Building materials price movement has zero impact on completed poorperly. Over 85% of residential is in subsale market. If one insisted to buy overpriced new launch unit is deserved to pay water fish price.

Developers charge premium price for added amenities and landscaping. By reducing unnecessary amenities and landscaping, developers could reduce RM PSF price.

As most bought poorperly with bank loan. Price rise slower than loan interest and expenses incurred is a financial losses e.g price stagnant.

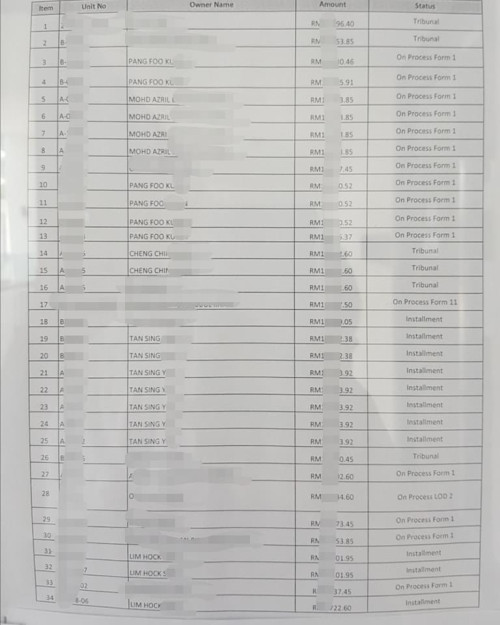

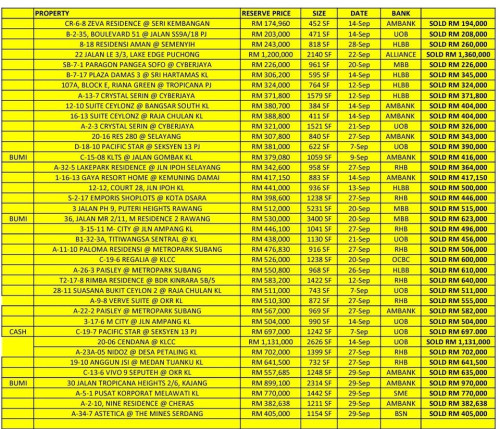

There could be substantial difference between asking, market, valuation and transacted price. Asking price is often syok sendiri and quoted by uuu.

Historically, rise in loan interest rate will tip overstretched borrowers into npl, incentived them to offload at below market price.

Many still ignorance to poorperly overhang. Until overhang is reduced substantially, price will remain suppressed.

Poorperly is illiquid, unlike commodities, stocks, BTC, etc, poorperly price takes years to bottom.

This post has been edited by icemanfx: Jul 15 2022, 04:11 AM

Will you think the property market will fall soon?, will the landed property fall in 2024?

Jul 15 2022, 03:57 AM

Jul 15 2022, 03:57 AM

Quote

Quote

0.0605sec

0.0605sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled