Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

dasecret

|

Mar 9 2017, 02:09 PM Mar 9 2017, 02:09 PM

|

|

QUOTE(puchongite @ Mar 9 2017, 01:52 PM) Actually from the list of funds, I am already seeing Amreits, Ponzi 2, CIMB titans are coming down. Those are still on the rise are EISC, KGF and Ponzi 1. And if you say you are at all time high, meaning your MY allocation in the port must be quite high. Mine also same; but I think Msia allocatio high or not is relative. When everyone else here say Msia doom doom doom I continue to hold MY funds lor So who else still have their MY EQ funds? |

|

|

|

|

|

vincabby

|

Mar 9 2017, 02:10 PM Mar 9 2017, 02:10 PM

|

|

QUOTE(Red_rustyjelly @ Mar 9 2017, 02:09 PM) Isn't this like stock market? i never buy stock market so i'm not sure where is the similarity. you mean buy low, sell high? |

|

|

|

|

|

Avangelice

|

Mar 9 2017, 02:11 PM Mar 9 2017, 02:11 PM

|

|

QUOTE(dasecret @ Mar 9 2017, 02:09 PM) Mine also same; but I think Msia allocatio high or not is relative. When everyone else here say Msia doom doom doom I continue to hold MY funds lor So who else still have their MY EQ funds? me. I jumped back in after it recovered post trump bleeding. even went into buying selected stocks in Malaysia |

|

|

|

|

|

puchongite

|

Mar 9 2017, 02:13 PM Mar 9 2017, 02:13 PM

|

|

QUOTE(dasecret @ Mar 9 2017, 02:09 PM) Mine also same; but I think Msia allocatio high or not is relative. When everyone else here say Msia doom doom doom I continue to hold MY funds lor So who else still have their MY EQ funds? Well, I use the word "high" in the sense that, while funds in other areas are dropping, only if the % allocation of MY funds is "high" enough, then you will still see the overall ROI increases. If one has smaller MY allocation, the profit gain from MY is not enough to cover the losses in other declining funds, then overall profitability will drop. ( I don't mean "high" as in "over" allocation ). This post has been edited by puchongite: Mar 9 2017, 02:14 PM |

|

|

|

|

|

Red_rustyjelly

|

Mar 9 2017, 02:13 PM Mar 9 2017, 02:13 PM

|

|

QUOTE(vincabby @ Mar 9 2017, 02:10 PM) i never buy stock market so i'm not sure where is the similarity. you mean buy low, sell high? Yeah, I never do fundmarket also, but i am constantly looking at it. Probably will do it soon. The only difference with stock market is there is a maturity date of 3 mths minimum ( not sure if got like 1 week or something?) |

|

|

|

|

|

vincabby

|

Mar 9 2017, 02:15 PM Mar 9 2017, 02:15 PM

|

|

QUOTE(Red_rustyjelly @ Mar 9 2017, 02:13 PM) Yeah, I never do fundmarket also, but i am constantly looking at it. Probably will do it soon. The only difference with stock market is there is a maturity date of 3 mths minimum ( not sure if got like 1 week or something?) the other diff is higher volatility. buy low sell high is the mantra for every investment if you ask me. |

|

|

|

|

|

Red_rustyjelly

|

Mar 9 2017, 02:17 PM Mar 9 2017, 02:17 PM

|

|

QUOTE(vincabby @ Mar 9 2017, 02:15 PM) the other diff is higher volatility. buy low sell high is the mantra for every investment if you ask me. Thats like placing my money to fund managers to invest for me. is kind of convenient when I have no time tracking everyday  |

|

|

|

|

|

vincabby

|

Mar 9 2017, 02:18 PM Mar 9 2017, 02:18 PM

|

|

QUOTE(Red_rustyjelly @ Mar 9 2017, 02:17 PM) Thats like placing my money to fund managers to invest for me. is kind of convenient when I have no time tracking everyday  that would be unit trust. if you mean stock market, you have to do it yourself. i think. |

|

|

|

|

|

puchongite

|

Mar 9 2017, 02:32 PM Mar 9 2017, 02:32 PM

|

|

QUOTE(frankzane @ Mar 9 2017, 02:01 PM) Hi Sifus, I still don't understand: Let's say I invested RM1000 in a fund and now I have a 6% return. So to 'earn' that return I have to sell some of the units right? That means my unit has now decreased (assuming no top up). So what will happen next month? With lesser units in hand, will I still see profits? Or what should I do? The profit you refer to is it the profit as it appears on FSM website ? After you sell some units, your % profit on FSM website will increase.  |

|

|

|

|

|

newbiz2008

|

Mar 9 2017, 02:35 PM Mar 9 2017, 02:35 PM

|

Getting Started

|

QUOTE(puchongite @ Mar 9 2017, 02:32 PM) The profit you refer to is it the profit as it appears on FSM website ? After you sell some units, your % profit on FSM website will increase.  usa equity market is going to like their trump president go up n down |

|

|

|

|

|

wodenus

|

Mar 9 2017, 03:21 PM Mar 9 2017, 03:21 PM

|

|

QUOTE(fun_feng @ Mar 8 2017, 12:14 AM) True, that instant tax relief money could be put to good use.. But i think ppl should give this a thought and think about the long term vs short term benefit of this.. Imean this is fsm thread right? Im assuming most ppl here are actively managing their money and could get a better yield of >1%pa than prs fund right? And that is assuming that your tax bracket is near the higher tier... If lower tier then its more at disadvantage No active management also more than 1%  |

|

|

|

|

|

wodenus

|

Mar 9 2017, 03:23 PM Mar 9 2017, 03:23 PM

|

|

QUOTE(Red_rustyjelly @ Mar 9 2017, 02:17 PM) Thats like placing my money to fund managers to invest for me. is kind of convenient when I have no time tracking everyday  Also when you get really old and your eyes become weak..  that's the thing about solo trading, will you still be able to stare at a monitor for hours when you are 64?  |

|

|

|

|

|

wodenus

|

Mar 9 2017, 03:29 PM Mar 9 2017, 03:29 PM

|

|

QUOTE(frankzane @ Mar 9 2017, 02:01 PM) Hi Sifus, I still don't understand: Let's say I invested RM1000 in a fund and now I have a 6% return. So to 'earn' that return I have to sell some of the units right? That means my unit has now decreased (assuming no top up). So what will happen next month? With lesser units in hand, will I still see profits? Or what should I do? Just treat this as a business. Don't touch it unless in an emergency. Leave it to your descendants when you are gone, so that everyone who meets them will complain about how unfair life is  |

|

|

|

|

|

Red_rustyjelly

|

Mar 9 2017, 03:30 PM Mar 9 2017, 03:30 PM

|

|

QUOTE(wodenus @ Mar 9 2017, 03:23 PM) Also when you get really old and your eyes become weak..  that's the thing about solo trading, will you still be able to stare at a monitor for hours when you are 64?  Fundsupermart have no fund managers right? |

|

|

|

|

|

wodenus

|

Mar 9 2017, 03:31 PM Mar 9 2017, 03:31 PM

|

|

QUOTE(Red_rustyjelly @ Mar 9 2017, 03:30 PM) Fundsupermart have no fund managers right? No they don't but the fund houses do. |

|

|

|

|

|

ykit_88

|

Mar 9 2017, 03:55 PM Mar 9 2017, 03:55 PM

|

Getting Started

|

QUOTE(T231H @ Mar 9 2017, 11:54 AM) Call them to ask then let us know will you? Thks Just called. Yes can transfer, just filled in the subsequent forms and done. |

|

|

|

|

|

Kaka23

|

Mar 9 2017, 03:59 PM Mar 9 2017, 03:59 PM

|

|

QUOTE(Vanguard 2015 @ Mar 9 2017, 11:26 AM) Kaka is a sis.  Sis, no time no see. Sudah hilang pergi mana? Busy working la bro.. investment generated "income" cannot cover active income yet ma... working time seldom lurk in Lyn |

|

|

|

|

|

fense

|

Mar 9 2017, 04:08 PM Mar 9 2017, 04:08 PM

|

|

QUOTE(ykit_88 @ Mar 9 2017, 11:19 AM) Sorry off topic abit. Not sure if this is the right platform to ask. I've open a PRS account with my friend cum AIA insurance agent two years back to get the RM500 incentive. Is it possible to transfer from AIA to another service provider OR preferably FSM? can. I transferred my affin hwang prs into fundsupermart, need filling some form in fundsupermart and at least wait 2-4 mths. it will appear in fsm acc. u need check is fsm had that PRS fund listed. This post has been edited by fense: Mar 9 2017, 04:09 PM |

|

|

|

|

|

prince_mk

|

Mar 9 2017, 07:40 PM Mar 9 2017, 07:40 PM

|

|

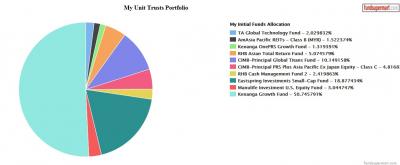

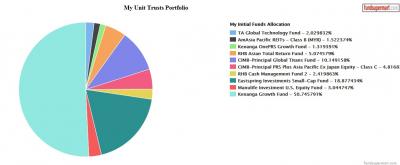

My Portfolio as at 9 Mac 2017. KGF, EA SC, Titan => all using EPF funds. Was advised by the FSM analyst, no more topping up Msia funds. Maybe can add CIMB Asia Pacific Income fund. Can advise on my portfolio ? This post has been edited by prince_mk: Mar 9 2017, 07:41 PM Attached thumbnail(s)

|

|

|

|

|

|

Avangelice

|

Mar 9 2017, 07:43 PM Mar 9 2017, 07:43 PM

|

|

QUOTE(prince_mk @ Mar 9 2017, 07:40 PM) My Portfolio as at 9 Mac 2017. KGF, EA SC, Titan => all using EPF funds. Was advised by the FSM analyst, no more topping up Msia funds. Maybe can add CIMB Asia Pacific Income fund. Can advise on my portfolio ? way too much on KGF bro. diversify further by topping up develop markets and Asia ex Japan |

|

|

|

|

Mar 9 2017, 02:09 PM

Mar 9 2017, 02:09 PM

Quote

Quote

0.0188sec

0.0188sec

0.36

0.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled