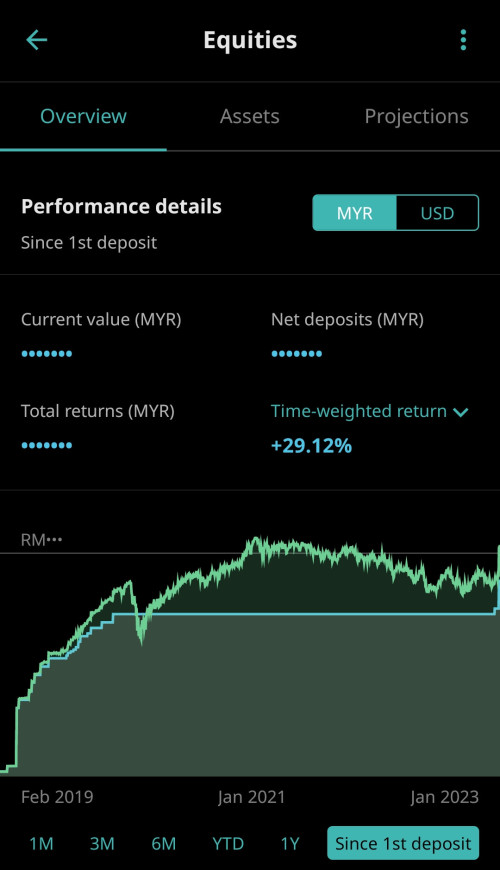

My StashAway (SRI36) FIRE FUND has dipped y-o-y but this is in tandem with the year 2022 that has not been kind to most investors overall. Perhaps my expectations for StashAway to do better has been ill-placed as I expected at least +8% CAGR at the beginning of 2022 rather than -11% y-o-y losses for 2022. Still I am a firm believer that time in the market >> timing the market. Let's hope that StashAway (& the global markets) will in better in 2023 and beyond despite a looming recession underway.

https://pictr.com/images/2023/01/06/EiZkHg.md.jpg

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Jan 6 2023, 12:04 PM

Jan 6 2023, 12:04 PM

Quote

Quote

0.0604sec

0.0604sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled