QUOTE(Avangelice @ Feb 22 2017, 05:56 PM)

there's no set rule. some people really believe in FD they place whatever they have in FD in multiple certificates that mature at different months, others find the thrill of stock trading, others like us find it convenient to buy into fsm where as others love their cimb bank RM that they pay extra service for the special feeling

think about it this way,as long as are learning each day to be better than what you are yesterday and make every day count is the best investment that one can make.

QUOTE(Ramjade @ Feb 22 2017, 06:14 PM)

Not sifu. But let me share with you my story. Used to be 100% promo FD, then move 30% into Amanah saham fixed price. Was planning to move 100%. Found out about FSM so decide to divert the remaining 70% into FSM. Got as far as 30% then realise RM is dropping like dead flies against all currency. Switch my remaining 40% into SGD for SGX. Will move out my FSM portion to Singapore UT. Additionally 10% from amanah saham each into SGX and Singapore UT.

Reason for moving

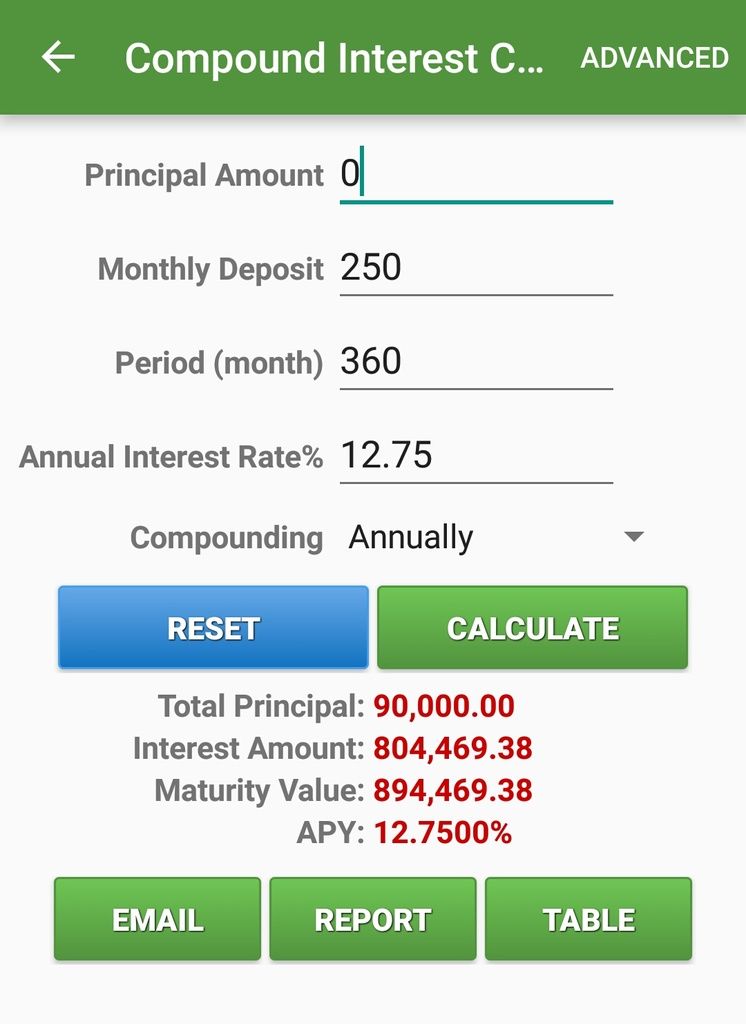

1) I am trying to make sure inflation don't eat into my money

2) Protect my RM from continuous and futrue decline.

No point earning 5-7% (dividends) in KLSE and see your RM depreciate. Better earn 5-7% (dividends) in SGX and have your value protected. Same with UT. No point earning 10% in MY when you can earned the same 10% in SG.

As you can see it's not fixed. Up to individual prefences and need.

QUOTE(xuzen @ Feb 22 2017, 06:15 PM)

100% in UTF.

0% in KLSE

0% in FD.

Many are confused with UTF, thinking that UTF is another asset class. To me UTF is a tool, a vault or a purse to hold my assets. UTF is not an asset class.

For example, if I want to hold cash or FD in normal everyday lingo, then I would participate in Money Market Fund.

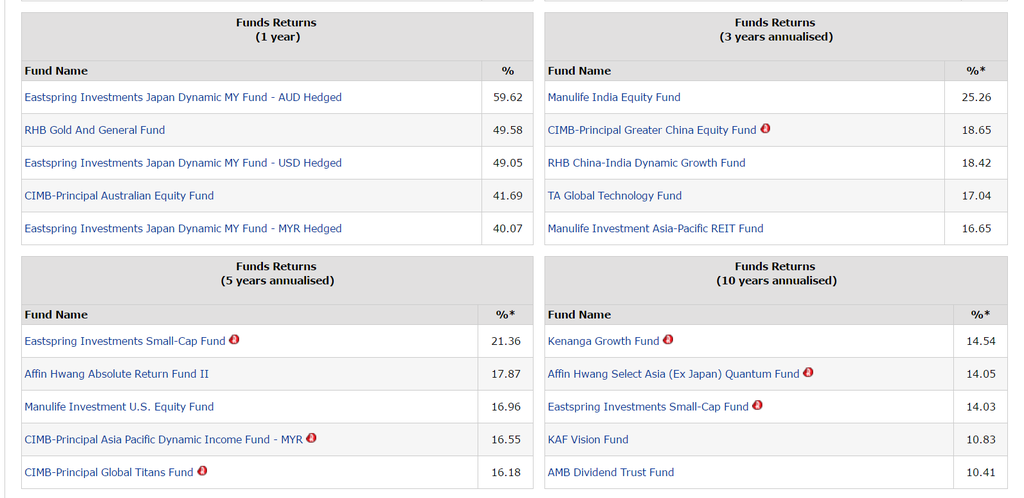

For example, if I want to hold common stocks in KLSE, then I would participate in Kenanga Growth Fund.

For example, if I want to expose myself to US stock market, then I would participate in Manulife US Equity.

For example, if I want to collect rental from properties, then I would participate in AmReits.

Etc etc etc....

Xuzen

QUOTE(T231H @ Feb 22 2017, 06:40 PM)

So from the responded postings......you will see the answers to your post is just individuals preference

Thanks for sharing your insights

Ramjade

Ramjade You are sifus to me as well!

Will continue to learn from you all.

Side note:

xuzen From what I researched, Maybank GIA-i provide higher returns(little bit) than Money Market Fund and same level of liquidity as Money Market Fund, what do you think about this?

Feb 22 2017, 05:45 PM

Feb 22 2017, 05:45 PM

Quote

Quote

0.0419sec

0.0419sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled