Hai GUys,

Have the Private Retirement Scheme (PRS) started already?

Anybody have any ifo?

Please advice.

Thanks Guys.

Private Retirement Scheme Started?

Private Retirement Scheme Started?

|

|

Sep 4 2012, 06:52 AM, updated 14y ago Sep 4 2012, 06:52 AM, updated 14y ago

Show posts by this member only | Post

#1

|

Junior Member

227 posts Joined: Jan 2009 |

Hai GUys,

Have the Private Retirement Scheme (PRS) started already? Anybody have any ifo? Please advice. Thanks Guys. |

|

|

|

|

|

Sep 4 2012, 12:16 PM Sep 4 2012, 12:16 PM

Show posts by this member only | Post

#2

|

Senior Member

4,436 posts Joined: Oct 2008 |

Still no action... I, too have asked around and none of the sevice provider can give me simple answers like what is the Sales charge, annual management fee, agent fee etc.

They say wait till Oct to get a clearer picture. Xuzen |

|

|

Sep 4 2012, 03:55 PM Sep 4 2012, 03:55 PM

Show posts by this member only | Post

#3

|

Senior Member

2,980 posts Joined: Jan 2007 From: Mount Chiliad |

My office here in CWA just finished training and introduction session about PRS.

But i didnt attend |

|

|

Sep 4 2012, 05:18 PM Sep 4 2012, 05:18 PM

Show posts by this member only | Post

#4

|

Senior Member

759 posts Joined: Feb 2012 |

It started already. ING Fund do provide PRS...

|

|

|

Sep 4 2012, 06:08 PM Sep 4 2012, 06:08 PM

Show posts by this member only | Post

#5

|

All Stars

14,990 posts Joined: Jan 2003 |

FSM also has a PRS (deducted from salary). Anyway don't need to depend on government, just agree with yourself to put away x% of your income in a unit trust every month, should see the results when you retire

|

|

|

Sep 4 2012, 07:07 PM Sep 4 2012, 07:07 PM

Show posts by this member only | Post

#6

|

Junior Member

227 posts Joined: Jan 2009 |

QUOTE(wodenus @ Sep 4 2012, 06:08 PM) FSM also has a PRS (deducted from salary). Anyway don't need to depend on government, just agree with yourself to put away x% of your income in a unit trust every month, should see the results when you retire Thanks for the input.What is the minimum commitment for PRS monthly? In this case ING which already started. Thanks |

|

|

|

|

|

Sep 4 2012, 07:28 PM Sep 4 2012, 07:28 PM

Show posts by this member only | Post

#7

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(umapathy @ Sep 4 2012, 07:07 PM) Thanks for the input. Check it out at http://www.fundsupermart.com.my under "Regular Savings Plan" What is the minimum commitment for PRS monthly? In this case ING which already started. Thanks |

|

|

Sep 4 2012, 10:46 PM Sep 4 2012, 10:46 PM

Show posts by this member only | Post

#8

|

Senior Member

1,639 posts Joined: Nov 2010 |

PRS = regular savings plan.

|

|

|

Sep 5 2012, 01:11 PM Sep 5 2012, 01:11 PM

Show posts by this member only | Post

#9

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(j.passing.by @ Sep 4 2012, 10:46 PM) What's the difference? This post has been edited by wodenus: Sep 5 2012, 01:12 PM |

|

|

Sep 5 2012, 01:43 PM Sep 5 2012, 01:43 PM

|

Junior Member

291 posts Joined: Dec 2007 |

|

|

|

Sep 5 2012, 01:55 PM Sep 5 2012, 01:55 PM

|

Junior Member

71 posts Joined: Apr 2009 |

wanted to type alot, but offend too much if likewise expose all.

it's a very sensitive issue towards malaysia economy n political issue. it relates alot of benefit party, n best part is, the last person to benefit is those who 'purchase' this scheme. n impact is huge within malaysia n malaysian who tend to 'invest' in it. it's an investment scheme in d end. make sure after reducing this money from ur epf or salary. retirement reaches u still have enuf. else might as well just use what u have on hand. very very sensitive.... personally to reply as a friend, dont get into this plan @.@ not positive <--- for me. |

|

|

Sep 5 2012, 01:59 PM Sep 5 2012, 01:59 PM

|

All Stars

14,990 posts Joined: Jan 2003 |

|

|

|

Sep 5 2012, 03:50 PM Sep 5 2012, 03:50 PM

|

Senior Member

952 posts Joined: Feb 2011 |

QUOTE(umapathy @ Sep 4 2012, 07:07 PM) Thanks for the input. get this month personal money, well explained abt PRS.What is the minimum commitment for PRS monthly? In this case ING which already started. Thanks Added on September 5, 2012, 3:53 pm QUOTE(kparam77 @ Sep 5 2012, 03:50 PM) SHARING ONLY.Who is PPA? - http://www.ppa.my/index.php/about/background/ FAQs on PRS... http://www.ppa.my/index.php/how-prs-works/faqs-on-prs/ Role of the SC in regulating PPA - http://www.ppa.my/index.php/how-prs-works/...regulating-ppa/ Getting advice - http://www.ppa.my/index.php/how-prs-works/getting-advice/ Who are PRS Providers - http://www.ppa.my/index.php/providers-and-...-prs-providers/ Benefits of PRS - http://www.ppa.my/index.php/how-prs-works/benefits-of-prs/ Tax incentives - http://www.ppa.my/index.php/how-prs-works/tax-incentives/ Joining PRS - http://www.ppa.my/index.php/how-prs-works/joining-prs/ This post has been edited by kparam77: Sep 5 2012, 03:53 PM |

|

|

|

|

|

Sep 5 2012, 04:15 PM Sep 5 2012, 04:15 PM

|

Junior Member

291 posts Joined: Dec 2007 |

QUOTE(wodenus @ Sep 5 2012, 01:59 PM) Cool.. now figure out if your taxes are going to be less if you have a Rm3000 tax relief. If not then it makes no difference right? 3% of RM3k = RM907% of RM3k = RM210 12% of RM3k = RM360 . . . . . might not be significant to u... but it is still $$$ ma~~ well, what regular savings plan offers?? |

|

|

Sep 17 2012, 12:31 PM Sep 17 2012, 12:31 PM

|

Junior Member

66 posts Joined: Jun 2010 |

QUOTE(christ86 @ Sep 5 2012, 01:55 PM) wanted to type alot, but offend too much if likewise expose all. it's a very sensitive issue towards malaysia economy n political issue. it relates alot of benefit party, n best part is, the last person to benefit is those who 'purchase' this scheme. n impact is huge within malaysia n malaysian who tend to 'invest' in it. it's an investment scheme in d end. make sure after reducing this money from ur epf or salary. retirement reaches u still have enuf. else might as well just use what u have on hand. very very sensitive.... personally to reply as a friend, dont get into this plan @.@ not positive <--- for me. It is an instant gain of 25% for me. Can you please advise the drawback that I might have missed out. Tq! |

|

|

Nov 21 2012, 09:52 AM Nov 21 2012, 09:52 AM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

This scheme is not capital guaranteed rite?

|

|

|

Nov 21 2012, 01:30 PM Nov 21 2012, 01:30 PM

|

Senior Member

832 posts Joined: Sep 2012 From: Richmond, Oakland hills |

QUOTE(cybermaster98 @ Nov 21 2012, 09:52 AM) Yes, it is not guaranteed."As with all investments, the returns from contributions made to PRS are not guaranteed and will depend on the performance of the PRS funds" by Sundaily. Copy and paste, http://www.malaysia-chronicle.com/index.ph...-safe?&Itemid=2 Little info about Private Retirement scheme (PRS), http://www.sc.com.my/eng/html/ppa/prs_english.pdf This post has been edited by adolph: Nov 21 2012, 01:31 PM |

|

|

Nov 21 2012, 05:38 PM Nov 21 2012, 05:38 PM

|

Junior Member

36 posts Joined: Nov 2012 |

QUOTE(christ86 @ Sep 5 2012, 02:55 PM) wanted to type alot, but offend too much if likewise expose all. Park all your money in bank or invest on your own lo, since you dont trust of fund manager and not interested on the tax relief~ it's a very sensitive issue towards malaysia economy n political issue. it relates alot of benefit party, n best part is, the last person to benefit is those who 'purchase' this scheme. n impact is huge within malaysia n malaysian who tend to 'invest' in it. it's an investment scheme in d end. make sure after reducing this money from ur epf or salary. retirement reaches u still have enuf. else might as well just use what u have on hand. very very sensitive.... personally to reply as a friend, dont get into this plan @.@ not positive <--- for me. |

|

|

Nov 21 2012, 10:48 PM Nov 21 2012, 10:48 PM

|

Senior Member

1,522 posts Joined: Mar 2007 From: Kuala Lumpur |

QUOTE(yong417 @ Sep 5 2012, 04:15 PM) 3% of RM3k = RM90 well said, you are the real financial planner that fully utilize the potential of your income.7% of RM3k = RM210 12% of RM3k = RM360 . . . . . might not be significant to u... but it is still $$$ ma~~ well, what regular savings plan offers?? QUOTE(akelvin @ Sep 17 2012, 12:31 PM) It is an instant gain of 25% for me. Can you please advise the drawback that I might have missed out. Tq! The drawback is1)People who doesn't submit income tax, so they don't care as well. 2)some of the people feel 25% is still not a good figure for them. QUOTE(cybermaster98 @ Nov 21 2012, 09:52 AM) Great Eastern Annuity plan is also entitle for the tax relief(RM3000) and it is guaranteed return. |

|

|

Nov 22 2012, 05:36 PM Nov 22 2012, 05:36 PM

|

Senior Member

1,423 posts Joined: Aug 2010 From: Sarawak |

Well, basically from my point of view, PRS is not much different than a normal Regular Monthly Investment in Unit Trust..

The introduction of PRS is more like an effort by the government to enhance the unit trust market or to encourage the citizens to invest in unit trusts.. Therefore, i see nothing interesting in it, rather than just a feeling of frustration because it is like introducing a new version of unit trust.. Noting new... |

|

|

Nov 23 2012, 09:25 AM Nov 23 2012, 09:25 AM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(smartinvestor01 @ Nov 22 2012, 05:36 PM) Well, basically from my point of view, PRS is not much different than a normal Regular Monthly Investment in Unit Trust.. At least we get TAX RELIEF up to RM3000 from YA2012 to YA2021The introduction of PRS is more like an effort by the government to enhance the unit trust market or to encourage the citizens to invest in unit trusts.. Therefore, i see nothing interesting in it, rather than just a feeling of frustration because it is like introducing a new version of unit trust.. Noting new... |

|

|

Nov 23 2012, 04:33 PM Nov 23 2012, 04:33 PM

|

Junior Member

671 posts Joined: Dec 2011 |

PPA do thing but yearly get RM8 fr each PRS members and 0.04% of the fund NAV. KNS.

|

|

|

Nov 24 2012, 12:12 AM Nov 24 2012, 12:12 AM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

You mean we need to pay RM8 annually to maintain PRS account ?

|

|

|

Nov 24 2012, 03:41 PM Nov 24 2012, 03:41 PM

|

Senior Member

2,429 posts Joined: Jul 2007 |

anyone has the disclosure agreement for public mutual PRS? or the web site for PM PRS?

|

|

|

Nov 24 2012, 03:43 PM Nov 24 2012, 03:43 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(ronnie @ Nov 24 2012, 12:12 AM) Yes. Read the brochure: http://www.ppa.my/wp-content/uploads/2012/...ewbookletBI.pdf |

|

|

Nov 29 2012, 10:47 AM Nov 29 2012, 10:47 AM

|

Junior Member

218 posts Joined: May 2008 |

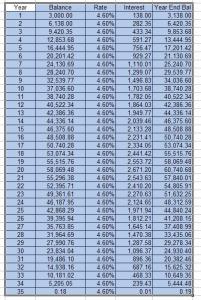

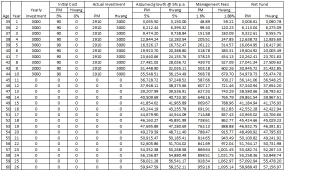

QUOTE(smartinvestor01 @ Nov 22 2012, 05:36 PM) Well, basically from my point of view, PRS is not much different than a normal Regular Monthly Investment in Unit Trust.. I Agree.The introduction of PRS is more like an effort by the government to enhance the unit trust market or to encourage the citizens to invest in unit trusts.. QUOTE(smartinvestor01 @ Nov 22 2012, 05:36 PM) Therefore, i see nothing interesting in it, rather than just a feeling of frustration because it is like introducing a new version of unit trust.. Noting new... I don't agree. There is actually something new. Tax relief for 10 years, and if compounded annually until you're 55, the annualized return rate will cover the Management Expense Ratio (1.5%) and Sales Load (3%). In other words, PRS is Unit Trust without fees A smart investor will know that fund fees is the number 1 drag to your long term fund return relative to the market returns. I have done the calculations. You can download the excel spreadheet --> Download Excel Spreadsheet from this Post Example scenario: If I'm 35 years old, and my tax rate is 26%. I contribute RM 3000 for 10 years (only) to take advantage of the tax relief. Assuming the PRS fund has 0% returns (that means no profit, no loss), then my Annual Compounded Interest is 1.95% until 55 years old. This is enough to cover for the "Yearly" Management Expense Ratio (1.5% of your total fund value) and Sales "Front" Load (3%). CODE Age Year Fund Contribution Fund Fund Value Income Tax Income Tax Total Return Amount Return (Year-End) Rate Relief Amount Rate (Ann.) Rate (Ann.) 35 2012 $3,000 0.0% $3,000.00 26.0% $780 35.02% 36 2013 $3,000 0.0% $6,000.00 26.0% $780 21.81% 37 2014 $3,000 0.0% $9,000.00 26.0% $780 15.82% 38 2015 $3,000 0.0% $12,000.00 26.0% $780 12.41% 39 2016 $3,000 0.0% $15,000.00 26.0% $780 10.20% 40 2017 $3,000 0.0% $18,000.00 26.0% $780 8.66% 41 2018 $3,000 0.0% $21,000.00 26.0% $780 7.53% 42 2019 $3,000 0.0% $24,000.00 26.0% $780 6.66% 43 2020 $3,000 0.0% $27,000.00 26.0% $780 5.96% 44 2021 $3,000 0.0% $30,000.00 26.0% $780 5.40% 45 2022 $- 0.0% $30,000.00 0.0% $- 4.60% 46 2023 $- 0.0% $30,000.00 0.0% $- 4.01% 47 2024 $- 0.0% $30,000.00 0.0% $- 3.54% 48 2025 $- 0.0% $30,000.00 0.0% $- 3.17% 49 2026 $- 0.0% $30,000.00 0.0% $- 2.87% 50 2027 $- 0.0% $30,000.00 0.0% $- 2.63% 51 2028 $- 0.0% $30,000.00 0.0% $- 2.42% 52 2029 $- 0.0% $30,000.00 0.0% $- 2.24% 53 2030 $- 0.0% $30,000.00 0.0% $- 2.08% 54 2031 $- 0.0% $30,000.00 0.0% $- 1.95% <--- Result 55 2032 This post has been edited by creativ: Nov 29 2012, 10:54 AM |

|

|

Nov 29 2012, 01:46 PM Nov 29 2012, 01:46 PM

|

Junior Member

291 posts Joined: Dec 2007 |

QUOTE(creativ @ Nov 29 2012, 10:47 AM) I Agree. just wondering, how many ppl @ 35 years old pay tax @ 26%? I don't agree. There is actually something new. Tax relief for 10 years, and if compounded annually until you're 55, the annualized return rate will cover the Management Expense Ratio (1.5%) and Sales Load (3%). In other words, PRS is Unit Trust without fees A smart investor will know that fund fees is the number 1 drag to your long term fund return relative to the market returns. I have done the calculations. You can download the excel spreadheet --> Download Excel Spreadsheet from this Post Example scenario: If I'm 35 years old, and my tax rate is 26%. I contribute RM 3000 for 10 years (only) to take advantage of the tax relief. Assuming the PRS fund has 0% returns (that means no profit, no loss), then my Annual Compounded Interest is 1.95% until 55 years old. This is enough to cover for the "Yearly" Management Expense Ratio (1.5% of your total fund value) and Sales "Front" Load (3%). CODE Age Year Fund Contribution Fund Fund Value Income Tax Income Tax Total Return Amount Return (Year-End) Rate Relief Amount Rate (Ann.) Rate (Ann.) 35 2012 $3,000 0.0% $3,000.00 26.0% $780 35.02% 36 2013 $3,000 0.0% $6,000.00 26.0% $780 21.81% 37 2014 $3,000 0.0% $9,000.00 26.0% $780 15.82% 38 2015 $3,000 0.0% $12,000.00 26.0% $780 12.41% 39 2016 $3,000 0.0% $15,000.00 26.0% $780 10.20% 40 2017 $3,000 0.0% $18,000.00 26.0% $780 8.66% 41 2018 $3,000 0.0% $21,000.00 26.0% $780 7.53% 42 2019 $3,000 0.0% $24,000.00 26.0% $780 6.66% 43 2020 $3,000 0.0% $27,000.00 26.0% $780 5.96% 44 2021 $3,000 0.0% $30,000.00 26.0% $780 5.40% 45 2022 $- 0.0% $30,000.00 0.0% $- 4.60% 46 2023 $- 0.0% $30,000.00 0.0% $- 4.01% 47 2024 $- 0.0% $30,000.00 0.0% $- 3.54% 48 2025 $- 0.0% $30,000.00 0.0% $- 3.17% 49 2026 $- 0.0% $30,000.00 0.0% $- 2.87% 50 2027 $- 0.0% $30,000.00 0.0% $- 2.63% 51 2028 $- 0.0% $30,000.00 0.0% $- 2.42% 52 2029 $- 0.0% $30,000.00 0.0% $- 2.24% 53 2030 $- 0.0% $30,000.00 0.0% $- 2.08% 54 2031 $- 0.0% $30,000.00 0.0% $- 1.95% <--- Result 55 2032 (i.e. annual income > 100k or approx 9k per mth) |

|

|

Nov 29 2012, 01:58 PM Nov 29 2012, 01:58 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(yong417 @ Nov 29 2012, 01:46 PM) just wondering, how many ppl @ 35 years old pay tax @ 26%? Nowadays is much more common than you think.. mid level managers (~10-15 years experience) working in KL MNC can easily hit that amount....(i.e. annual income > 100k or approx 9k per mth) This post has been edited by gark: Nov 29 2012, 01:59 PM |

|

|

Nov 29 2012, 02:12 PM Nov 29 2012, 02:12 PM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Nov 29 2012, 03:00 PM Nov 29 2012, 03:00 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(yong417 @ Nov 29 2012, 01:46 PM) just wondering, how many ppl @ 35 years old pay tax @ 26%? Off my mind, I recall reading somewhere that around 1.5% of Malaysian citizen pays the highest tier tax, i.e 29 million x 1.5% = 435,000 tax-payers(i.e. annual income > 100k or approx 9k per mth) This PRS scheme is only as good as the tax relief. I won't be surprise, financially savvy contributors will not put more than RM 3,000.00 p.a. Once the tax relief is gone, the whole PRS scheme will be redundant. Xuzen |

|

|

Nov 29 2012, 04:51 PM Nov 29 2012, 04:51 PM

|

Senior Member

2,545 posts Joined: Sep 2011 |

Read in The Star last Sunday that quite a number of funds have been approved. May I know which of them already start 'selling' the scheme? And any recommendation which one shall I go for?

|

|

|

Nov 29 2012, 09:07 PM Nov 29 2012, 09:07 PM

|

Junior Member

291 posts Joined: Dec 2007 |

QUOTE(gark @ Nov 29 2012, 01:58 PM) Nowadays is much more common than you think.. mid level managers (~10-15 years experience) working in KL MNC can easily hit that amount.... QUOTE(ronnie @ Nov 29 2012, 02:12 PM) if i not remember wrongly, our per capita income is abt 28k p.a.the illustration of the 1.95% seems only for a small group of ppl. |

|

|

Nov 30 2012, 12:50 AM Nov 30 2012, 12:50 AM

|

Senior Member

3,294 posts Joined: Dec 2005 |

QUOTE(creativ @ Nov 29 2012, 10:47 AM) I Agree. You won't be getting tax relief if bringing the previous balance forward.I don't agree. There is actually something new. Tax relief for 10 years, and if compounded annually until you're 55, the annualized return rate will cover the Management Expense Ratio (1.5%) and Sales Load (3%). In other words, PRS is Unit Trust without fees A smart investor will know that fund fees is the number 1 drag to your long term fund return relative to the market returns. I have done the calculations. You can download the excel spreadheet --> Download Excel Spreadsheet from this Post Example scenario: If I'm 35 years old, and my tax rate is 26%. I contribute RM 3000 for 10 years (only) to take advantage of the tax relief. Assuming the PRS fund has 0% returns (that means no profit, no loss), then my Annual Compounded Interest is 1.95% until 55 years old. This is enough to cover for the "Yearly" Management Expense Ratio (1.5% of your total fund value) and Sales "Front" Load (3%). CODE Age Year Fund Contribution Fund Fund Value Income Tax Income Tax Total Return Amount Return (Year-End) Rate Relief Amount Rate (Ann.) Rate (Ann.) 35 2012 $3,000 0.0% $3,000.00 26.0% $780 35.02% 36 2013 $3,000 0.0% $6,000.00 26.0% $780 21.81% 37 2014 $3,000 0.0% $9,000.00 26.0% $780 15.82% 38 2015 $3,000 0.0% $12,000.00 26.0% $780 12.41% 39 2016 $3,000 0.0% $15,000.00 26.0% $780 10.20% 40 2017 $3,000 0.0% $18,000.00 26.0% $780 8.66% 41 2018 $3,000 0.0% $21,000.00 26.0% $780 7.53% 42 2019 $3,000 0.0% $24,000.00 26.0% $780 6.66% 43 2020 $3,000 0.0% $27,000.00 26.0% $780 5.96% 44 2021 $3,000 0.0% $30,000.00 26.0% $780 5.40% 45 2022 $- 0.0% $30,000.00 0.0% $- 4.60% 46 2023 $- 0.0% $30,000.00 0.0% $- 4.01% 47 2024 $- 0.0% $30,000.00 0.0% $- 3.54% 48 2025 $- 0.0% $30,000.00 0.0% $- 3.17% 49 2026 $- 0.0% $30,000.00 0.0% $- 2.87% 50 2027 $- 0.0% $30,000.00 0.0% $- 2.63% 51 2028 $- 0.0% $30,000.00 0.0% $- 2.42% 52 2029 $- 0.0% $30,000.00 0.0% $- 2.24% 53 2030 $- 0.0% $30,000.00 0.0% $- 2.08% 54 2031 $- 0.0% $30,000.00 0.0% $- 1.95% <--- Result 55 2032 |

|

|

Nov 30 2012, 07:25 AM Nov 30 2012, 07:25 AM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Nov 30 2012, 09:16 AM Nov 30 2012, 09:16 AM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(yong417 @ Nov 29 2012, 09:07 PM) yong417,That's why I shared the excel for download. When you personalize the values in the excel sheet, you will know if it is worth it to you or not. Two factors which will affect your annualized return: 1. The older you are, the higher your annualized return rate when you reach 55. 2. The higher your tax rate, the higher your annualized return rate when you reach 55 Having said the above, I'm not advocating that you start investing in PRS in your later years. It is never to late to start investing. The earlier you start, the better due the the compounding effect of interest. Investing early also lowers risk, because you have time on your side. Added on November 30, 2012, 10:51 am QUOTE(xuzen @ Nov 29 2012, 03:00 PM) This PRS scheme is only as good as the tax relief. I won't be surprise, financially savvy contributors will not put more than RM 3,000.00 p.a. Exactly!QUOTE(xuzen @ Nov 29 2012, 03:00 PM) You're right. I'm predicting the PRS scheme financially savvy, young, new contributors will start falling out the closer we are to year 2021.I'm also hoping the government will extend the tax relief beyond 2021, if they genuinely wants to encourage the rakyat to save for retirement. (Please don't bring politics into this thread) This post has been edited by creativ: Nov 30 2012, 10:59 AM |

|

|

Nov 30 2012, 04:11 PM Nov 30 2012, 04:11 PM

|

Senior Member

2,207 posts Joined: Aug 2008 |

Hi, are the insurance's Annuity plan & PRS different products that entitle tax relief RM3K each (RM6K if got both) or just one of them is entitled for 3K tax relief? Confuse la...Thanks.

|

|

|

Nov 30 2012, 04:57 PM Nov 30 2012, 04:57 PM

|

Junior Member

104 posts Joined: Jun 2011 |

QUOTE(xuzen @ Nov 29 2012, 03:00 PM) Off my mind, I recall reading somewhere that around 1.5% of Malaysian citizen pays the highest tier tax, i.e 29 million x 1.5% = 435,000 tax-payers lesser than that, 11 millions workers (not entire population) = 1.5% = 165,000This PRS scheme is only as good as the tax relief. I won't be surprise, financially savvy contributors will not put more than RM 3,000.00 p.a. Once the tax relief is gone, the whole PRS scheme will be redundant. Xuzen |

|

|

Nov 30 2012, 08:48 PM Nov 30 2012, 08:48 PM

|

Senior Member

3,294 posts Joined: Dec 2005 |

|

|

|

Nov 30 2012, 10:10 PM Nov 30 2012, 10:10 PM

|

Junior Member

105 posts Joined: Nov 2006 |

As long as your monthly income is more than RM4K, you will benefit from PRS RM3K tax relief.

|

|

|

Dec 4 2012, 10:18 AM Dec 4 2012, 10:18 AM

|

Junior Member

218 posts Joined: May 2008 |

Has anybody gone on-board PRS already? If yes, which Fund House have you chosen?

We only have a couple of weeks left to catch the 2012 boat. |

|

|

Dec 4 2012, 01:08 PM Dec 4 2012, 01:08 PM

|

Junior Member

26 posts Joined: Mar 2009 |

I applied Public mutual moderate convention fund. Paid RM3k. However it required Management fees (2%) + service cahrge (1.5%) and the PPA account open for RM10.

|

|

|

Dec 4 2012, 02:09 PM Dec 4 2012, 02:09 PM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Dec 4 2012, 04:30 PM Dec 4 2012, 04:30 PM

|

Senior Member

3,294 posts Joined: Dec 2005 |

HwangIM is cheapest among the three at the moment.

|

|

|

Dec 4 2012, 07:23 PM Dec 4 2012, 07:23 PM

|

Senior Member

919 posts Joined: May 2005 |

how much hwangIM is charging, there are not many hwang office and branches around in KL and PJ.

|

|

|

Dec 4 2012, 07:46 PM Dec 4 2012, 07:46 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

Can we invest in few PRS provider? Maybe 2 provider? As not all provider is going full fledge yet, only next year we will know who is offering the best deal..

|

|

|

Dec 4 2012, 08:59 PM Dec 4 2012, 08:59 PM

|

Junior Member

218 posts Joined: May 2008 |

|

|

|

Dec 4 2012, 09:09 PM Dec 4 2012, 09:09 PM

|

Senior Member

2,545 posts Joined: Sep 2011 |

I'm interested as well. Do we just walk-in the branches and apply for the account on the spot?

|

|

|

Dec 6 2012, 08:25 PM Dec 6 2012, 08:25 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

Lyners, pls help urgently.

I intend to invest in this prs scheme. So far i think only ing, cimb, hwang and public have launched prs scheme. Am doing a comparison and so far these are what i manage to find out. Public; 3% entry cost. If taking growth fund, there is a 1.6% management and admin fees yearly. Transfer fee to other prs operators at rm25 Hwang; No entry cost. Exit cost unknown. Management and admin fees unknown but someone told me it is 2.5% yearly. Transfer fee to other prs operator at rm50. Ppa charges is the same for all funds. Rm8 for every year if there is deposit. Exempted for entry year and year where account is not active. Not sure about ing and cimb. Pls advise as i intend to buy asap. Thanks. |

|

|

Dec 6 2012, 08:40 PM Dec 6 2012, 08:40 PM

|

Senior Member

3,294 posts Joined: Dec 2005 |

I just opened a PRS account with Hwang yesterday with a pretty nice young lady CRM. For HwangIM, there is no sales charge, trustee fee is 0.04%, management fee is up to 1.8%, switching is 0%. Those charges by PPA is same for all the providers.

|

|

|

Dec 6 2012, 08:46 PM Dec 6 2012, 08:46 PM

|

Junior Member

70 posts Joined: Jan 2009 |

If not mistaken, HwangIM has the highest management fee among the PRS providers, which is up to 1.8%. Other providers only charge 1.5%....

|

|

|

Dec 6 2012, 08:47 PM Dec 6 2012, 08:47 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(echoesian @ Dec 6 2012, 08:40 PM) I just opened a PRS account with Hwang yesterday with a pretty nice young lady CRM. For HwangIM, there is no sales charge, trustee fee is 0.04%, management fee is up to 1.8%, switching is 0%. Those charges by PPA is same for all the providers. Pretty nice young lady crm???Trustee fee for public is the same at 0.04%. Is hwang's 1.8% for the growth fund or moderate or conservative. Public have different rates for different fund. Their most expensive is growth at 1.5%. Are you sure hwang does not have exit fees? |

|

|

Dec 6 2012, 09:58 PM Dec 6 2012, 09:58 PM

|

Senior Member

3,294 posts Joined: Dec 2005 |

QUOTE(kochin @ Dec 6 2012, 08:47 PM) Pretty nice young lady crm??? Not sure about exit fees, what is that actually?Trustee fee for public is the same at 0.04%. Is hwang's 1.8% for the growth fund or moderate or conservative. Public have different rates for different fund. Their most expensive is growth at 1.5%. Are you sure hwang does not have exit fees? Growth - up to 1.8% Moderate - up to 1.5% Conservative - up to 1.3% |

|

|

Dec 6 2012, 10:22 PM Dec 6 2012, 10:22 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

ok, i got the breakdown liao.

taking growth fund as an example. hwang is charging 0 entry fees, 0 exit fees, management fees of 1.8% + trustee fees of 0.4%; PPA is taking another 0.4% as management fees; transfer fees at rm50 per transaction to other providers PB is charging 3% upfront fees (entry fees), 0 exit fees, management fees of 1.5%, trustee fees of 0.6%; PPA is taking another 0.4% as management fees; transfer fees at rm25 per transaction to other providers so basically it boils down to fund performance as the difference is quite minor. any advice on which of these perform better historically? fyi, cimb is at management fees of 1.4% + trustee fees of 0.4%. transfer at rm75. cheers! |

|

|

Dec 6 2012, 11:10 PM Dec 6 2012, 11:10 PM

|

Senior Member

546 posts Joined: Sep 2010 |

QUOTE(kochin @ Dec 6 2012, 10:22 PM) ok, i got the breakdown liao. Happy Investing!taking growth fund as an example. hwang is charging 0 entry fees, 0 exit fees, management fees of 1.8% + trustee fees of 0.4%; PPA is taking another 0.4% as management fees; transfer fees at rm50 per transaction to other providers PB is charging 3% upfront fees (entry fees), 0 exit fees, management fees of 1.5%, trustee fees of 0.6%; PPA is taking another 0.4% as management fees; transfer fees at rm25 per transaction to other providers As far as Public Mutual PRS fund is concern, contributors may obtained it from 2 distribution channels, either Public Bank or Public Mutual Private Retirement Consultant (PRC). The entry fee is at 3% with no exit fee for the moment and applies to all 3 core funds & 3 shariah compliance PRS funds. Interested contributors may check out Public Mutual PRS fund titles at www.ppa.my. However, the management fee of 1.5%pa DOES NOT apply to all Public Mutual PRS funds as it varies from one fund to another. Do visit the nearest Public Bank branch and get a Product Highthlights Sheet (PHS) so basically it boils down to fund performance as the difference is quite minor. Agree any advice on which of these perform better historically? PRS funds have only been launched at nothing more than 7 days, hence... fyi, cimb is at management fees of 1.4% + trustee fees of 0.4%. transfer at rm75. cheers! This post has been edited by felixwang: Dec 7 2012, 03:09 PM |

|

|

Dec 6 2012, 11:31 PM Dec 6 2012, 11:31 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

I want to invest...

Added on December 7, 2012, 12:02 amCan put beneficiary in PRS account? This post has been edited by Kaka23: Dec 7 2012, 12:02 AM |

|

|

Dec 7 2012, 12:06 AM Dec 7 2012, 12:06 AM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(felixwang @ Dec 6 2012, 11:10 PM) but i got it from public mutual website wor:http://www.publicmutual.com.my/LinkClick.a...os%3d&tabid=496 pls advise. thanks. |

|

|

Dec 7 2012, 09:32 AM Dec 7 2012, 09:32 AM

|

Senior Member

952 posts Joined: Feb 2011 |

QUOTE(kochin @ Dec 6 2012, 10:22 PM) ok, i got the breakdown liao. go for default option. u can avoid any manual transfer in future. or, choose which fund is match with ur risk tolerance. just stick with the fund until u retire.taking growth fund as an example. hwang is charging 0 entry fees, 0 exit fees, management fees of 1.8% + trustee fees of 0.4%; PPA is taking another 0.4% as management fees; transfer fees at rm50 per transaction to other providers PB is charging 3% upfront fees (entry fees), 0 exit fees, management fees of 1.5%, trustee fees of 0.6%; PPA is taking another 0.4% as management fees; transfer fees at rm25 per transaction to other providers so basically it boils down to fund performance as the difference is quite minor. any advice on which of these perform better historically? fyi, cimb is at management fees of 1.4% + trustee fees of 0.4%. transfer at rm75. cheers! market always volitile,u just need to ride with market. regular contribution is better way compare with lump sump, if u not sure abt market directions. historically? PRS is new to market, so, no past record. but basicaly, its a UT. so, read the relevant documents, the asset allocation, local, oversea. and u can compare similar pure UT funds in the market. u can get some clear picture. get a PRS consultant to brief/guides you. suggestion only. |

|

|

Dec 7 2012, 02:39 PM Dec 7 2012, 02:39 PM

|

Junior Member

359 posts Joined: Dec 2012 |

i spoke to a PRS agent and apparently i was encouraged to buy their unit trust instead. In fact i was told that it is the government that put a mandatory for these banks to set up this PRS and they had no choice but to accept the government offer.

Also the fund size according to the agent will be very small, whereby only higher income tax payers will buy and max will only be RM3k. Imagine in reality who and how many ppl in Malaysia really pay tax? This times RM3k/year and then divided into 8 funds approved by government. Therefore the PRS fund size is very small for each bank and also no historical proven record. I really into this PRS as it give 26% returns every year (via income tax). on the other hand, i am worried that with PRS given at lowest priority among the other unit trust by the 8 banks, the capability of fund managers assigned by the bank may not generate any growth of money. Any thoughts? |

|

|

Dec 7 2012, 03:17 PM Dec 7 2012, 03:17 PM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(turbopips @ Dec 7 2012, 02:39 PM) i spoke to a PRS agent and apparently i was encouraged to buy their unit trust instead. In fact i was told that it is the government that put a mandatory for these banks to set up this PRS and they had no choice but to accept the government offer. Firstly, Unit Trust Agents cum PRS Agents are sales men. They will want to sell you products that gives them the highest commission. Selling Unit Trust gives them higher commission than selling PRS (compare the sales charge) Also the fund size according to the agent will be very small, whereby only higher income tax payers will buy and max will only be RM3k. Imagine in reality who and how many ppl in Malaysia really pay tax? This times RM3k/year and then divided into 8 funds approved by government. Therefore the PRS fund size is very small for each bank and also no historical proven record. I really into this PRS as it give 26% returns every year (via income tax). on the other hand, i am worried that with PRS given at lowest priority among the other unit trust by the 8 banks, the capability of fund managers assigned by the bank may not generate any growth of money. Any thoughts? Secondly, what's wrong with small fund size? The drawback of big fund size is that the fund manager will incur "impact cost" when managing the fund. Thirdly, PRS is not managed by banks, just like Unit trusts, they are managed by Unit Trust Management Company (UTMC) Fourthly, if you are worried if the UTMC fund manager capability, you can check on his historical performance in managing his other funds. (Of course, historical performance does not guarantee future performance.) This post has been edited by creativ: Dec 7 2012, 03:20 PM |

|

|

Dec 7 2012, 03:34 PM Dec 7 2012, 03:34 PM

|

Senior Member

546 posts Joined: Sep 2010 |

QUOTE(Kaka23 @ Dec 6 2012, 11:31 PM) I want to invest... Added on December 7, 2012, 12:02 amCan put beneficiary in PRS account? Ans: Unlike EPF, nomination of beneficiaries is YET to be made available to PRS. Added on December 7, 2012, 3:51 pm QUOTE(turbopips @ Dec 7 2012, 02:39 PM) i spoke to a PRS agent and apparently i was encouraged to buy their unit trust instead. This post has been edited by felixwang: Dec 7 2012, 03:51 PMIn fact i was told that it is the government that put a mandatory for these banks to set up this PRS Ans:Untrue and they had no choice but to accept the government offer Ans:Untrue . Also the fund size according to the agent will be very smal Ans:Untrue l, whereby only higher income tax payers will buy Ans:Untrue and max will only be RM3k Ans:True, if you are referring to tax exemption . Imagine in reality who and how many ppl in Malaysia really pay tax? This times RM3k/year and then divided into 8 funds approved by governmentAns: 8 PRS Providers and NOT 8 Funds . Therefore the PRS fund size is very small for each bank Ans:Untrue and also no historical proven record.Ans: True, because it is NEW I really into this PRS as it give 26% returns every year (via income tax) Ans: Whether you are referring to "investment returns" or "tax returns", both are NOT true. Frankly speaking, I have the slightest idea what you are trying to say since the beginning of your comment. . on the other hand, i am worried that with PRS given at lowest priority among the other unit trust by the 8 banks Ans:We are referred as PRS Providers and some of the PRS Providers distribution channel is via finance institution (Banks etc.) , the capability of fund managers assigned by the bank may not generate any growth of money.Ans: I am not following you at all Any thoughts? |

|

|

Dec 7 2012, 04:01 PM Dec 7 2012, 04:01 PM

|

Senior Member

952 posts Joined: Feb 2011 |

QUOTE(turbopips @ Dec 7 2012, 02:39 PM) i spoke to a PRS agent and apparently i was encouraged to buy their unit trust instead. In fact i was told that it is the government that put a mandatory for these banks to set up this PRS and they had no choice but to accept the government offer. both pure UT and PRS(UT as well) has pros and cons respectively. u need to understand it first. the most important how much risk u willing to take. PRS is not only for tax payers. tax reliaef only for 10 yrs.Also the fund size according to the agent will be very small, whereby only higher income tax payers will buy and max will only be RM3k. Imagine in reality who and how many ppl in Malaysia really pay tax? This times RM3k/year and then divided into 8 funds approved by government. Therefore the PRS fund size is very small for each bank and also no historical proven record. I really into this PRS as it give 26% returns every year (via income tax). on the other hand, i am worried that with PRS given at lowest priority among the other unit trust by the 8 banks, the capability of fund managers assigned by the bank may not generate any growth of money. Any thoughts? and there are many ppls dont hv epf, so, they will may make use this scheme with lower SC. if the stament is correct...government that put a mandatory....... should thanks for it, becasue, what they done is good job. 1. understand abt saving is important for malaysian. 2. understand tht EPF money is not enuf for retirment, its not abt the fund size.........., smaller size easy to manage than bigger size. u can ask any FM. sure PRS FM are experience one. do you think, the management will assign fresh FM. even the PRS agent need hv at least 3 yrs experiance as UT agent. my tought only. |

|

|

Dec 7 2012, 04:07 PM Dec 7 2012, 04:07 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(turbopips @ Dec 7 2012, 02:39 PM) i spoke to a PRS agent and apparently i was encouraged to buy their unit trust instead. In fact i was told that it is the government that put a mandatory for these banks to set up this PRS and they had no choice but to accept the government offer. How did you calculate this 26% returns per year via income tax? I really dont understand what ure trying to say here.Also the fund size according to the agent will be very small, whereby only higher income tax payers will buy and max will only be RM3k. Imagine in reality who and how many ppl in Malaysia really pay tax? This times RM3k/year and then divided into 8 funds approved by government. Therefore the PRS fund size is very small for each bank and also no historical proven record. I really into this PRS as it give 26% returns every year (via income tax). on the other hand, i am worried that with PRS given at lowest priority among the other unit trust by the 8 banks, the capability of fund managers assigned by the bank may not generate any growth of money. Any thoughts? This post has been edited by cybermaster98: Dec 7 2012, 04:09 PM |

|

|

Dec 7 2012, 04:09 PM Dec 7 2012, 04:09 PM

|

Senior Member

546 posts Joined: Sep 2010 |

QUOTE(kochin @ Dec 7 2012, 12:06 AM) but i got it from public mutual website wor: Ans: The following are the schedule of management fee on all 3 core funds - PRS Growth Fund (1.5%pa), PRS Moderate Fund (1.25%pa) and PRS Conservative Fund (1.00%pa). The same schedule of management fee applies to all 3 shariah compliance funds. Do check out Public Mutual Product Highlights Sheet (PHS) at any Public Bank branch nears you. http://www.publicmutual.com.my/LinkClick.a...os%3d&tabid=496 pls advise. thanks. |

|

|

Dec 7 2012, 04:21 PM Dec 7 2012, 04:21 PM

|

Senior Member

546 posts Joined: Sep 2010 |

QUOTE(kparam77 @ Dec 7 2012, 04:01 PM) Even the PRS agent need hv at least 3 yrs experiance as UT agent. This post has been edited by felixwang: Dec 7 2012, 04:23 PMAns: PRS Distribution channel via agent is known as Private Retirement Scheme Consultant or in short, PRC. For those who are registered with FIMM for 3 years of more, can be exempted from PRS examination with t&c. As for new PRC candidates who have been registered with FIMM for a period of less than 3 years , will have to take PRS examination as to obtain their PRC license. So far, PRS examination is only made available in Mahsa, University College, KL. http://www.fimm.com.my/contents.asp?sid=10...0160&zid=100009 my tought only. |

|

|

Dec 7 2012, 04:34 PM Dec 7 2012, 04:34 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(cybermaster98 @ Dec 7 2012, 04:07 PM) How did you calculate this 26% returns per year via income tax? I really dont understand what ure trying to say here. Lets say your total income for 2012 is RM 103,000.00. The tax you have to pay to our beloved govt is RM 14,315.00 (first RM100K) + RM 780.00 (next RM 3K @ 26%) = RM 15,095.00 accoding to the LHDN schedule. If you have made a RM 3,000 contribution to PRS, then you need to pay RM 14,315.00 only because the govt allowed you a RM 3,000.00 tax relief from this scheme. In essense you save RM 780.00 in tax. If that is the case, you are actually contributing only RM 3,000.00 - 780.00 = RM 2,220.00. So in essense, you have already made a 26% gain. Understand? Xuzen |

|

|

Dec 8 2012, 12:51 AM Dec 8 2012, 12:51 AM

|

Junior Member

359 posts Joined: Dec 2012 |

Thanks to all sifus for the advice as this is the first time I will invest in ut as I normally invest in equities.

Actually the prs agent is from public mutual. I dunno how true but agent told me she makes the same commission but she prefers to invest in normal ut than prs due to what I stated earlier. But when I explain about close to 26% yoy return (10yrs) then only she realize my intention of buy prs. I am not sure if rm3k /yr is a lot or not when invest in ut but I am quite sure most ppl will not buy more than 3k per yr for prs. And if yr tax bracket not high, he/she may think twice or wait a few yrs first to see performance before buy. The agent says bigger fund offers more flexibility n liquidity n is better. I read the brochure n the same fund managers manage the three funds(growth, moderate n conservative). They r liew mun hon and zaharudin ghazali. I have no idea who they r or their track record. In hong kong, there is no epf equivalent,, but employees have to contribute a certain amount thru prs n some of the funds is losing money n my counterparts there are cursing. At least here the gov is giving ard 26% "discount" depend on yr tax bracket. So far I only consult public mutual so if others have consulted other providers do share yr thoughts of which prs to buy. Thank you. |

|

|

Dec 8 2012, 09:38 AM Dec 8 2012, 09:38 AM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(xuzen @ Dec 7 2012, 04:34 PM) Lets say your total income for 2012 is RM 103,000.00. Thats wht i thought as well. But he just mentioned 26% which isnt really correct. He's merely saving on the equivalent of a 26% tax on the taxable amount above 100K which equates to RM780 only for the whole year. The tax you have to pay to our beloved govt is RM 14,315.00 (first RM100K) + RM 780.00 (next RM 3K @ 26%) = RM 15,095.00 accoding to the LHDN schedule. If you have made a RM 3,000 contribution to PRS, then you need to pay RM 14,315.00 only because the govt allowed you a RM 3,000.00 tax relief from this scheme. In essense you save RM 780.00 in tax. If that is the case, you are actually contributing only RM 3,000.00 - 780.00 = RM 2,220.00. So in essense, you have already made a 26% gain. Understand? Xuzen But my question is, to get that RM780 tax relief per year, you have to ensure you invest in a PRS fund that gives you back a better return. I mean it would be pointless to invest in something that 'loses' money rite? So although u may be saving RM780 from taxes, you risk losing much more through the investment itself. Is this a risk or am i being too paranoid? |

|

|

Dec 8 2012, 09:42 AM Dec 8 2012, 09:42 AM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(cybermaster98 @ Dec 8 2012, 09:38 AM) Thats wht i thought as well. But he just mentioned 26% which isnt really correct. He's merely saving on the equivalent of a 26% tax on the taxable amount above 100K which equates to RM780 only for the whole year. If you cannot stomach a 70% equity: 30% fixed income exposure, then you can opt for 20% equity: 80%fixed income fund aka conservative. But my question is, to get that RM780 tax relief per year, you have to ensure you invest in a PRS fund that gives you back a better return. I mean it would be pointless to invest in something that 'loses' money rite? So although u may be saving RM780 from taxes, you risk losing much more through the investment itself. Is this a risk or am i being too paranoid? It all depends on contributor risk profile. Xuzen |

|

|

Dec 8 2012, 11:24 AM Dec 8 2012, 11:24 AM

|

Junior Member

218 posts Joined: May 2008 |

QUOTE(turbopips @ Dec 8 2012, 12:51 AM) Hi Turbopips,I would stopped taking advise from your unit trust agent if I were you. If you want to buy from her, go ahead, she is a sales person after all. The only benefit I see is that she can help you with the administrative work of buying a fund from her company. But when it comes to investment and financial advice, stop taking it from her. |

|

|

Dec 8 2012, 12:17 PM Dec 8 2012, 12:17 PM

|

Senior Member

572 posts Joined: Sep 2007 |

QUOTE(xuzen @ Dec 7 2012, 04:34 PM) Lets say your total income for 2012 is RM 103,000.00. A person with total annual income RM 103,000.00, may save $780 bcos they are in highest tax bracket 26%The tax you have to pay to our beloved govt is RM 14,315.00 (first RM100K) + RM 780.00 (next RM 3K @ 26%) = RM 15,095.00 accoding to the LHDN schedule. If you have made a RM 3,000 contribution to PRS, then you need to pay RM 14,315.00 only because the govt allowed you a RM 3,000.00 tax relief from this scheme. In essense you save RM 780.00 in tax. If that is the case, you are actually contributing only RM 3,000.00 - 780.00 = RM 2,220.00. So in essense, you have already made a 26% gain. Understand? Xuzen How about those total TAXABLE income RM 53,000.00 contributing the same $3000 save how much? 19% If i sells PRS i also will use 26% to promote as if all malaysians earns over taxable 100,000 a year most ppl who consider only thinks about money but never realised who they are, after invested only knows their tax bracket only 3% Added on December 8, 2012, 12:26 pm QUOTE(cybermaster98 @ Dec 8 2012, 09:38 AM) Thats wht i thought as well. But he just mentioned 26% which isnt really correct. He's merely saving on the equivalent of a 26% tax on the taxable amount above 100K which equates to RM780 only for the whole year. Let say u contribute 3000 month for 3 yearsBut my question is, to get that RM780 tax relief per year, you have to ensure you invest in a PRS fund that gives you back a better return. I mean it would be pointless to invest in something that 'loses' money rite? So although u may be saving RM780 from taxes, you risk losing much more through the investment itself. Is this a risk or am i being too paranoid? U would have contribute a total $108,000 Is there any possbilities at end of year 3 your investment is worth = $92,000? U need to earn back your capital the next few years How different is PRS compare to regular unit trusts? Does EFP pays u less after u contribute $108,000? This post has been edited by Kinitos: Dec 8 2012, 12:26 PM |

|

|

Dec 8 2012, 01:21 PM Dec 8 2012, 01:21 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(Kinitos @ Dec 8 2012, 12:17 PM) A person with total annual income RM 103,000.00, may save $780 bcos they are in highest tax bracket 26% Funny enough, the people who are very interested in this PRS scheme tend to be people who are at the highest tax bracket. How about those total TAXABLE income RM 53,000.00 contributing the same $3000 save how much? 19% If i sells PRS i also will use 26% to promote as if all malaysians earns over taxable 100,000 a year most ppl who consider only thinks about money but never realised who they are, after invested only knows their tax bracket only 3% Those at the say 3% tax bracket tend not to be so interested in this PRS thingy. I have an epiphany: Since some PRS provider are giving zero upfront charges and all else being equal, guess my money will go into PRS vis-a-vis traditional cash investment into UT. Bye bye Pub-Mut; hello HwangDBS. I am happy this PRS happened, maybe it will kick-start the beginning of zero upfront era for the industry. Yeah, Pub-Mut the lumbering and slumbering giant will probably awaken by this and start to give better return to its investors. Zero upfront fee would be a good start. Xuzen |

|

|

Dec 8 2012, 01:44 PM Dec 8 2012, 01:44 PM

|

Junior Member

359 posts Joined: Dec 2012 |

QUOTE(cybermaster98 @ Dec 8 2012, 09:38 AM) Thats wht i thought as well. But he just mentioned 26% which isnt really correct. He's merely saving on the equivalent of a 26% tax on the taxable amount above 100K which equates to RM780 only for the whole year. Maybe I have confused u. Rm780/3000=26%. if the fund mgr didn't make any money, u get 26%return from the3k u invested. The question is whether the fund mgr is capable to grow or lose yr capital?But my question is, to get that RM780 tax relief per year, you have to ensure you invest in a PRS fund that gives you back a better return. I mean it would be pointless to invest in something that 'loses' money rite? So although u may be saving RM780 from taxes, you risk losing much more through the investment itself. Is this a risk or am i being too paranoid? U mentioned above "to get that rm780 tax relief per year, u have to ensure you invest in a prs fund that gives you back better return" -- this is not true. Whether or not the fund perform, if u invested rm3k per year n yr tax bracket is 26%, u will get yr rm780 tax relief. Hope this explains. Added on December 8, 2012, 1:55 pm QUOTE(creativ @ Dec 8 2012, 11:24 AM) Hi Turbopips, I call public bank but the salesperson I talked to only sell ut,not prs. And she does not want to recommend me any agent, citing she don't know. Last week I saw a public mutual roadshow, n finally I met someone who can sell prs. I would stopped taking advise from your unit trust agent if I were you. If you want to buy from her, go ahead, she is a sales person after all. The only benefit I see is that she can help you with the administrative work of buying a fund from her company. But when it comes to investment and financial advice, stop taking it from her. In short, she is the only agent I know who sell prs. Any recommendation of good prs agent contacts for me? This post has been edited by turbopips: Dec 8 2012, 01:55 PM |

|

|

Dec 8 2012, 01:57 PM Dec 8 2012, 01:57 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(turbopips @ Dec 8 2012, 01:44 PM) Maybe I have confused u. Rm780/3000=26%. if the fund mgr didn't make any money, u get 26%return from the3k u invested. The question is whether the fund mgr is capable to grow or lose yr capital? U didnt get what i was trying to say. Of course i know ull get RM780 when u invest min 3K in PRS. Thats confirmed. But what i meant was, you may get Rm780 from the Gov in the form of a tax relief, but if your fund loses money then whatever small amount of tax relief you get will be easily obscured by the loss of your capital investment.U mentioned above "to get that rm780 tax relief per year, u have to ensure you invest in a prs fund that gives you back better return" -- this is not true. Whether or not the fund perform, if u invested rm3k per year n yr tax bracket is 26%, u will get yr rm780 tax relief. Hope this explains. |

|

|

Dec 8 2012, 02:09 PM Dec 8 2012, 02:09 PM

|

Junior Member

359 posts Joined: Dec 2012 |

QUOTE(xuzen @ Dec 8 2012, 01:21 PM) Funny enough, the people who are very interested in this PRS scheme tend to be people who are at the highest tax bracket. Yes u r rite. If my tax bracket is not more than 15%, I will think twice to invest in prs. Those at the say 3% tax bracket tend not to be so interested in this PRS thingy. I have an epiphany: Since some PRS provider are giving zero upfront charges and all else being equal, guess my money will go into PRS vis-a-vis traditional cash investment into UT. Bye bye Pub-Mut; hello HwangDBS. I am happy this PRS happened, maybe it will kick-start the beginning of zero upfront era for the industry. Yeah, Pub-Mut the lumbering and slumbering giant will probably awaken by this and start to give better return to its investors. Zero upfront fee would be a good start. Xuzen Malaysia income tax is too high n u easily hit the high bracket. Nowadays a person cannot say he is rich if he/she earn rm 120k per year. our salary increase , inflation increase even more, but the income tied to tax bracket remains. Btw, do share with us the hwang dbs contacts if u think it's better. Thanks |

|

|

Dec 8 2012, 09:40 PM Dec 8 2012, 09:40 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(xuzen @ Dec 8 2012, 01:21 PM) Funny enough, the people who are very interested in this PRS scheme tend to be people who are at the highest tax bracket. boss, even though i agree hwang in all essence is the cheaper entry and seems to be the best among all prs fund currently in terms of entry cost, i think i would still go for pb.Those at the say 3% tax bracket tend not to be so interested in this PRS thingy. I have an epiphany: Since some PRS provider are giving zero upfront charges and all else being equal, guess my money will go into PRS vis-a-vis traditional cash investment into UT. Bye bye Pub-Mut; hello HwangDBS. I am happy this PRS happened, maybe it will kick-start the beginning of zero upfront era for the industry. Yeah, Pub-Mut the lumbering and slumbering giant will probably awaken by this and start to give better return to its investors. Zero upfront fee would be a good start. Xuzen reasons: 1. performance of the fund is more important. the differences is very minimal. although i hate that pb charges 3% entry cost. just hope that pb is gonna recoup this charges over the years. let's not forget their yearly maintenance fees is lower than hwangs. and hwangs have a huge disclaimer that they reserve right to change their fees structure. imagine they impose exit cost later, you would be paying exit fees and future values. and those who invest in prs is definitely going for long term. 2. there's cumulative benefits with pb. hopefully this constitute as part of their calculation towards qualifying for gold status. and btw yes, this prs biggest attraction is for the tax relief. 26% for the highest income bracket. even if the fund does not give positive return, we would have gotten the gain upfront equivalent to our tax relief lor. so any syt agent wanna service me? kekeke. |

|

|

Dec 9 2012, 11:35 AM Dec 9 2012, 11:35 AM

|

Senior Member

3,294 posts Joined: Dec 2005 |

QUOTE(Limster88 @ Dec 6 2012, 08:46 PM) If not mistaken, HwangIM has the highest management fee among the PRS providers, which is up to 1.8%. Other providers only charge 1.5%.... Don't forget most of the other providers do charge sales charge, even the annual mgmt fee is higher if you calculate in a longer term, it will be still cheaper... |

|

|

Dec 10 2012, 10:24 AM Dec 10 2012, 10:24 AM

|

Senior Member

1,542 posts Joined: Jan 2005 From: Seri Kembangan |

The income tax relief for PRS start from this year or next year? I ask my unit trust agents and all of them haven't got a license to sell PRS. It's difficult to find one as at now.

|

|

|

Dec 10 2012, 11:26 AM Dec 10 2012, 11:26 AM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(netcrawler @ Dec 10 2012, 10:24 AM) The income tax relief for PRS start from this year or next year? I ask my unit trust agents and all of them haven't got a license to sell PRS. It's difficult to find one as at now. just call them and i'm sure they will send someone to service you lor.but can we request for specific requirements of the agents? kekeke. |

|

|

Dec 10 2012, 12:50 PM Dec 10 2012, 12:50 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(kochin @ Dec 8 2012, 09:40 PM) and btw yes, this prs biggest attraction is for the tax relief. 26% for the highest income bracket. even if the fund does not give positive return, we would have gotten the gain upfront equivalent to our tax relief lor. So in short, if your fund loses money then dont dream about having that small tax relief cover your losses. Dont forget that the main purpose of the PRS scheme is for ppl to pump money into our country's financial system. Thats the only way to stay afloat in times of crisis. So basically, the rakyat is helping with a bailout of our financial system. Although not at critical level yet but if both Europe and US remain in recession for 2013, then the domino effect will hit Malaysia. So dont just blindly invest in any PRS fund. Learn about the fund and its potential before committing. And dont ever be satisfied with a RM65 monthly savings. |

|

|

Dec 10 2012, 01:29 PM Dec 10 2012, 01:29 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(cybermaster98 @ Dec 10 2012, 12:50 PM) If the fund doesnt give you a positive return, you will be facing big losses overall la. That income tax relief is only worth max RM780 per year for the highest tax bracket. Whats so great about RM780 per year? Thats equivalent to a tax saving of RM 65 per month. How many ppl are in that tax bracket anyway? U gotta be earning more than RM8,300 per month to 'qualify'. boss, a bit far fetch, no?So in short, if your fund loses money then dont dream about having that small tax relief cover your losses. Dont forget that the main purpose of the PRS scheme is for ppl to pump money into our country's financial system. Thats the only way to stay afloat in times of crisis. So basically, the rakyat is helping with a bailout of our financial system. Although not at critical level yet but if both Europe and US remain in recession for 2013, then the domino effect will hit Malaysia. So dont just blindly invest in any PRS fund. Learn about the fund and its potential before committing. And dont ever be satisfied with a RM65 monthly savings. let's break it down to simple layman approach, shall we? The myth 1. IF the fund breaks even or increase, then no problem 2. IF the fund losses overall, what are the chances of it loses more than 20+% every freaking year? although i know where you are coming from but for me personally, my views are: The fact 1. IF we don't invest in this scheme, the gomen CONFIRM taxing me at the scheduled % 2. IF i invest in this scheme, i would have CONFIRM save my scheduled % tax rates so in total: 1. i have a fact that i would 'safe' certain percentage; 2. a possible scenario of gaining further or losing more than my investment. we are talking the best use of my rm3k to make my $$ work harder for me mah. i do agree i might have better use for my money overall but specifically for 3k, i am 'hoping' i might gain from this lor. no right or wrong, it is a matter of choice nia. btw, if i assume a salaried worker at RM7150 per month + 2 months bonus, he/she would be in the 26% tax bracket too (without tax relief). another scenario; the person earns rm6300 per month + 2 months bonus + he is getting rm1k per month from his rental of property (or other side income equivalent), also hit RM100k per annum. let's not forget; for taxable income >50k, already 19% >70k, already 24% that seems like an awful lot to me leh even at 19%. |

|

|

Dec 10 2012, 04:10 PM Dec 10 2012, 04:10 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(kochin @ Dec 8 2012, 09:40 PM) boss, even though i agree hwang in all essence is the cheaper entry and seems to be the best among all prs fund currently in terms of entry cost, i think i would still go for pb. Pub-Mut PRS is a seperate entity, it does not count towards the Gold Status. So, no free insurance & free will writing for you.reasons: 1. performance of the fund is more important. the differences is very minimal. although i hate that pb charges 3% entry cost. just hope that pb is gonna recoup this charges over the years. let's not forget their yearly maintenance fees is lower than hwangs. and hwangs have a huge disclaimer that they reserve right to change their fees structure. imagine they impose exit cost later, you would be paying exit fees and future values. and those who invest in prs is definitely going for long term. 2. there's cumulative benefits with pb. hopefully this constitute as part of their calculation towards qualifying for gold status. and btw yes, this prs biggest attraction is for the tax relief. 26% for the highest income bracket. even if the fund does not give positive return, we would have gotten the gain upfront equivalent to our tax relief lor. Xuzen Added on December 10, 2012, 4:21 pm QUOTE(cybermaster98 @ Dec 10 2012, 12:50 PM) If the fund doesnt give you a positive return, you will be facing big losses overall la. That income tax relief is only worth max RM780 per year for the highest tax bracket. Whats so great about RM780 per year? Thats equivalent to a tax saving of RM 65 per month. How many ppl are in that tax bracket anyway? U gotta be earning more than RM8,300 per month to 'qualify'. Why so kia-si (scare to die?)So in short, if your fund loses money then dont dream about having that small tax relief cover your losses. Dont forget that the main purpose of the PRS scheme is for ppl to pump money into our country's financial system. Thats the only way to stay afloat in times of crisis. So basically, the rakyat is helping with a bailout of our financial system. Although not at critical level yet but if both Europe and US remain in recession for 2013, then the domino effect will hit Malaysia. So dont just blindly invest in any PRS fund. Learn about the fund and its potential before committing. And dont ever be satisfied with a RM65 monthly savings. It is only after all RM 3K p.a. and that is 3% exposure in total of your annual income (assuming the income is RM 100K p.a.). Furthermore, even the aggresive fund is invested in 70% equities and 30% fixed income. 70% equities = RM 2,100.00 into equities = Value at risk of 2.1% in total only. Therefore no need to be so kia-si. Try seeing the bigger picture and do not be so myopic. Xuzen This post has been edited by xuzen: Dec 10 2012, 04:21 PM |

|

|

Dec 10 2012, 04:24 PM Dec 10 2012, 04:24 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(xuzen @ Dec 10 2012, 05:10 PM) Pub-Mut PRS is a seperate entity, it does not count towards the Gold Status. So, no free insurance & free will writing for you. It is a shame the PRS doesnt count in mutual gold status... It is similiar to UT EPF investment, they should make it the same to gain mutual gold status. Just my thought..Xuzen Added on December 10, 2012, 4:21 pm Why so kia-si (scare to die?) It is only after all RM 3K p.a. and that is 3% exposure in total of your annual income (assuming the income is RM 100K p.a.). Furthermore, even the aggresive fund is invested in 70% equities and 30% fixed income. 70% equities = RM 2,100.00 into equities = Value at risk of 2.1% in total only. Therefore no need to be so kia-si. Try seeing the bigger picture and do not be so myopic. Xuzen |

|

|

Dec 10 2012, 05:25 PM Dec 10 2012, 05:25 PM

|

Senior Member

952 posts Joined: Feb 2011 |

|

|

|

Dec 10 2012, 05:31 PM Dec 10 2012, 05:31 PM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(xuzen @ Dec 10 2012, 04:10 PM) Pub-Mut PRS is a seperate entity, it does not count towards the Gold Status. So, no free insurance & free will writing for you. The bigger picture would be RM3,000 (min) per annum x say 10 years which adds up to min 30K. Imagine if losses are big and ppl just rush into that just to get a RM 780 per annum 'discount' on tax. We're not just talking about not making a profit or cutting even, but actually losing. Xuzen Added on December 10, 2012, 4:21 pm Why so kia-si (scare to die?) It is only after all RM 3K p.a. and that is 3% exposure in total of your annual income (assuming the income is RM 100K p.a.). Furthermore, even the aggresive fund is invested in 70% equities and 30% fixed income. 70% equities = RM 2,100.00 into equities = Value at risk of 2.1% in total only. Therefore no need to be so kia-si. Try seeing the bigger picture and do not be so myopic. Xuzen Im not kiasi and neither am i against investments. I have heavy investments in properties, gold and also unit trusts. All im saying is that ppl (especially those who dont have much to spare) shouldnt blindly rush into PRS schemes without considering the risks. This post has been edited by cybermaster98: Dec 10 2012, 05:32 PM |

|

|

Dec 10 2012, 05:31 PM Dec 10 2012, 05:31 PM

|

Junior Member

359 posts Joined: Dec 2012 |

QUOTE(kochin @ Dec 8 2012, 09:40 PM) and btw yes, this prs biggest attraction is for the tax relief. 26% for the highest income bracket. even if the fund does not give positive return, we would have gotten the gain upfront equivalent to our tax relief lor. I think there’s enough explanations in all the previous postings on the role of tax relief in PRS, so I need not elaborate more on the taxes, coz ultimately everyone has their logical thinking behind. There’s no right/wrong. But for the high tax bracket person who does not agree with your statement above although he has the additional RM3k to spare, I think there could be 3 scenarios: 1. He is a bloodly good investor, and consistently make >26% returns on their investments every year. So PRS is an added risk for them 2. He is very risk averse. 3. He has enough exposure on equities For me, even if the year is badly hit and the PRS fund manager loses >20%, I don’t think I am that good to use the RM3k to make any profits for myself in any risk investments for that year (besides FD). And also RM3k/yr is but another diversification in portfolio to me as it will be the first UT that I am buying. Added on December 10, 2012, 5:43 pm QUOTE(cybermaster98 @ Dec 10 2012, 12:50 PM) Dont forget that the main purpose of the PRS scheme is for ppl to pump money into our country's financial system. Thats the only way to stay afloat in times of crisis. So basically, the rakyat is helping with a bailout of our financial system. Although not at critical level yet but if both Europe and US remain in recession for 2013, then the domino effect will hit Malaysia. Thanks for putting things into another perspective for us. Which makes me recollect what my Public mutual fund salesperson says that they (PRS fund providers) r not very keen and it’s the government that mandate certain bank/company to setup this PRS. I am not sure why but maybe fund too small? And it could be WIN-WIN situation more for both rakyat and government? My biggest worry is that the funds are not putting their top notch fund managers to manage this PRS. Also the fund size may not be big as I think majority of the contributor will be non-bumi, higher tax bracket earners due to lesser avenue for them for bigger tax deduction. And their small RM3k contributions will be spread out in the 8 PRS providers. This post has been edited by turbopips: Dec 10 2012, 06:00 PM |

|

|

Dec 10 2012, 08:29 PM Dec 10 2012, 08:29 PM

|

Senior Member

572 posts Joined: Sep 2007 |

QUOTE(cybermaster98 @ Dec 8 2012, 01:57 PM) U didnt get what i was trying to say. Of course i know ull get RM780 when u invest min 3K in PRS. Thats confirmed. But what i meant was, you may get Rm780 from the Gov in the form of a tax relief, but if your fund loses money then whatever small amount of tax relief you get will be easily obscured by the loss of your capital investment. You're a high income earner == High IQThe sentences below will deem suffice for you : HWANG PRS CONSERVATIVE FUND To provide Members with a Fund that preserves* capital for their retirement needs. *The Fund is not a capital guaranteed nor a capital protected fund. |

|

|

Dec 10 2012, 11:19 PM Dec 10 2012, 11:19 PM

|

Senior Member

633 posts Joined: Jan 2006 |

QUOTE(cybermaster98 @ Dec 10 2012, 05:31 PM) The bigger picture would be RM3,000 (min) per annum x say 10 years which adds up to min 30K. Imagine if losses are big and ppl just rush into that just to get a RM 780 per annum 'discount' on tax. We're not just talking about not making a profit or cutting even, but actually losing. If you are already into unit trust why so worried about PRS. Same as unit trust except Account 1 & Account 2 policy only. In fact currently for Hwang & Public Mutual , their PRS are feeder funds to their existing Unit Trusts Funds. Don't know about CIMB or Manulife. Further more you can switch PRS funds if the one you select today is none performing.Im not kiasi and neither am i against investments. I have heavy investments in properties, gold and also unit trusts. All im saying is that ppl (especially those who dont have much to spare) shouldnt blindly rush into PRS schemes without considering the risks. |

|

|

Dec 11 2012, 08:28 AM Dec 11 2012, 08:28 AM

|

Senior Member

4,440 posts Joined: Jan 2010 From: Kuala Lumpur |

QUOTE(Kinitos @ Dec 10 2012, 08:29 PM) You're a high income earner == High IQ Dont the 2 statements actually contradict each other? How could they claim to 'preserve' capital for the retirement needs of investors and then say its not 'capital guaranteed'? We all know the PRS scheme is not capital guaranteed.The sentences below will deem suffice for you : HWANG PRS CONSERVATIVE FUND To provide Members with a Fund that preserves* capital for their retirement needs. *The Fund is not a capital guaranteed nor a capital protected fund. Added on December 11, 2012, 8:29 am QUOTE(penangmee @ Dec 10 2012, 11:19 PM) If you are already into unit trust why so worried about PRS. Same as unit trust except Account 1 & Account 2 policy only. In fact currently for Hwang & Public Mutual , their PRS are feeder funds to their existing Unit Trusts Funds. Don't know about CIMB or Manulife. Further more you can switch PRS funds if the one you select today is none performing. Who's worried? Im discussing the merits of the PRS. If its worth my while, i might consider investing in it. Not just for the RM780 discount but for future growth and to diversify my investments. This post has been edited by cybermaster98: Dec 11 2012, 08:29 AM |

|

|

Dec 11 2012, 05:00 PM Dec 11 2012, 05:00 PM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

Hi all, anyone actually invested into this PRS? I'm aware of some info on this, and agree with others that one of the reasons for going into this is to reduce the taxable income, and save up to rm780 per year.

I'm considering going for the growth or conservative fund, but for eg public mutual, i can't find further details on how they are going to invest except for the percentage in equity. To those who have invested, which one did you go for? Hwang? Pb? Anyone tried investing in this via fundsupermart? Also, let's say i invest into conservative fund, and let's assume after first 2 yrs it's losing money say 5% pa, can we 'sell' the fund and just leave the proceeds in ppa/epf account getting the standard epf dividen? ii understand there is a 70/30 distribution where we can't touch the 70% until retirement, so let's say out of rm30k invested, rm21k cannot be touched but can we sell or are we locked in forever into this prs?? Any ideas? This post has been edited by poolcarpet: Dec 11 2012, 05:04 PM |

|

|

Dec 11 2012, 07:32 PM Dec 11 2012, 07:32 PM

|

Senior Member

2,545 posts Joined: Sep 2011 |

If I'm not wrong, you can withdraw all the money with 8% penalty.

|

|

|

Dec 11 2012, 07:46 PM Dec 11 2012, 07:46 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

Dec 11 2012, 07:51 PM Dec 11 2012, 07:51 PM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

QUOTE(lowyat101 @ Dec 11 2012, 07:32 PM) ok just called hwang to check my understanding. here's what i know.lets say rm3k in per year, for 10 yrs. total is rm30k in. distribution of 70/30 so rm21k can't be touched till retirement withdrawal. the other rm9k can be taken out (either partial or full) but only once a year and subject to 8% tax. and lets say i want to exit... well, its not possible to exit. can switch to conservative fund and just let it grow till retirement. so the big con of this is once you put in your money, give it a big hug and say see you in xx years' time the pro is of course the tax relief / immediate gain. based on hwang prs materials conservative fund is projected around 5% returns i think with growth fund max about 11%. think this is still better than epf returns but obviously there is a risk. anyone else actually already jumped into this prs? |

|

|

Dec 11 2012, 07:55 PM Dec 11 2012, 07:55 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(penangmee @ Dec 11 2012, 12:19 AM) If you are already into unit trust why so worried about PRS. Same as unit trust except Account 1 & Account 2 policy only. In fact currently for Hwang & Public Mutual , their PRS are feeder funds to their existing Unit Trusts Funds. Don't know about CIMB or Manulife. Further more you can switch PRS funds if the one you select today is none performing. For Hwang, which feeder fund is it for the PRS growth fund? |

|

|

Dec 11 2012, 08:43 PM Dec 11 2012, 08:43 PM

|

Senior Member

2,980 posts Joined: Jan 2007 From: Mount Chiliad |

im late joining this thread.

the discussion is getting heavier. i will start my own PRS on january, god's willing. |

|

|

Dec 11 2012, 09:12 PM Dec 11 2012, 09:12 PM

|

Junior Member

359 posts Joined: Dec 2012 |

QUOTE(cybermaster98 @ Dec 11 2012, 08:28 AM) If its worth my while, i might consider investing in it. Not just for the RM780 discount but for future growth and to diversify my investments. If tax relief is not yr main reason of buying PRS. I suggest its better for u to continue invest in your unit trust/gold. Why?1. U dont want yr investment to be tied down till the age of 55 years in PRS as the capital is not guaranteed. 2. Its historical performance is unknown yet unlike the normal unit trust u buy 3. U may want to wait to see the performance of the PRS fund managers against normal UT to see if there's signifcant. The money is yours... so this is just suggestion. This post has been edited by turbopips: Dec 11 2012, 09:16 PM |

|

|

Dec 11 2012, 11:36 PM Dec 11 2012, 11:36 PM

|

Senior Member

633 posts Joined: Jan 2006 |

|

|

|

Dec 11 2012, 11:58 PM Dec 11 2012, 11:58 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

hwang's growth funds have increased by about 1.1% since commencement of trading from late november.

annualised already >10% p.a. |

|

|

Dec 12 2012, 12:27 AM Dec 12 2012, 12:27 AM

|

Senior Member

1,639 posts Joined: Nov 2010 |

1. PRS vs. Unit trusts.

The income distributions (if any) in PRS are tax exempted. 2. PRS vs. EPF. There are statements that both allow tax deductions on contributions by employer (up to 19%, combining both PRS and EPF, of the employee's salary). But silent on whether the employer's contribution into PRS is considered non-income to the employee, unlike EPF. It is also best to keep in mind that it is possible to switch between providers as well as between funds within the same provider. There might be some switching or transfer fees, and in the case of Public Mutual zero fees within their PRS funds. So it is cheaper than the normal unit trusts if we were to switch to better funds, within or out to another provider, and don't have to pay sales charges (if any) again. Should check out the PPA.my site http://www.ppa.my/index.php/providers-and-...proved-schemes/ for more info... (I see why PM agents may not be happy, sales charge for their PRS is 3% vs 5.5% for their equity unit trusts.) |

|

|

Dec 12 2012, 09:10 AM Dec 12 2012, 09:10 AM

|

Senior Member

548 posts Joined: Sep 2005 From: Mars |

I'm planning to go for hwangim growth. Any known issues or negative points?