Outline ·

[ Standard ] ·

Linear+

[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

|

tadashi987

|

Mar 9 2019, 09:40 AM Mar 9 2019, 09:40 AM

|

|

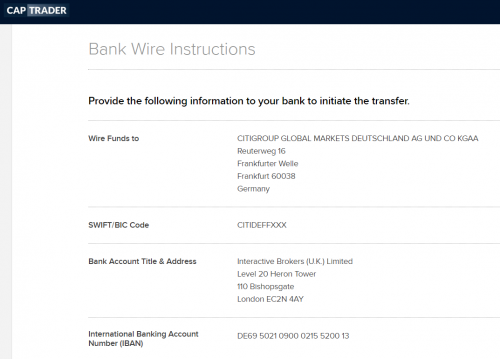

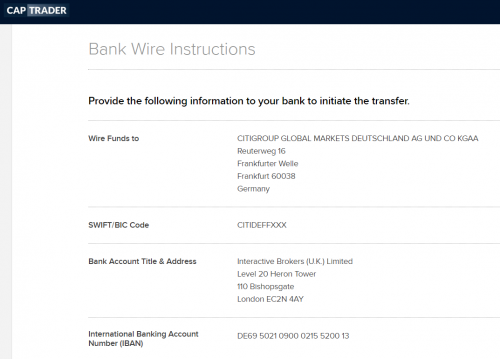

QUOTE(alexkos @ Mar 7 2019, 09:23 PM)  ini masa captrader ask alex to bank in (general info) then need notify another side also (instarem) when do wiring from instarem to captrader, the latter asks for wiring intention. In other words, you must notify both parties, if not ah, money songlap in between? So Ramjade is correct. Itu Captrader use IB (see the name Interactive Broker). If captrader gg, maybe can sue IB? So you have done your first trade dy?  come share share ur experience BTW came across the captrader account opening Ireland trade seem to have stamp tax? you might want to put this into ur fee calculation also https://www.captrader.com/en/account/conditions/ This post has been edited by tadashi987: Mar 9 2019, 09:45 AM

This post has been edited by tadashi987: Mar 9 2019, 09:45 AM |

|

|

|

|

|

tadashi987

|

Mar 9 2019, 12:06 PM Mar 9 2019, 12:06 PM

|

|

QUOTE(alexkos @ Mar 9 2019, 11:35 AM) Hehe.. Alex hoot Xetra Germany exchange... So bypass London... No stamp tax That's why SXR8 wins I came across a brokerage call FirstTrader which offer zero commission trade, but sadly they dont accept Malaysian  |

|

|

|

|

|

tadashi987

|

Mar 9 2019, 03:08 PM Mar 9 2019, 03:08 PM

|

|

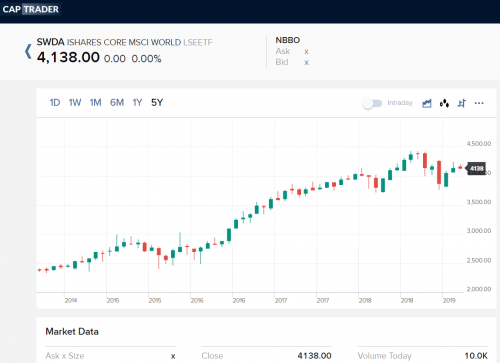

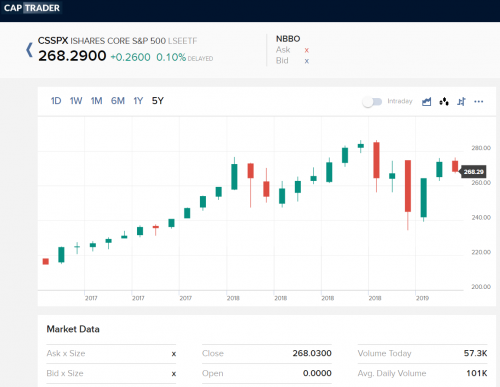

QUOTE(alexkos @ Mar 7 2019, 09:05 PM) hmm, if play absolute figure....later i generate it.... we talk relative figure first, i.e., % correct me if I'm wrong. Actually SA can be used to hoot SXR8 (ireland domiciled SP500). If yes, then you get the withholding tax 15% only, same as DIY method. So this will be a non-issue. The only advantage for DIY is no platform fee every year. If SA, every year 0.8% donation to platform. Alex fast ask google: https://lazybutintelligentinvesting.wordpre...from-singapore/FTSE All-World UCITS ETF (VWRD) <---ireland domiciled VWRD fact check https://americas.vanguard.com/institutional...ssetCode=EQUITYcost: 0.25% annual fee CapTrader has access to VWRD no problem. Actually any international broker can do that also. Just CapTrader alex find cheapest (for initial minimum deposit) is SWDA , CSPX tradeable on CapTrader, any place for me to check what ETF can be purchased on CapTrader? i tried their demo account cannot login at all  This post has been edited by tadashi987: Mar 9 2019, 03:15 PM This post has been edited by tadashi987: Mar 9 2019, 03:15 PM |

|

|

|

|

|

tadashi987

|

Mar 9 2019, 04:41 PM Mar 9 2019, 04:41 PM

|

|

QUOTE(alexkos @ Mar 9 2019, 04:35 PM) QUOTE(alexkos @ Mar 9 2019, 04:36 PM)   thx dude |

|

|

|

|

|

tadashi987

|

Mar 9 2019, 11:26 PM Mar 9 2019, 11:26 PM

|

|

QUOTE(alexkos @ Mar 9 2019, 06:16 PM) U r welcome... If u see lseetf... It means London.... So will kena stamp tax oh... Careful ya was concerned because check on justetf website and saw that it is listed on XETRA as well, so wonder if it possible to find the XETRA listed SWDA  maybe i should just open a captrader account and give it a shot, ok if i fund the account? This post has been edited by tadashi987: Mar 9 2019, 11:27 PM |

|

|

|

|

|

tadashi987

|

Apr 17 2019, 11:46 PM Apr 17 2019, 11:46 PM

|

|

QUOTE(alexkos @ Apr 17 2019, 09:37 PM) Added 'passive investing' bideo inb4 ringgit sadding sarahan siapa Sifuuu i am waiting you to share the instarem -> captrader method  |

|

|

|

|

|

tadashi987

|

Apr 18 2019, 10:06 AM Apr 18 2019, 10:06 AM

|

|

QUOTE(alexkos @ Apr 18 2019, 09:57 AM) havent, my SA havent accumulate to 18k yet  |

|

|

|

|

|

tadashi987

|

May 14 2019, 03:32 PM May 14 2019, 03:32 PM

|

|

what is FI? lol, Fund index?

|

|

|

|

|

|

tadashi987

|

May 14 2019, 04:13 PM May 14 2019, 04:13 PM

|

|

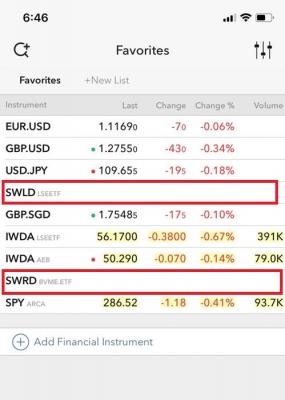

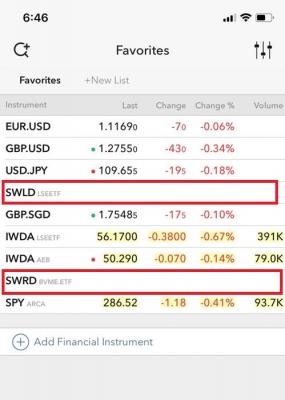

QUOTE(roarus @ May 13 2019, 09:05 PM) Great - SPDR's SWRD 0.12% Total Expense Ratio vs iShares' IWDA 0.2%. Once the volume and AUM grows (which shouldn't be too long), I'll start collecting unless iShares drop their TER to compete. why not collecting now? |

|

|

|

|

|

tadashi987

|

May 14 2019, 04:15 PM May 14 2019, 04:15 PM

|

|

QUOTE(ViktorJ @ May 14 2019, 04:12 PM) Financial Independence in this context. But a more commonly used one is Foreign Investment. Ah so SA investors are all FI investor as well  |

|

|

|

|

|

tadashi987

|

May 15 2019, 12:05 AM May 15 2019, 12:05 AM

|

|

QUOTE(BetfairTrader @ May 14 2019, 11:32 PM) are there no malaysian broker that offers S&P500? dont think so, even it does, the broker fee gonna be a big pain |

|

|

|

|

|

tadashi987

|

May 17 2019, 08:05 PM May 17 2019, 08:05 PM

|

|

QUOTE(roarus @ May 13 2019, 09:05 PM) Great - SPDR's SWRD 0.12% Total Expense Ratio vs iShares' IWDA 0.2%. Once the volume and AUM grows (which shouldn't be too long), I'll start collecting unless iShares drop their TER to compete. Hi roarus, the SWRD / SWLD seem has no changes or changes % at all on IB/TradeStation, why is that so? I checked on on the opening price for today is 0.00 as well is that because no trading at all?

|

|

|

|

|

|

tadashi987

|

May 17 2019, 08:56 PM May 17 2019, 08:56 PM

|

|

QUOTE(roarus @ May 17 2019, 08:49 PM) Yup, simply there's no trade on those 2 counters - it's not UK holiday today, the other 2 world indexes IWDA and VWRD are kicking and exchanging hands   hope the volume grow soon haha, since the TER is much better than IWDA |

|

|

|

|

|

tadashi987

|

May 17 2019, 09:11 PM May 17 2019, 09:11 PM

|

|

QUOTE(honsiong @ May 17 2019, 09:00 PM) SGX has a SPDR S&P500 fund. No need to go thru that many trouble, but dunno dividends got taxed or not. What is the ticker? but i think IWDA/SWRD track different things as SPY. QUOTE SPY

The S&P 500® (total return) index tracks 500 large cap US stocks.

IWDA/SWRD

The MSCI World index tracks stocks from 23 developed countries world wide. As of January 2019 the index consisted of 1.632 constituents. SPY more on US but IWDA/SWRd more on whole world |

|

|

|

|

|

tadashi987

|

Jun 24 2019, 11:38 AM Jun 24 2019, 11:38 AM

|

|

QUOTE(roarus @ May 13 2019, 09:05 PM) Great - SPDR's SWRD 0.12% Total Expense Ratio vs iShares' IWDA 0.2%. Once the volume and AUM grows (which shouldn't be too long), I'll start collecting unless iShares drop their TER to compete. did you eye on LCWD as well? i think should be tracking same index, TER 0.12% as well, but the volume and AUM already grow compared to SWRD. but the differences: 1) it is by Lyxor 2) it is domiciled in Luxembourg, which I'm not sure if the witholding tax with US = 15%, as well any exit tax/ capital tax applied in Luxembourg domiciled ETF do you have any info for these? This post has been edited by tadashi987: Jun 24 2019, 11:38 AM |

|

|

|

|

|

tadashi987

|

Jul 9 2019, 06:52 PM Jul 9 2019, 06:52 PM

|

|

QUOTE(Chounz @ Jul 9 2019, 01:56 PM) Guys, i just done funding for trade station international. Would like to know moving forward i just use IB website or apps to trade? Or should use back trade station website?

Replace the currency with your to-buy equities/ETF currency Replace the IWDA with your to-buy equities/ETF ticker You can trade using the IB website, IBKR mobile app, IBKR desktop software the tradestation own app and desktop software are not favorable, not user friendly tbh  This post has been edited by tadashi987: Jul 9 2019, 06:52 PM This post has been edited by tadashi987: Jul 9 2019, 06:52 PM |

|

|

|

|

|

tadashi987

|

Jul 14 2019, 11:16 PM Jul 14 2019, 11:16 PM

|

|

QUOTE(Ramjade @ Jul 14 2019, 08:12 PM) Index investing have it's place but I am more inclined towards dividend growth investing. any dividend growth ETF recommended? |

|

|

|

|

|

tadashi987

|

Jul 14 2019, 11:25 PM Jul 14 2019, 11:25 PM

|

|

QUOTE(chickenessence @ Jul 14 2019, 11:20 PM) Newbie's reply, try this: VHYL:LN Vanguard FTSE All-World High Dividend Yield UCITS ETF  Waiting for answer from sifu here too i wonder if there is any ETF that is high dividend and non-distributing haha  |

|

|

|

|

|

tadashi987

|

Jul 23 2019, 09:42 PM Jul 23 2019, 09:42 PM

|

|

QUOTE(-CoupeFanatic- @ Jul 23 2019, 10:53 AM) waiting to accumulate as much as possible to dump into index funds when there is a discount  accumulate through where? saving account?  |

|

|

|

|

|

tadashi987

|

Aug 9 2019, 02:24 PM Aug 9 2019, 02:24 PM

|

|

QUOTE(Sumofwhich @ Aug 9 2019, 11:31 AM) Thanks. Any tips to open a SG bank accoount if not working in SG? I recently opened a USBank account and just found out the ThinkOrSwim broker charges USD25 for withdrawal. 1) Open a CIMB MY account (skip if u already have) 2) Open a SG FastSaver account 3) Transfer SG1,000 from ur another bank acc in SG (must be own account) or CIMB Click MY (TT)  |

|

|

|

|

Mar 9 2019, 09:40 AM

Mar 9 2019, 09:40 AM

Quote

Quote

0.0562sec

0.0562sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled