3y years chart n below all show crossover to downtrend.

This post has been edited by WhitE LighteR: Mar 8 2018, 07:12 PM

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 8 2018, 07:10 PM Mar 8 2018, 07:10 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 8 2018, 07:37 PM Mar 8 2018, 07:37 PM

Show posts by this member only | IPv6 | Post

#12342

|

Senior Member

1,802 posts Joined: Oct 2015 |

My whole portfolio bleeding like mad. Especially my India manulife fund at negative 10% .

|

|

|

Mar 8 2018, 08:27 PM Mar 8 2018, 08:27 PM

|

Senior Member

2,649 posts Joined: Nov 2010 |

not surprising.. giving so much market volatility

imo, still more to come.. brave urself for the ride yo DIY -2.40 MP -1.85 |

|

|

Mar 8 2018, 09:40 PM Mar 8 2018, 09:40 PM

Show posts by this member only | IPv6 | Post

#12344

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(WhitE LighteR @ Mar 8 2018, 07:10 PM) Another disappointing fund recently is Manulife REIT. Interest rate is increasing what. All reits on SGX experienced a sell down but not to low level as last Nov. 3y years chart n below all show crossover to downtrend.

QUOTE(BacktoBasics @ Mar 8 2018, 07:37 PM) Never concentrate too much money in one fund. My India still 2%+. Only down about 3%. QUOTE(xcxa23 @ Mar 8 2018, 08:27 PM) not surprising.. giving so much market volatility Mari. Mari. imo, still more to come.. brave urself for the ride yo DIY -2.40 MP -1.85 |

|

|

Mar 8 2018, 09:56 PM Mar 8 2018, 09:56 PM

|

Junior Member

225 posts Joined: Jul 2017 |

QUOTE(xcxa23 @ Mar 8 2018, 08:27 PM) not surprising.. giving so much market volatility Buy-the-dip-believers-rejoice-as-white-house-eases-trade-tensionimo, still more to come.. brave urself for the ride yo DIY -2.40 MP -1.85 QUOTE(WhitE LighteR @ Mar 8 2018, 07:10 PM) Another disappointing fund recently is Manulife REIT. As expected. 3y years chart n below all show crossover to downtrend.

Interest rate hike is not good for REIT. I removed REIT fund from my portfolio since second half of 2016. This post has been edited by i1899: Mar 8 2018, 10:03 PM |

|

|

Mar 8 2018, 10:13 PM Mar 8 2018, 10:13 PM

|

Senior Member

5,648 posts Joined: Mar 2011 From: Jalan Tijani |

QUOTE(i1899 @ Mar 8 2018, 04:44 PM) Don't use "emergency fund" for risk investment like UT. Curious why 10 years = 1 full cycle? "Emergency fund" is expenses reserved for next 6 months, includes education fee, normal living expenses, renovation of house etc etc, in upcoming months . Invest in stock/UT using money that u won't need for at least 2-3 years. If that money can stay inside market for at least 1 full cycle (10 years) is the best lah. Good luck and happy investing. |

|

|

|

|

|

Mar 8 2018, 10:48 PM Mar 8 2018, 10:48 PM

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Mar 8 2018, 11:42 PM Mar 8 2018, 11:42 PM

Show posts by this member only | IPv6 | Post

#12348

|

Junior Member

51 posts Joined: Oct 2011 |

|

|

|

Mar 9 2018, 08:12 AM Mar 9 2018, 08:12 AM

Show posts by this member only | IPv6 | Post

#12349

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(ssl_lim @ Mar 8 2018, 11:42 PM) Bull run already entering year 8 (since 2009) cause US govt pump money into the system. Only a matter of time before artificial Pumping of money will show it's true effects. The heat is showing with interest rates rising. Many who took on debts during cheap money when interest rates keep increasing. |

|

|

Mar 9 2018, 09:13 AM Mar 9 2018, 09:13 AM

|

Senior Member

1,177 posts Joined: Nov 2007 |

Decided to sell down some of my equity funds. Even though markets are green today, I'm really nervous about the prospect of a trade war. Too much volatility at the moment.

|

|

|

Mar 9 2018, 09:23 AM Mar 9 2018, 09:23 AM

|

Senior Member

696 posts Joined: Feb 2008 |

QUOTE(wankongyew @ Mar 9 2018, 09:13 AM) Decided to sell down some of my equity funds. Even though markets are green today, I'm really nervous about the prospect of a trade war. Too much volatility at the moment. I will wait for the 2nd half of the day (2pm is the best time) to decide whether to dump or not.... Who knows the tide might turns... |

|

|

Mar 9 2018, 09:32 AM Mar 9 2018, 09:32 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Ramjade @ Mar 8 2018, 10:48 PM) for sure economy will crash/reset ngam ngam every 10 years?not 12 years? not 6 years? not 15 years? if yes, i gotta get me that crystal ball of yours else maybe it's NOT a sure thing and especially NOT ngam ngam every 10 years just clarifying for the sake of those who bulat bulat telan This post has been edited by wongmunkeong: Mar 9 2018, 09:38 AM |

|

|

Mar 9 2018, 09:36 AM Mar 9 2018, 09:36 AM

|

Junior Member

629 posts Joined: Nov 2011 |

JPMorgan Co-President Sees Possible 40% Correction in Equity Markets

http://www.theedgemarkets.com/article/jpmo...-equity-markets Need fast fast dump before too late.. |

|

|

|

|

|

Mar 9 2018, 09:41 AM Mar 9 2018, 09:41 AM

|

Senior Member

696 posts Joined: Feb 2008 |

QUOTE(akping_1 @ Mar 9 2018, 09:36 AM) JPMorgan Co-President Sees Possible 40% Correction in Equity Markets Your kind of mindset is what causes the correction to happen...http://www.theedgemarkets.com/article/jpmo...-equity-markets Need fast fast dump before too late.. Why market will dip? Because of many investors dump. Why many investors dump? Because fear of market dip. |

|

|

Mar 9 2018, 09:52 AM Mar 9 2018, 09:52 AM

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(akping_1 @ Mar 9 2018, 09:36 AM) JPMorgan Co-President Sees Possible 40% Correction in Equity Markets Always take any news with a grain of salt imohttp://www.theedgemarkets.com/article/jpmo...-equity-markets Need fast fast dump before too late.. And if there's ppl dumping, who's buying? Instil fear in the market, big player silently buying back at much lower price Tats how rich get richer.. Tats jz my opinion.. Do as u wish as that's ur money 😁 This post has been edited by xcxa23: Mar 9 2018, 09:52 AM |

|

|

Mar 9 2018, 10:09 AM Mar 9 2018, 10:09 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

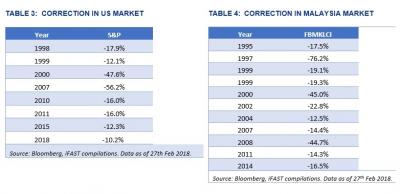

looks like not every 10 years there is a correction...but very possibility every 3 years on average....

https://www.fundsupermart.com.my/main/resea...ncertainty-9473 but in the longer term charts....just see how All Ords price index goes after every crisis... https://www.fundsupermart.com.my/main/resea...ned-9-Feb--9391 just hope this time is not that "BIG" crash KIM and trump had been behaving lately..... will China send in KIM to settle with Trump on this time too? Attached thumbnail(s)

|

|

|

Mar 9 2018, 10:27 AM Mar 9 2018, 10:27 AM

|

Junior Member

206 posts Joined: Nov 2009 |

I think i will say this to the mirror every morning.

Key things for investors to bear in mind are that: corrections in the order of 5-15% are normal; in the absence of recession, a deep bear market is unlikely; selling shares after a fall just locks in a loss; share pullbacks provide opportunities for investors to pick them up more cheaply; while shares may have fallen, dividends haven’t; and finally, to avoid getting thrown of a long-term investment strategy it’s best to turn down the noise during times like the present. From Oliver's Insight |

|

|

Mar 9 2018, 11:03 AM Mar 9 2018, 11:03 AM

|

Junior Member

338 posts Joined: Nov 2014 |

Sold a little bit too early. Should have waited for a few more days .....

This post has been edited by jfleong: Mar 9 2018, 11:03 AM |

|

|

Mar 9 2018, 11:05 AM Mar 9 2018, 11:05 AM

|

All Stars

14,863 posts Joined: Mar 2015 |

|

|

|

Mar 9 2018, 11:23 AM Mar 9 2018, 11:23 AM

|

All Stars

14,863 posts Joined: Mar 2015 |

lets the trills ride begins.....

U.S. President Donald Trump pressed ahead on Thursday with import tariffs of 25 percent on steel and 10 percent for aluminium but exempted Canada and Mexico ... "If you don't want to pay tax, bring your plant to the USA," added Trump, flanked by steel and aluminium workers. Plans for the tariffs, set to start in 15 days, https://sg.finance.yahoo.com/news/trump-set...--business.html |

| Change to: |  0.0213sec 0.0213sec

0.33 0.33

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 01:25 AM |