savers. After twice cuts in OPR, the interest rate is now just 1.35%. So, I am looking for a savings account with higher interest rates. If I have more than RM 1000 that I do not intend to use in next few months, I would save the money in ASNB, or invest in PRS. In short, I do not need more than RM 1000 of money for easy withdrawal and ad hoc spending. This Privilege$aver account is meant to bridge the gap between my BSA and ASNB, and acts as a compromise between liquidity and high interest rate. With this amount of savings, it will be a few rm difference per year of interest, not worth the effort to burn your brain cells. |

|

|

|

|

|

MGM

|

Mar 20 2020, 12:42 PM Mar 20 2020, 12:42 PM

|

|

QUOTE(wyh @ Mar 13 2020, 01:43 PM) std c's privilege savers still not affected by OPR lowered ? 4% is much good than present's ocbc at 3.4 QUOTE(Eurobeater @ Mar 13 2020, 04:00 PM) So far, no news. So can enjoice fist I am thinking of switching from OCBC 360 to this privilege savers if the diff in interest is still 3.4% vs 4%. OCBC has already reduced twice but not SCB? |

|

|

|

|

|

MGM

|

Apr 2 2020, 10:03 AM Apr 2 2020, 10:03 AM

|

|

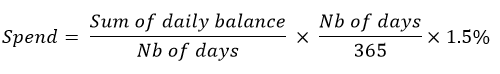

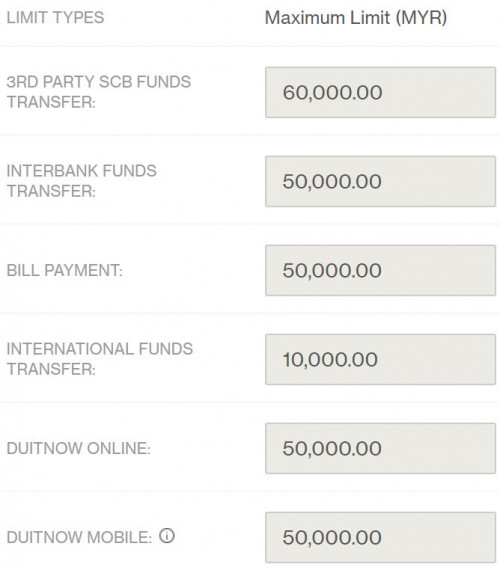

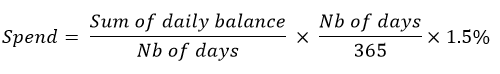

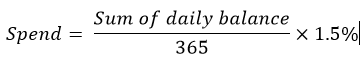

QUOTE(LostAndFound @ Apr 2 2020, 02:52 AM) Mine is almost exactly 0.75 time, full month of March. QUOTE(Gabriel03 @ Apr 2 2020, 08:55 AM) Here is how I did my calculations. Daily Balance Max = 100k If above 100k, then the Daily balance is 100k  Simplified Formula  Based on the two months data (half in Feb and full in March), the calculated value is slightly less than the actual interest given. I don’t know why but I am not complaining. SO in total , still getting 4% (without the investment part)? |

|

|

|

|

|

MGM

|

Apr 9 2020, 08:11 PM Apr 9 2020, 08:11 PM

|

|

So now is PSA 3.6% VS OCBC360 3.4%.

|

|

|

|

|

|

MGM

|

Apr 20 2020, 08:08 AM Apr 20 2020, 08:08 AM

|

|

QUOTE(GrumpyNooby @ Apr 20 2020, 07:37 AM) But you have more than RM 100k and close to RM 200k. Maybe you need both. Good idea to have both, so that u can switch between them when needed. |

|

|

|

|

|

MGM

|

Apr 20 2020, 09:57 AM Apr 20 2020, 09:57 AM

|

|

QUOTE(!@#$%^ @ Apr 20 2020, 08:56 AM) yeah that too. also just in case ocbc doesn't wanna open islamic one? Can get ASM3, at least 0.5% better. |

|

|

|

|

|

MGM

|

Apr 20 2020, 11:26 AM Apr 20 2020, 11:26 AM

|

|

QUOTE(!@#$%^ @ Apr 20 2020, 10:38 AM) difficult to get and not liquid enuf ASM is just like CASA except no ATM withdrawal and is hard to buy. I just redeemed 105k early this month to clear my CC debts n transferring to EPF. |

|

|

|

|

|

MGM

|

Apr 26 2020, 12:56 PM Apr 26 2020, 12:56 PM

|

|

QUOTE(taiping... @ Apr 26 2020, 12:42 PM) Have to spend so much Ocbc is my preferred cause hav to spend lesser Ocbc is unethical tho Have to spend how much, cant load into ewallet? |

|

|

|

|

|

MGM

|

May 4 2020, 01:22 PM May 4 2020, 01:22 PM

|

|

QUOTE(taiping... @ May 4 2020, 01:21 PM) Went and open a PSA They say now got promo during MCO If open account now, will waive rm8 RM8 IS FOR the AF of the debit card? 1 time only? |

|

|

|

|

|

MGM

|

May 8 2020, 12:41 PM May 8 2020, 12:41 PM

|

|

Just open PSA, so if start depositing this month >RM3K n use CC >1K, I can start collecting the 3.6% Interest for May even though it is a partial month?

|

|

|

|

|

|

MGM

|

May 12 2020, 06:09 PM May 12 2020, 06:09 PM

|

|

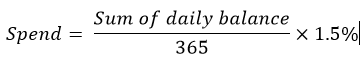

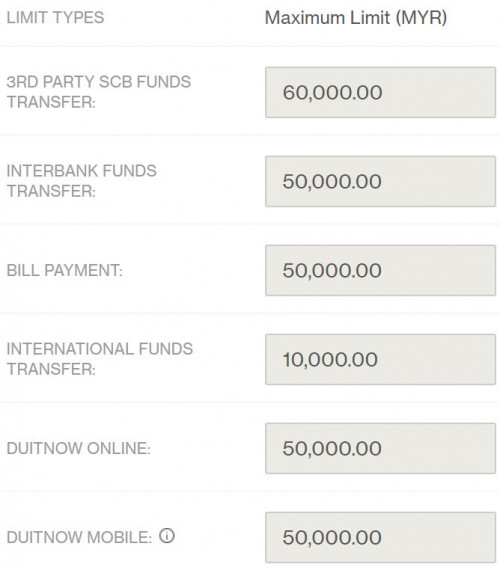

QUOTE(GrumpyNooby @ May 8 2020, 03:56 PM) Because of this PC? Standard Chartered Malaysia cuts base rate by 50bps effective May 14https://www.theedgemarkets.com/article/stan...ffective-may-14QUOTE(zenquix @ May 8 2020, 07:15 PM) so far SCB has given 21 days notice when they change product features so i think it is OK to give them the benefit of doubt QUOTE(qu3vax @ May 8 2020, 09:24 PM) who knows, maybe might same like ocbc style I just open this PSA last week and is thinking of transfering rm90k from SSPN to PSA or OCBC360? Would like to confirm the following: 1) IBFT is free from PSA to other banks' account? 2) What is the max IBFT per day? 3) Interest rate for this month still stay at 3.6%? |

|

|

|

|

|

MGM

|

May 12 2020, 06:25 PM May 12 2020, 06:25 PM

|

|

QUOTE(GrumpyNooby @ May 12 2020, 06:14 PM) 1) Yes  2) RM 50k  3) No announcement so far presumed as it is Thanks bro, is there a cut off time like ocbc360's 9.45pm to be considered as same day transaction? |

|

|

|

|

|

MGM

|

May 12 2020, 06:39 PM May 12 2020, 06:39 PM

|

|

QUOTE(GrumpyNooby @ May 12 2020, 06:27 PM) Good if it is 12am, I will transfer to OCBC360 b4 9.45pm and from OCBC360 transfer to PSA after 9.45pm. |

|

|

|

|

Feb 11 2020, 02:39 PM

Feb 11 2020, 02:39 PM

Quote

Quote

0.0585sec

0.0585sec

1.02

1.02

7 queries

7 queries

GZIP Disabled

GZIP Disabled