From experience, most ppl insured through the famous company i.e. GE, AIA, ING, PRU, HLA, Allianz, Manulife, etc

Reason being : our friends/relatives are these companies' agent.

After we save the agent's number, normally we will just put the policy aside.

Years later, some agent come after us and say it's better to do a review. FOC, why not?

And the common feedback, the plan or medical card outdated/ not really good, better do something on it..

So, what you gonna do? Sometime can be tough decision as you know medical protection is really important.

Esp your existing agent no longer in this line, or the new agent seems very trustworthy or very pro, whatsoever

Sounds familiar huh?

Well, the main intention of this post is to guide you on how to analyse the medical card, by yourself.

Hope it helps, more or less... :-)

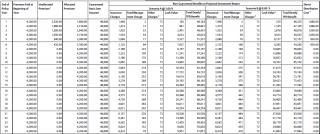

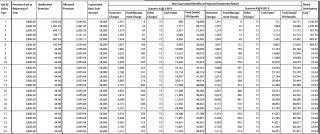

The comparison shall include (Priority from Top)

1) Limit for Outpatient Cancer Treatment / Kidney Dialysis

2) Annual Limit

3) Life Time Limit

4) Term of Coverage

5) Co Insurance

6) Surcharge if exceed room and board

7) Cost of Insurance

In next post i will explain the reason for above sequence.

The scope of coverage is actually very wide, so i just focus on what's really carry weight

Perhaps you may suggest some if you think that is also important for medical protection.

————————————————————————————————————————————————————————————————————

I don't want to go too deep for this part, just surface information which should be enough for us to analyse the H&S plan by ourselves.

1) Limit for Outpatient Cancer Treatment / Kidney DialysisYou have to fork out the money from your pocket for above treatment once it reaches the claim limit.

Needless to say, those H&S plan which set limit for above treatment are not recommended.

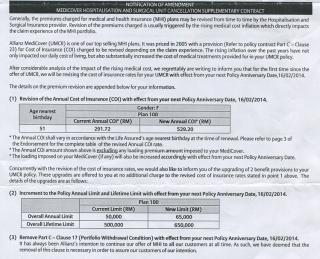

2) Annual Limit **The insurer has tried their very best to enhance the product in this competitive market. Guess what, there are some H&S plan in this market comes with

no annual limit, subject to T&C. With this enhancement, all other medical cards w/o this feature are basically obsolete

3) Life Time Limit At least 500k/ 1mil (pretty subjective) , to ensure the medical expenses is adequate, esp for long term disease.

4) Term of Coverage At least 80 years old. Certain plan cover up to 70 years old only, so who's gonna pay for the medical bill if a claim made after 70 years old ?

5) Co Insurance Some insurer impose 10% co insurance with minimum charge & maximum capping (normally inpatient), whichever is lower OR without maximum capping (normally outpatient),

6) Surcharge if exceed room and board Some insurer impose 20% co-payment with maximum capping, whichever is lower

7) Cost of Insurance The cost of the medical card, that can be vary much esp age catching up although the coverage is about the same. Considerate medical protection is one of the essential role for retirement planning, thus it's important to make sure the cost is not too high.

In next post we shall narrow the topic to the medical plan of each insurer

---------------------------------------------------------------------------------------------------------------------------------------------------------------

Mar 9 2008, 10:12 PM, updated 18y ago

Mar 9 2008, 10:12 PM, updated 18y ago

Quote

Quote

0.2356sec

0.2356sec

0.81

0.81

6 queries

6 queries

GZIP Disabled

GZIP Disabled