Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

bcombat

|

Jan 8 2023, 09:42 AM Jan 8 2023, 09:42 AM

|

|

the fund managers/ robo advisors sure they want to say something goods about their portfolio to attract more investor come abroad. After all their rice bowl is from the management fees that impose on the investors funds.

more money in the funds = higher fees collected. So, we have to do proper due diligence on the funds prior to investing.

|

|

|

|

|

|

coolguy99

|

Jan 8 2023, 10:00 AM Jan 8 2023, 10:00 AM

|

|

I withdrew my StashAway Malaysia portfolio. Money came in 3 days later. Pretty efficient.

|

|

|

|

|

|

rahsk

|

Jan 8 2023, 11:02 PM Jan 8 2023, 11:02 PM

|

Getting Started

|

does any one still have hope in stash away? any one stil profiting well?

i did for 3 years, dca-ed regularly, nothing worked out and i gave it all up

|

|

|

|

|

|

SUSxander2k8

|

Jan 9 2023, 02:50 AM Jan 9 2023, 02:50 AM

|

|

QUOTE(rahsk @ Jan 8 2023, 11:02 PM) does any one still have hope in stash away? any one stil profiting well? i did for 3 years, dca-ed regularly, nothing worked out and i gave it all up Since you’re halfway there give it another 2 years and it should break even by then At least better than buying UT and still holding losses in a decade 🤦♀️ |

|

|

|

|

|

RoosterGold

|

Jan 10 2023, 05:49 PM Jan 10 2023, 05:49 PM

|

Getting Started

|

QUOTE(rahsk @ Jan 8 2023, 11:02 PM) does any one still have hope in stash away? any one stil profiting well? i did for 3 years, dca-ed regularly, nothing worked out and i gave it all up Am a firm believer that time in the market >> timing the market. Y2022 was definitely painful on my StashAway portfolio as I saw NAV diminish Y-o-Y though am still slightly up overall. Still, can't say I am not disappointed with StashAway's ERAA (with reference to their backtested 2008 scenario) which claimed double digit returns (11.4%) vs S&P500 with negative returns (-23.2%). I suppose shall give them another 3 years to live up to their claims. (ref.: Google StashAway: 2008 Backtest) |

|

|

|

|

|

SUSxander2k8

|

Jan 10 2023, 07:04 PM Jan 10 2023, 07:04 PM

|

|

QUOTE(RoosterGold @ Jan 10 2023, 05:49 PM) Am a firm believer that time in the market >> timing the market. Y2022 was definitely painful on my StashAway portfolio as I saw NAV diminish Y-o-Y though am still slightly up overall. Still, can't say I am not disappointed with StashAway's ERAA (with reference to their backtested 2008 scenario) which claimed double digit returns (11.4%) vs S&P500 with negative returns (-23.2%). I suppose shall give them another 3 years to live up to their claims. (ref.: Google StashAway: 2008 Backtest) No need so long in another 2 years should have 5 track record then you can compare itself The new reopt has better returns then the past 2 was a big mistake and hopefully they have learn a lesson not to allocate 20% to high beta ETF 🤦♀️ |

|

|

|

|

|

honsiong

|

Jan 11 2023, 12:24 AM Jan 11 2023, 12:24 AM

|

|

QUOTE(rahsk @ Jan 8 2023, 11:02 PM) does any one still have hope in stash away? any one stil profiting well? i did for 3 years, dca-ed regularly, nothing worked out and i gave it all up Still using it, since 2017. The whole market down, blame stashaway only meh? |

|

|

|

|

|

MGM

|

Jan 12 2023, 07:33 AM Jan 12 2023, 07:33 AM

|

|

So anyone make money from Stashaway?

|

|

|

|

|

|

bcombat

|

Jan 12 2023, 09:04 AM Jan 12 2023, 09:04 AM

|

|

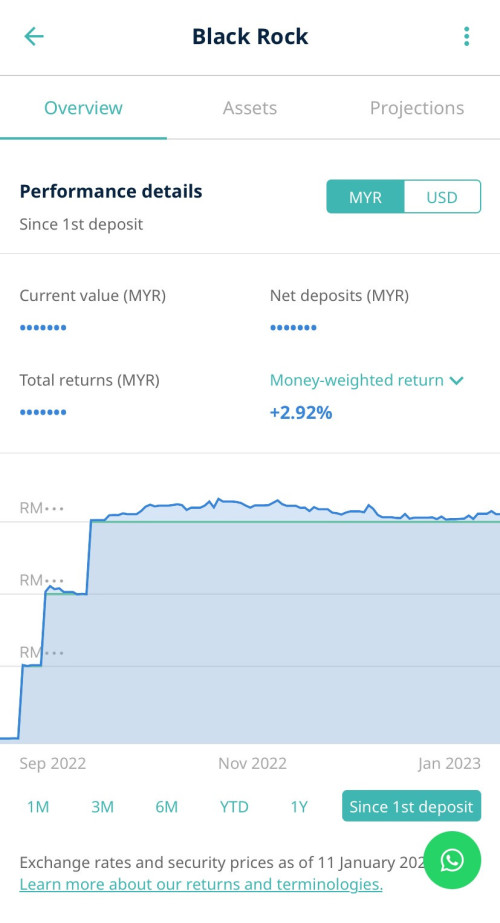

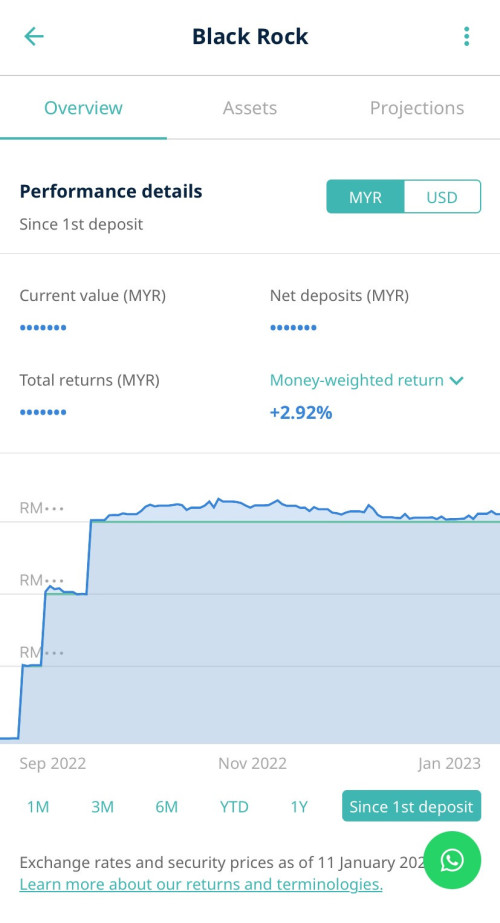

QUOTE(MGM @ Jan 12 2023, 07:33 AM) So anyone make money from Stashaway?  a little bit from black rock aggressive portfolio |

|

|

|

|

|

neverfap

|

Jan 12 2023, 02:31 PM Jan 12 2023, 02:31 PM

|

|

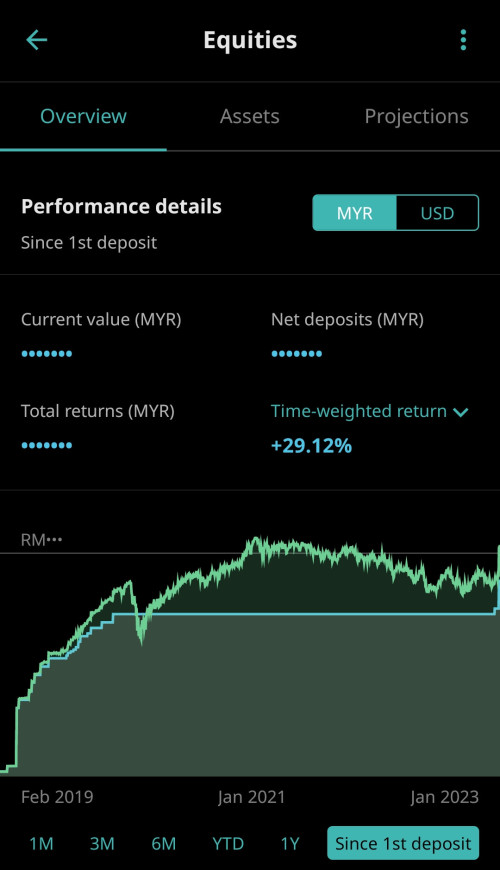

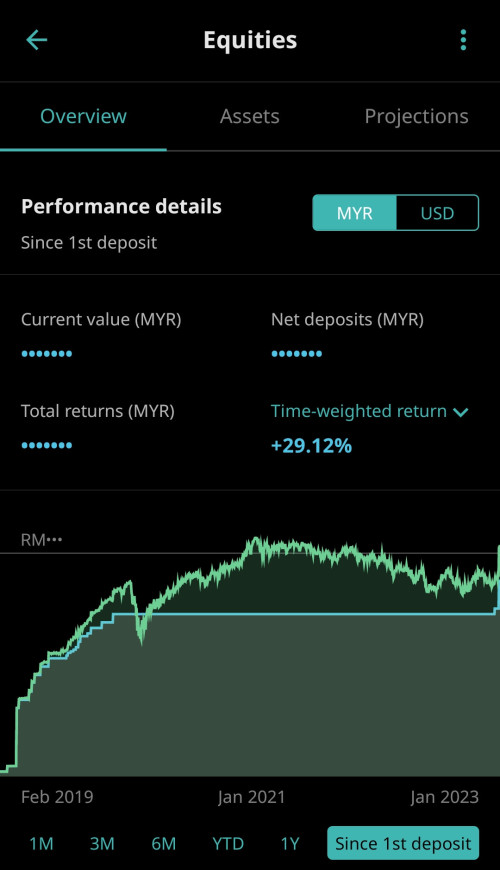

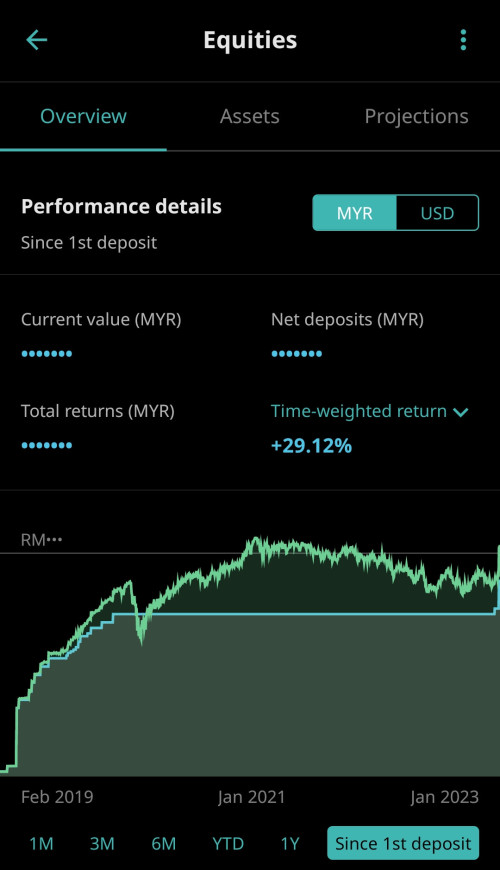

QUOTE(MGM @ Jan 12 2023, 07:33 AM) So anyone make money from Stashaway? Took some time off from investing Just started to invest not long ago Gain a lil This post has been edited by neverfap: Feb 9 2023, 05:57 AM |

|

|

|

|

|

SUSxander2k8

|

Jan 12 2023, 06:23 PM Jan 12 2023, 06:23 PM

|

|

QUOTE(neverfap @ Jan 12 2023, 02:31 PM) Took some time off from investing Just started to invest not long ago  Not bad almost yearly 10% 👏 |

|

|

|

|

|

RoosterGold

|

Jan 13 2023, 11:12 AM Jan 13 2023, 11:12 AM

|

Getting Started

|

QUOTE(neverfap @ Jan 12 2023, 02:31 PM) Took some time off from investing Just started to invest not long ago   Returns are similar to mine but don't be fooled by the Time-Weighted Return of around 30% since this is cumulative over the investment period. My actual CAGR is only 5%-6% at the moment for StashAway (SRI36). |

|

|

|

|

|

tehoice

|

Jan 13 2023, 03:49 PM Jan 13 2023, 03:49 PM

|

|

QUOTE(RoosterGold @ Jan 13 2023, 11:12 AM)  Returns are similar to mine but don't be fooled by the Time-Weighted Return of around 30% since this is cumulative over the investment period. My actual CAGR is only 5%-6% at the moment for StashAway (SRI36). I'd take the 5-6% annualised return, anytime, in such a bad year considerably. |

|

|

|

|

|

honsiong

|

Jan 13 2023, 03:53 PM Jan 13 2023, 03:53 PM

|

|

QUOTE(tehoice @ Jan 13 2023, 03:49 PM) I'd take the 5-6% annualised return, anytime, in such a bad year considerably. EPF LOL |

|

|

|

|

|

tehoice

|

Jan 13 2023, 04:16 PM Jan 13 2023, 04:16 PM

|

|

QUOTE(honsiong @ Jan 13 2023, 03:53 PM) also on liquidity and accessibility |

|

|

|

|

|

Natsukashii

|

Jan 13 2023, 04:20 PM Jan 13 2023, 04:20 PM

|

|

QUOTE(RoosterGold @ Jan 13 2023, 11:12 AM)  Returns are similar to mine but don't be fooled by the Time-Weighted Return of around 30% since this is cumulative over the investment period. My actual CAGR is only 5%-6% at the moment for StashAway (SRI36). Wow.. I don't even have 10k lol What ETFs and how much allocations you have in your Fire Fund? |

|

|

|

|

|

zstan

|

Jan 13 2023, 04:24 PM Jan 13 2023, 04:24 PM

|

|

QUOTE(tehoice @ Jan 13 2023, 04:16 PM) also on liquidity and accessibility Maybank shares lor at least 5% for the past few years already |

|

|

|

|

|

bcombat

|

Jan 13 2023, 04:33 PM Jan 13 2023, 04:33 PM

|

|

when market recover later, SA portfolio returns likely show much better results than now. But need to wait….

|

|

|

|

|

|

zstan

|

Jan 13 2023, 04:37 PM Jan 13 2023, 04:37 PM

|

|

QUOTE(bcombat @ Jan 13 2023, 04:33 PM) when market recover later, SA portfolio returns likely show much better results than now. But need to wait…. need DJI to go back to 36000 then profit d |

|

|

|

|

|

SUSxander2k8

|

Jan 13 2023, 05:34 PM Jan 13 2023, 05:34 PM

|

|

QUOTE(zstan @ Jan 13 2023, 04:37 PM) need DJI to go back to 36000 then profit d You bought at the high? 🤦♀️ Sometimes no need to wait as not all ETFs doesn’t correspond well to the index |

|

|

|

|

Jan 8 2023, 09:42 AM

Jan 8 2023, 09:42 AM

Quote

Quote

0.0304sec

0.0304sec

0.71

0.71

6 queries

6 queries

GZIP Disabled

GZIP Disabled