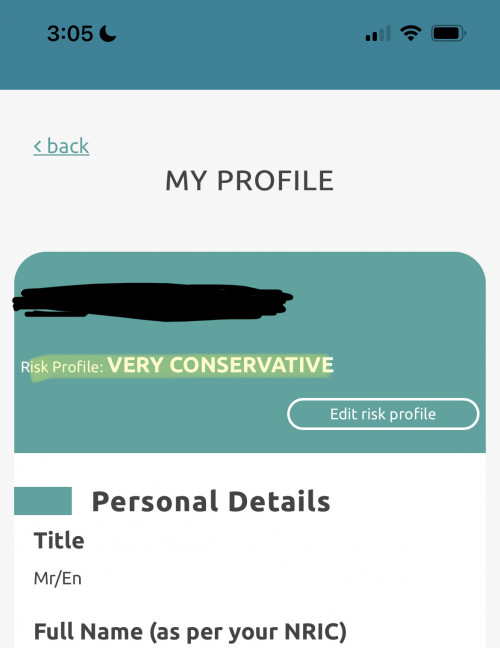

QUOTE(Davidtcf @ Mar 8 2022, 03:09 PM)

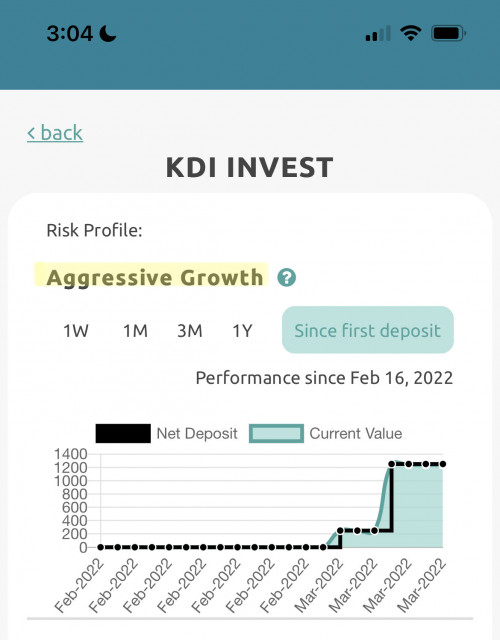

Another problem with KDI Invest.

Gonna withdraw my funds. Unacceptable error with their app since I can’t change the risk once money is in.

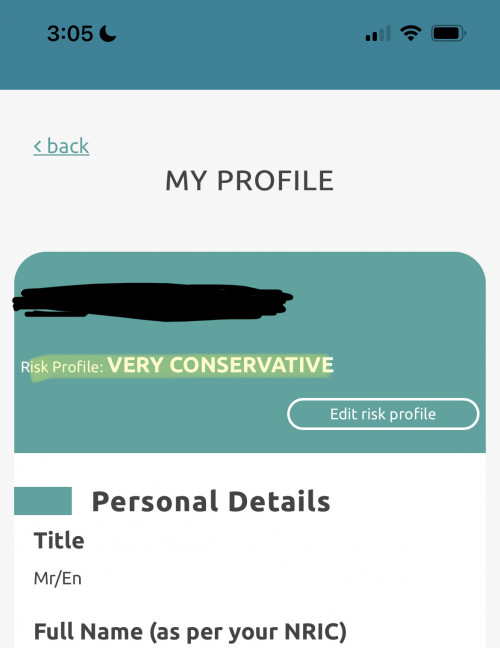

Check both your portfolio and profile, they could end up being different:

h

h

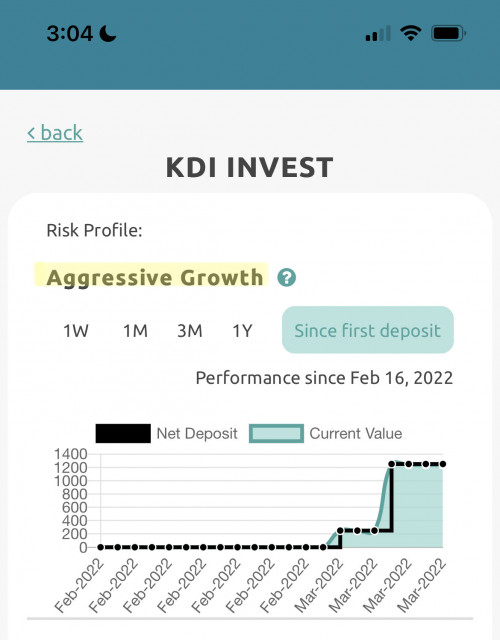

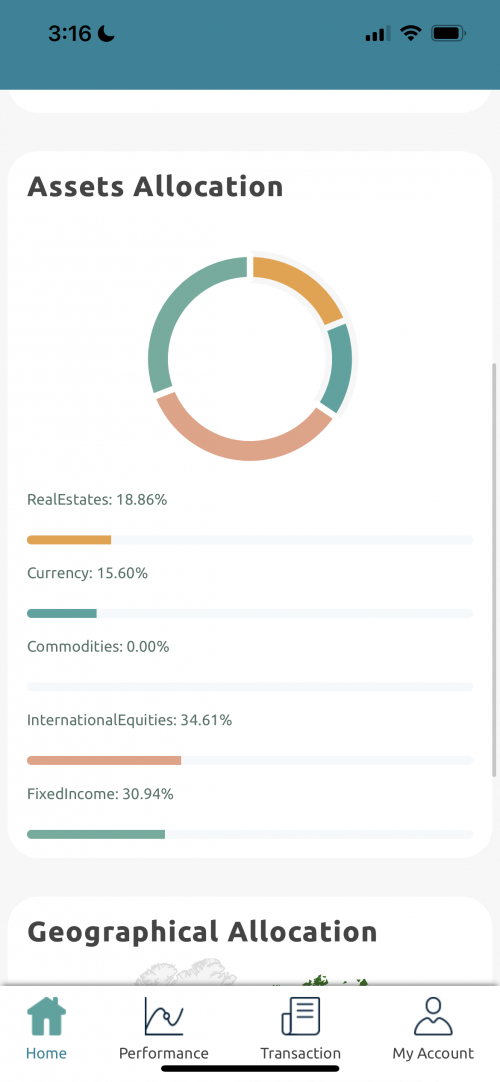

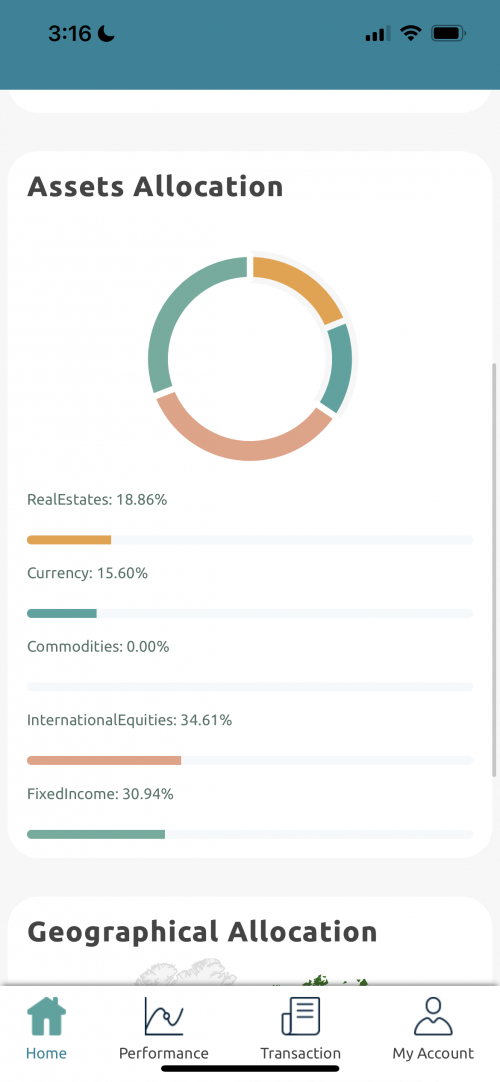

When I first registered only put aggressive growth . Then after that I changed to conservative before funds entered. Still till today it chose this. So means my funds are in aggressive growth without my consent? Hence why I’m thinking why allocated 34.61% to equity? Doesn’t make sense. Only found out today.

Does this look like conservative portfolio? Not at all:

Gonna wait they iron this out first. Tested out MYTHEO so far much better than their interface. Or can consider Stashaway also. Right now KDI invest still a mess.

Edit: already sent an email to digitalinvesting@kenanga.com.my with all the screenshots.

Downsides of kDI still no multi portfolios and switching Gonna withdraw my funds. Unacceptable error with their app since I can’t change the risk once money is in.

Check both your portfolio and profile, they could end up being different:

h

hWhen I first registered only put aggressive growth . Then after that I changed to conservative before funds entered. Still till today it chose this. So means my funds are in aggressive growth without my consent? Hence why I’m thinking why allocated 34.61% to equity? Doesn’t make sense. Only found out today.

Does this look like conservative portfolio? Not at all:

Gonna wait they iron this out first. Tested out MYTHEO so far much better than their interface. Or can consider Stashaway also. Right now KDI invest still a mess.

Edit: already sent an email to digitalinvesting@kenanga.com.my with all the screenshots.

KDI invest still a gamble because everything stillness broken except their AI asset allocations

Mar 8 2022, 06:02 PM

Mar 8 2022, 06:02 PM

Quote

Quote 0.0216sec

0.0216sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled