QUOTE(klee123 @ Mar 8 2013, 04:18 PM)

Thanks, looking forward to your thoughts. What was the unit size you purchased? Looks like you have already gained some profit

Disclaimer : I do not solely promote, I just give my investment point of view based on my research. You may purchase other development surrounding but investment value will be different from one another.

Before I purchase phase 1, I asked myself...is there a potential of rental and capital appreciation...then I study the demographic and consumer spending power...the answers is YES. Why...here's goes my point of view...

1) Location - Dataran Sunway

Almost all of the ground floor units are fully rental out, and almost every corner shop facing the main roads are bankers...speaking of bankers, there are so much...even myself lost count...as for me...whether the place is in invest-able or not, I'll refer to the bankers, bankers done a lots of research before they spends on opening a branch in this area and compete among each other to gain customers database. Even Starbucks open up their branch in the middle of Dataran Sunway...where parking is absolutely menace to find one.

2) Tune Hotel

Can someone tell me why Tune Hotel build a branch at Kota Damansara? This place is not even a tourist hotspot.

3) Sunway and Encorp does have land for future development nearby, the answer you need to self dig (hate spoon feeding). After you know where is their future development and concept, then you'll appreciate why I purchase phase 1. Phase 2 not bad...just slightly harder to digest for now. Once other (Sunway and Encorp) future development starts, the digestion will be better eventually.

4) MRT Line

The study of MRT line is very important...go read at MRT.com.my to know where's the next station is...therefore you know what type of profession or person may rent a unit from you. Therefore you may predict the rental value. Of course there will be competition among Casa Indah 1 and 2, but there always a debate and investment cost between people who wanna rent/buy old completed property.

5) Surrounding rental price

Current surrounding rental price are based on today without MRT and without Shopping Mall, there will be rental appreciation once the MRT is complete. Study the oversea nearby property such as Singapore, Tokyo, Hong Kong and London. Those command good public transport will command good rental demand and good rental yield.

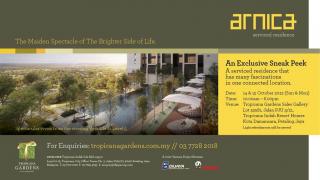

6) Tropicana Gardens development

Even thou there is 4 blocks of serviced apartment, average 400 units per blocks, what do you expect from the 1 million sqft build up mall? Let's say 50% occupancy, there would be 800 units. Based on the number of occupants, do you think the mall tenants will improve? Once the mall tenants improve, it will affect back on the rental price as well...and vice versa.

7) Capital Appreciation

Have to depends on Sunway and Encorp future development and TG shopping mall concepts. So far from what Sunway Nexis brochure, it does look promising and benefit to TG residence as well...

there's few more points that I may add later, as for now I'm tired and sleepy...good night to you all and happy hunting.

This post has been edited by Ero-Sennin: Mar 9 2013, 12:28 AM

Sep 12 2012, 04:22 PM, updated 13y ago

Sep 12 2012, 04:22 PM, updated 13y ago Quote

Quote

0.1672sec

0.1672sec

0.47

0.47

6 queries

6 queries

GZIP Disabled

GZIP Disabled