QUOTE(cybermaster98 @ Dec 10 2012, 12:50 PM)

If the fund doesnt give you a positive return, you will be facing big losses overall la. That income tax relief is only worth max RM780 per year for the highest tax bracket. Whats so great about RM780 per year? Thats equivalent to a tax saving of RM 65 per month. How many ppl are in that tax bracket anyway? U gotta be earning more than RM8,300 per month to 'qualify'.

So in short, if your fund loses money then dont dream about having that small tax relief cover your losses. Dont forget that the main purpose of the PRS scheme is for ppl to pump money into our country's financial system. Thats the only way to stay afloat in times of crisis. So basically, the rakyat is helping with a bailout of our financial system. Although not at critical level yet but if both Europe and US remain in recession for 2013, then the domino effect will hit Malaysia.

So dont just blindly invest in any PRS fund. Learn about the fund and its potential before committing. And dont ever be satisfied with a RM65 monthly savings.

boss, a bit far fetch, no?

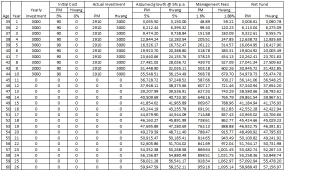

let's break it down to simple layman approach, shall we?

The myth

1. IF the fund breaks even or increase, then no problem

2. IF the fund losses overall, what are the chances of it loses more than 20+% every freaking year?

although i know where you are coming from but for me personally, my views are:

The fact

1. IF we don't invest in this scheme, the gomen CONFIRM taxing me at the scheduled %

2. IF i invest in this scheme, i would have CONFIRM save my scheduled % tax rates

so in total:

1. i have a fact that i would 'safe' certain percentage;

2. a possible scenario of gaining further or losing more than my investment.

we are talking the best use of my rm3k to make my $$ work harder for me mah. i do agree i might have better use for my money overall but specifically for 3k, i am 'hoping' i might gain from this lor. no right or wrong, it is a matter of choice nia.

btw, if i assume a salaried worker at RM7150 per month + 2 months bonus, he/she would be in the 26% tax bracket too (without tax relief).

another scenario; the person earns rm6300 per month + 2 months bonus + he is getting rm1k per month from his rental of property (or other side income equivalent), also hit RM100k per annum.

let's not forget;

for taxable income >50k, already 19%

>70k, already 24%

that seems like an awful lot to me leh even at 19%.

Dec 6 2012, 08:25 PM

Dec 6 2012, 08:25 PM

Quote

Quote

0.0220sec

0.0220sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled