» Click to show Spoiler - click again to hide... «

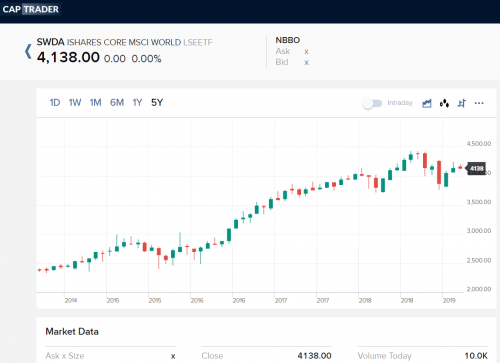

Ringgit too sad? Or duwan too much home-bias? Want look for gooding investment outside Bolehland? Look no further than SP500!

Thanks to cooperation from numerous parties and technologies we have today, you can invest in SP500 at the cheapest cost possible with a little work outlined below.

The result is a solid equity holding forming part of your portfolio.

If you are looking for international equity holding, look no further than SP500.

Step-by-step hand-carry mode

» Click to show Spoiler - click again to hide... «

1) Open a Wise account. https://wise.com/my

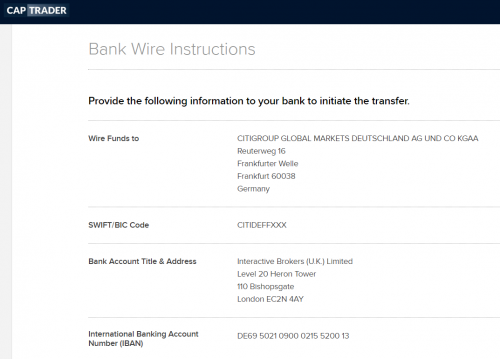

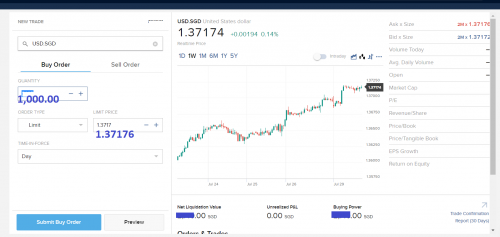

2) Open a TradeStation Global account (interactive broker as backend)

3) Wait for no.1 and 2 account activated

4) Once both are online, initiate wire transfer via Wise to TradeStation Global (Alex suggest RM7k Ringgit as minimum = ~2k GBP).

5) You should have at least 2k GBP in TradeStation Global.

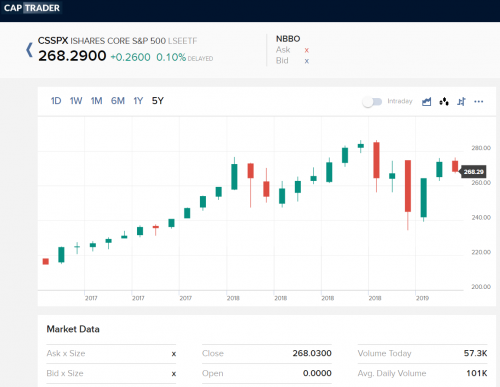

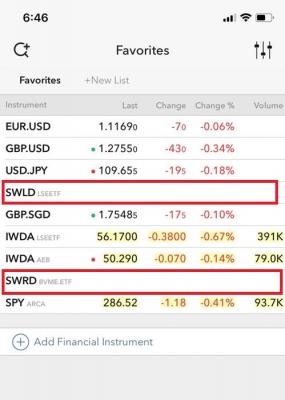

6) Hoot CSP1 (code name for iShares SP500 index fund, domiciled in Ireland, but listed in London Stock Exchange)

7) Come back at least 5 years later (preferably longer investment horizon).

Total cost incurred: [Cheapest Route as at 19 May 2021]

» Click to show Spoiler - click again to hide... «

a) Wise ~0.5% forex charge one-way.

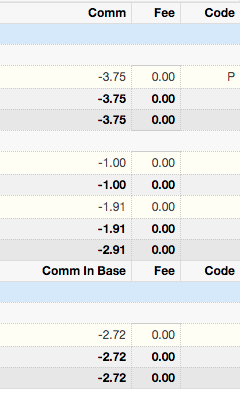

b) TradeStation Global brokerage charge 0.12% or 1.5 GBP, whichever higher.

https://www.tradestation-international.com/pricing/

c) CSP1 SP500 index fund annual charge 0.07%

Fast Q&A [Last updated 19 May 2021]

» Click to show Spoiler - click again to hide... «

1) Why Wise?

Cheapest

2) Why TradeStation Global?

No annual charge like Interactive Broker. But need minimum 2k GBP in the account to prove that you are worthy to be their customer.

3) why SXR8?

Ireland-domiciled (15% dividend withholding), dividend is automatically reinvested (accumulating)

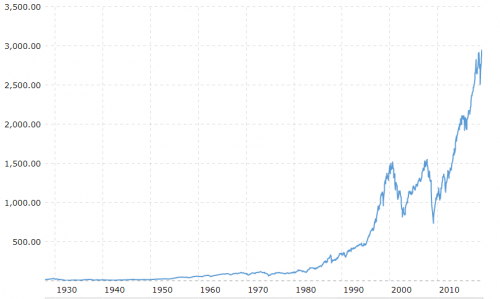

4) why SP500?

Itu Warren Buffett also prescribe like this for his wife once he passed away. Just follow.

SP500 is broad-based diversification. You hoot SP500 means you get microsoft, apple, facebook, abott, 3m, berkshire, bla bla bla....mcd also masuk.... all in one package.

5) Why must at least 5 years?

You tot skim cepat kaya kah? Ini bukan money game. Minimum 5 years to set aside such amount. If not, please don't hoot SP500.

6) Sure win?

nothing is sure under the sun. If want sure, FD is your best bet.

7) confirm cheaper than stashaway?

First time charge is ~0.5% forex (Wise), then another 0.12% for brokerage...

then annually only eat 0.07% annual fee...

you do the math

8) I like glide-down efficient frontier thingy oh, how leh?

Research has proven that glide-down or up has minimal effect. What is more important is your asset allocation, e.g., 50/50.

Consider William Sharpe with brilliant theories also use 50/50 personally.

9) 0.07% annual charge got trick or not? I heard normal fund charge is 0.5% to 2 % annually?

Ini product Jack Bogle, the founder of Vanguard. The world need to thank him for spearheading the index fund movement.

0.07% very cheap d, coz what the fund manager do is just mimick the sp500 holding. By market capitalization. They no need do research. Save cost. Save your money also.

10) what risk am I taking over here?

Market risk (maksud if US market gg, SP500 gg, your money gg)

Currency risk (maksud if USD gg, your money also gg)

11) got sales charge and redemption fee or not?

Only pay forex fee (one-time), then brokerage fee (also one time), when you want sell, pay one more time brokerage fee....then repatriate your money back to malaysia (maybe forex kena again, you know, the money changer always eat bid/ask)

12) Siapa Bogleheads?

A community who loves the late Sir Jack Bogle, the founder of first index fund. When the index fund is first launched, it was dubbed as being 'un-American', and was labeled as the Bogle's folly. Today, Vanguard Index fund survives with very large holding, while many active funds were gone.

13) If TradeStation Global gg how?

Then our money gg

14) can DCA or not?

Because of brokerage charge (see the charge above), Alex suggest keep rm7k then hoot, like that you get maximum saving. If not, every transaction 1.5 GBP painful oh, unless you don't mind with that.

15) i scare TradeStation Global songlap my money leh. How leh?

Hmm..like that, can choose a more reputable broker. But higher forex + brokerage if choose this path. Yes, important to do due diligence.

16) I'm not rich leh, where got 7k to hoot?

slowly save ba.... can use other instrument like FSM growth fund, or SA slowly grow nest egg first. But once reach 7k, and you're thinking of setting aside this money for >5 years in international equity market, then come back here =)

17) U ni, macam ETF je, bukan index fund wor. I want index fund how?

Sorry itu Vanguard sama Blackrock sekalian no offer index fund direct purpose to Malaysian. Our best bet is through ETF.

18) Apa ETF?

Visit our mothership at

https://forum.lowyat.net/topic/3396549

19) If want bring back money from TradeStation Global how?

Got one fren demonstrated via TransferWire -> Malaysia Maybank success. Tapi cost a bit steep, averaging 1%.

Please refer to my comrade @wt_vinci original post @ https://forum.lowyat.net/index.php?showtopi...post&p=92533264

20) You maciam say TradeStation Global cheaper than Captrader oh. How ah?

*revised, Tradestation global = cheapest. (20 Aug 2020)

TradeStation Global is cheaper in the sense that you hoot a size of RM7-8k and only need to pay roughly GBP1.5 commission fee.

For CapTrader, you need around RM18k fund size to enjoy maximum discount on commission fee.

https://www.tradestation-international.com/pricing/

Substitute all Captrader thingy with TradeStation Global, it's interchangeable.

Protip: CapTrader and TS Global both use IB as platform too =)

Cheapest

2) Why TradeStation Global?

No annual charge like Interactive Broker. But need minimum 2k GBP in the account to prove that you are worthy to be their customer.

3) why SXR8?

Ireland-domiciled (15% dividend withholding), dividend is automatically reinvested (accumulating)

4) why SP500?

Itu Warren Buffett also prescribe like this for his wife once he passed away. Just follow.

SP500 is broad-based diversification. You hoot SP500 means you get microsoft, apple, facebook, abott, 3m, berkshire, bla bla bla....mcd also masuk.... all in one package.

5) Why must at least 5 years?

You tot skim cepat kaya kah? Ini bukan money game. Minimum 5 years to set aside such amount. If not, please don't hoot SP500.

6) Sure win?

nothing is sure under the sun. If want sure, FD is your best bet.

7) confirm cheaper than stashaway?

First time charge is ~0.5% forex (Wise), then another 0.12% for brokerage...

then annually only eat 0.07% annual fee...

you do the math

8) I like glide-down efficient frontier thingy oh, how leh?

Research has proven that glide-down or up has minimal effect. What is more important is your asset allocation, e.g., 50/50.

Consider William Sharpe with brilliant theories also use 50/50 personally.

9) 0.07% annual charge got trick or not? I heard normal fund charge is 0.5% to 2 % annually?

Ini product Jack Bogle, the founder of Vanguard. The world need to thank him for spearheading the index fund movement.

0.07% very cheap d, coz what the fund manager do is just mimick the sp500 holding. By market capitalization. They no need do research. Save cost. Save your money also.

10) what risk am I taking over here?

Market risk (maksud if US market gg, SP500 gg, your money gg)

Currency risk (maksud if USD gg, your money also gg)

11) got sales charge and redemption fee or not?

Only pay forex fee (one-time), then brokerage fee (also one time), when you want sell, pay one more time brokerage fee....then repatriate your money back to malaysia (maybe forex kena again, you know, the money changer always eat bid/ask)

12) Siapa Bogleheads?

A community who loves the late Sir Jack Bogle, the founder of first index fund. When the index fund is first launched, it was dubbed as being 'un-American', and was labeled as the Bogle's folly. Today, Vanguard Index fund survives with very large holding, while many active funds were gone.

13) If TradeStation Global gg how?

Then our money gg

14) can DCA or not?

Because of brokerage charge (see the charge above), Alex suggest keep rm7k then hoot, like that you get maximum saving. If not, every transaction 1.5 GBP painful oh, unless you don't mind with that.

15) i scare TradeStation Global songlap my money leh. How leh?

Hmm..like that, can choose a more reputable broker. But higher forex + brokerage if choose this path. Yes, important to do due diligence.

16) I'm not rich leh, where got 7k to hoot?

slowly save ba.... can use other instrument like FSM growth fund, or SA slowly grow nest egg first. But once reach 7k, and you're thinking of setting aside this money for >5 years in international equity market, then come back here =)

17) U ni, macam ETF je, bukan index fund wor. I want index fund how?

Sorry itu Vanguard sama Blackrock sekalian no offer index fund direct purpose to Malaysian. Our best bet is through ETF.

18) Apa ETF?

Visit our mothership at

https://forum.lowyat.net/topic/3396549

19) If want bring back money from TradeStation Global how?

Got one fren demonstrated via TransferWire -> Malaysia Maybank success. Tapi cost a bit steep, averaging 1%.

Please refer to my comrade @wt_vinci original post @ https://forum.lowyat.net/index.php?showtopi...post&p=92533264

20) You maciam say TradeStation Global cheaper than Captrader oh. How ah?

*revised, Tradestation global = cheapest. (20 Aug 2020)

TradeStation Global is cheaper in the sense that you hoot a size of RM7-8k and only need to pay roughly GBP1.5 commission fee.

For CapTrader, you need around RM18k fund size to enjoy maximum discount on commission fee.

https://www.tradestation-international.com/pricing/

Substitute all Captrader thingy with TradeStation Global, it's interchangeable.

Protip: CapTrader and TS Global both use IB as platform too =)

Ok thanks bye =)

postscript:

Bacalah “你能吗" in the attached pdf. Good luck!

Warren Buffet endorsed

John Bogle said yes

Forumer contribution

Yours Truly Personal Finance series - Start well, start early

12-Step Recovery Program for Active Investors

Are You Active or Passive? Google Form Survey representing Malaysian investor profiling (2025 currently open)

Contribute now

This post has been edited by alexkos: Jun 26 2025, 11:19 AM

Attached File(s)

IfYouCan.pdf ( 185.99k )

Number of downloads: 1126

IfYouCan.pdf ( 185.99k )

Number of downloads: 1126

Feb 26 2019, 10:15 PM, updated 5 months ago

Feb 26 2019, 10:15 PM, updated 5 months ago

Quote

Quote

0.7329sec

0.7329sec

0.22

0.22

6 queries

6 queries

GZIP Disabled

GZIP Disabled