Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

calapia

|

Mar 22 2019, 09:30 AM Mar 22 2019, 09:30 AM

|

|

newbie reporting.. earlier already read some articles and the boss interview..... registered mine and did first transfer.. let see how good is this platform... been wanting to find one robo to ease my mind...

|

|

|

|

|

|

calapia

|

Mar 27 2019, 02:42 PM Mar 27 2019, 02:42 PM

|

|

bro wanna ask... i am testing water with this... the fees is on a monthly basis...so my investment will goes down on monthly basis unless my portfolio making some bucks to cover that up.. does it also mean i can see the result on monthly basis? as if it give me better return or not performing even if its minor?

|

|

|

|

|

|

calapia

|

Apr 1 2019, 02:13 PM Apr 1 2019, 02:13 PM

|

|

QUOTE(honsiong @ Apr 1 2019, 01:12 PM) Usually OCBC auto weekly transfer is run at 8AM, but until 11AM ady still no transfer happening, so I did a manual transfer. Then the auto transfer happened at 12PM. Happy April Fool OCBC. GGWP. means u transfer twice? |

|

|

|

|

|

calapia

|

Apr 14 2019, 11:28 AM Apr 14 2019, 11:28 AM

|

|

QUOTE(neverfap @ Apr 13 2019, 09:29 PM) Used up my investment quota liao Will invest next month But change to weekly basis haha Thanks! Eh means do it on monthly better or split to weekly better?? |

|

|

|

|

|

calapia

|

Apr 29 2019, 11:10 AM Apr 29 2019, 11:10 AM

|

|

bro.. wanna ask do u guys do monthly or weekly investment? i am doing it manually currently on monthly basis but thought of splitting to weekly..does it make sense?

|

|

|

|

|

|

calapia

|

Apr 29 2019, 03:44 PM Apr 29 2019, 03:44 PM

|

|

QUOTE(sue1388 @ Apr 29 2019, 03:40 PM) New in this few, need time and experience to boost my confident  i am new to SA as well...but so far so good. been gradually doing monthly and now possibly switch to weekly (smaller amount) to SA.. its still an investoment platform so adjust ur risk to ur level |

|

|

|

|

|

calapia

|

Jun 3 2019, 03:09 PM Jun 3 2019, 03:09 PM

|

|

QUOTE(Ancient-XinG- @ Jun 3 2019, 12:54 PM) Wowowow. Spark liang reviewed SA. Incoming capital surge hahaha eh all mandarin leh..banana here..wat did he says? |

|

|

|

|

|

calapia

|

Jun 21 2019, 02:02 PM Jun 21 2019, 02:02 PM

|

|

QUOTE(Pain4UrsinZ @ Jun 21 2019, 01:55 PM) my investment 2 months already @15% risk, so far both portfolio return and currency impact is GREEN @ 2 % just checked mine is 5%. been doing monthly sikit top up for more than 3 months. i hv 2 portfolio. one higher and one lower risk. both combined at 5% return today. |

|

|

|

|

|

calapia

|

Aug 5 2019, 11:29 AM Aug 5 2019, 11:29 AM

|

|

QUOTE(Ancient-XinG- @ Aug 2 2019, 08:08 PM) Any ideas on SAMY series B funding? They mentioned will have exciting months ahead got a note from them... "Since we launched our portfolios 24 months ago, our portfolios have returned cumulatively between 6.8% (our lowest-risk portfolio) to 21.3% (our highest-risk portfolio), in Malaysian Ringgit. This is equivalent to 3.4% to 10% annual returns, depending on risk levels. Our balanced portfolio, equivalent to 40% equity and 60% bonds (StashAway Risk Index 16%), has returned 11.2% in 2 years, with a 2.6% overperformance versus its same-risk benchmark.** We recently closed a round of fundraising: $12 million USD from Eight Roads and Asia Capital & Advisors! Eight Roads" |

|

|

|

|

|

calapia

|

Aug 16 2019, 03:47 PM Aug 16 2019, 03:47 PM

|

|

yo bro i just done my SGX test and submit to support to unlock all risk level...wanna ask bro with 36% risk..how is the return so far? mine with 20% risk return so far still 5%+ since March this year...

This post has been edited by calapia: Aug 16 2019, 03:47 PM

|

|

|

|

|

|

calapia

|

Aug 21 2019, 09:19 AM Aug 21 2019, 09:19 AM

|

|

QUOTE(honsiong @ Aug 16 2019, 04:11 PM) I got -23% during christmas correction, can you stomach that? hm.... i can stomach that but ain't SA suppose to re-balance the portfolio seeing the downward trend.....?? anyway i have diff portfolio created as well. perhaps i will use one with max risk and other remains the same to test water... This post has been edited by calapia: Aug 21 2019, 09:24 AM |

|

|

|

|

|

calapia

|

Aug 21 2019, 10:52 AM Aug 21 2019, 10:52 AM

|

|

QUOTE(honsiong @ Aug 21 2019, 10:40 AM) -23% is well within the 36% value at risk. Also you meant reoptimization, not rebalancing. Rebalancing happens everytime you deposit, withdraw, and get dividends. hm...i do manual transfer twice a month....so by right it should.... QUOTE(-CoupeFanatic- @ Aug 21 2019, 10:46 AM) for example, a 36% risk index, they claim that there is a 99% probability that your portfolio will only drop to a maximum of 36%, which means only a 1% probability that it will drop beyond 36%. But I feel that it will be an inevitability that it will drop wayyy beyond the 36% threshold, simply due to Murphy's law that states "Anything that can go wrong will go wrong". I don't know if the Stashaway algorithm can perform any better than the market when the next recession hits. If they can, they are god already. well.. if equity down, try the bond.... vice versa. i am not finance expert here though... but surely cannot predict when recession hit |

|

|

|

|

|

calapia

|

Sep 5 2019, 09:06 AM Sep 5 2019, 09:06 AM

|

|

hm.... guys... suddenly just now i noticed my yield is over 20%..... earlier was like 8-10%... anyone know wats going on at the market?

Also i unlock the max risk but i didn't go for it after looking at the portfolio which they will use for that risk level..... end up i m still playing safe for capital growth over long term basis...

|

|

|

|

|

|

calapia

|

Sep 5 2019, 11:26 AM Sep 5 2019, 11:26 AM

|

|

QUOTE(neverfap @ Sep 5 2019, 09:27 AM) Currency impact maybe? And ETF in your portfolio is performing well? Check the usd yield too. Btw the "earlier" in your statement is how long apart? like weeks apart only... well later i ll check with my lay man maths = total invested vs total return formula |

|

|

|

|

|

calapia

|

Sep 10 2019, 10:53 AM Sep 10 2019, 10:53 AM

|

|

QUOTE(calapia @ Sep 5 2019, 11:26 AM) like weeks apart only... well later i ll check with my lay man maths = total invested vs total return formula Ok recheck now standing at 8%.. this seems more accurate than ealier over 20%... wondering if it's a system bug. Just a week differences... |

|

|

|

|

|

calapia

|

Sep 23 2019, 01:07 PM Sep 23 2019, 01:07 PM

|

|

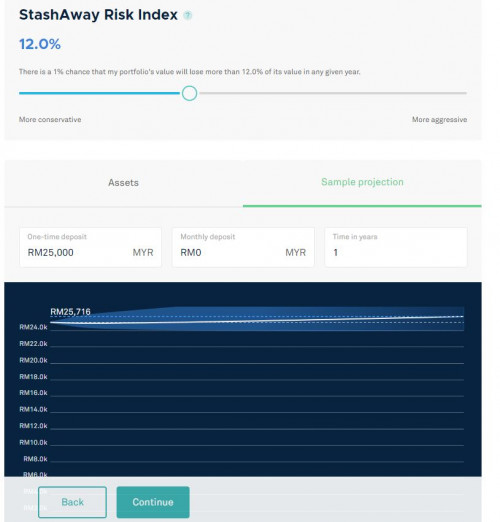

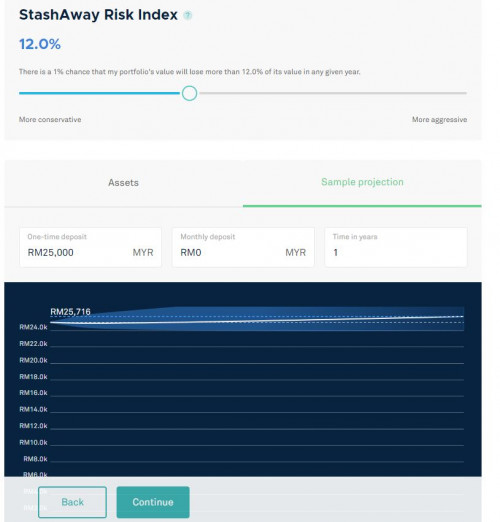

QUOTE(whycanot323 @ Sep 21 2019, 03:31 PM)  im new here. based on the settings above, 1 year return is 716/25,000=2.86% isnt this return is so much lower than any 12months FD ? can enlighten me whats the beautiful of stashaway? you can check the portfolio for that risk index you choose. i unlocked max risk and look at the portfolio not to my interest. so i switch back to my original risk profile. like other forumer said, its better to do monthly small deposit. for me i split into bi weekly since they dun hv min amount of investment. so far my return is better than FD can offer. |

|

|

|

|

|

calapia

|

Oct 3 2019, 11:52 AM Oct 3 2019, 11:52 AM

|

|

QUOTE(moosset @ Oct 3 2019, 11:34 AM) RM 90 only .... mine is RM500 profit wiped off.  wakakakaka same here.... i think is just lousy market. i am on 22% risk profile... its time to trigger the balancing |

|

|

|

|

|

calapia

|

Nov 5 2019, 03:59 PM Nov 5 2019, 03:59 PM

|

|

QUOTE(honsiong @ Nov 3 2019, 12:24 AM) Stashaway flies only when market flies hm... so far it rebounce to 8% liao for my portfolio...still a lot better than FD to me..  |

|

|

|

|

|

calapia

|

Jan 7 2020, 01:40 PM Jan 7 2020, 01:40 PM

|

|

QUOTE(Bilvinduet @ Jan 5 2020, 04:07 PM) I've been looking around and considering this. But from briefly reading this thread it looks like a lot of people are playing around with relatively small amounts for this. Is this safe for larger investments? i m investing small amount monthly but over a year now sudah jadi bukit.... |

|

|

|

|

|

calapia

|

Mar 3 2020, 09:28 AM Mar 3 2020, 09:28 AM

|

|

hm..... mine still got 4% and 3%..... earlier was like close to 20%....

|

|

|

|

|

Mar 22 2019, 09:30 AM

Mar 22 2019, 09:30 AM

Quote

Quote

0.4127sec

0.4127sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled