QUOTE(xuzen @ Nov 2 2017, 11:45 AM)

Yah, thereabout.... slightly bigger, 2.5 Yr.

The other significant asset is my KWSP port which is double than this cash port.

I don't have properties, I don't flip prop. My wealth comes purely from salary in which I spend less than I earn, then invest the rest.

I save, then invest using DCA, i.e., the regular Joe method. I still have 20 more years thereabout till retirement.

If I have started much younger, in my twenties, I would be in a much better position now. I only started to be financially savvy in my mid 30's. I wasted ten years of time in my twenties. Having said this, I do notice some of these people who join the forum are much younger. Kudos to them to be financially savvy at such a young age. Let me tell you young people, it is worth it.... Delayed gratification is worth it! Watch your risk, let the return take care of itself....

Xuzen

Thanks senpai for sharing The other significant asset is my KWSP port which is double than this cash port.

I don't have properties, I don't flip prop. My wealth comes purely from salary in which I spend less than I earn, then invest the rest.

I save, then invest using DCA, i.e., the regular Joe method. I still have 20 more years thereabout till retirement.

If I have started much younger, in my twenties, I would be in a much better position now. I only started to be financially savvy in my mid 30's. I wasted ten years of time in my twenties. Having said this, I do notice some of these people who join the forum are much younger. Kudos to them to be financially savvy at such a young age. Let me tell you young people, it is worth it.... Delayed gratification is worth it! Watch your risk, let the return take care of itself....

Xuzen

I myself nearing 30 y.o., have been "observing" for investment instrument for too many years before actually dipping into it.

Btw, I would like to kindly ask for help on building "DIY" port, my current purchased UTs:

- Kenanga Growth - 2 unit

- MANU Reit - 2 unit

- TA Global Tech - 2 unit

- CIMB Greater China - 1 unit

*unit = x amount of money

Above are DIY that I put about 1/3 of UT investment while the rest of 2/3 goes to balanced managed portfolio. In near future I'd have even less time to monitor it, so my future strategy is to look at my base UT and top up on those I'd like to. I'm looking for more "base" UT to compliment above.

Candidates:

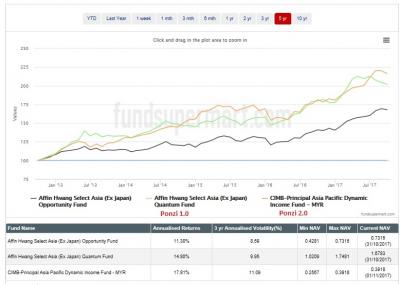

- CIMB Global Titan

- Affin Hwang Select Asia ( Ex Japan ) Opportunity

- Eastspring Global Emerging Market ( new candidate, hehe )

Likely going to be ex-candidate:

- CIMB Chi Indi Indo

- Interpac Dana Safi

A lot of lucrative UT are heavily Asia based, trying to diversify here. Any input please? Of course I'm open to more UT not mentioned above that are reliable in long term, Thanks in advance.

This post has been edited by Vk21: Nov 2 2017, 03:38 PM

Nov 2 2017, 03:37 PM

Nov 2 2017, 03:37 PM

Quote

Quote

0.0207sec

0.0207sec

0.46

0.46

6 queries

6 queries

GZIP Disabled

GZIP Disabled