I usually dont post much in the forum but follow this thread. But what happened lately made me want to share my experience

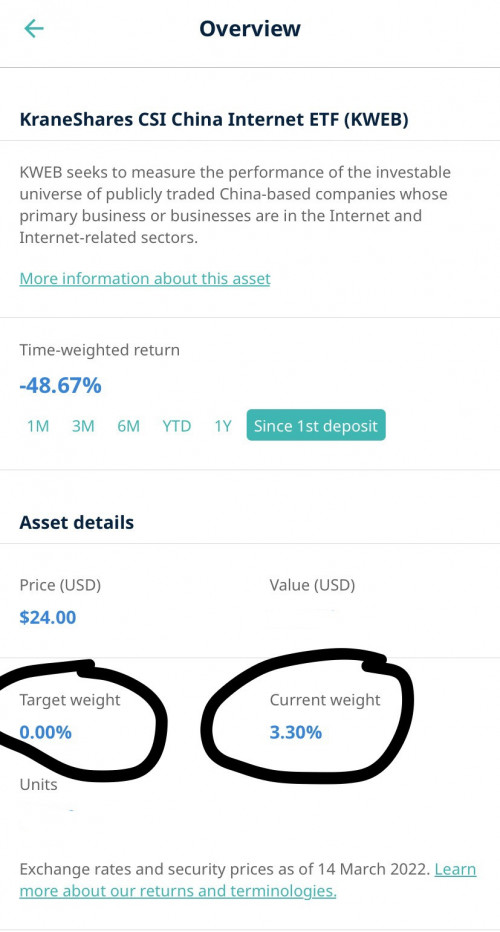

I too was invested in 36% risk since June last year, and the recent reoptimisation has cost me over RM 400. But looking back a month ago I met a friend who is really an expert in analyzing markets. He used this software that has many graphs, and he told me KWEB is definitely going down because there is a low pressure (his words). But he didnt tell me to sell or buy he just advised me to be careful. I understand the risks and believed somehow in buying the dip more but still being careful. And the last week I bought RM 200 into 36% SRI. Thank God I didnt put in RM1,000 OR more. That bought 26USD worth of KWEB at 30 USD. It crashed down further after that and immediately went into reoptimization later.

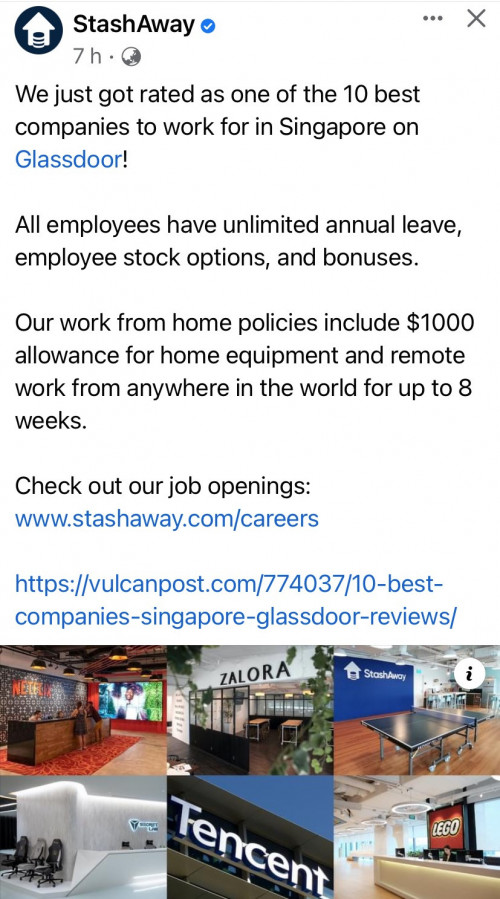

Anyways reoptimization topic aside, I dont know why I feel that StashAway's portfolio ETF selection seems very questionable :confused: I am not an expert but just looking at the 1 year performance and 5 year performance gives me some doubts

like why EWA? The graphs show that its such a poor performer 22.65 on 2017 and 24.22 in 2022 (thats a 6% increase in 5 years)

IJR looks good if its long term, but in one year it started at 114 and it went down to 104.

VNQI as well price at 2011 50.23 and price today 49.16 (thats a -2.09%) decrease in 10 years!

XLE is OK but while oil prices are sky rocketing up its just merely hovering around the 72-77 range..

XLP was sold at a low as well securing some losses

KWEB was a gamble but a lost gamble...

Does anyone understand their logic behind their selection? I would like to learn why

from technical analysis point of view, kweb has been in downtrend for months… can’t see any bullish sign to go in. But TA is for retail investor as part of investment guideline. No sure whether fund managers are also using it.

Oct 30 2021, 04:59 PM

Oct 30 2021, 04:59 PM

Quote

Quote

0.0463sec

0.0463sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled