QUOTE(fun_feng @ Mar 8 2017, 12:14 AM)

True, that instant tax relief money could be put to good use..

But i think ppl should give this a thought and think about the long term vs short term benefit of this..

Imean this is fsm thread right? Im assuming most ppl here are actively managing their money and could get a better yield of >1%pa than prs fund right?

And that is assuming that your tax bracket is near the higher tier... If lower tier then its more at disadvantage

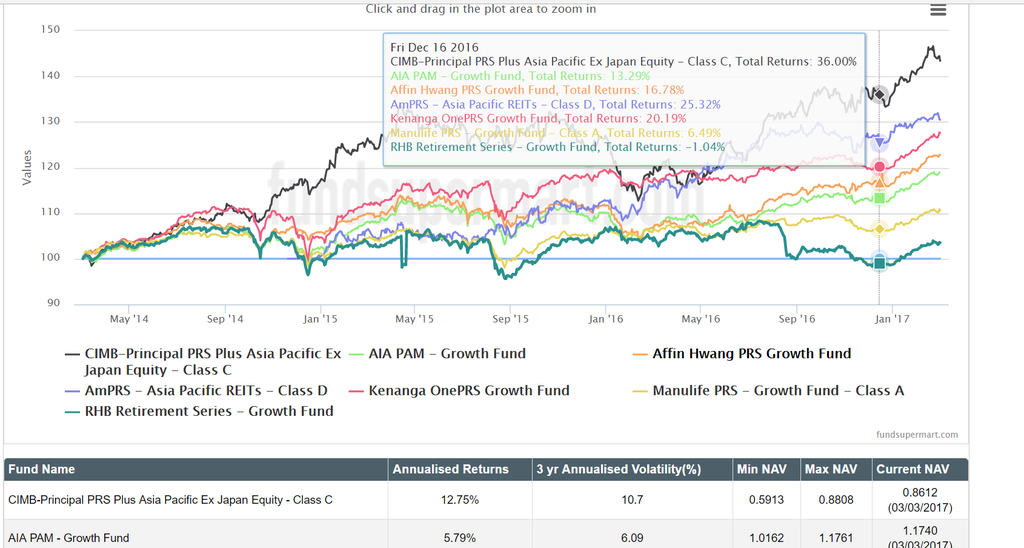

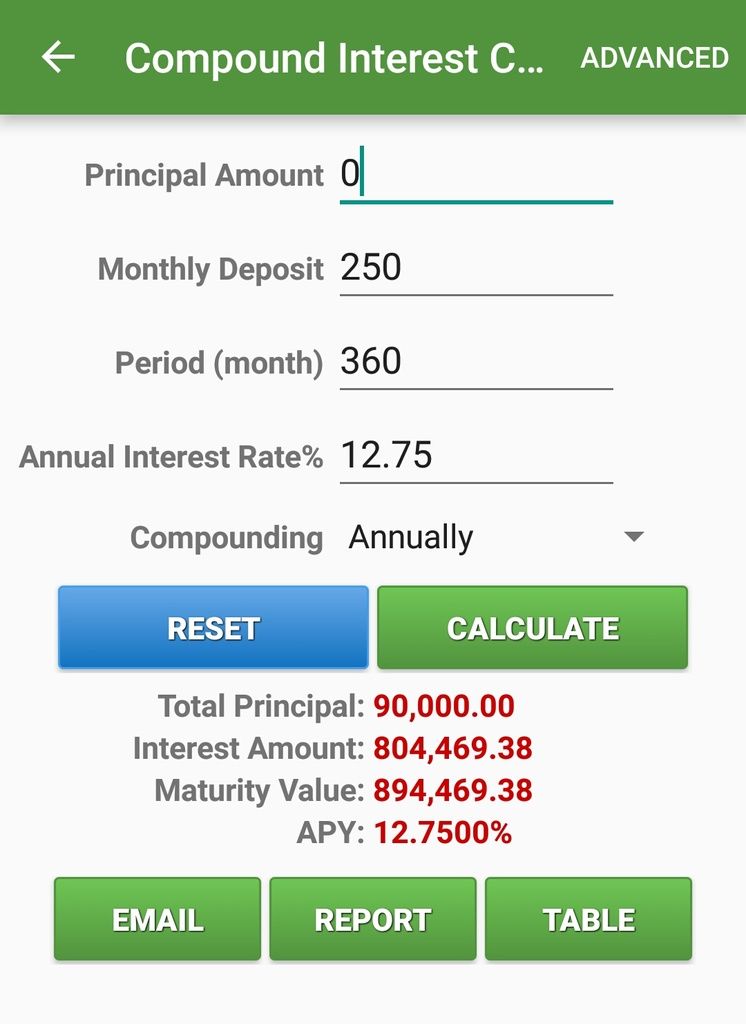

hm.. i think U are assuming all PRS funds returns <=1%pa?

heheh. please do check first - not all PRS funds as as "good"

as for short vs long term, er.. dont U think think equities will "grow in price" in the long term due to inflation, economic growth, etc?

isn't that long term thinking?

also - the tax relief, be it <=15% or >=24.5%, isn't that also long term thinking? every year, "make" that % and use the cold hard cash for FD, stocks, mortgage extra paydown, etc.?

in addition - those below 30s, with the Gov extra incentive.. still not worthwhile?

hm.. U running your own biz returning way more than the combined above in %pa terms?

if so, good BUT the above is passive or non-active income/assets.

if one wishes to compare active income - IMHO, better to use things like trading in options, forex, futures, margin stocks & flipping properties.

no absolute right/wrong, just perspectives

QUOTE(j.passing.by @ Mar 8 2017, 12:15 AM)

I'm afraid it was my own spiel. If it was a copy & paste job, I would give the link to that webpage.

I don't think Feng said anything about any guarantees. The 'instant return' was from the tax relief - which could be about 20%, more or less, depending on your tax bracket.

He was just pointing out that if there is still 20-30 years before reaching 55 to withdraw without any penalties... then the upfront benefit will be amortised down to less than 1% per year.

His query was: Given the poor choice of limited PRS funds to invest, is it worthwhile to go PRS instead of a normal UT fund for such a long term investment?

Well, if one is already having some UT funds, maybe choose the PRS fund that piggy-back feeding into the UT fund you already have.

If the tax relief is not high, then maybe it is not worthwhile to have 2 separate accounts on the same fund...

Anyway, I would still advocates VA or DCA... regular purchases, instead of plugging in 3k just before the Dec 31st deadline when the markets are on Xmas rally.

On the aspect of "amortised down" over 20-30 years, i've done similar Excel sims on SSPN (lagi worse, FD rate++ pa only but with tax relief). If every year we get the tax relief for new $ injected, even if SSPN fell from $6K to $3K next year onwards, it will still be worth my time to do SSPN for the next 15 years due to the total IRR pa% (Excel's XIRR). Note - i was already on SSPN since 2008, not "virgin"

- lagi worse (longer time frame ma).

Thus, similar calculations/logic will be for PRS and the additional bonus is if one does equity PRS, equities generally rise in the long run due to inflation, economic growth, population (sheeples?) growth, etc.

This post has been edited by wongmunkeong: Mar 8 2017, 07:01 AM

Mar 7 2017, 07:37 PM

Mar 7 2017, 07:37 PM

Quote

Quote

0.0215sec

0.0215sec

0.71

0.71

6 queries

6 queries

GZIP Disabled

GZIP Disabled