QUOTE(tehoice @ Jan 13 2023, 03:49 PM)

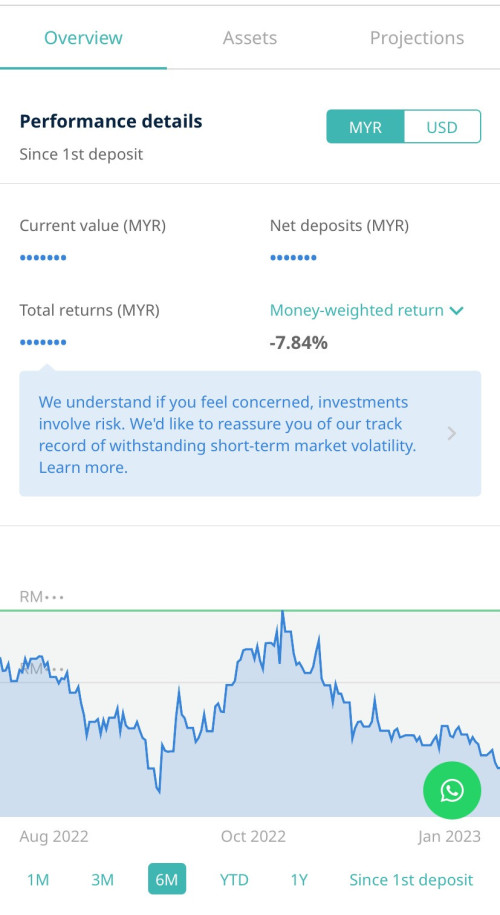

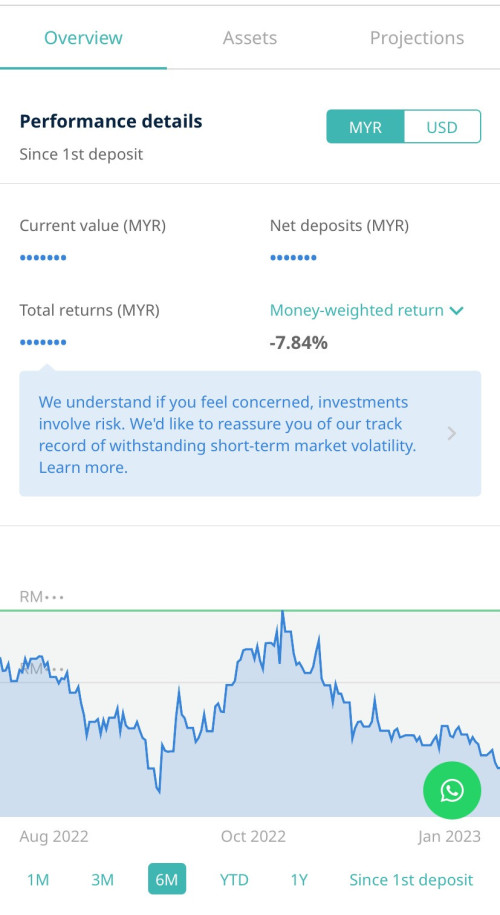

Agreed considering how Y2022 was such a terrible year across multiple investments.Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jan 14 2023, 10:00 PM Jan 14 2023, 10:00 PM

|

Junior Member

53 posts Joined: Jan 2023 |

|

|

|

|

|

|

Jan 16 2023, 09:34 AM Jan 16 2023, 09:34 AM

|

Junior Member

53 posts Joined: Jan 2023 |

QUOTE(Natsukashii @ Jan 13 2023, 04:20 PM) My FIRE FUND on StashAway is the standard SRI 30.0% portofolio so currently has EWJ, ISAC, SPEM, VEU, XLE, XLK, XLV while the rest are bonds & commodities. Natsukashii liked this post

|

|

|

Jan 26 2023, 03:48 PM Jan 26 2023, 03:48 PM

|

Junior Member

384 posts Joined: Oct 2011 |

QUOTE(RoosterGold @ Jan 13 2023, 11:12 AM)  Returns are similar to mine but don't be fooled by the Time-Weighted Return of around 30% since this is cumulative over the investment period. My actual CAGR is only 5%-6% at the moment for StashAway (SRI36). the app showing 30%.... but the 30% is totally misleading calc.. i did a calculation in excel , comparing if i placing FD with average promo rate of 12-18months each year. for 2019 Jan to 2022 Jan... basically past 4years FD can earn more than stashaway... PLUS no risk if go for FD i have just decided to withdraw all my 30k from stashaway today for new user that thinking to going in stashaway, my sugesstion is a big no, please dont |

|

|

Jan 26 2023, 04:10 PM Jan 26 2023, 04:10 PM

Show posts by this member only | IPv6 | Post

#19924

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(whycanot323 @ Jan 26 2023, 03:48 PM) i have invested during 2019 till now for 30k... Question is did you get out with a profit?the app showing 30%.... but the 30% is totally misleading calc.. i did a calculation in excel , comparing if i placing FD with average promo rate of 12-18months each year. for 2019 Jan to 2022 Jan... basically past 4years FD can earn more than stashaway... PLUS no risk if go for FD i have just decided to withdraw all my 30k from stashaway today for new user that thinking to going in stashaway, my sugesstion is a big no, please dont If yes by all means go ahead as they are not consistent with AA hence you can see the lower performing and mid range is performing is stable while higher risks is bearing the brunt This year AA is much more resilient as compared to past 3 years as I believe the new CIO is much convincing than the previous one 🤦♀️ |

|

|

Jan 26 2023, 04:27 PM Jan 26 2023, 04:27 PM

|

Junior Member

384 posts Joined: Oct 2011 |

QUOTE(xander2k8 @ Jan 26 2023, 04:10 PM) Question is did you get out with a profit? yes with profit, but the profit is relatively equivalent or lower slightly if i park this 30k in FD with promo rate since 2019 jan till 2022 janIf yes by all means go ahead as they are not consistent with AA hence you can see the lower performing and mid range is performing is stable while higher risks is bearing the brunt This year AA is much more resilient as compared to past 3 years as I believe the new CIO is much convincing than the previous one 🤦♀️ |

|

|

Jan 27 2023, 11:54 AM Jan 27 2023, 11:54 AM

|

Senior Member

3,492 posts Joined: Jan 2003 |

QUOTE(whycanot323 @ Jan 26 2023, 03:48 PM) slightly sick. will add on at a later date when i have timedon't compare FD against equity, esp since we have the once a decade bear market currently. comparing bear market vs FD will make it seem like it's better to stick to FD, but you'll lose out of the remaining 9 years of bull market. compare against a DIY portfolio of S&P500, and see by how much SA is underperforming |

|

|

|

|

|

Jan 27 2023, 12:07 PM Jan 27 2023, 12:07 PM

Show posts by this member only | IPv6 | Post

#19927

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jan 27 2023, 12:11 PM Jan 27 2023, 12:11 PM

Show posts by this member only | IPv6 | Post

#19928

|

All Stars

14,892 posts Joined: Mar 2015 |

QUOTE(whycanot323 @ Jan 26 2023, 03:48 PM) i have invested during 2019 till now for 30k... Yes, don't go for SA or any other equity investment.the app showing 30%.... but the 30% is totally misleading calc.. i did a calculation in excel , comparing if i placing FD with average promo rate of 12-18months each year. for 2019 Jan to 2022 Jan... basically past 4years FD can earn more than stashaway... PLUS no risk if go for FD i have just decided to withdraw all my 30k from stashaway today for new user that thinking to going in stashaway, my sugesstion is a big no, please dont If the investor does not fully understand or willing to take investment risks. Any form of equity investments has risk, while FD has no investment risk. Like Medufsaid said in the earlier post, "don't compare FD against equity, esp since we have the once a decade bear market currently. comparing bear market vs FD will make it seem like it's better to stick to FD, but you'll lose out of the remaining 9 years of bull market." So happens you happened to travel into the current bear winter. If you had invested during 2017 till 2019, you may see a different light. Will this bear winter last forever? Will your returns in FD ever beats the inflation rate? Do you want to sleep better thinking you will not have investment risk by going for FD? Your risks, your returns, your choice of peacefulness you seek, your money your decision..... Attached thumbnail(s)

RoosterGold liked this post

|

|

|

Jan 27 2023, 02:59 PM Jan 27 2023, 02:59 PM

Show posts by this member only | IPv6 | Post

#19929

|

Senior Member

4,491 posts Joined: Mar 2014 |

|

|

|

Jan 27 2023, 03:41 PM Jan 27 2023, 03:41 PM

Show posts by this member only | IPv6 | Post

#19930

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(bcombat @ Jan 27 2023, 12:07 PM) Cash because they are uncertain on what to allocate for those lower SRI as they are trying preserve your portfolio and moving into recession regime now For any Asset Allocation last year you should ask the previous underperform CIO instead 🤦♀️ This year SA should not lose a lot in % otherwise you will see more leaving and smaller AUM in the future |

|

|

Jan 28 2023, 12:43 AM Jan 28 2023, 12:43 AM

Show posts by this member only | IPv6 | Post

#19931

|

Junior Member

998 posts Joined: May 2014 |

Putting substantial of funds in the cash equivalent assets may not be safer option when the dollar is weakened. Can see MWR for USD has improved but MYR in ringgit were headed to different direction. Selective unit trust has set aside 1x% to 2x% into cash/ money market funds since mid of last year. SA only adopt defensive stance at end of last year. |

|

|

Jan 28 2023, 03:05 AM Jan 28 2023, 03:05 AM

Show posts by this member only | IPv6 | Post

#19932

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(bcombat @ Jan 28 2023, 12:43 AM)   Putting substantial of funds in the cash equivalent assets may not be safer option when the dollar is weakened. Can see MWR for USD has improved but MYR in ringgit were headed to different direction. Selective unit trust has set aside 1x% to 2x% into cash/ money market funds since mid of last year. SA only adopt defensive stance at end of last year. Markets and them got it wrong with bonds as they figures it will hold instead |

|

|

Jan 30 2023, 11:19 AM Jan 30 2023, 11:19 AM

|

Junior Member

53 posts Joined: Jan 2023 |

QUOTE(whycanot323 @ Jan 26 2023, 03:48 PM) i have invested during 2019 till now for 30k... CAGR (Compound Annual Grwoth Rate) is the yardstick across my various investments. the app showing 30%.... but the 30% is totally misleading calc.. i did a calculation in excel , comparing if i placing FD with average promo rate of 12-18months each year. for 2019 Jan to 2022 Jan... basically past 4years FD can earn more than stashaway... PLUS no risk if go for FD i have just decided to withdraw all my 30k from stashaway today for new user that thinking to going in stashaway, my sugesstion is a big no, please dont FD is relatively "safer" than investing equity since one's capital is protected with a fixed return but equity/stocks has more potential to grow over the medium to long term. I would suggest doing an analysis for the broad market like the S&P500 vs FD over a 10, 20 & 30 year period. |

|

|

|

|

|

Jan 30 2023, 02:43 PM Jan 30 2023, 02:43 PM

Show posts by this member only | IPv6 | Post

#19934

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(RoosterGold @ Jan 30 2023, 11:19 AM) CAGR (Compound Annual Grwoth Rate) is the yardstick across my various investments. Factor in as well if there is dividend given out to be reinvested as well 👏FD is relatively "safer" than investing equity since one's capital is protected with a fixed return but equity/stocks has more potential to grow over the medium to long term. I would suggest doing an analysis for the broad market like the S&P500 vs FD over a 10, 20 & 30 year period. RoosterGold liked this post

|

|

|

Jan 31 2023, 12:40 PM Jan 31 2023, 12:40 PM

|

Junior Member

53 posts Joined: Jan 2023 |

|

|

|

Jan 31 2023, 12:45 PM Jan 31 2023, 12:45 PM

Show posts by this member only | IPv6 | Post

#19936

|

Junior Member

745 posts Joined: Jul 2016 |

-13.87% TWR as of 31/1/2023

22% RI This post has been edited by akhito: Jan 31 2023, 12:46 PM |

|

|

Jan 31 2023, 01:22 PM Jan 31 2023, 01:22 PM

Show posts by this member only | IPv6 | Post

#19937

|

Senior Member

4,665 posts Joined: Jan 2003 |

|

|

|

Jan 31 2023, 01:33 PM Jan 31 2023, 01:33 PM

|

Junior Member

384 posts Joined: Oct 2011 |

QUOTE(Medufsaid @ Jan 27 2023, 11:54 AM) slightly sick. will add on at a later date when i have time don't compare FD against equity, esp since we have the once a decade bear market currently. comparing bear market vs FD will make it seem like it's better to stick to FD, but you'll lose out of the remaining 9 years of bull market. compare against a DIY portfolio of S&P500, and see by how much SA is underperforming QUOTE(MUM @ Jan 27 2023, 12:11 PM) Yes, don't go for SA or any other equity investment. If the investor does not fully understand or willing to take investment risks. Any form of equity investments has risk, while FD has no investment risk. Like Medufsaid said in the earlier post, "don't compare FD against equity, esp since we have the once a decade bear market currently. comparing bear market vs FD will make it seem like it's better to stick to FD, but you'll lose out of the remaining 9 years of bull market." So happens you happened to travel into the current bear winter. If you had invested during 2017 till 2019, you may see a different light. Will this bear winter last forever? Will your returns in FD ever beats the inflation rate? Do you want to sleep better thinking you will not have investment risk by going for FD? Your risks, your returns, your choice of peacefulness you seek, your money your decision..... QUOTE(RoosterGold @ Jan 30 2023, 11:19 AM) CAGR (Compound Annual Grwoth Rate) is the yardstick across my various investments. FD is relatively "safer" than investing equity since one's capital is protected with a fixed return but equity/stocks has more potential to grow over the medium to long term. I would suggest doing an analysis for the broad market like the S&P500 vs FD over a 10, 20 & 30 year period. QUOTE(xander2k8 @ Jan 30 2023, 02:43 PM) understood, maybe i miss out the 2017 ?those from 2017, what are your CAGR ? i believe 2019 to 2023 are not too short in term of investment period i even top up during 2020 march to june during sharp fall... still not much "earn" in true % compared to FD dont follow the app return % shown, it is misleading calc.... again, im here to learn and share my view guys... dont shoot me if my thinking is different RoosterGold liked this post

|

|

|

Jan 31 2023, 01:43 PM Jan 31 2023, 01:43 PM

Show posts by this member only | IPv6 | Post

#19939

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(whycanot323 @ Jan 31 2023, 01:33 PM) understood, maybe i miss out the 2017 ? You need to factor the exchange rate those from 2017, what are your CAGR ? i believe 2019 to 2023 are not too short in term of investment period i even top up during 2020 march to june during sharp fall... still not much "earn" in true % compared to FD dont follow the app return % shown, it is misleading calc.... again, im here to learn and share my view guys... dont shoot me if my thinking is different The best is for you take their USD value and compared CAGR is the right way because of your underlying assets value Then factor in the management fees if any being paid during the period You can’t compare side by side with FD firstly because there is fees involved 🤦♀️ |

|

|

Jan 31 2023, 02:11 PM Jan 31 2023, 02:11 PM

Show posts by this member only | IPv6 | Post

#19940

|

All Stars

14,892 posts Joined: Mar 2015 |

QUOTE(whycanot323 @ Jan 31 2023, 01:33 PM) understood, maybe i miss out the 2017 ? The attached image shows,those from 2017, what are your CAGR ? i believe 2019 to 2023 are not too short in term of investment period i even top up during 2020 march to june during sharp fall... still not much "earn" in true % compared to FD dont follow the app return % shown, it is misleading calc.... did the apps returns calculations takes into the date and amount of each of your Deposits/Withdrawals? again, im here to learn and share my view guys... dont shoot me if my thinking is different Individual SRI annualised performance Since individual portfolio SRI inception till end MAY 2022 For annualised data of till end Dec 2022, perhaps have to wait for them to publish. If cannot wait, perhaps have to compile manually from their monthly portfolio reviews and commentary reports. BTW, I think, since the data as in this image is in "annualised" value. I believes if after taking into consideration of data from end June till end Dec 2022... The annualised rate of some SRI will still be better than FD annualised from 2017/8 to end 2022 This post has been edited by MUM: Jan 31 2023, 02:58 PM Attached thumbnail(s)

|

| Change to: |  0.0364sec 0.0364sec

0.85 0.85

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 01:24 AM |