» Click to show Spoiler - click again to hide... «

QUOTE(xuzen @ Mar 6 2017, 12:07 PM)

Hari ini dalam sejarah:

I "played"

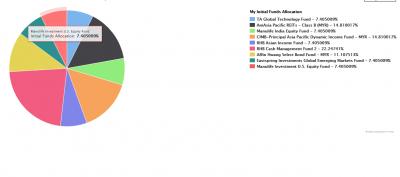

Ponzi 2.0 circa Feb 2015 to May 2016 (approx. 5 quarters period). I dump in by DCA around MYR 100K, and sold everything in May 2016 to switch to RHB AIF. I made a profit of six percent during the whole duration via the participation in Ponzi 2.0 UTF. Is it fantastic? Definitely no, if compared to higher risk UTF such as TA GTF or China only fund.

The three year annualized return for Ponzi 2.0 is 13.27% with a volatility of 10.54%. This means that the UTF in observation will still be considered normal behavior if she performs between 13.27 - 10.54 = 2.73% (worse case scenario) or 13.27 + 10.54 = 23.81% (best case scenario).

With a six percent return, the fund has deemed to perform "normally".

Xuzen

Part two:

Now, suppose the another fund has a lower volatility, say 5.12% whilst still having the same annualized return of 13.27%. This means that the new UTF in observation will still be considered normal behavior if she performs between 13.27 - 5.12 = 8.15% (worse case scenario) or 13.27 + 5.12 = 18.39% (best case scenario).

Can you now see that the new fund is "safer" in the sense, it does not drop so much in its normal behavior? You may argue, meh! It does not go up very higher either...

Nonetheless in the professional portfolio manager circle, they are trained to watch out for risk rather than return.

If you still buy the narrative that risk is a more important marker to watch, hence a professional portfolio manager would want to get the best bang for the buck or in this case, the best return for the risk taken. That is why the risk to reward ratio, that is return divided by risk is a good parameter to assist one to select a good UTF to participate in.

On the contrary, if one is a pure speculator, then one will be inclined to choose UTF that has very high volatility. Some UTF in the FSM universe such as RHB gold and general UTF has 30% volatility. Such UTF like this would be a punter /speculator choice UTF!

Hence, if you want to be a passive investor, choose low volatility, if you want excitement , choose high volatility.

Xuzen

p/s FSM - UTF... macam-macam ada.

This post has been edited by xuzen: Mar 10 2017, 04:23 PM

Mar 9 2017, 07:48 PM

Mar 9 2017, 07:48 PM

Quote

Quote

0.0208sec

0.0208sec

0.49

0.49

6 queries

6 queries

GZIP Disabled

GZIP Disabled