std c's privilege savers still not affected by OPR lowered ?

4% is much good than present's ocbc at 3.4

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

|

Mar 13 2020, 01:43 PM Mar 13 2020, 01:43 PM

Return to original view | Post

#1

|

Senior Member

1,447 posts Joined: Jan 2008 |

std c's privilege savers still not affected by OPR lowered ?

4% is much good than present's ocbc at 3.4 |

|

|

|

|

|

May 26 2020, 10:53 PM May 26 2020, 10:53 PM

Return to original view | Post

#2

|

Senior Member

1,447 posts Joined: Jan 2008 |

QUOTE(MiKE7LIM @ May 14 2020, 07:58 PM) one of the officer contact me to confirm I want to have this account, then send me the form via email. (on phone 2mins) did you request for debit card ? or just plain account, i assume ?Signed & email back (took me around 5-8mins) wait for 2-3 hours another officer call to verified and confirmed (on phone 2-3 mins ) Completed. Account available the process is easy and straight forward. |

|

|

May 27 2020, 12:31 AM May 27 2020, 12:31 AM

Return to original view | Post

#3

|

Senior Member

1,447 posts Joined: Jan 2008 |

|

|

|

Jun 6 2020, 10:59 PM Jun 6 2020, 10:59 PM

Return to original view | Post

#4

|

Senior Member

1,447 posts Joined: Jan 2008 |

|

|

|

Jul 2 2020, 12:18 PM Jul 2 2020, 12:18 PM

Return to original view | Post

#5

|

Senior Member

1,447 posts Joined: Jan 2008 |

QUOTE(Batusai @ Jul 2 2020, 01:30 AM) First 100k will entitle 3.6% p.a (0.1+2.0+1.5) withdraw 3k out and ttransfer back in considered fresh fund ?Amount after the first 100k will entitle 2.1% p.a only. Can refer back the tnc from previous page So back to your question. To hit 3.6% p.a yes. Only 100k but monthly still need fresh funds 3k transaction 2.0% and spending 1k on SC credit card 1.5% |

|

|

Jul 14 2020, 10:04 PM Jul 14 2020, 10:04 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

1,447 posts Joined: Jan 2008 |

|

|

|

|

|

|

Mar 3 2021, 02:15 PM Mar 3 2021, 02:15 PM

Return to original view | Post

#7

|

Senior Member

1,447 posts Joined: Jan 2008 |

The retail spending interest bonus is based on transaction date or posting date ?

|

|

|

Mar 30 2021, 09:54 AM Mar 30 2021, 09:54 AM

Return to original view | Post

#8

|

Senior Member

1,447 posts Joined: Jan 2008 |

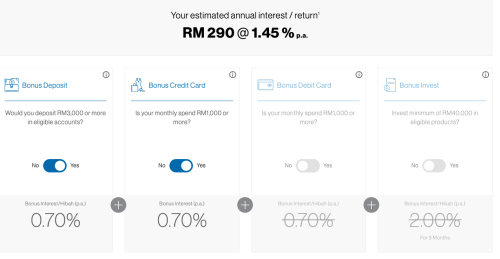

QUOTE(exwuliao @ Mar 30 2021, 09:48 AM) Okay I realized that the Invest bonus is just for 3 months. i got peanut amount of $ . so i stick with std Chartered. not much significant and too hassle to handle one more bank. so after that it's only Deposit (0.9%) + Debit Card (0.9%) + CC (0.9%) = 2.7% bonus interest comparing it to RHB's Smart Account Deposit (1.80%) + Pay (0.5%) + Spend (0.5%) = 2.8% bonus interest Plus optional Invest (1.0% of net investment) to close an account also need queue and time |

|

|

Jan 25 2022, 10:54 PM Jan 25 2022, 10:54 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

1,447 posts Joined: Jan 2008 |

|

|

|

Feb 7 2022, 12:18 AM Feb 7 2022, 12:18 AM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,447 posts Joined: Jan 2008 |

|

|

|

Jun 20 2022, 11:35 AM Jun 20 2022, 11:35 AM

Return to original view | IPv6 | Post

#11

|

Senior Member

1,447 posts Joined: Jan 2008 |

Closing acct still need to go back to the branch where u open the acct?

Or any branch will do so |

|

|

Jun 27 2022, 08:09 AM Jun 27 2022, 08:09 AM

Return to original view | IPv6 | Post

#12

|

Senior Member

1,447 posts Joined: Jan 2008 |

|

|

|

Sep 28 2022, 07:38 PM Sep 28 2022, 07:38 PM

Return to original view | Post

#13

|

Senior Member

1,447 posts Joined: Jan 2008 |

|

|

|

Jan 31 2024, 11:56 PM Jan 31 2024, 11:56 PM

Return to original view | Post

#14

|

Senior Member

1,447 posts Joined: Jan 2008 |

QUOTE(ericlaiys @ Jan 31 2024, 11:24 PM)  Now this saving acc has become worse than hlb pay and save... only get 1.45% ..who want to spend 1k on debit card with no benefit? at least gxbank can get 1% cashback. Time to avoid this acc as this rate start 1 Feb - 31 Jan 2025 |

| Change to: |  1.0788sec 1.0788sec

0.35 0.35

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 11:28 PM |