QUOTE(Drian @ Mar 30 2023, 02:53 PM)

You still cannot compared equity because SA doesn’t buys 100% equities on US as well 🤦♀️You should apple to apple instead 🤦♀️ when the proper benchmark would be ACWI

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Mar 30 2023, 04:18 PM Mar 30 2023, 04:18 PM

Show posts by this member only | IPv6 | Post

#20061

|

Senior Member

4,652 posts Joined: Jan 2003 |

QUOTE(Drian @ Mar 30 2023, 02:53 PM) You still cannot compared equity because SA doesn’t buys 100% equities on US as well 🤦♀️You should apple to apple instead 🤦♀️ when the proper benchmark would be ACWI |

|

|

|

|

|

Mar 30 2023, 05:43 PM Mar 30 2023, 05:43 PM

|

Senior Member

4,999 posts Joined: Jan 2003 |

QUOTE(xander2k8 @ Mar 30 2023, 04:18 PM) You still cannot compared equity because SA doesn’t buys 100% equities on US as well 🤦♀️ The benchmark here is how well SA allocate/manage the equities in the right region /companies/sector. You should apple to apple instead 🤦♀️ when the proper benchmark would be ACWI And that benchmark to beat is snp500. SA is suppose to buy any equities in any region /companies/sector so that it can beat the snp500. If they can't beat snp500 , it means that their active asset management on the equity side is not able to outperform the passive SnP 500 index. This post has been edited by Drian: Mar 30 2023, 05:43 PM red streak liked this post

|

|

|

Mar 30 2023, 08:39 PM Mar 30 2023, 08:39 PM

Show posts by this member only | IPv6 | Post

#20063

|

Senior Member

4,652 posts Joined: Jan 2003 |

QUOTE(Drian @ Mar 30 2023, 05:43 PM) The benchmark here is how well SA allocate/manage the equities in the right region /companies/sector. Not everything in the world revolves with SnP500 and you are wrong to benchmark with it because it is only for American listed companies 🤦♀️And that benchmark to beat is snp500. SA is suppose to buy any equities in any region /companies/sector so that it can beat the snp500. If they can't beat snp500 , it means that their active asset management on the equity side is not able to outperform the passive SnP 500 index. You want to benchmark that just buy the biggest 50 American companies and when the US economy collapse good for you then 👏 SA benchmarks are proxied by MSCI World Equity Index (for equities) and FTSE World Government Bond Index (for bonds). The benchmarks we use have the same 10-years realised volatility as our portfolios. So you should benchmark it with ACWI or VT or VTI ETFs rather than taking a wrong benchmark again as you are just comparing like a Tesla and a hybrid Toyota 🤦♀️ |

|

|

Mar 30 2023, 08:49 PM Mar 30 2023, 08:49 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(Drian @ Mar 30 2023, 05:43 PM) The benchmark here is how well SA allocate/manage the equities in the right region /companies/sector. I'm all for shitting on Stashaway, but at least be reasonable.And that benchmark to beat is snp500. SA is suppose to buy any equities in any region /companies/sector so that it can beat the snp500. ... I'd like to see where did Stashaway annouced their mission statement is to beat the SP500 index. QUOTE(Stashaway) Our same-risk benchmarks are proxied by MSCI World Equity Index (for equities) and FTSE World Government Bond Index (for bonds). The benchmarks we use have the same 10-years realised volatility as our portfolios. SP500 is an incredibly US-centric index, while most Stashaway portfolios have a more balanced international:us ratio and not pure equities. QUOTE(Drian @ Mar 30 2023, 05:43 PM) ... I would put every single cent I have access to into Stashaway if they are such miracle maker that they can create a portfolio with a mixture of Equities, Bonds, Fixed Income, Cash that is globally diversified and still outperform a raw equities SP500 only portfolio.If they can't beat snp500 , it means that their active asset management on the equity side is not able to outperform the passive SnP 500 index. That's simply not how it works. You pick Stashaway because you want to minimize volatility without losing too much upside, not to outperform SP500. https://www.stashaway.sg/r/debunking-high-risk-high-return You are so far off the mark that I ended up agreeing with the local misinformation spammer and defending Stashaway. That's how far off you are. This post has been edited by Hoshiyuu: Mar 30 2023, 08:54 PM |

|

|

Mar 30 2023, 08:54 PM Mar 30 2023, 08:54 PM

Show posts by this member only | IPv6 | Post

#20065

|

Senior Member

4,652 posts Joined: Jan 2003 |

QUOTE(Hoshiyuu @ Mar 30 2023, 08:49 PM) I'm all for shitting on Stashaway, but at least be reasonable. Don’t bother explaining to him as even he is just comparing equities end 🤦♀️https://www.stashaway.my/r/returns-since-launch-YTD-2022  SP500 is an incredibly US-centric index, while most Stashaway portfolios have a more balanced international:us ratio and not pure equities. I would put every single cent I have access to into Stashaway if they are such miracle maker that they can create a portfolio with a mixture of Equities, Bonds, Fixed Income, Cash that is globally diversified and still outperform a raw equities SP500 only portfolio. That's simply not how it works. You pick Stashaway because you want to minimize volatility without losing too much upside, not to outperform SP500. You are so far off the mark that I ended up agreeing with the local misinformation spammer and defending Stashaway. That's how far off you are. It is just like buying a Tesla and comparing with a hybrid Toyota 🤦♀️ rahtid liked this post

|

|

|

Apr 2 2023, 06:13 PM Apr 2 2023, 06:13 PM

|

Junior Member

821 posts Joined: Apr 2006 |

hi. any sifu here can comment profit YTD on the few difference risk account - like 16%, 22% and more adventures 36% risk ?

|

|

|

|

|

|

Apr 2 2023, 06:46 PM Apr 2 2023, 06:46 PM

Show posts by this member only | IPv6 | Post

#20067

|

All Stars

14,866 posts Joined: Mar 2015 |

QUOTE(genesic @ Apr 2 2023, 06:13 PM) hi. any sifu here can comment profit YTD on the few difference risk account - like 16%, 22% and more adventures 36% risk ? Found this, ...Move the slider to your desired SRI and then view the YTD result. Caveat emptor, ...not sure how accurate that reading is. https://www.stashaway.my/ |

|

|

Apr 2 2023, 11:01 PM Apr 2 2023, 11:01 PM

Show posts by this member only | IPv6 | Post

#20068

|

Senior Member

4,652 posts Joined: Jan 2003 |

|

|

|

Apr 3 2023, 09:41 PM Apr 3 2023, 09:41 PM

|

Junior Member

116 posts Joined: Dec 2006 |

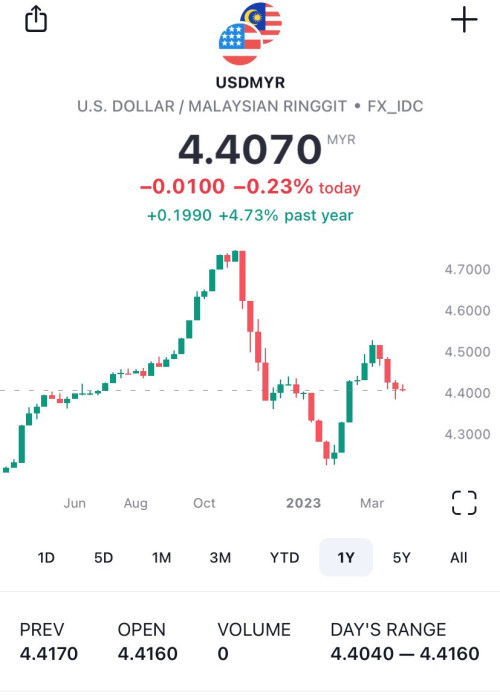

Anyone would be able to shed some light on why my RM is positive but USD is negative? Want to get understanding of it. Thanks.

RM +450++ USD - 500++ |

|

|

Apr 3 2023, 11:05 PM Apr 3 2023, 11:05 PM

Show posts by this member only | IPv6 | Post

#20070

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

QUOTE(footie_ft @ Apr 3 2023, 09:41 PM) Anyone would be able to shed some light on why my RM is positive but USD is negative? Want to get understanding of it. Thanks. Since your deposits, USD strengthened vs MYR. MYR weakened so you get more MYR, but if you were earning USD and depositing that, you would have lost money.RM +450++ USD - 500++ footie_ft liked this post

|

|

|

Apr 4 2023, 01:13 AM Apr 4 2023, 01:13 AM

Show posts by this member only | IPv6 | Post

#20071

|

Senior Member

4,652 posts Joined: Jan 2003 |

QUOTE(footie_ft @ Apr 3 2023, 09:41 PM) Anyone would be able to shed some light on why my RM is positive but USD is negative? Want to get understanding of it. Thanks. If you deposit at 2021 you would be gaining in RM while losing USD because the ETFs is currently is mostly in a loss 🤦♀️RM +450++ USD - 500++ footie_ft liked this post

|

|

|

Apr 4 2023, 07:56 AM Apr 4 2023, 07:56 AM

Show posts by this member only | IPv6 | Post

#20072

|

All Stars

14,866 posts Joined: Mar 2015 |

QUOTE(footie_ft @ Apr 3 2023, 09:41 PM) Anyone would be able to shed some light on why my RM is positive but USD is negative? Want to get understanding of it. Thanks. Perhaps this can helps you, ...RM +450++ USD - 500++ How Currency Impacts Your StashAway Portfolio https://www.stashaway.my/r/how-currency-imp...haway-portfolio footie_ft liked this post

|

|

|

Apr 4 2023, 09:16 AM Apr 4 2023, 09:16 AM

Show posts by this member only | IPv6 | Post

#20073

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(footie_ft @ Apr 3 2023, 09:41 PM) Anyone would be able to shed some light on why my RM is positive but USD is negative? Want to get understanding of it. Thanks. Forex gainRM +450++ USD - 500++ footie_ft liked this post

|

|

|

|

|

|

Apr 4 2023, 09:41 AM Apr 4 2023, 09:41 AM

Show posts by this member only | IPv6 | Post

#20074

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(footie_ft @ Apr 3 2023, 09:41 PM) Anyone would be able to shed some light on why my RM is positive but USD is negative? Want to get understanding of it. Thanks. RM +450++ USD - 500++  footie_ft liked this post

|

|

|

Apr 4 2023, 05:32 PM Apr 4 2023, 05:32 PM

|

Senior Member

689 posts Joined: Dec 2005 |

just to update ppl here....i cash out all my SA managed portfolio and custom made my own in stashaway now. i only buy what i wanted e.g specific bond or specific etf....

still this seems cheaper than other etf offered by other platform... cheaper as in if i just wanted to buy one ETF with rm100 entry point.. let me know if there are others.. |

|

|

Apr 4 2023, 05:54 PM Apr 4 2023, 05:54 PM

Show posts by this member only | IPv6 | Post

#20076

|

Senior Member

4,652 posts Joined: Jan 2003 |

QUOTE(calapia @ Apr 4 2023, 05:32 PM) just to update ppl here....i cash out all my SA managed portfolio and custom made my own in stashaway now. i only buy what i wanted e.g specific bond or specific etf.... Where on earth you can buy one ETF for rm100 🤦♀️ still this seems cheaper than other etf offered by other platform... cheaper as in if i just wanted to buy one ETF with rm100 entry point.. let me know if there are others.. Even the cheapest is already at more than usd25 hence more than rm100 Why bother with SA while paying fees yearly 🤦♀️ when you can buy cheaper and fractional at IBKR 🤦♀️ |

|

|

Apr 4 2023, 06:56 PM Apr 4 2023, 06:56 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(calapia @ Apr 4 2023, 05:32 PM) just to update ppl here....i cash out all my SA managed portfolio and custom made my own in stashaway now. i only buy what i wanted e.g specific bond or specific etf.... Just remember not to be penny wise pound foolish! As far as ease of access go, Stashaway is pretty high up there considering the fees and general experience compared to other options.still this seems cheaper than other etf offered by other platform... cheaper as in if i just wanted to buy one ETF with rm100 entry point.. let me know if there are others.. This post has been edited by Hoshiyuu: Apr 4 2023, 06:59 PM |

|

|

Apr 5 2023, 10:29 AM Apr 5 2023, 10:29 AM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

with so many countries against USD now, having all in US equities seems like a time bomb watermineral liked this post

|

|

|

Apr 5 2023, 11:44 AM Apr 5 2023, 11:44 AM

|

Senior Member

689 posts Joined: Dec 2005 |

QUOTE(Hoshiyuu @ Apr 4 2023, 06:56 PM) Just remember not to be penny wise pound foolish! As far as ease of access go, Stashaway is pretty high up there considering the fees and general experience compared to other options. thats why i m asking on options if you have the list, do share... TruboXL liked this post

|

|

|

Apr 5 2023, 12:00 PM Apr 5 2023, 12:00 PM

Show posts by this member only | IPv6 | Post

#20080

|

All Stars

14,866 posts Joined: Mar 2015 |

QUOTE(calapia @ Apr 4 2023, 05:32 PM) just to update ppl here....i cash out all my SA managed portfolio and custom made my own in stashaway now. i only buy what i wanted e.g specific bond or specific etf.... Mind sharing what etf buying platform are you using now to custom made your own portfolio now?still this seems cheaper than other etf offered by other platform... cheaper as in if i just wanted to buy one ETF with rm100 entry point.. let me know if there are others.. Mind list out What etf have you bought that has entry price of rm100 for your portfolio? |

| Change to: |  0.0322sec 0.0322sec

0.23 0.23

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 09:27 PM |