QUOTE(guy3288 @ Apr 30 2022, 05:49 PM)

dont put too high hope of these things la.. cant earn much one, you can profit alot means you also can loss big..... just for the sake of diversity throw some lo.

more important is increase your earning power, active income, accumulate a mountain then you dont rely of these anymore,

wealth preservation cukup

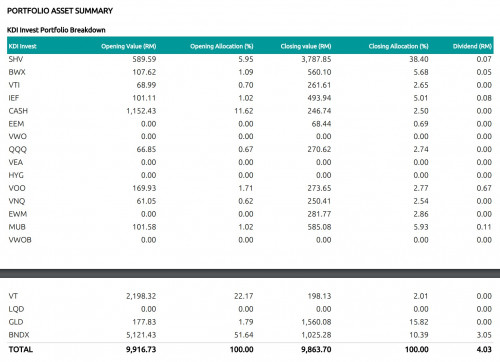

Yes, just sharing on a small amount of KDI invest experience

KDI save, if okay with working day withdrawal, then seems it is a okay option compare to traditional FD

QUOTE(sgh @ Apr 30 2022, 06:21 PM)

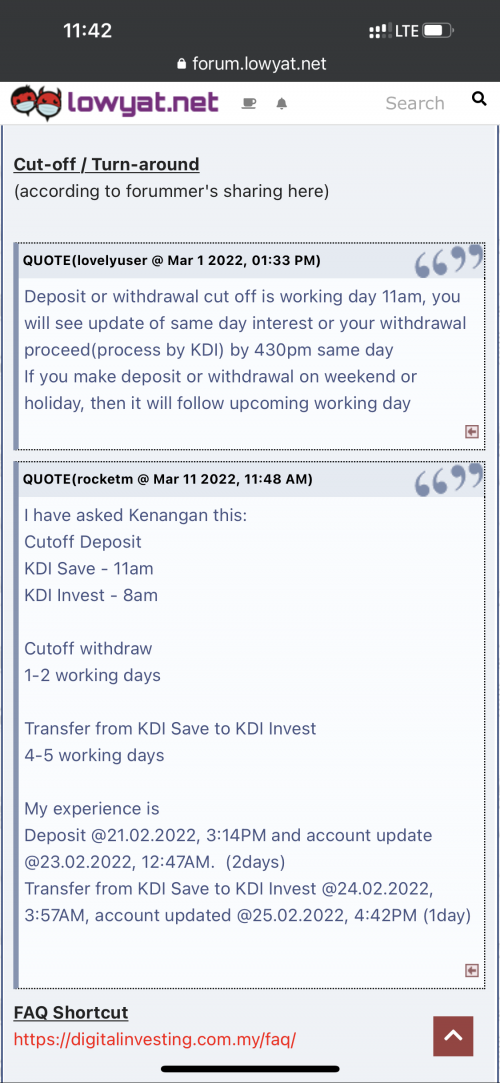

I think need to be fair in judgement. From what I read KDI invest is use monies buy US listed ETF. So you initiate withdraw they have to sell off to get you monies this take time. Even if you DIY

in US exchange yourself today sell today get monies?

I believe KDI save is different it is pool everyone monies go invest some safer instruments. That pool of monies I believe they hold some small portion no invest to meet redemption request like you. That is why you today sell early you get monies early.

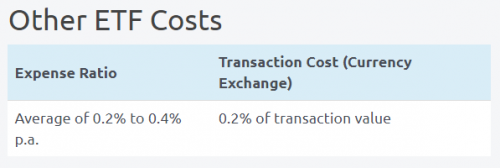

Yes, for KDI invest, it is explained in the FAQ

Does DIY in US exchange sell, get the amount transacted ? I don't know either.

QUOTE(Medufsaid @ Apr 30 2022, 07:16 PM)

Really hope kdi won't end up buy high sell low

never mind. KDI's email masok junk mail

The problem I felt, it is unstable now, some said this is a time to buy the dip though, I don't have the stomach on this for now, just invest when you have the spare, without worrying

Or choose KDI save for now, 3% up to 200K is not that bad

Apr 30 2022, 12:08 PM

Apr 30 2022, 12:08 PM

Quote

Quote

0.0269sec

0.0269sec

0.93

0.93

6 queries

6 queries

GZIP Disabled

GZIP Disabled