Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

akping_1

|

May 24 2017, 07:42 AM May 24 2017, 07:42 AM

|

|

Hi all, i'm new to FSM and just place order for the following 2 fund.

Affin Hwang Select Bond Fund - MYR RM1300

CIMB-Principal Global Titans Fund RM1300

and looking to add another risk level 8-9 which give better return into the fund , which 1 is better selection?

CIMB-Principal Small Cap Fund

Kenanga Asia Pacific Total Return Fund

Eastspring Investments Global Emerging Markets Fund

AFFIN HWANG SELECT DIVIDEND FUND

Planned to add RM2000 on it

Thanks all..

This post has been edited by akping_1: May 24 2017, 07:44 AM

|

|

|

|

|

|

akping_1

|

May 24 2017, 07:58 AM May 24 2017, 07:58 AM

|

|

QUOTE(T231H @ May 24 2017, 07:52 AM)  with just "these" criteria.... goto FSM website, click FUNDS INFO, FUND SELECTOR, then under "Main Categories" select "Equity" click generate table. then select your named funds.... click "Display shortlisted" your funds performance and risk rating can be seen there...... btw,....I would go for CIMB.....free switching with your existing GTF.... and also btw,...your CIMB GTF at 50% allocation what is your "expected ROI" for this year? Hi, i has update my post Affin Hwang Select Bond Fund - MYR RM1300 CIMB-Principal Global Titans Fund RM1300 my expected return is abt 8% per year, sure higher better |

|

|

|

|

|

akping_1

|

May 24 2017, 10:23 AM May 24 2017, 10:23 AM

|

|

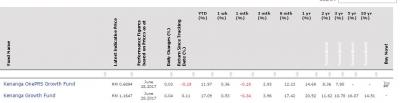

QUOTE(Ramjade @ May 24 2017, 10:11 AM) plumberlyCIMB-Principal Small Cap Fund -> Kenanga Growth FUnd Kenanga Asia Pacific Total Return Fund -> Cimb asia pacific/Rhb Asia Income Eastspring Investments Global Emerging Markets Fund -> Up to you AFFIN HWANG SELECT DIVIDEND FUND -> I think you can drop this We are still not there yet. When Public Mutual start feeling the heat, we know we have made a dent. Thanks for replied, so mean your advices are buy the 1 bold? CIMB-Principal Small Cap Fund -> Kenanga Growth FUnd Kenanga Asia Pacific Total Return Fund -> Cimb asia pacific/Rhb Asia Income Eastspring Investments Global Emerging Markets Fund -> Up to you AFFIN HWANG SELECT DIVIDEND FUND -> I think you can drop this |

|

|

|

|

|

akping_1

|

May 24 2017, 10:30 AM May 24 2017, 10:30 AM

|

|

QUOTE(Ramjade @ May 24 2017, 10:27 AM) No. Buy the one after the arrow. noted and thanks sifu for the advice, will consider for it... |

|

|

|

|

|

akping_1

|

Jun 1 2017, 11:57 AM Jun 1 2017, 11:57 AM

|

|

Weird, i still unable to generate the Portfolio X-ray in MYR at Morningstar Malaysia it show me this

|

|

|

|

|

|

akping_1

|

Jun 20 2017, 02:48 PM Jun 20 2017, 02:48 PM

|

|

May i know if i got CMF, wan to use it to buy other fund, the best way is using UT inter/intra switching? will it faster to complete the purchase compare to transfer money from acc?

|

|

|

|

|

|

akping_1

|

Jul 5 2017, 08:53 PM Jul 5 2017, 08:53 PM

|

|

QUOTE(Ancient-XinG- @ Jul 5 2017, 08:46 PM) now got 2 type of UHNW people in forum 1 which humble like so many oldies here. 1 which boost. UHNW with lot high amount of monthly loan installment? |

|

|

|

|

|

akping_1

|

Jul 6 2017, 01:15 PM Jul 6 2017, 01:15 PM

|

|

QUOTE(fun_feng @ Jul 6 2017, 01:13 PM) Thanks for informing that FSM SG have 2 step verification. SO i wonder why FSM MY do not want to do the same? maybe we are not worth the cost to do it.  I think the redemption to own account was only introduced sometimes last year... AFTER a ruling by gov. It seems FSM have no initiative to beef up its security... anyway, with a password they could still sell all your fund and buy some "gold fund"...  This make me think of u r get the Idea from Johson Lee JJPTR hacker trick |

|

|

|

|

|

akping_1

|

Jul 6 2017, 02:49 PM Jul 6 2017, 02:49 PM

|

|

QUOTE(fun_feng @ Jul 6 2017, 02:26 PM)  JJPTR hacking incident is a pathetic excuse to abscond with the money Hacking in the other hand, is a world wide multi billion industry involving experts from russia, china, NK... The threats are very real.. You mention about some1 know your password n sabotage your account, it more like the same as hack to your account d. |

|

|

|

|

|

akping_1

|

Jul 9 2017, 01:21 PM Jul 9 2017, 01:21 PM

|

|

I'm from group B, just start to invest in FSM since 1 months plus ago...

previously put most of spare money into e-GIA until recently the burst then start to looking for alternative for it n start FSM

|

|

|

|

|

|

akping_1

|

Jul 17 2017, 07:49 PM Jul 17 2017, 07:49 PM

|

|

QUOTE(Avangelice @ Jul 17 2017, 07:24 PM) or you get burned in the process, make the wrong calls and lose the money you invested, you owe the bank a substantial amount of money and forced to sell your assets to cover the lost. I do not have any beef with you but I need to remind those who follow your way of investing be aware of what is at stake. From the ROI look nice up to 9%, but we all dunno what is the interest rate he get from bank, if 6% then the actual return is 3% for the cat... |

|

|

|

|

|

akping_1

|

Jan 27 2018, 07:45 PM Jan 27 2018, 07:45 PM

|

|

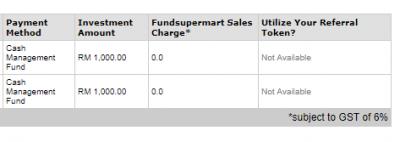

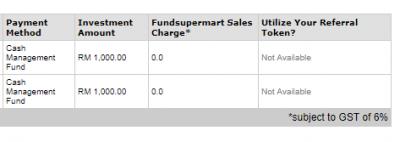

QUOTE(Amanda85 @ Jan 27 2018, 03:39 PM) Lol. I purposely got to get the voucher. should have just stay home. by the way, the voucher stated that is for 'new investments only', not top up. and only can use for 1 new fund. i was assuming 0% for every top up. Nope, just now i ask the lady, she mention is for 1 order, mean u can add few fund together, even the 1 u r holding, then keyin the same promo code Attached thumbnail(s)

|

|

|

|

|

|

akping_1

|

Mar 9 2018, 09:36 AM Mar 9 2018, 09:36 AM

|

|

JPMorgan Co-President Sees Possible 40% Correction in Equity Markets http://www.theedgemarkets.com/article/jpmo...-equity-marketsNeed fast fast dump before too late.. |

|

|

|

|

|

akping_1

|

Jan 21 2020, 02:21 PM Jan 21 2020, 02:21 PM

|

|

Any1 here received the touch n go soft reload pin for the Dec 2019 PRS promo ?

|

|

|

|

|

|

akping_1

|

Oct 21 2020, 10:31 AM Oct 21 2020, 10:31 AM

|

|

Which REIT funds that are highly recommend?

|

|

|

|

|

May 24 2017, 07:42 AM

May 24 2017, 07:42 AM

Quote

Quote

0.5850sec

0.5850sec

0.64

0.64

7 queries

7 queries

GZIP Disabled

GZIP Disabled