QUOTE(tadashi987 @ Oct 27 2025, 12:13 PM)

Medufsaid, you sure? theoretically FSM shouldn't charge twice the forex fee just because we are using cash account.

FSMOne Malaysia, can confirm?

We would like to clarify that FSMOne does not charge double forex fees for MYR-to-USD conversions used in Regular Savings Plans (RSP).

When you invest in USD-denominated funds via RSP, the currency conversion occurs once, at the time your MYR is converted to USD to facilitate your investment.

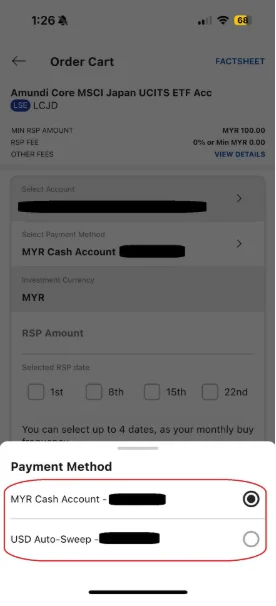

For clients who prefer to have more control over the exchange rate, an alternative option is available:

✅ You may manually convert your MYR to USD via your Cash Account first, and then park the funds in the USD Auto-Sweep account for your upcoming RSP deduction.

Both methods involve only a single conversion, but manual conversion allows you to decide when to convert based on your preferred exchange rate.

FSMOne remains committed to offering transparent and cost-efficient investment solutions for all clients.

Jul 24 2025, 04:37 PM

Jul 24 2025, 04:37 PM

Quote

Quote

0.0375sec

0.0375sec

0.98

0.98

6 queries

6 queries

GZIP Disabled

GZIP Disabled