Another month passes....

Oct 2017 is a happy - happy month right? All your ports went up-up-up. Syiok boh?

Time for another tok-kok-sing-song-blow-water post. "My daddy is bigger than your daddy" type post.

Port did a 2% M-o-M gain. That translates to one of my best M-o-M ROI for the past 12-mths rolling tracking. To give an idea, a 2% monthly gain is like 50% of my gross salary.

In the precceding 12 months rolling, only one month gave a negative return. The other eleven months are green.

Overall port ROI is 8% p.a. Risk to reward ratio is 1.17, Distribution of ROI is positively skewed with negative kurtosis. This means that my expected value have more tendency to cluster around the mean value. In this sense, it means it is more predictable than positive kurtosis value. Large positive value kurtosis means that extreme outlier outcomes are more prevalent.

Forecasted future ROI is exponential with respect to time.

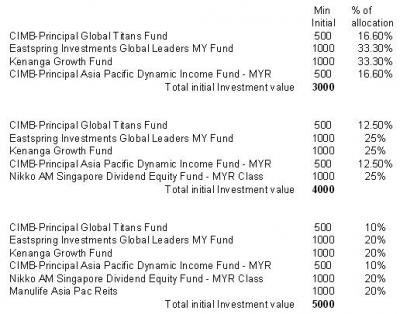

The port's alpha is generated by TA Tech and China fund. Manureits and Esther bond meanwhile made my beta small which meant that the overall port does not swing up and down too much (maintain low volatility). RHB EMB & IDS meanwhile are there as wildcard (pure diversification) as sometimes they do provide pleasant surprises. My IDS exposure is mainly because of the PRU - 14 narrative.

Xuzen

This post has been edited by xuzen: Nov 1 2017, 09:27 PM

Nov 1 2017, 03:47 PM

Nov 1 2017, 03:47 PM

Quote

Quote

0.0230sec

0.0230sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled