Outline ·

[ Standard ] ·

Linear+

Anyone know about foreign FD?

|

Ramjade

|

Aug 17 2016, 12:08 AM Aug 17 2016, 12:08 AM

|

|

QUOTE(ohemmgee @ Aug 16 2016, 11:44 PM) What is the minimum amount should I deposit in a foreign currency account ? I am not looking for FD. Just wanna park the money in USD. All the banks websites not very helpful Usually rm5000. Some require rm1-3k only. |

|

|

|

|

|

Ramjade

|

Nov 23 2019, 01:45 PM Nov 23 2019, 01:45 PM

|

|

QUOTE(Hansel @ Nov 23 2019, 01:40 PM) Good afternoon, forummers,.... Just enquiring here if any of you guys have brought back any foreign currencies to be entered into our Msian Banks' foreign currency fixed deposits (FCFDs) ? I noticed our Msian Banks' FCFDs have higher interest rates than my banks do overseas. Hoping for some opinions and advice here,... thank you, bros and sis,.... Been there done that. Suffered loss. Hong leong was offering aud FD at about 5%p.a last time. Due to markup exchange rates (both ways) + fall in AUD = loss. However even if AUD didn't fall, would still make a loss (markup exchange rates (both ways) > 5%)   Drop in AUD further increase mu losses This post has been edited by Ramjade: Nov 23 2019, 01:49 PM |

|

|

|

|

|

Ramjade

|

Nov 23 2019, 01:59 PM Nov 23 2019, 01:59 PM

|

|

QUOTE(moosset @ Nov 23 2019, 01:54 PM) really? true or not?? I think those USD FD in Cambodia etc have higher interest rates. wah.... I didn't know you save in FD in foreign currencies. Might as well just use AUD to buy stocks in ASX? That was last time during form 5 when inexperienced. Tried my hands on what ever banks investment instrument. Turns out the only winning person is the banks. Hence I am anti-banks since then. Only good things about banks last time was FD at 4.5-4.8% for 5 years!!! Nowadays when banks try selling me stuff I tell them no thank you. I do my own investments.   This post has been edited by Ramjade: Nov 23 2019, 02:00 PM This post has been edited by Ramjade: Nov 23 2019, 02:00 PM |

|

|

|

|

|

Ramjade

|

Aug 3 2022, 12:17 PM Aug 3 2022, 12:17 PM

|

|

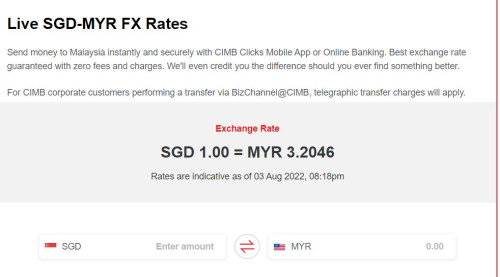

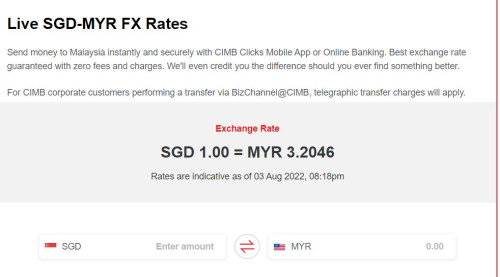

QUOTE(CommodoreAmiga @ Aug 3 2022, 08:24 AM) Yes, seems like it. But i think the problem is the conversion rate. I am not sure how it is. If we can keep the money in USD it's great, if need to convert back to RM and then convert again to USD, then jalat. Anyone has experience? Yeah, thinking of this, but SGD rates not as high as the USD shown. I have already opened a CIMB SG account and activated yesterday. QUOTE(no6 @ Aug 3 2022, 09:43 AM) maybank's rate is so good. is this mbb sg or my ? Avoid putting foreign FD with Malaysian banks. Upon first placement you will need to convert MYR intonusd at bank rate. Upon maturity if you want the money back ou need to convert back again at bank rate. Don't let 3%+ yield tempt you. Everytime you convert money the bank only untung. Even with 3%+FD your final net amount will be negative or say 1%p.a. This post has been edited by Ramjade: Aug 3 2022, 12:18 PM |

|

|

|

|

|

Ramjade

|

Aug 3 2022, 02:18 PM Aug 3 2022, 02:18 PM

|

|

QUOTE(no6 @ Aug 3 2022, 01:36 PM) can we transfer usd directly from wise into malaysian multi-currency account and then make foreign fd placement thereafter ? Never try before. I did try with Australia FD before last time 5%p.a and ended up negative return. So much for foreign FD. That's why I said a US 3% FD cannot even beat a 5% p.a Australia FD. Best to avoid. This post has been edited by Ramjade: Aug 3 2022, 02:19 PM |

|

|

|

|

|

Ramjade

|

Aug 3 2022, 09:33 PM Aug 3 2022, 09:33 PM

|

|

QUOTE(sgh @ Aug 3 2022, 03:11 PM) FD ended up negative return is becuz when you convert back to MYR using the bank rate correct? If don't convert means you are positive correct? But then that means the AUD stuck there I see. Yes need to convert back into rm or else the money is forever stuck as aud. QUOTE(CommodoreAmiga @ Aug 3 2022, 08:30 PM) Thanks for the reply. Btw, i have found something here. CIMB claims to have the best SGD rates conversion with no additional fee. Even based on the rates alone of RM 3.20xx, it is really better than my WISE (i did a quick check) which is at RM 3.22 and not counting the Conversion fee yet! So those who thinking the WISE route maybe double check the rates and compare before you transfer.  It's a known never ending promo  . Keep in mind it's a promo and may end some time in the future. It's not a permanent feature. |

|

|

|

|

|

Ramjade

|

Oct 14 2022, 01:50 PM Oct 14 2022, 01:50 PM

|

|

QUOTE(Hansel @ Oct 13 2022, 07:11 PM) Somehow,... I wouldn't want to lock-up my funds in a Fixed Deposit. I'd want to average down when I feel like it,... Hence, I've chosen to put my SGD into FSM's Cash Acct... 0.55% p.a., calculated daily and banked-in every quarter. For other foreign funds, yes, into 1-mth FDs. ... I've also applied for the SSB, November Tranche,... What have you guys done ? Use Tiger mmf. Giving you 3%p.a+ |

|

|

|

|

|

Ramjade

|

Oct 14 2022, 04:37 PM Oct 14 2022, 04:37 PM

|

|

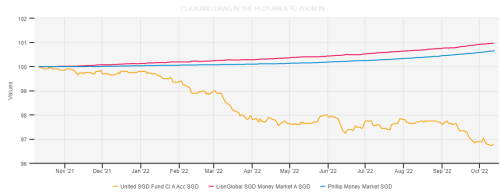

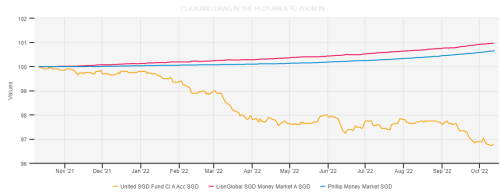

QUOTE(Hansel @ Oct 14 2022, 01:57 PM) MMF got principal risk,... at the point of taking-out, you may not get back your full principal, let along any 'interest' to be earned. United cl a SGD fund or something like that. Last time I heard it's full. |

|

|

|

|

|

Ramjade

|

Oct 16 2022, 10:23 AM Oct 16 2022, 10:23 AM

|

|

QUOTE(Hansel @ Oct 15 2022, 12:29 PM) Ok bro,.. don't know-lar,... frankly, I'm still for the higher-risk instruments,... buying-in when I feel like it. Hence, I would want my funds to be liquid and capital-secured. Sg mmf are quite secure. Never see any issue with them. |

|

|

|

|

|

Ramjade

|

Oct 17 2022, 01:19 PM Oct 17 2022, 01:19 PM

|

|

QUOTE(harmonics3 @ Oct 17 2022, 01:16 PM)  You mean United SGD Fund Cl A? It has dropped 3% for the past 1 year vs. other mmf funds. Not sure. But I know like 5 years back I cannot even buy. Cause all blocked. |

|

|

|

|

|

Ramjade

|

Nov 6 2022, 01:31 PM Nov 6 2022, 01:31 PM

|

|

QUOTE(TOS @ Nov 6 2022, 01:21 PM) Can anyone confirm that OCBC SG does not have foreign time/fixed deposit rates? I only found UOB and DBS USD FD rates, but couldn't find comparable data from OCBC's SG website. https://www.ocbc.com/personal-banking/depos...rest-rates.page (It shows 0% for all currencies). I have decided to move my HKD funds over to DBS SG for short 1-2 months USD FD parking as the rates are quite favourable compared to the 0.3% p.a. rate given by Mox. You can try tiger USD mmf. It's one of their recommended funds. I believed run by Fullerton. |

|

|

|

|

|

Ramjade

|

Nov 6 2022, 02:03 PM Nov 6 2022, 02:03 PM

|

|

QUOTE(TOS @ Nov 6 2022, 01:49 PM) Uhm... https://www.fullertonfund.com/investment-fu...ss_currency=USDIf you check the fact sheet for Class A: 1. 2. » Click to show Spoiler - click again to hide... « 3. » Click to show Spoiler - click again to hide... « No, I am not betting with counterparties like Qatar National Bank... And no, strictly 4 weeks to 8 weeks...  So DBS still the way to go.  I feel safest is still MMF. FD if you break means no interest. |

|

|

|

|

|

Ramjade

|

Nov 6 2022, 02:08 PM Nov 6 2022, 02:08 PM

|

|

QUOTE(TOS @ Nov 6 2022, 02:06 PM) Ok, according to my recent study of "risk", we have different views on the meaning of "safest'. I look at tenure, counterparty, underlying assets etc. You are more concerned with tenure alone. Perfectly fine. :thumbsup: I am more concern that about to get acess to money anytime I need and still get interest. |

|

|

|

|

|

Ramjade

|

Nov 7 2022, 12:47 PM Nov 7 2022, 12:47 PM

|

|

QUOTE(harmonics3 @ Nov 7 2022, 12:21 PM) That will be good, in Malaysia we have KDI save @ 2.5% p.a. (until year end) with same day deposit/withdrawal (cutoff time at 11am during weekdays). Anything similar in Singapore (especially >2.5% p.a.)? It's call their SSB but I think one month withdrawal wait. |

|

|

|

|

|

Ramjade

|

Nov 7 2022, 07:57 PM Nov 7 2022, 07:57 PM

|

|

QUOTE(TOS @ Nov 7 2022, 07:46 PM) Uhm... SSB is a totally different product vs KDI Save. SSB is a government-guaranteed saving bonds. The directly-comparable product in Malaysia is Sukuk Prihatin offerred 2 years ago if you still remember. KDI Save operates like a money market mutual fund in the backend, like Versa's Affin Hwang Enhanced Deposit Fund. Its direct counterparts in SG include: 1. Stashaway SG Simple 2. Endowus SG Cash Smart 3. Syfe Cash+ ( harmonics3 Can consider this, there is quick withdrawal possible within same day and next business day: https://help.syfe.com/hc/en-us/articles/441...-does-it-work-) And SG brokers offer similar products: 3. Moomoo/Futu SG SmartSave 4. Tiger Broker SG Tiger Vault 5. FSM SG Auto-Sweep Account 6. POEMS SG Smart Park Yikes I read wrongly. I read like is there anything safe over sg side with capital protection. So not sure why straight think about ssb. Didn't read properly. |

|

|

|

|

|

Ramjade

|

Nov 18 2022, 01:46 PM Nov 18 2022, 01:46 PM

|

|

QUOTE(CommodoreAmiga @ Nov 18 2022, 11:18 AM) But we cannot open DBS account easily, can we? Can. If you are willing to travel. Question is are you willing to fly down there just to open bank account? |

|

|

|

|

|

Ramjade

|

Nov 23 2022, 02:10 PM Nov 23 2022, 02:10 PM

|

|

QUOTE(CommodoreAmiga @ Nov 23 2022, 01:43 PM) But can you transfer from SG bank back to WISE? I read you can't receive money from outside Malaysia? Have you tried? Of course you can but is silly to bring money back to Malaysia. One stuff I practice is one way ticket money and only bring it back if really needed. Or else, I won't bring back at all. |

|

|

|

|

|

Ramjade

|

Jan 18 2023, 11:06 AM Jan 18 2023, 11:06 AM

|

|

QUOTE(gooroojee @ Jan 18 2023, 10:39 AM) Hi, side question. Do you have exchange rate and final amount to be received for dbs remit from SG to MY? Maybe comparing $1k and $50k assuming $50k has better rates. I can share rates for cimb and maybank in return. 😊 DBS remit still cannot beat CIMB SG rate. Tested so many time (didn't initiate the transfer). Just key in value. This post has been edited by Ramjade: Jan 18 2023, 11:07 AM |

|

|

|

|

|

Ramjade

|

Oct 23 2023, 08:06 PM Oct 23 2023, 08:06 PM

|

|

QUOTE(abcn1n @ Oct 23 2023, 07:51 PM) TOS Is the 3.8% net of Stashaway's fees? BTW, couldn't find the post which says can only open Stashaway Singapore with Singpass. FYI, can open without Singpass No need singpass. Can use passport. Other day I just login and next day that asked for my passport. I look just to check and see if I got any money left inside there (planning to move all loose change to moomoo). Told them want to cancel acocunt. Not net fees. Net fees around 3.5-3.6%? This post has been edited by Ramjade: Oct 23 2023, 08:07 PM |

|

|

|

|

|

Ramjade

|

Oct 23 2023, 08:47 PM Oct 23 2023, 08:47 PM

|

|

QUOTE(TOS @ Oct 23 2023, 08:15 PM) Oh no need SingPass. Great then. Finally a good place to park my SGD for short-term.  You got singpass just go with moomoo. Moomoo mmf is better than stashaway. |

|

|

|

|

Aug 17 2016, 12:08 AM

Aug 17 2016, 12:08 AM

Quote

Quote

0.0607sec

0.0607sec

0.11

0.11

7 queries

7 queries

GZIP Disabled

GZIP Disabled