QUOTE(nokia2003 @ Mar 14 2010, 09:39 PM)

realistically, only a handful of malaysians can afford to allocate such an amount of money for the sole purpose of 'hedging'.

The main purpose of the majority of Malaysians opening an offshore account is the ease of moving your money around.

QUOTE(nokia2003 @ Mar 14 2010, 09:39 PM)

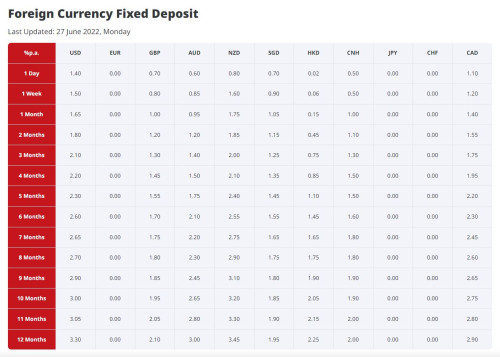

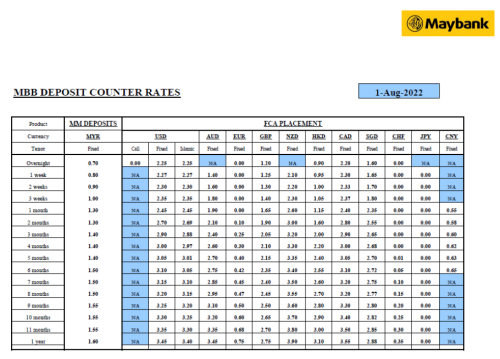

besides their rates aren't precisely attractive, even compared side by side with the local australian citibank and HSBC and worse the need of being locked down for a year tenancy.

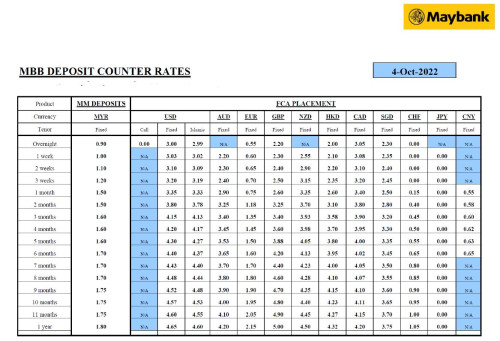

Besides the 1-year tenure, you may also choose the 1-month, 3-month, 6-month tenure and so on but the rate will be substantially lower than the 1-year rate.

The only currency that gives you a better rate on shorter tenure rather than 1-year tenure is the US Dollar. Both HSBC International and Citi International Personal Bank both quote higher interest rate for US Dollar time deposit for 6-month tenure only compared to 1-year tenure.

QUOTE(nokia2003 @ Mar 14 2010, 09:39 PM)

however the great thing about these two options is, you don't have to physically leave the country.

Exactly ! Things are even easier if you already are a HSBC Premier customer ! Basically you just leave them your contact at HSBC Singapore. Those guys in HSBC Singapore will refer your case to their colleagues in HSBC International in Singapore and very soon someone from HSBC International will call you. They will ask you to send them a photocopy of your IC and passport. They will then process your application and you shall receive the welcome package in a week time.

Please note that HSBC Singapore and HSBC International and completely different entities and people working there report and get orders from different bosses. The HSBC International office is located in the same building as HSBC Singapore HQ but those people working in HSBC International will report everything back to HSBC UK and not HSBC Singapore.

This is the same in HSBC Hong Kong and HSBC International in Hong Kong.

QUOTE(nokia2003 @ Mar 14 2010, 09:39 PM)

if my memory hasn't failed me, my housemate (who on the HSBC premier) has conveyed to me, that there isn't any minimum amount required to maintain the australian HSBC premier account, provided the one in malaysia is kept at the allocated threshold.

Correct !

QUOTE(nokia2003 @ Mar 14 2010, 09:39 PM)

he opened his account before arriving in melbourne and it has seems to be going well for him at the moment and still gets to enjoy the perks from the australian HSBC.

Yes. This can also be done in HSBC USA, HSBC UK, HSBC Canada, HSBC Hong Kong, HSBC Taiwan, HSBC Singapore, HSBC International offshore etc.

QUOTE(KVReninem @ Mar 14 2010, 10:02 PM)

I remember this had been ages ago.

QUOTE(KVReninem @ Mar 14 2010, 10:02 PM)

Like you open Premier Malaysia, HK & you can open another in Australia with little rain check if not mistaken.

They only care about the relation with your premier in Msia... tat`s far I know.

This thing only started in year 2007. The previous HSBC Premier membership did not offer their clients this kind of perks. Standard Chartered is copying all these and offer more or less the same perks as HSBC Premier with their Priority Banking but Standard Chartered is no where as big as HSBC.

The other one is Citibank CitiGold. As long as you maintan your CitiGold status in Malaysia, you'll enjoy the same service and get a CitiGold special time deposit rate should you decide to open an offshore account with them in Singapore or Hong Kong. Citibank started this in late 2008. So, HSBC actually is the first one to offer this kind of service and overall, it is still a lot better than Standard Chartered Priority Banking and Citibank CitiGold.

QUOTE(nokia2003 @ Mar 14 2010, 10:30 PM)

however, my housemate has also added, if your balance in the HSBC premier malaysia drops below RM200000 (intentionally or not), you not only have to pay the penalty fees in malaysia, but in australia as well. sounds fair to me IMHO, since it was free for you to maintain the australian HSBC premier account.

Please take note that if your total net worth in HSBC Premier Malaysia falls below RM200,000, you will be charged RM150 per month and you will be given 3-month to top-up your fund. Should your total asset under management in HSBC Premier Malaysia is still below the required RM200,000 after the 3-month grace period, they will kick you out of HSBC Premier.

QUOTE(KVReninem @ Mar 14 2010, 10:42 PM)

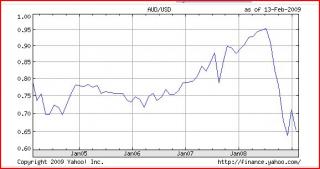

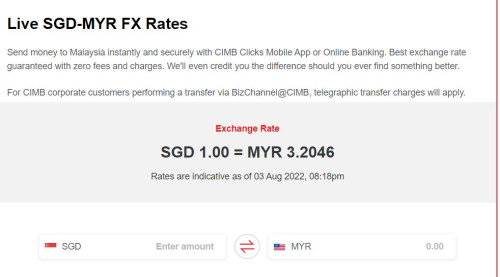

perks sound good actually for offshore account & does this effected by the ex rate changes?

like right now you see it at 3.0, sooner will reach about 3.4...

does it allow you to hedge in this matter? like hold at this rate of 3?

For currency hedging, usually your banker will advise you to play dual currency investment. This kind of investment is designed specially for this purpose.

QUOTE(KVReninem @ Mar 14 2010, 10:42 PM)

RM200000, quite a figure but its good against as long the bank dont run away with your money.

They won't run away with your money. You will only loss your money when they go bankrupt which is a highly unlikely scenario because the government won't allow it as it poses a systemic risk to the global economy and many people will be affected. Citibank and Bank of America are both very good examples. Besides, a lot of people have a lot more than just RM200,000 with banks like HSBC, Citibank etc.

QUOTE(nokia2003 @ Mar 14 2010, 10:57 PM)

from the HSBC premier point of view, i can pinpoint out three distinct advantages:

1. you can link and integrate the malaysian and australian (we will use both of these countries as an example, in this instance) accounts into one viewable account. this means that you are free to move your cash from/to one account to another at your convenience, 24/7 (both internet and telephone) and at your discretion.

2. you are free to withdraw money, at the local currency, without incurring any fees or costs, IF you are extremely desperate for physical cash.

3. you are free to select the products offered by the australian HSBC side; investments, savings, day-to-day accounts et cetera.

Spot on !!!

Another advantage is that you'll be given a complimentary credit card in anywhere you hold a HSBC Premier account. It is very common for a US citizen who is a HSBC Premier client to hold several credit cards issued by HSBC from several different countries such as HSBC Delaware USA, HSBC Canada and HSBC UK etc.

This post has been edited by MilesAndMore: Mar 15 2010, 01:09 AM

Jun 6 2007, 10:45 PM, updated 19y ago

Jun 6 2007, 10:45 PM, updated 19y ago

Quote

Quote

0.2441sec

0.2441sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled