QUOTE(dasecret @ Jun 15 2017, 04:05 PM)

Err... seriously? Which fund exactly?

Thing is, a lot of them buy local equity funds using EPF, because easier for agents to get high amount through EPF than cash investment

Now.... for the past few years, returns less than EPF dividend.... how?

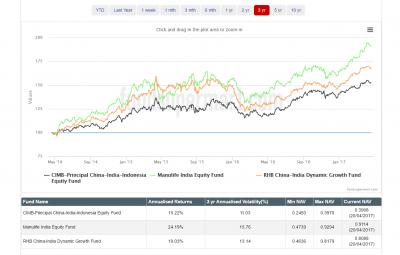

just some examples

PUBLIC GROWTH FUND YTD 12%

PUBLIC TACTICAL ALLOCATION FUND YTD 11.5%

PUBLIC FAR-EAST ALPHA-30 FUND YTD 13.5%

don't shot me sifus, I am not PM consultant, just a small investor at both PM and FSM, what I meant was if didn't consider their high SC, PM actually have some good return funds, why don't they offer 2 systems, one in DIY like FSM that has around 2% SC or lower, the other one remain their current SC 5.5% for people don't trust online platform and prefer face to face consultant service?

may be like what 2387581 said, PM don't care about small fish as long as they can hold their bigger customers

This post has been edited by ehwee: Jun 15 2017, 05:31 PM

Feb 20 2017, 03:23 PM

Feb 20 2017, 03:23 PM

Quote

Quote

0.7841sec

0.7841sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled