QUOTE(jacksonpang @ Dec 21 2022, 04:18 PM)

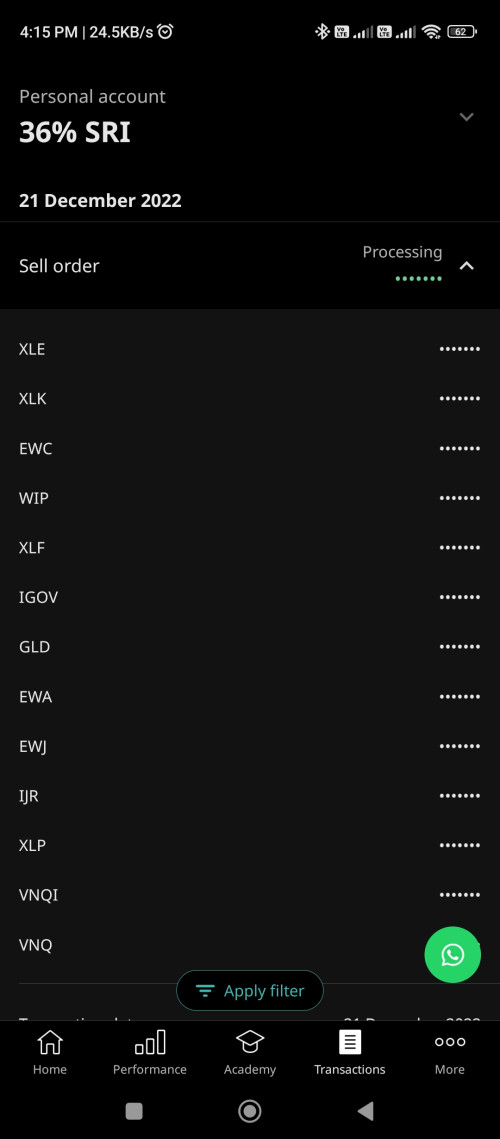

No notification on apps or email, but already selling.. sighs, at -27% loss. Incoming re-opt again!

SA did hinted a few backs in their news letter that they gonna reopt again

Yes selling off bonds, tech and reits to buy defensive position into healthcare 🤦♀️

My suggestion is when they sold off faster take out money before buying new position tomorrow

QUOTE(Medufsaid @ Dec 21 2022, 04:39 PM)

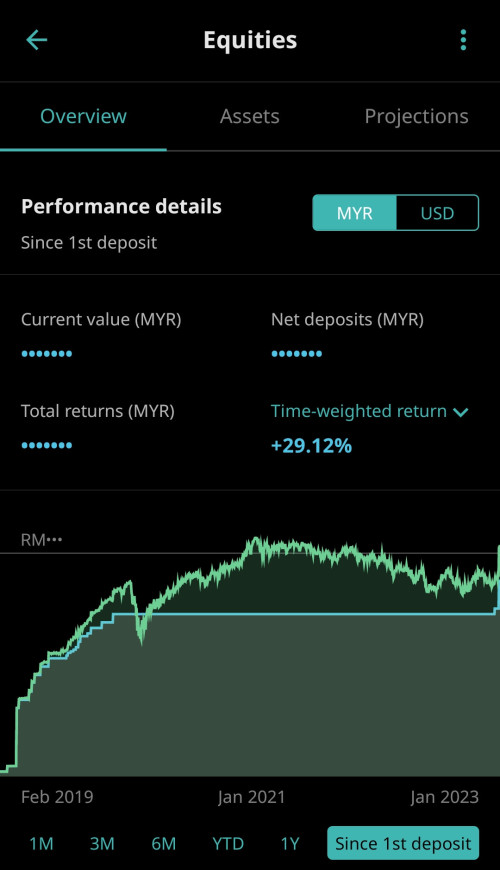

i setup a flexi portfolio with exact same portfolio as classic 36% since June. only have RM100, just so that i can track if big or small amt has difference in performance.

no sell orders there (although it means SA has put an end to my experiment).

unless you are investing in ESG or thematic, I suggest you just accept the reopt or just create a flexible portfolio with the same allocation and move everything there

No point doing experiment using usd22 as percentage is too low 🤦♀️

If you really wanna track put it in at least rm500 for better weightage

This post has been edited by xander2k8: Dec 21 2022, 04:43 PM

Dec 2 2022, 01:56 AM

Dec 2 2022, 01:56 AM

Quote

Quote

0.0694sec

0.0694sec

0.40

0.40

7 queries

7 queries

GZIP Disabled

GZIP Disabled