QUOTE(frankliew @ Feb 29 2024, 09:34 AM)

?0-500 7%... then 22%...

Anyone know about foreign FD?

|

|

Feb 29 2024, 02:21 PM Feb 29 2024, 02:21 PM

|

Senior Member

6,247 posts Joined: Jun 2006 |

|

|

|

|

|

|

Mar 1 2024, 10:52 AM Mar 1 2024, 10:52 AM

Show posts by this member only | IPv6 | Post

#1002

|

Junior Member

771 posts Joined: Jun 2015 |

So whats the best fd rates for Singapore bank FD in March 2024?

|

|

|

Mar 1 2024, 11:31 AM Mar 1 2024, 11:31 AM

|

Junior Member

210 posts Joined: Feb 2022 |

QUOTE(whycanot323 @ Feb 23 2024, 05:18 PM) some local bank FD matured in march... Worst thing about placing in foreign FD is the bank spread. When bank sell you foreign currency it will be expensive and vice versa. This is unavoidable. The other major thing to consider is your view on whether Ringgit will strengthen or not in the future. As a hint when you see malaysian banks promoting foreign FDs their view is ringgit will strengthen in the future. Therefore not so easy transaction yes?sad to see the current local bank FD rate i am new to Foreign FD thread... what are the cons about placing Foreign FD? the points to think of before doing so? |

|

|

Mar 13 2024, 05:57 PM Mar 13 2024, 05:57 PM

|

Senior Member

1,127 posts Joined: Feb 2011 From: Penang |

Hey guys I'm trying to buy some foreign bond via my CIMB RM but I need to open a foreign currency account and foreign FD account to keep the coupon payouts.

Is there a way to use Wise to bank in money into the FCA? The default way of having the bank convert my MYR will use the bank's counter rate which is terrible. |

|

|

Mar 15 2024, 03:55 PM Mar 15 2024, 03:55 PM

|

Junior Member

31 posts Joined: Apr 2009 |

Hi

Does any one know if there is any bank in Malaysia or Singapore that allows the opening of foreign currency fixed deposit by putting in the foreign currency via cash? I have some GBP and would like to put it into an FD cause converting back is not worth it considering I got it around 2015 when the rate was at its all time high, I think 1 GBP = 6.7 MYR, if not mistaken. Cause I search around and mostly it seems that you have to put it in home currency (SGD or MYR) then the bank will convert to the foreign currency you want. But is there any bank that allows you to bank in the actual currency? Any advice is appreciated. Thank you |

|

|

Mar 15 2024, 04:31 PM Mar 15 2024, 04:31 PM

|

Junior Member

525 posts Joined: Jan 2003 From: 25.18.122.57 |

Quick answer, no.

|

|

|

|

|

|

Mar 15 2024, 06:48 PM Mar 15 2024, 06:48 PM

Show posts by this member only | IPv6 | Post

#1007

|

All Stars

24,392 posts Joined: Feb 2011 |

QUOTE(gandalfaaron @ Mar 15 2024, 03:55 PM) Hi Singapore accept GBP cash deposit. But not sure if they can open GBP FD. Also if you deposit GBP cash in Singapore I think they take 1-2%cut?Does any one know if there is any bank in Malaysia or Singapore that allows the opening of foreign currency fixed deposit by putting in the foreign currency via cash? I have some GBP and would like to put it into an FD cause converting back is not worth it considering I got it around 2015 when the rate was at its all time high, I think 1 GBP = 6.7 MYR, if not mistaken. Cause I search around and mostly it seems that you have to put it in home currency (SGD or MYR) then the bank will convert to the foreign currency you want. But is there any bank that allows you to bank in the actual currency? Any advice is appreciated. Thank you |

|

|

Mar 15 2024, 08:49 PM Mar 15 2024, 08:49 PM

|

Junior Member

31 posts Joined: Apr 2009 |

|

|

|

Mar 15 2024, 09:06 PM Mar 15 2024, 09:06 PM

|

Senior Member

3,496 posts Joined: Jan 2003 |

gandalfaaron if you go midvalley now and convert to MYR, and then convert back to GBP, you only lose 0.75%. this means it's 0.379% just to convert back to RM https://cashchanger.co/malaysia/mc/max-mone...ey-megamall/520 you should be looking for a place that'll take it and deposit into your multi-currency acct without charge This post has been edited by Medufsaid: Mar 15 2024, 09:08 PM Ramjade and CommodoreAmiga liked this post

|

|

|

Mar 15 2024, 10:36 PM Mar 15 2024, 10:36 PM

|

Junior Member

31 posts Joined: Apr 2009 |

QUOTE(Medufsaid @ Mar 15 2024, 09:06 PM) gandalfaaron if you go midvalley now and convert to MYR, and then convert back to GBP, you only lose 0.75%. this means it's 0.379% just to convert back to RM https://cashchanger.co/malaysia/mc/max-mone...ey-megamall/520 my purpose is actually to get back in MYR, but the amount I will lose is quite significant. which is why rather than converting I was hoping if I can straight away put in the cash into FD and get some interest at the same time cut some loses. you should be looking for a place that'll take it and deposit into your multi-currency acct without charge Imagine if you have 1000 GBP bought at a rate of 6.7 and now you are selling it at 6 MYR, you are loosing about 0.7 cents for each GBP you sell, that is about 700 MYR disappear into thin air. If its 10k GBP, I will be at a lost of 7k MYR. |

|

|

Mar 15 2024, 11:18 PM Mar 15 2024, 11:18 PM

|

Senior Member

3,496 posts Joined: Jan 2003 |

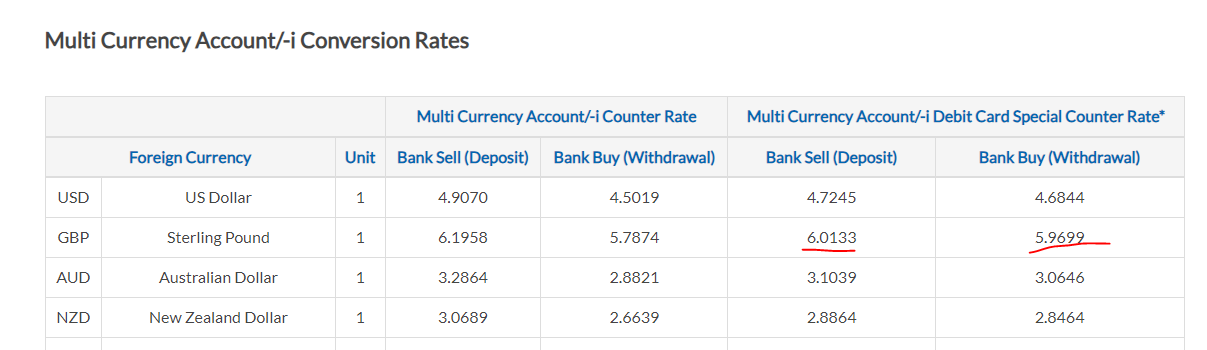

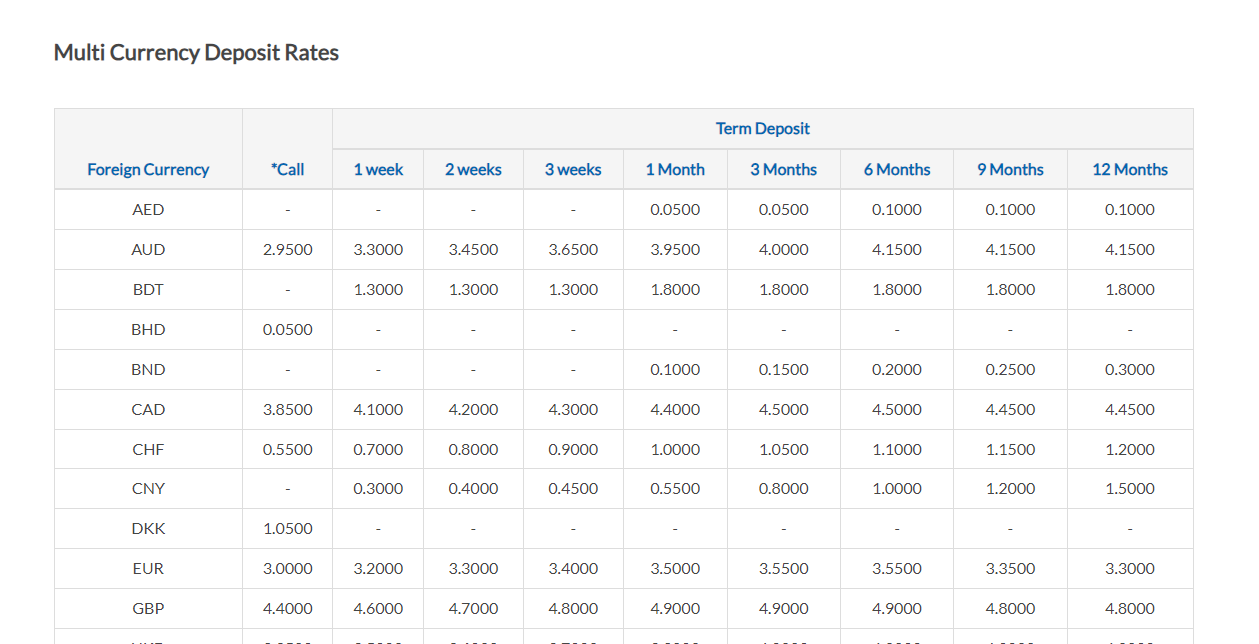

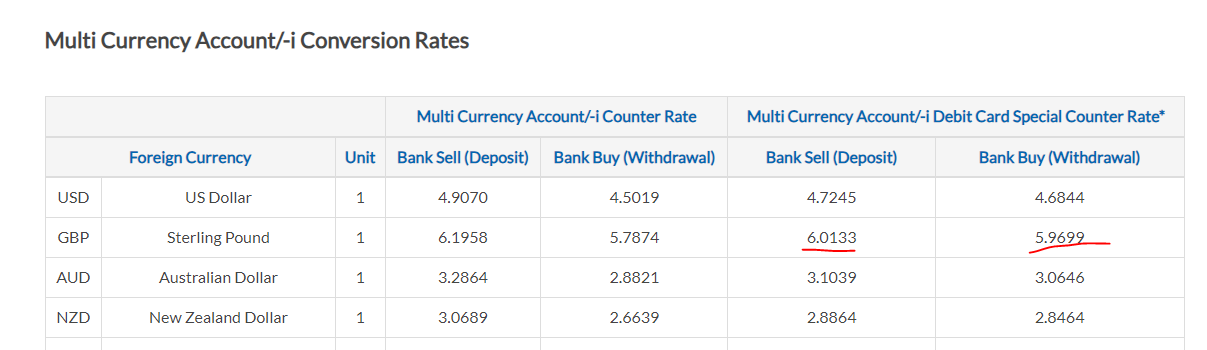

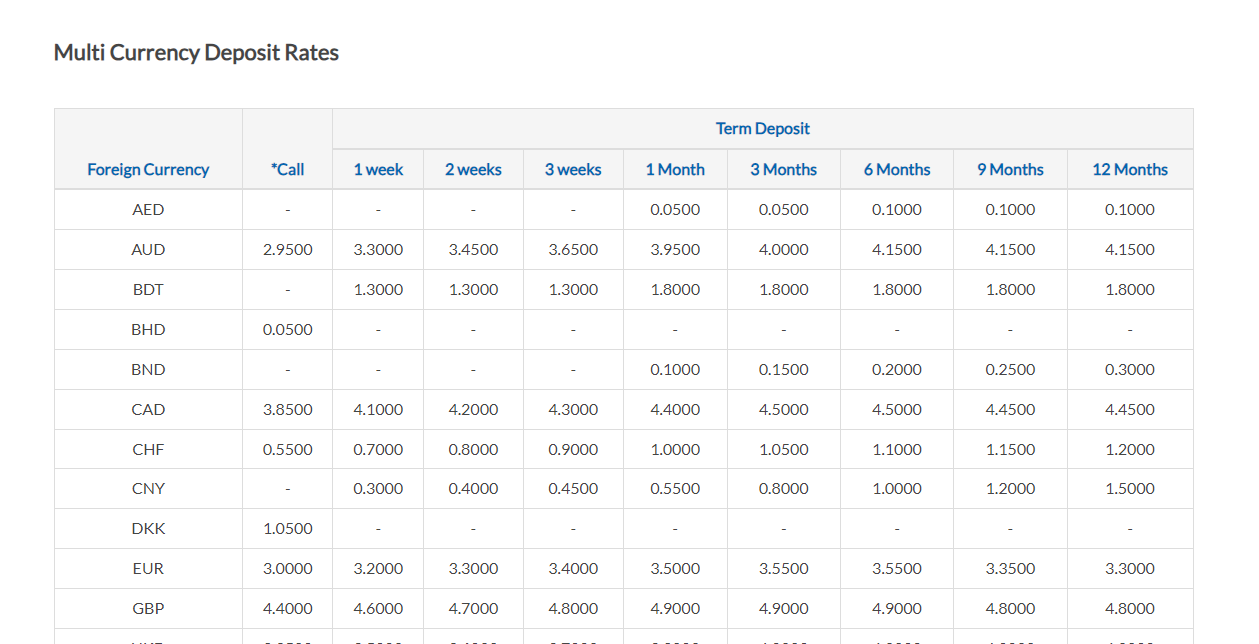

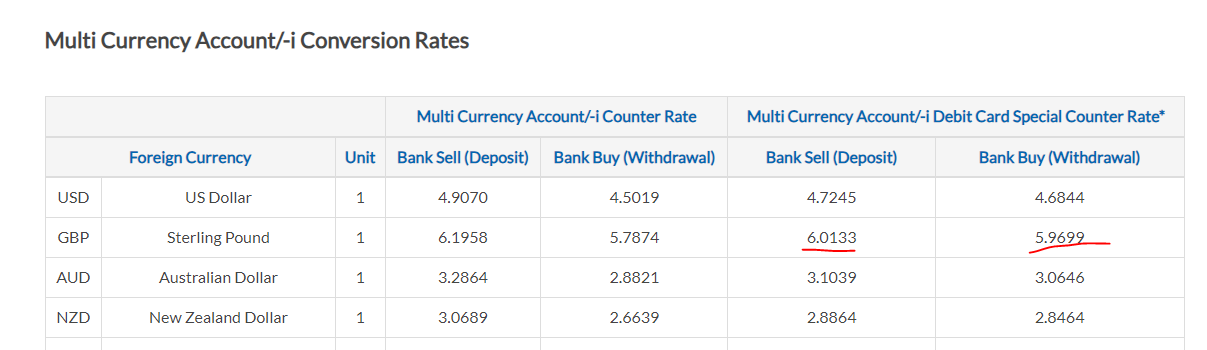

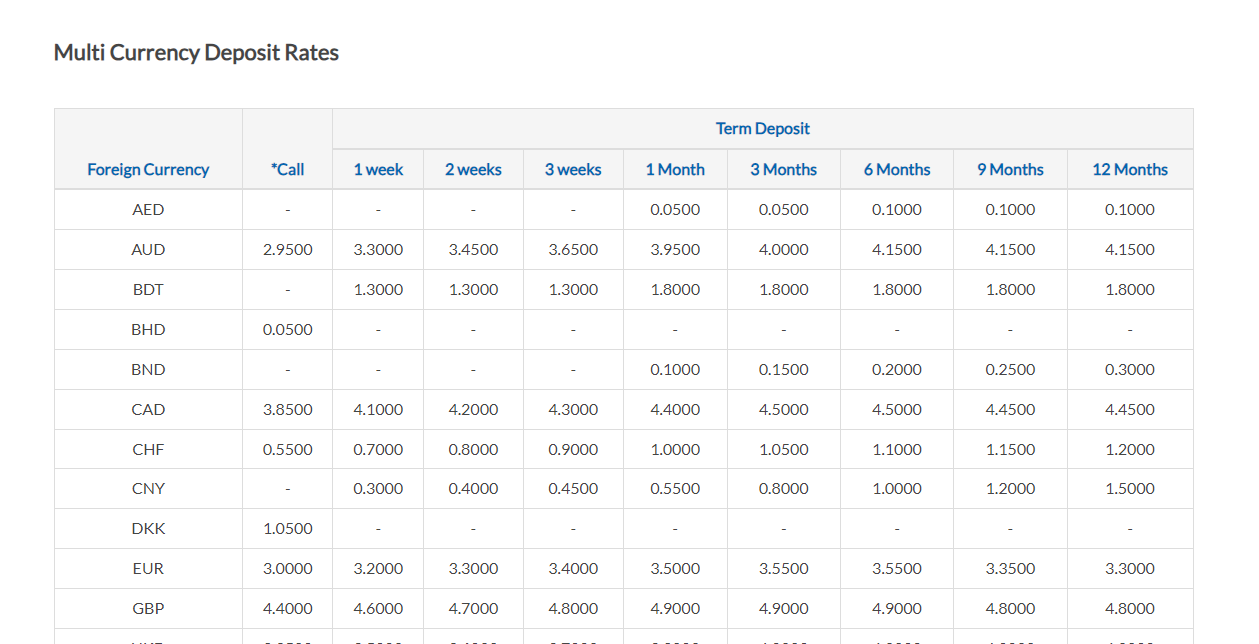

gandalfaaron my advice to you, as someone who played with futures, unrealised losses is the same as realised losses RHB MCA conversion from MYR back into GBP is as competitive as midvalley rates https://www.rhbgroup.com/treasury-rates/mul...card/index.html.  just shrink a bit of the GBP you have into RHB MCA, and then FD it. you'll recoup back the 0.7% double conversion losses, then be on your way to getting some interest  This post has been edited by Medufsaid: Mar 15 2024, 11:21 PM CommodoreAmiga and Ramjade liked this post

|

|

|

Mar 16 2024, 08:03 AM Mar 16 2024, 08:03 AM

Show posts by this member only | IPv6 | Post

#1012

|

Junior Member

758 posts Joined: May 2019 |

QUOTE(Medufsaid @ Mar 15 2024, 11:18 PM) gandalfaaron my advice to you, as someone who played with futures, unrealised losses is the same as realised losses Thanks a mil. RHB MCA conversion from MYR back into GBP is as competitive as midvalley rates https://www.rhbgroup.com/treasury-rates/mul...card/index.html.  just shrink a bit of the GBP you have into RHB MCA, and then FD it. you'll recoup back the 0.7% double conversion losses, then be on your way to getting some interest  Is it safe to say that the RHB MCA is one of the best MCA tool? Both rates and conversion margin ? |

|

|

Mar 16 2024, 12:22 PM Mar 16 2024, 12:22 PM

Show posts by this member only | IPv6 | Post

#1013

|

All Stars

24,392 posts Joined: Feb 2011 |

|

|

|

|

|

|

Mar 16 2024, 02:10 PM Mar 16 2024, 02:10 PM

|

Junior Member

31 posts Joined: Apr 2009 |

QUOTE(Medufsaid @ Mar 15 2024, 11:18 PM) gandalfaaron my advice to you, as someone who played with futures, unrealised losses is the same as realised losses I see, this seems to be a viable option.RHB MCA conversion from MYR back into GBP is as competitive as midvalley rates https://www.rhbgroup.com/treasury-rates/mul...card/index.html.  just shrink a bit of the GBP you have into RHB MCA, and then FD it. you'll recoup back the 0.7% double conversion losses, then be on your way to getting some interest  thank you so much for the advice. |

|

|

Mar 16 2024, 08:13 PM Mar 16 2024, 08:13 PM

|

Junior Member

758 posts Joined: May 2019 |

|

|

|

Mar 17 2024, 02:58 AM Mar 17 2024, 02:58 AM

Show posts by this member only | IPv6 | Post

#1016

|

Junior Member

197 posts Joined: Apr 2012 |

What is the best way to convert MYR to USD and save in FD? I see alot of discussions here are on saving SGD in SG bank.

|

|

|

Mar 17 2024, 08:51 AM Mar 17 2024, 08:51 AM

|

Senior Member

3,496 posts Joined: Jan 2003 |

|

|

|

Mar 17 2024, 09:27 AM Mar 17 2024, 09:27 AM

|

Senior Member

7,576 posts Joined: May 2012 |

|

|

|

Mar 18 2024, 03:42 AM Mar 18 2024, 03:42 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

|

|

|

Mar 18 2024, 09:14 AM Mar 18 2024, 09:14 AM

Show posts by this member only | IPv6 | Post

#1020

|

All Stars

24,392 posts Joined: Feb 2011 |

QUOTE(hksgmy @ Mar 18 2024, 03:42 AM) As far as I know DBS, OCBC, UOB accept. But they charge you an arm and a leg for it. Around 1-2%. Last time DBS accept for free. That was years ago. You need to have a multicurrency account or a foreign currency account before they can take your cash.You are better off brining your cash to place like arcade to change for SGD then use banks to deposit. Unless somehow you can call your RM and ask them waive the fees for you. |

| Change to: |  0.0246sec 0.0246sec

0.46 0.46

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 11:48 PM |