QUOTE(TOS @ Apr 27 2022, 09:13 PM)

"Past returns are no indicator of future performance."

sure we all must know this basic.. but if a class of portfolio doing well over a LONG period, when all others doing badly it mean something right? good portfolio as they say...

but here we are talking about a 2 month old portfolio, too "young" to qualify yet as "past return".

Actually i had doubted that balanced portfolio could earn 10% profit , if you get the drift in my post.

QUOTE(lovelyuser @ Apr 27 2022, 10:20 PM)

Be rational bro, the investment date is very crucial. Even though both are same portfolio, investment date plays an important element to determine return la

i know that la bro.

you must remember everyone got excited straight away and we are jumped in.

all about same time, dont believe go back see the posts

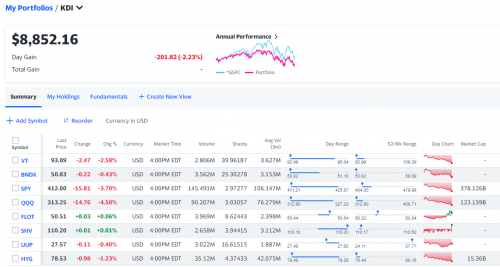

if not why Davidctf's portfolio now underwater?

same same lah

And that day he didnt mean 10% profit also! i just pretend dont know

cucuk him abit to get the truth.

QUOTE(Davidtcf @ Apr 27 2022, 11:20 PM)

Lol just checked again.. Now -11. Not percent bro but RM.

QUOTE(gchowyh @ Apr 28 2022, 12:18 AM)

I think you might have seen my nickname in FD thread & I was a staunch believer prior to last month & don't really dare to invest in shares or unit trusts.

But after knowing Kenanga, Touch n Go GO+ (at promo rates) & crypto savings, it is too hard to resist putting FD funds there.

yeah i remember you, do u remember me ?. I am heavy in FD also, i have substantial amount at 4.85% till end 2023 BR FD.

all these other stuffs just play play only.

Apr 28 2022, 12:58 AM

Apr 28 2022, 12:58 AM

Quote

Quote

0.0262sec

0.0262sec

0.21

0.21

6 queries

6 queries

GZIP Disabled

GZIP Disabled