QUOTE(xuzen @ Mar 7 2018, 06:35 PM)

Of all the possible answers that we can come up with, " I need money now " is the best answer when asked, when do I sell my UTF...

No, I am not trolling, I am serious.

At other times, just put your money to work for you.

Xuzen

QUOTE(xcxa23 @ Mar 7 2018, 08:36 PM)

most important answer imo,

may i ask if its suddenly/emergency case?

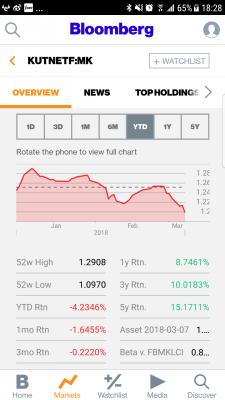

lock profit (miss many times to lock already) i know the feeling.. was seeing

4 digit earning last few month and puff now 4 digit in red

The money is working good for me for the past years. Is just that timing at the wrong side...

QUOTE(i1899 @ Mar 7 2018, 10:19 PM)

Personally, i think below reason is very weird reason for selling UT.

"I need money now"

- if u need BIG money NOW, u should know earlier, right? A better way is sell gradually since at least 6 months ago.

- And, don't use emergency fund/ saving for wedding/ house down-payment for investment, so that u not need to sell with loss when u need them.

- if u r a retiree, u just need to sell "a bit" every month for ur expenses, not ALL...

So, i need money now, then i sell ALL now, sounds no sense.

Its for my education. I planned all already to gain as much as possible. Suddenly my uni close down the 6 month grace period for paying. Or else I will only pay last minute and the money in FSM can gain some petrol for me. Too bad, the uni so cruel... Pay them earlier they gain a lot and I gain nothing....

Managed port I wont touch. It hold 60% of the FSM port. My DIY port is small enough.

Mar 7 2018, 10:44 PM

Mar 7 2018, 10:44 PM

Quote

Quote

0.0249sec

0.0249sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled