QUOTE(alexkos @ May 11 2019, 07:44 PM)

Should thank Trump, I get to buy cheaper next round[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

|

|

May 12 2019, 10:49 PM May 12 2019, 10:49 PM

Return to original view | Post

#1

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

|

|

|

May 13 2019, 09:05 PM May 13 2019, 09:05 PM

Return to original view | Post

#2

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ May 13 2019, 10:09 AM) Hehe... Found another convert. To become a member, you're required to disclose your asset allocation and fund size (joke). Great - SPDR's SWRD 0.12% Total Expense Ratio vs iShares' IWDA 0.2%. Once the volume and AUM grows (which shouldn't be too long), I'll start collecting unless iShares drop their TER to compete.Happy on board. Feel free to contribute. Gula: SPDR new fund on all world index launched Jan 2019. |

|

|

May 13 2019, 09:59 PM May 13 2019, 09:59 PM

Return to original view | Post

#3

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ May 13 2019, 09:16 PM) ya....itu new Spider macam gooding..... now i'm still with SP500, if in out the commission fee quite pain for now.... You have the option to keep it, and add all world index ETF from now on. Lump both as your global portion, and when it's time to rebalance and sell global because it is over weighted in your portfolio - sell SXR8 first. |

|

|

May 14 2019, 04:22 PM May 14 2019, 04:22 PM

Return to original view | Post

#4

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

May 17 2019, 08:49 PM May 17 2019, 08:49 PM

Return to original view | Post

#5

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(tadashi987 @ May 17 2019, 08:05 PM) Hi roarus, the SWRD / SWLD seem has no changes or changes % at all on IB/TradeStation, why is that so? Yup, simply there's no trade on those 2 counters - it's not UK holiday today, the other 2 world indexes IWDA and VWRD are kicking and exchanging handsI checked on on the opening price for today is 0.00 as well is that because no trading at all? [attachmentid=10249032][attachmentid=10249033] |

|

|

May 17 2019, 09:38 PM May 17 2019, 09:38 PM

Return to original view | Post

#6

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

|

|

|

May 18 2019, 01:52 PM May 18 2019, 01:52 PM

Return to original view | Post

#7

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(honsiong @ May 17 2019, 11:42 PM) QUOTE(alexkos @ May 17 2019, 11:53 PM) itu captrader min charge 4 EUR per trade~ so around RM20 also. I'd say once you hit the RM50,000 mark, it's time to wave goodbye to StashAway and wear the big boy's pants with an international broker.U buy one share, SXR8 around 250EUR now..... should be less than RM1,500. Then u can cry to the world, u own the best companies in the world achievement unlocked. annual fee 0.07% only. But if small capital, can do SA first. SA eat 1% rain or shine, so yummy. Alternatively via TradeStation, and USD denominated funds: i. FAST to IB's SG Citibank: free - I believe honsiong has access to SG bank account ii. Convert SGD->USD: USD2 min - convert up to ~USD33,333 before paying more iii. 1 share of whichever rocks your boat IWDA/CSPX/VWRD: USD56.33 / USD283.28 / USD84.34 iv. Commission GBP1.5 equivalent in USD (~USD1.95) min, or 0.12% of trade value - buy up to ~USD1625 in value before paying more The above works well for SGD2000 bi-monthly buy in. Bonus: Step 0. MYR->SGD - we all have a few Malaysian relatives and friends working in Singapore that sends money back every month right? Strike up a win-win rate |

|

|

May 18 2019, 03:27 PM May 18 2019, 03:27 PM

Return to original view | Post

#8

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ May 18 2019, 02:12 PM) You open a SG Maybank/CIMB account which can do FAST Transfer. Interactive Broker’s Citibank SG account is where you’ll transfer to.QUOTE(alexkos @ May 18 2019, 02:18 PM) Can’t find any laws prohibiting that, afterall it’s perfectly legal to exchange money notes with your friends and family. It’s the same mechanism as Instarem/MoneyMatch - the pool of MYR nevers leaves Malaysia and SGD never leaves Singapore |

|

|

May 18 2019, 10:06 PM May 18 2019, 10:06 PM

Return to original view | Post

#9

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ May 18 2019, 06:51 PM) wah, looks like myr-sg-tradestation path really save a lot wei.... USD2 conversion process is done within Interactive Brokers - you convert at spot rate and pay 0.6bps (0.0006) of value traded or min USD2forex also save, trading commission also save why alex so bodo? itu sgd->usd follow investment bank kan? must be very cheap ~ 0.1%? and trading commission around 2 USD per trade, made it substantially lower for subsequent recurring investment. So let's say i aim 2k USD per trade, only incur 2 USD min, and that's around <RM8500 for each investment.... gooding wei! huat liao lo, can hantam CSPX = iShares SP500 alex favorite in GBP. i checked tradestation international website....dia cakap... UK stocks = 1.5GBP per trade ...SUI...WIN LIAO..... my sxr8 RM18k kalah liao.... instarem also 0.45%... sian....money eaten ======= but downside of this move is 1) need parking S$500 in maybank SG can't touch, if not kena penalty $2 per month 2) maybank SG opening fee eat RM25 courier 3) maybank SG annual fee how much? since they provide debit card, i think they sure eat annual fee Is it worth it? S$500 = RM1500 non-investible sum.... Maybank iSavvy i. yes you park $500 ii. I submitted forms to my local Maybank branch - they courier to Singapore for me (via DHL!) iii. debit card is free no charge iv. initial funding $500 can do with Instarem CIMB SG FastSaver is another option: i. no fall below fee, no debit card ii. has FAST transfer which is the thing you need in this case iii. initial funding $1000 - requirement is to do FAST transfer for initial funding $1000, but members have reported success performing CIMB MY -> CIMB SG and via Instarem iv. high-ish interest for a Singapore account, not that you should park money too long - 1% p.a. for first $50,000, 1.5% after up to $75,000 I hold both accounts, pros of having Maybank: i. outside the local big 3 DBS/UOB/OCBC - Maybank is top 7, is a qualified bank by MAS standard and back in Nov 2018 broke off from Maybank Berhad to form Maybank Singapore Limited ii. if you plan to open a CDP account to trade shares with local brokers (whether paranoia of nominee account or want to attend AGM), Maybank supports EPS for shares iii. 'teh tarik' funds every month between 2 accounts to keep from being dormant, I don't want to have to head down to Singapore just to re-activate a bank account This post has been edited by roarus: May 18 2019, 10:08 PM |

|

|

May 18 2019, 10:46 PM May 18 2019, 10:46 PM

Return to original view | Post

#10

|

Senior Member

1,042 posts Joined: Jan 2003 |

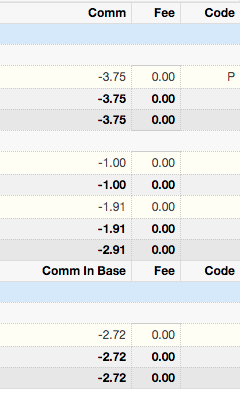

QUOTE(alexkos @ May 18 2019, 10:26 PM) sui ah. additional question 1. No platform or inactivity fee - 0.5% stamp duty is waived for LSEETF1) tradestation annual platform fee got? can't find it 2) I saw tradestation got macam additional charge for LSE platform, and Netherland Amsterdam also....but my Captrader din charge me these *additional fees like clearing etc. 3) your cimb sg fastsaver recommend gooding. Looks like no annual fee this one. and S$10 for one debit card.. hmm..... 4) itu maybank since got debit card, i think sure got annual fee one. Can check? 2. No fees under my Trade Confirmation statement, only commission 3. I didn't even activate my Maybank iSavvy debit card, therefore I did not request for a CIMB SG one 4. Confirm no annual fee for debit card My statement comprising of: 1. SG stock SGX - SGD3.75 commission 2. US stock NYSE ARCA - USD1 commission 3. UK ETF LSEETF - USD1.91 commission (GBP1.5 equivalent) 4. SGD->USD - SGD2.72 commission (USD2 equivalent)  This post has been edited by roarus: May 18 2019, 10:49 PM |

|

|

May 18 2019, 10:59 PM May 18 2019, 10:59 PM

Return to original view | Post

#11

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ May 18 2019, 10:48 PM) alex research house So it seems it boils down to how often you push in EUR4000. If monthly, dude go for the mother Interactive Brokers directly - you'll hit USD100k in no time and enjoy tiered commission pricing. 2,3,4 months once is probably fine - 6 months or more is probably a drag and cost of opportunitytradestation 1) itu exchange fees for Netherland Amsterdam (SXR8) costs additional EUR 0.75 per ETF trade 2) If LSE, cheaper, exchange fee w/ clearing only 16 cent GBP, kasih dia lah. Bonus fact alex punya captrader charges zero exchange and clearing fee when hoot SXR8, and also commission 0.1% trade value (provided that you hoot 4k EUR and above). Even cheaper than tradestation 0.12% hehe |

|

|

May 18 2019, 11:16 PM May 18 2019, 11:16 PM

Return to original view | Post

#12

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ May 18 2019, 10:55 PM) power...this is really cheapest route I struck a deal with my friend at half of Instarem's rate - we pre-agree on the date and session of exchange e.g. date, morning/afternoon/evening. On that day and session I'll capture screens of:MYR -> tumpang kawan -> SG CIMB -> 2 USD IB rate -> GBP -> HOOT CSPX total damage assume kawan eat 0.1% assume 2k USD fund transfer (0.1%) tradestation commission (0.12%) total damage = 0.32% WOW If can psycho SG kawan, total cost become 0.22%..... wah.... my instarem alone eat me 0.45%, Captrader eat 0.1%....total 0.55%.....alex white flag i. Instarem - how much MYR it'll cost me to buy SGD ii. CashChanger.co - how much MYR he'd get for that same amount of SGD (sub this for whatever money changer your friend uses) iii. Shared Google sheet between both of us with formula to calculate based on Instarem's rate and half of the fee rate My friend pretty cincai, as long as he's getting more than CashChanger.co he's happy enough. I offer him bonus service to key in captcha if he wants the money in ASNB too (best effort of course). |

|

|

May 18 2019, 11:20 PM May 18 2019, 11:20 PM

Return to original view | Post

#13

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ May 18 2019, 11:05 PM) Not much difference in this case really, volume for both are high and the price for a slice is about the same. I guess GBP will have the advantage if funding is allowed in GBP via Instarem? |

|

|

|

|

|

May 20 2019, 11:34 AM May 20 2019, 11:34 AM

Return to original view | Post

#14

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(kart @ May 19 2019, 10:02 PM) Old article (RIP John) - but to set expectation to 4% level even though historically it's 9-ish-close-to-10%https://www.cnbc.com/2017/03/22/jack-bogle-...ext-decade.html No one knows if this is the tail of a bull run or we have another extension 2-5 years to go |

|

|

Jun 24 2019, 10:12 PM Jun 24 2019, 10:12 PM

Return to original view | Post

#15

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(tadashi987 @ Jun 24 2019, 11:38 AM) did you eye on LCWD as well? i think should be tracking same index, TER 0.12% as well, but the volume and AUM already grow compared to SWRD. No, it wasn't in my radar.but the differences: 1) it is by Lyxor 2) it is domiciled in Luxembourg, which I'm not sure if the witholding tax with US = 15%, as well any exit tax/ capital tax applied in Luxembourg domiciled ETF do you have any info for these? 1) Shouldn't be an issue, AUM size looks healthy and growing and it's physical replication 2) I believe it's the same treatment as Ireland @ 15%, but do a search to confirm Overall, not bad looking Edit: Should've taken account spread as % LCWD, 2 cents bid/ask spread at last done 10.62 0.02/10.62*100 = 0.1883% TER: 0.12% IWDA, 2 cents bid/ask spread at last done 57.98 0.02/57.98*100 = 0.0345% TER: 0.20% Looks like you're still dodging on TER but taking on spread hit at the moment This post has been edited by roarus: Jun 24 2019, 10:56 PM |

|

|

Jul 2 2019, 12:10 AM Jul 2 2019, 12:10 AM

Return to original view | Post

#16

|

Senior Member

1,042 posts Joined: Jan 2003 |

|

|

|

Jul 4 2019, 12:03 AM Jul 4 2019, 12:03 AM

Return to original view | Post

#17

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(chickenessence @ Jul 3 2019, 11:04 PM) From the online chat support, i was told that there will be inactivity as i mentioned. This is what I got from a rep named Oscari can share the screen shot if u guys like to see. Tradestation and Tradestation Global.. is there any difference? Anyway, the fee thing i am asking.. Don't seem to be able to find any info online? (or i can't find it?) From the fee u mentioned, generally if less capital, TradeStation >> CapTrader lo? thanks to u, i just get to know what is boglehead 3 fund portfolio. Dont worry.. always DYDD right?  TradeStation is US market only (US domicile, with SIPC protection), TradeStation Global covers US and outside (UK domicile, regulated by FCA) Fees, or rather broker commission I'm assuming you were referring to: https://www.tradestation-international.com/...ng-commissions/ QUOTE(alexkos @ Jul 2 2019, 01:45 PM) Say first, pls hoot sp500 only after considering your asset allocation. Er, why 50/50? That's a risk profile for a person in the 50's gliding into retirementEg. 50/50 asset allocation. Means 50% hoot equity, 50% hoot fixed income. Alex duwan see ppl here hoot too much equity. When market downturn, Fuiyo I tell you..... Just see 2008 as lesson. This post has been edited by roarus: Jul 4 2019, 12:05 AM |

|

|

Jul 10 2019, 10:05 PM Jul 10 2019, 10:05 PM

Return to original view | Post

#18

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Chounz @ Jul 10 2019, 09:23 AM) But my understanding is IB need to have at least USD10 commission per month. They might have lowered the commission for US exchange, traded a counter (NYSE ARCA) in small amount back in May to cure an itch and was only charged USD1And trade station min commission for a share is USD 1.5. Can explain further on this? This post has been edited by roarus: Jul 10 2019, 10:06 PM |

|

|

Jul 11 2019, 02:45 PM Jul 11 2019, 02:45 PM

Return to original view | Post

#19

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Chounz @ Jul 11 2019, 12:58 AM) Can check with you. I just use IBKR app under TradeStation account to trade a US stock, but the commission charged is USD 1 instead of USD1.5 (TradeStation minimum fee) got any idea? Thanks for testing out as well, which exact exchange did the trade happen? You can see this via Reports > Statements > Trade ConfirmationPerhaps they indeed did lower the rate, but have not updated the commissions table yet. |

|

|

Jul 11 2019, 10:39 PM Jul 11 2019, 10:39 PM

Return to original view | Post

#20

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ Jul 11 2019, 03:55 PM) kantoi took so long to open tradestation account. I open tradestation global account, want use their UK facility, but with USD instrument. Wait, you're attempting to send GBP to IB's UK Citibank, and then convert to USD? Isn't the fund you want on LSE available in GBP?Money pergi to citibank NA, with funny personal account number attached just behind citibank account number. Itu instarem bosong say can't do that, can only wire to citibank. So now fund stuck, dunno IKBR can detect my fund or not... already 10 days =( inb4 GBP 1.5 per transaction or 0.12% whichever higher trap QUOTE(alexkos @ Jul 11 2019, 06:13 PM) They blocked your application or something? Do talk to TradeStation Global support regarding this fabulous offer you saw on their main page: https://www.tradestation-international.com/global/» Click to show Spoiler - click again to hide... « |

| Change to: |  0.0594sec 0.0594sec

0.52 0.52

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 29th November 2025 - 11:26 AM |