Landed property prices rise in a sector on recovery modeMonday, 16 Jan 2023

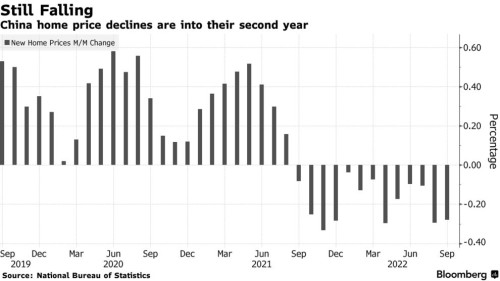

PETALING JAYA: Kenanga Research remains “neutral” on property developers on the view that the sector will continue to be weighed down by the bearish oversupply and cautious lending activity of banks.

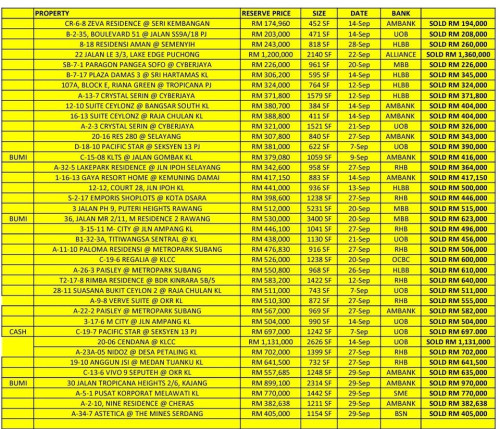

A bright spot for the sector, however, is the landed homes sub-segment. Since the onset of the Covid-19 pandemic, prices for terrace homes were the only sub-segment that have shown notable growth, while prices of high-rises and detached homes have either declined or only grown marginally, the research firm revealed.

Housing affordability for many buyers has been eroded by the higher interest rates and soaring construction cost.

The already high household debt-to-gross domestic product (GDP) ratio in Malaysia, which stood at 85% at the end of June 2022, has added to this.

“Our key concerns going into 2023 are developers’ elevated net debt levels and tight cash flows, exacerbated by higher interest rates,” the research house stated in a recent report.

The operating environment for developers is expected to remain challenging in 2023 underpinned by soft pricing power seen in 2022 despite the rising construction and land costs.

While the loan approval rate for the 10 months of 2022 had recovered to pre-pandemic levels of 43%, it is still pale in comparison to the 45% to 51% seen during the upcycle in 2011-2014, Kenanga Research noted.

Bank Negara had raised its overnight policy rate (OPR) by 100 basis points (bps) last year to 2.75% to fight inflation and normalise its rate levels.

Economists at UOB Research expect the central bank to raise the OPR by another 25 bps to 3% this week when its Monetary Policy Committee meets.

This will only add further pressure to buyer’s affordability and translate to higher financing costs and a potential liquidity crunch for highly leveraged developers, as well as weigh on their earnings.

The economy is also starting to slow with Maybank IB Research estimating the GDP growth rate for October and November 2022 averaging at 5% as compared to 14.2% year-on-year in the third quarter of 2022.

Kenanga Research thinks property developers are struggling to pass on higher construction costs to buyers, as price hikes will hurt take-up, putting the viability of the new launches at risk. Thus most choose to sacrifice on margins earned.

“Despite the reprieve (in the overhang situation), we note that there is still a long way towards recovery as units in circulation are still rather high versus historical levels – creating price competition and pressure for new unit launches,” Kenanga Research added.

With all these in mind, Kenanga Research believes developers focusing on landed townships such as Eco World Development Group Bhd, IOI Properties Group Bhd (IOIProp) and Sime Darby Property Bhd will fare better than the rest.

Its top picks are developers with strong cash flows that could anchor good dividends such as Eco World and IOIProp.

Jul 14 2022, 02:59 PM, updated 4 months ago

Jul 14 2022, 02:59 PM, updated 4 months ago

Quote

Quote

0.2127sec

0.2127sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled