Hi all, newbie here. Just learn about this product also.

Understand that it is not PIDM protected, wondering if there's risk of loss of principal amount for the KDI FD?

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Mar 30 2022, 02:11 PM Mar 30 2022, 02:11 PM

Return to original view | Post

#1

|

Junior Member

132 posts Joined: Mar 2022 |

Hi all, newbie here. Just learn about this product also.

Understand that it is not PIDM protected, wondering if there's risk of loss of principal amount for the KDI FD? |

|

|

|

|

|

Apr 13 2022, 03:20 PM Apr 13 2022, 03:20 PM

Return to original view | Post

#2

|

Junior Member

132 posts Joined: Mar 2022 |

I registered the account at 1pm, got the approve by 4pm same day.

Made my first deposit last night at 10pm, till now still didn't reflect in the statement. Received email notification on the deposit but why is the turnaround time so slow hmmmm.. |

|

|

Apr 13 2022, 03:22 PM Apr 13 2022, 03:22 PM

Return to original view | Post

#3

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(Davidtcf @ Apr 13 2022, 10:44 AM) yea no face or fingerprint scan makes it hard to login. Yup have to manually log in every time. Even the ASNB app got the fingerprint function.also need to wait statement on 1st to see any up or downs for the portfolio. as long it can make profit on long term hold I'm ok. Free management fees for first RM3k for KDI invest makes it a sell for me. I like to have something easy to withdraw.. KDI invest suit this reason. (5 days wait time is standard) withdrawing from IBKR back to Malaysia will incur higher charges (need to withdraw larger amounts to be worth it). |

|

|

May 1 2022, 11:22 AM May 1 2022, 11:22 AM

Return to original view | Post

#4

|

Junior Member

132 posts Joined: Mar 2022 |

|

|

|

May 1 2022, 11:44 AM May 1 2022, 11:44 AM

Return to original view | Post

#5

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(mitodna @ Apr 30 2022, 11:20 AM) Exit out KDI Invest the initial RM250, when saw the amount is like RM250.3, after cash out, the final amount is RM248.1, money received yesterday May I know why the final amount is not RM250.30? I think there's no fee charging for funds below RM3k for KDI Invest? |

|

|

May 2 2022, 08:59 AM May 2 2022, 08:59 AM

Return to original view | IPv6 | Post

#6

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(Medufsaid @ May 1 2022, 02:42 PM) the amount you see every day (week?) is the current value in USD calculated into MYR rate. to really convert back to MYR for good, got percentage deduction QUOTE(shawnme @ May 1 2022, 12:08 PM) i see thanks for the reply. Majority of my funds are put under KDI Safe, I only put a small amount to test it on the Aggressive Mode. Understand that this kind of ETF should aim for long term, but as discussed above most of the robo adviser in Msia are not doing very well. Dunno if I should DCA, even if it's the money that I'm comfortable to lose... |

|

|

|

|

|

May 2 2022, 12:49 PM May 2 2022, 12:49 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(sgh @ May 2 2022, 12:20 PM) When you start to question yourself it means you have the answer you should not go for investment Aggressive Mode. For me I am like you many years ago and it make sense since I am young working and starting family so every dollar and cents is hard-earned cannot go into aggressive mode. Now going towards retirement mode, with more monies saved I can take some risk and put some capital into aggressive mode. After-all my own govt has CPF aka Msia EPF as my backup. I'm just testing water since it's a new instrument. The money that I put at KDI-Invest Aggressive Mode is less than 1% of my KDI portfolios. Let's say I DCA-ing until RM3000 (for 0 management fees), it's not going to make me poor or rich, depending on its performance. It's just a means of portfolio diversification for newbie like me. |

|

|

May 2 2022, 01:21 PM May 2 2022, 01:21 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

132 posts Joined: Mar 2022 |

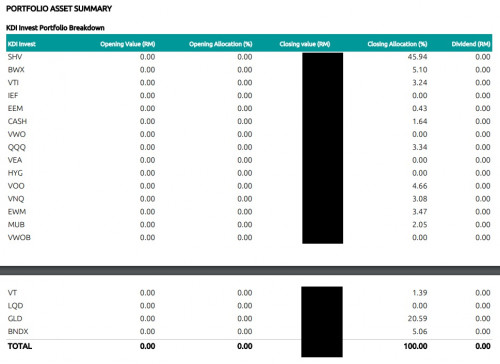

QUOTE(elimi8z @ May 2 2022, 12:48 PM) QUOTE Firstly, for an investment amount of above RM3,000, KDI charges a management fee of 0.7% or less per annum. Do note that there are no fees charged for an investment amount that is RM3,000 and below. For further details please refer to the fee schedule. That means if your current value rise >RM3000 they also won't charge you right? Posting my Aggressive portfolio for comparison (April statement), it seems like the biggest difference is SHV followed by GLD only..  QUOTE(sgh @ May 2 2022, 01:03 PM) Sorry I misread becuz in your earlier post you ask should I DCA then latest you say testing water. That means before you ask should DCA your mind is made up to test water am I correct? Yup, I am just testing water to see if I wanna DCA until an amount that im comfortable to lose. |

|

|

May 3 2022, 11:54 AM May 3 2022, 11:54 AM

Return to original view | Post

#9

|

Junior Member

132 posts Joined: Mar 2022 |

|

|

|

May 10 2022, 11:04 AM May 10 2022, 11:04 AM

Return to original view | Post

#10

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(Davidtcf @ May 9 2022, 11:22 AM) I wacked 1k for KDI invest last week also when the market fell sharply.. hope will gain from it. I notice my KDI invest allocation in Asia increased todaynow total at 2.2k.. will wait another good time to deposit the remaining few hundred. Since we cant pick the funds in KDI, just wondering if "buy the dip" method would work here? |

|

|

May 11 2022, 03:19 PM May 11 2022, 03:19 PM

Return to original view | Post

#11

|

Junior Member

132 posts Joined: Mar 2022 |

|

|

|

May 11 2022, 07:32 PM May 11 2022, 07:32 PM

Return to original view | Post

#12

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(MUM @ May 11 2022, 03:31 PM) Maybe just maybe, they are trying to get on the same train. 😁🤑 So the AI harvested this news and decided it is a buy signal? 😂"Asia stock stars may see more tailwinds even as world tightens" (May 8): Fed hikes, decades-high inflation and Covid lockdowns in China are only adding to investor bets that Southeast Asia’s stock markets may be one of the best places to park their money right now. Buyers are touting an economic reopening and the region’s attraction as a hedge against higher commodity prices, which is helping the MSCI Asean Index break out of a three-year relative downtrend versus its global peer. Foreign funds have been net buying Southeast Asia shares every month of this year, with total inflows of US$10 billion so far, Bloomberg-compiled data show. https://www.theedgemarkets.com/article/asia...-world-tightens QUOTE(lovelyuser @ May 11 2022, 03:46 PM) https://www.theedgemarkets.com/article/bnm-...-record-low-175 since KDI Safe is so much more flexible, if the bank offers promo rate >3%, can always withdraw and park the fund there.BNM increase OPR to 2%, hopefully our KDI Save return rate can be higher, or maybe the 2.25% above 200k deposit can be higher. This post has been edited by Alocasia: May 11 2022, 07:35 PM |

|

|

May 11 2022, 10:18 PM May 11 2022, 10:18 PM

Return to original view | Post

#13

|

Junior Member

132 posts Joined: Mar 2022 |

|

|

|

|

|

|

May 19 2022, 06:08 PM May 19 2022, 06:08 PM

Return to original view | Post

#14

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(guy3288 @ May 18 2022, 09:40 PM) you seem to think people who put millions in FD dont know how to invest I learnt this concept from GenXGenYGenZ back then when I was still a student. He also said that focus on saving your first million and the following steps would be easier. Even with 1M, and 4% p.a averagely back then is already 40k p.a and 3.3k per month. Can you consistently make 3.3k nett from other investment like stocks monthly? And one may need to sell the stock before they can take the profit.inflation will eat away their money etc. You forgot to look at the quantum. the actual amount of money you can get from it be investment or FD. example A has 500k to invest - go hard for 10% return. Good year got 10% return =RM50,000, passive income RM4166 pm. happy. Bad year? B has RM10M in FD ,monthly got RM20833 to spend Does he need to worry about inflation? i dont think inflation will eat away his money. High risk high return, just how high the risk i need to take? to earn enough to spend. |

|

|

May 19 2022, 07:40 PM May 19 2022, 07:40 PM

Return to original view | Post

#15

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(sgh @ May 19 2022, 06:36 PM) The key to this strategy is when can you earn your first million ? If salary worker you can do some maths if can hit by the time you retire then yes that strategy works. If cannot hit then the strategy does not work out very well isn't it? Also don't just look at the 3.3k in your e.g also need to factor in the rising cost of living and any other loans you haven't pay finish like house, car, kids education etc. I'm merely suggesting that 3.3k as additional & passive income, not ask u to retire w 3.3k to spend monthly. Agree that the question is HOW to attain that first 1 million. I'm a bit old school and still believe in invest in yourself, upskills to increase job income, and stay frugal. Anyway I think we are a bit derailed from the KDI topic. While my close friends are whinning on how much they lost in stocks/ crypto, I'm just happy that at least I have 3% + my capital. Even now invest in property with 3% p.a return is very good already. |

|

|

Jul 8 2022, 10:50 PM Jul 8 2022, 10:50 PM

Return to original view | Post

#16

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(guy3288 @ Jul 8 2022, 10:43 PM) KDI Invest Growth and Aggressive portfolio again at its peak now, just like in end of May 2022... All the while I have been trying small amount withdrawal and experienced same day bank-in. profit 2.3-2.5% over cost since Feb 2022 Sold RM5ok KDI Save this morning, till now money still not in teruk!!! Got many credit cards to pay, long weekend habis lah.......first time kena KDI save holding money so long....got RM80k 0% BT from UOB today, but wont be in time to pay my cards due date 11.7.22 Your experience made me think perhaps I should try a bigger amount next day to test the turnaround time in case I need money to park somewhere more urgently. |

|

|

Sep 13 2022, 09:03 AM Sep 13 2022, 09:03 AM

Return to original view | Post

#17

|

Junior Member

132 posts Joined: Mar 2022 |

I plan withdraw lump sum (100k) from KDI-Save, has anyone done that before?

Can do in 1 transaction or need any extra approval/ validation process? |

|

|

Oct 3 2022, 10:26 PM Oct 3 2022, 10:26 PM

Return to original view | Post

#18

|

Junior Member

132 posts Joined: Mar 2022 |

QUOTE(guy3288 @ Oct 3 2022, 08:52 PM) lack of reading You are right. Today I made some withdrawal, it showed RM X at 2.95% at the checkout page. Felt weird but didn't bother much until I checked lowyat. Wah you are right la bruh.... ini cilakak punya KDI actually reduces interest rate for amount above RM50k i checked 1 acc above RM50k found 3.0% is now only 2.95% i am sure above RM200k previously 2.25% will likely now become <2% Ini mana ada improvement for me? Really cunning......KDI play tricks like this.. makan big depositors vomit some out for smaller amount. Ok proof here: 1day interest earned is RM7.93 1st RM50k x 3.44%/365 = RM4.71 RM39798.22 x 2.95%/365 = RM3.22 Total = RM7.93 If above RM50k pays 3.0% total interest for 1 day should be RM7.98 Will move my money away soon. guy3288 liked this post

|

| Change to: |  0.1318sec 0.1318sec

0.69 0.69

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 10:29 AM |