QUOTE(cklimm @ Mar 7 2022, 08:42 AM)

WHether you in SA KDI or MyTheo irregardless markets up or down you still have to pay the fees If you scared then by all means put your money in gold FD or MMF then

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Mar 7 2022, 09:05 AM Mar 7 2022, 09:05 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

|

|

|

Mar 7 2022, 09:24 AM Mar 7 2022, 09:24 AM

Show posts by this member only | IPv6 | Post

#402

|

Junior Member

376 posts Joined: Feb 2015 |

nice to see a thread on KDI!

Personally I'll be using it mainly for their MMF - KDI Save, that sweet 3%. Then maybe test the waters on KDI Invest, keeping my AUM there below RM3K for their zero fees. |

|

|

Mar 7 2022, 09:42 AM Mar 7 2022, 09:42 AM

|

Junior Member

711 posts Joined: Sep 2021 |

QUOTE(xander83 @ Mar 7 2022, 09:05 AM) WHether you in SA KDI or MyTheo irregardless markets up or down you still have to pay the fees If small fees fair lah...you open shop, hire Bangala runs for you, regardless your shop makes money or not, still need to pay Bangala right?If you scared then by all means put your money in gold FD or MMF then But the fees have to be small lah, especially for small fry investors like me. |

|

|

Mar 7 2022, 10:09 AM Mar 7 2022, 10:09 AM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(xander83 @ Mar 7 2022, 09:05 AM) WHether you in SA KDI or MyTheo irregardless markets up or down you still have to pay the fees ok will give mytheo a try also for their income and inflation hedge portfolio.If you scared then by all means put your money in gold FD or MMF then problem now is can't login. walaowe.. edit: ok can login but loading pages still funky. So far their app load performance is the worst. Should start doing some maintenance This post has been edited by Davidtcf: Mar 7 2022, 10:17 AM |

|

|

Mar 7 2022, 10:16 AM Mar 7 2022, 10:16 AM

Show posts by this member only | IPv6 | Post

#405

|

Senior Member

2,337 posts Joined: Oct 2014 |

QUOTE(Hoshiyuu @ Mar 7 2022, 08:53 AM) That's the price of having a manager, market goes up, down, sideways, you will be paying them regardless. QUOTE(xander83 @ Mar 7 2022, 09:05 AM) WHether you in SA KDI or MyTheo irregardless markets up or down you still have to pay the fees Back then in 2020, I've bought Maybank, CIMB, PBB, HLFG, RHB stocks myself, and they are now all 20~40% profit, If you scared then by all means put your money in gold FD or MMF then seems like I am doing a better job than the managers.  |

|

|

Mar 7 2022, 10:19 AM Mar 7 2022, 10:19 AM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(cklimm @ Mar 7 2022, 10:16 AM) Back then in 2020, I've bought Maybank, CIMB, PBB, HLFG, RHB stocks myself, and they are now all 20~40% profit, no wrong buying Bursa stocks. I have some there too. But remember to diversify.seems like I am doing a better job than the managers.  Also note that MYR has dropped many times in the past due to our political issues. Hence why many people prefer to invest overseas to protect the value of their MYR. Even Singaporeans like to buy ETFs like VWRA, SWRD, EIMI (even though their SGD so strong). Just go to r/singaporefi to read how they invest. This post has been edited by Davidtcf: Mar 7 2022, 10:21 AM |

|

|

|

|

|

Mar 7 2022, 10:19 AM Mar 7 2022, 10:19 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(c64 @ Mar 7 2022, 09:42 AM) If small fees fair lah...you open shop, hire Bangala runs for you, regardless your shop makes money or not, still need to pay Bangala right? THat’s why you pay more for better quality workers otherwise how can you make money But the fees have to be small lah, especially for small fry investors like me. QUOTE(Davidtcf @ Mar 7 2022, 10:09 AM) ok will give mytheo a try also for their income and inflation hedge portfolio. Income portfolio you better off buying DIY as it would cheaper unless you are putting small amount because the returns are dismal compared to MMF ratesproblem now is can't login. walaowe.. At the moment inflation hedge is running hot with DBB and DBO is ATH that’s why you need to be aware because YTD is at 5% gain so you need to slowly DCA on the dips |

|

|

Mar 8 2022, 09:36 AM Mar 8 2022, 09:36 AM

|

Junior Member

998 posts Joined: May 2014 |

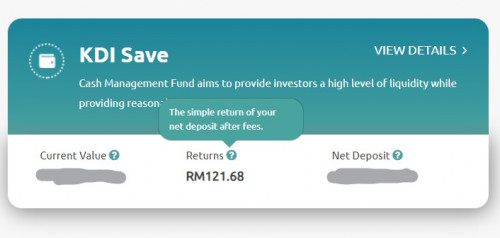

just do a testing to withdrawal….

withdraw same sum from both KDI save and KDI invest on 2/3 Already received fund 3/3 in my bank acc next day for KDI save But I only get refund on 7/3 for money parked under KDI invest and it is not exact amount I requested earlier …. slightly less than my I requested |

|

|

Mar 8 2022, 12:36 PM Mar 8 2022, 12:36 PM

|

Senior Member

7,553 posts Joined: May 2012 |

QUOTE(bcombat @ Mar 8 2022, 09:36 AM) just do a testing to withdrawal…. got fees on fxwithdraw same sum from both KDI save and KDI invest on 2/3 Already received fund 3/3 in my bank acc next day for KDI save But I only get refund on 7/3 for money parked under KDI invest and it is not exact amount I requested earlier …. slightly less than my I requested bcombat liked this post

|

|

|

Mar 8 2022, 02:05 PM Mar 8 2022, 02:05 PM

|

Junior Member

380 posts Joined: Aug 2010 |

|

|

|

Mar 8 2022, 03:09 PM Mar 8 2022, 03:09 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

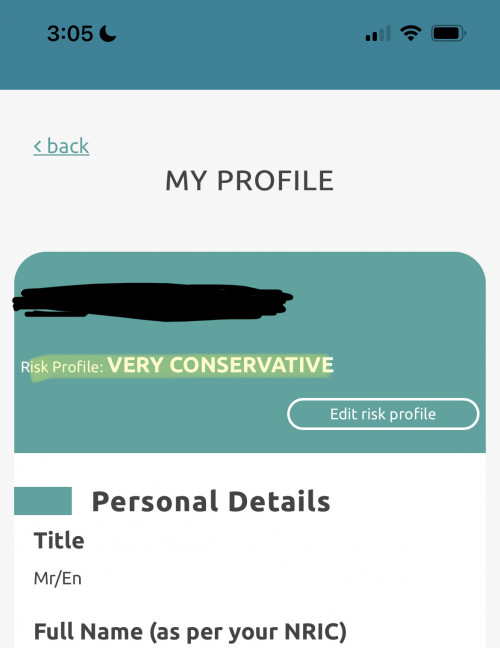

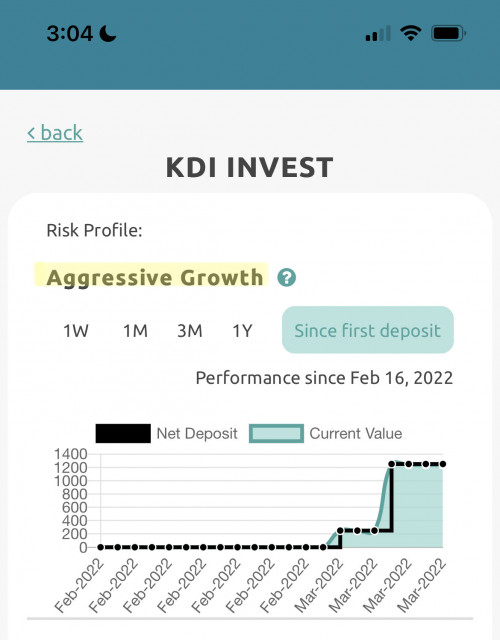

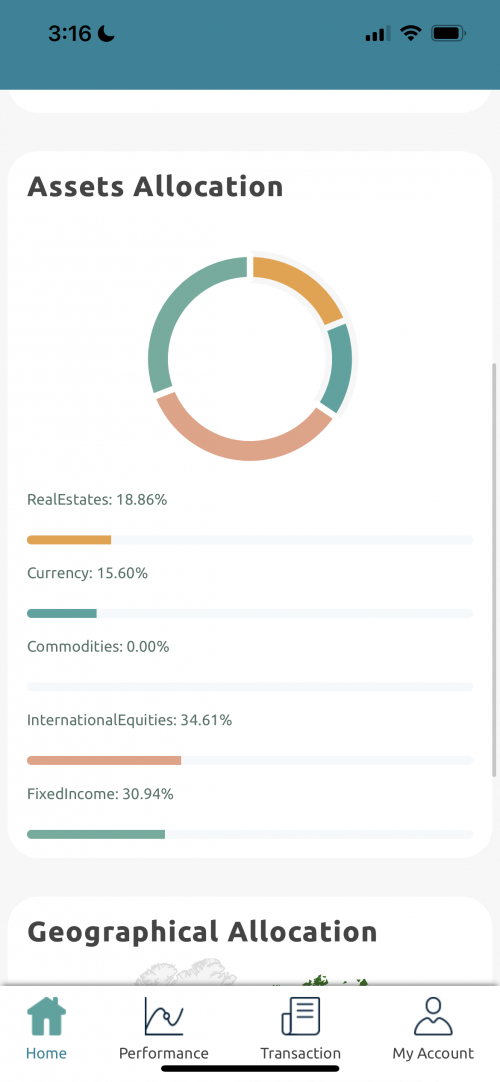

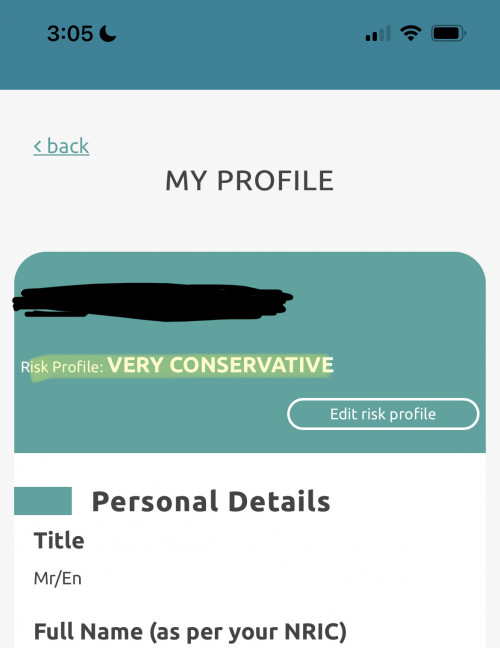

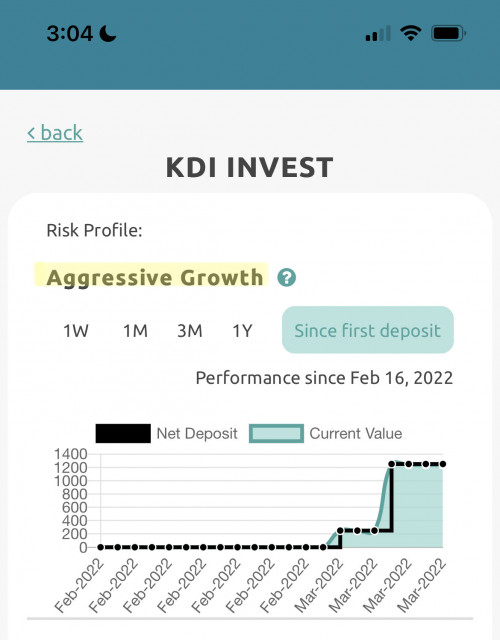

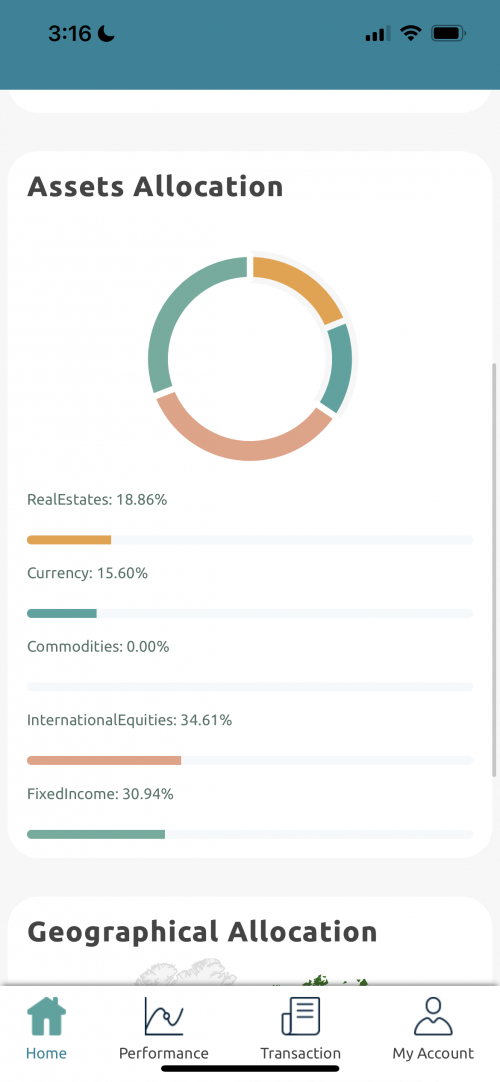

Another problem with KDI Invest.

Gonna withdraw my funds. Unacceptable error with their app since I can’t change the risk once money is in. Check both your portfolio and profile, they could end up being different:   When I first registered only put aggressive growth . Then after that I changed to conservative before funds entered. Still till today it chose this. So means my funds are in aggressive growth without my consent? Hence why I’m thinking why allocated 34.61% to equity? Doesn’t make sense. Only found out today. Does this look like conservative portfolio? Not at all:  Gonna wait they iron this out first. Tested out MYTHEO so far much better than their interface. Or can consider Stashaway also. Right now KDI invest still a mess. Edit: already sent an email to digitalinvesting@kenanga.com.my with all the screenshots. This post has been edited by Davidtcf: Mar 8 2022, 03:32 PM |

|

|

Mar 8 2022, 03:14 PM Mar 8 2022, 03:14 PM

Show posts by this member only | IPv6 | Post

#412

|

Senior Member

3,488 posts Joined: Jan 2003 |

so this step doesn't work?

QUOTE(shawnme @ Mar 3 2022, 04:55 PM) Accidentally stumbled onto it. I did it without selling anything, and despite after the deposit succeeded as I was just playing around without matter the consequences. doesn't seem to be aggressive growth though. check back the postsIf i remember correctly, it took a few days before it actually changed. This post has been edited by Medufsaid: Mar 8 2022, 03:30 PM |

|

|

Mar 8 2022, 03:26 PM Mar 8 2022, 03:26 PM

|

Junior Member

992 posts Joined: Jun 2013 |

QUOTE(Vickyle @ Mar 8 2022, 02:05 PM) Is the return not 8.21 with 3% (100,000x0.03/365)? How is it 30.39? Need sifu enlighten me Your are right, the daily return is RM 8.21Edit: unless it is not "daily return", but "total return"? RM 30.39 is total return since day one of placement And for your info, RM 100,000 build up over few days, not within the same day ya Davidtcf liked this post

|

|

|

|

|

|

Mar 8 2022, 04:08 PM Mar 8 2022, 04:08 PM

|

Senior Member

4,546 posts Joined: Jun 2009 From: Selangor / Sarawak / New York |

Thinking if i should switch from stashaway simple of KDI save.

What other benefits does KDI offer other than 3% vs 2.4%? Next year onwards after promo period finishes, it will go to 2.25%? Any fees on the savings account? |

|

|

Mar 8 2022, 04:11 PM Mar 8 2022, 04:11 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Michaelbyz23 @ Mar 8 2022, 04:08 PM) Thinking if i should switch from stashaway simple of KDI save. KDI Save great to use.. 3% earned on daily basis. Fast deposit and withdrawal also.What other benefits does KDI offer other than 3% vs 2.4%? Next year onwards after promo period finishes, it will go to 2.25%? Any fees on the savings account? Next year nobody knows what rate they will offer.. need to be Oracle only can know No fees.. they profit by rolling your money around liao. More money u put in in some ways they can earn. Win- win for both sides. This post has been edited by Davidtcf: Mar 8 2022, 04:12 PM |

|

|

Mar 8 2022, 04:22 PM Mar 8 2022, 04:22 PM

|

Junior Member

183 posts Joined: Aug 2011 |

Tried KDI Save so far so good with daily return. Then decided to try out KDI Invest with balance portfolio few days back, currently down -2.98%

|

|

|

Mar 8 2022, 05:11 PM Mar 8 2022, 05:11 PM

Show posts by this member only | IPv6 | Post

#417

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(BooYa @ Mar 8 2022, 04:22 PM) Tried KDI Save so far so good with daily return. Then decided to try out KDI Invest with balance portfolio few days back, currently down -2.98% normal, since now US market has big bear Medufsaid liked this post

|

|

|

Mar 8 2022, 05:24 PM Mar 8 2022, 05:24 PM

|

Junior Member

992 posts Joined: Jun 2013 |

QUOTE(Michaelbyz23 @ Mar 8 2022, 04:08 PM) Thinking if i should switch from stashaway simple of KDI save. KDI Save 3%pa guarantee return is for up to RM 200k deposit and till year endWhat other benefits does KDI offer other than 3% vs 2.4%? Next year onwards after promo period finishes, it will go to 2.25%? Any fees on the savings account? SA Simple 2.4%pa is PROJECTED return RM 100k deposit of SA Simple and KDI Save, interest difference will be RM 1.64/day If you have more than 200k, then park 200k in KDI Save, the rest in SA Simple 2.4% |

|

|

Mar 8 2022, 05:28 PM Mar 8 2022, 05:28 PM

Show posts by this member only | IPv6 | Post

#419

|

Senior Member

4,488 posts Joined: Mar 2014 |

QUOTE(Davidtcf @ Mar 8 2022, 03:09 PM) Another problem with KDI Invest. 34% equities is not aggressive.Gonna withdraw my funds. Unacceptable error with their app since I can’t change the risk once money is in. Check both your portfolio and profile, they could end up being different:   When I first registered only put aggressive growth . Then after that I changed to conservative before funds entered. Still till today it chose this. So means my funds are in aggressive growth without my consent? Hence why I’m thinking why allocated 34.61% to equity? Doesn’t make sense. Only found out today. Does this look like conservative portfolio? Not at all:  Gonna wait they iron this out first. Tested out MYTHEO so far much better than their interface. Or can consider Stashaway also. Right now KDI invest still a mess. Edit: already sent an email to digitalinvesting@kenanga.com.my with all the screenshots. That's less than EPF. |

|

|

Mar 8 2022, 05:57 PM Mar 8 2022, 05:57 PM

|

Junior Member

992 posts Joined: Jun 2013 |

QUOTE(lovelyuser @ Mar 8 2022, 03:26 PM) Your are right, the daily return is RM 8.21 RM 30.39 is total return since day one of placement And for your info, RM 100,000 build up over few days, not within the same day ya  Vickyle liked this post

|

| Change to: |  0.0220sec 0.0220sec

0.23 0.23

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 12:32 PM |