Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

Ramjade

|

Jan 7 2018, 09:27 PM Jan 7 2018, 09:27 PM

|

|

QUOTE(ruffell @ Jan 7 2018, 09:19 PM) I am still new in this so pls bear with me. Everybody is talking about US peaking and will start to drop soon. One thing I don't understand is what impact it has to other countries if US drop. Should I be worried when US drop when I'm holding China, Asia Pacific and India funds for example? Thank you Masters. Of course. When US and China sneeze, the world catches a cold. |

|

|

|

|

|

xuzen

|

Jan 7 2018, 09:27 PM Jan 7 2018, 09:27 PM

|

|

UTF investing is not skim cepat kaya, she needs to utilise the magic of compounding to work her magic.

A very conservative compounding of 6% [ which is very easily achievable with UTF investing ] can very much beat the current inflation. If you are abit gung ho, you may engineer your portfolio to go for 9% or 12% if you are a young person with very long investing horizon. UTF works well around this ROI range given time.

What UTF investing is not is when participant treat it as a trading platform to go in and out like stock market. This, UTF investing is a very poor choice for such a purpose.

Xuzen

|

|

|

|

|

|

SUSyklooi

|

Jan 7 2018, 10:16 PM Jan 7 2018, 10:16 PM

|

|

QUOTE(ruffell @ Jan 7 2018, 09:19 PM) I am still new in this so pls bear with me. Everybody is talking about US peaking and will start to drop soon. One thing I don't understand is what impact it has to other countries if US drop. Should I be worried when US drop when I'm holding China, Asia Pacific and India funds for example? Thank you Masters. while waiting for responses, can try read post 11078 and 11090...I think it has some similarity to what you asked.... yes, when US mkts drops....so will China nd the rest of the global mkts.... when CHina drops,...so will US and the rest of the global mkts..... it is how severe will each of them be impacted and for how long each of them be impacted. thus...it is always recommended to set your FI:EQ allocation properly and invest with the money that you would not want to touch for a few years.... This post has been edited by yklooi: Jan 7 2018, 10:25 PM |

|

|

|

|

|

ruffell

|

Jan 7 2018, 11:55 PM Jan 7 2018, 11:55 PM

|

New Member

|

QUOTE(yklooi @ Jan 7 2018, 10:16 PM) while waiting for responses, can try read post 11078 and 11090...I think it has some similarity to what you asked.... yes, when US mkts drops....so will China nd the rest of the global mkts.... when CHina drops,...so will US and the rest of the global mkts..... it is how severe will each of them be impacted and for how long each of them be impacted. thus...it is always recommended to set your FI:EQ allocation properly and invest with the money that you would not want to touch for a few years.... Thanks for the advice  I'm relatively newbie in investing unit trust. Currently my allocation is 50% bank savings, 50% unit trusts. Of the 50% UT, I think around 80% is equity and 20% fixed income. 2016 made 5% profit. 2017 lost 4%. Still lots to learn from all the Masters  |

|

|

|

|

|

SUSyklooi

|

Jan 8 2018, 12:09 AM Jan 8 2018, 12:09 AM

|

|

QUOTE(ruffell @ Jan 7 2018, 11:55 PM) Thanks for the advice  I'm relatively newbie in investing unit trust. Currently my allocation is 50% bank savings, 50% unit trusts. Of the 50% UT, I think around 80% is equity and 20% fixed income. 2016 made 5% profit. 2017 lost 4%. Still lots to learn from all the Masters  2017 was a good year for EQ and yet you lost 4% with your 20%FI:80%EQ? mind telling what did your portfolio consisted of and how many % each? I guess you gung ho into gold and mineral  |

|

|

|

|

|

lee82gx

|

Jan 8 2018, 10:37 AM Jan 8 2018, 10:37 AM

|

|

QUOTE(yklooi @ Jan 8 2018, 12:09 AM) 2017 was a good year for EQ and yet you lost 4% with your 20%FI:80%EQ? mind telling what did your portfolio consisted of and how many % each? I guess you gung ho into gold and mineral  Not one to speculate but maybe through Public Mutual? |

|

|

|

|

|

SUSyklooi

|

Jan 8 2018, 10:59 AM Jan 8 2018, 10:59 AM

|

|

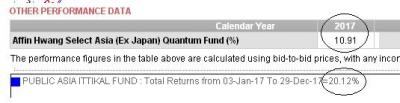

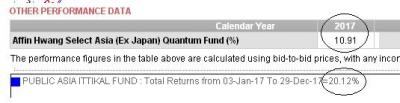

QUOTE(lee82gx @ Jan 8 2018, 10:37 AM) Not one to speculate but maybe through Public Mutual? yeah,..maybe that is right...the SC already are a killer of ROI.... btw,...my Public mutual Asia Ittikal fund did much better than my Ponzi 1.0 for 2017...yes better but only for 2017  This post has been edited by yklooi: Jan 8 2018, 11:04 AM Attached thumbnail(s) This post has been edited by yklooi: Jan 8 2018, 11:04 AM Attached thumbnail(s)

|

|

|

|

|

|

ben3003

|

Jan 8 2018, 11:02 AM Jan 8 2018, 11:02 AM

|

|

im planning to top up, but seems like all are getting quite high except for interpac dana safi which i no plan to topup, my kenanga oledi flying but IDS is like shit.. dunno what to topup, do DCA?

|

|

|

|

|

|

WhitE LighteR

|

Jan 8 2018, 11:04 AM Jan 8 2018, 11:04 AM

|

|

QUOTE(ben3003 @ Jan 8 2018, 11:02 AM) im planning to top up, but seems like all are getting quite high except for interpac dana safi which i no plan to topup, my kenanga oledi flying but IDS is like shit.. dunno what to topup, do DCA? No rush. If u feel the entry point not ngam, u just keep in warchest until time is right |

|

|

|

|

|

SUSyklooi

|

Jan 8 2018, 11:07 AM Jan 8 2018, 11:07 AM

|

|

QUOTE(ben3003 @ Jan 8 2018, 11:02 AM) im planning to top up, but seems like all are getting quite high except for interpac dana safi which i no plan to topup, my kenanga oledi flying but IDS is like shit.. dunno what to topup, do DCA? try not look at the fund prices but the number of stars the countries/regions the given by FSM and correspond it to the fund that you had.......(well, if you trust FSM) QUOTE(WhitE LighteR @ Jan 8 2018, 11:04 AM) No rush. If u feel the entry point not ngam, u just keep in warchest until time is right  ultimately it boils down to one happiness.... |

|

|

|

|

|

puchongite

|

Jan 8 2018, 11:21 AM Jan 8 2018, 11:21 AM

|

|

QUOTE(ben3003 @ Jan 8 2018, 11:02 AM) im planning to top up, but seems like all are getting quite high except for interpac dana safi which i no plan to topup, my kenanga oledi flying but IDS is like shit.. dunno what to topup, do DCA? We all will be forever in this mode. Because the fund drops, so we will think it has no more potential. And if the fund has gained, we think it has already reaching it's max.  |

|

|

|

|

|

ben3003

|

Jan 8 2018, 11:24 AM Jan 8 2018, 11:24 AM

|

|

QUOTE(WhitE LighteR @ Jan 8 2018, 11:04 AM) No rush. If u feel the entry point not ngam, u just keep in warchest until time is right i takut i terpakai the money  i see the market reports still positive and msia market will up at least until after election, so still got abit potential. Most likely gonna topup Ponzi 2.0, KGF and EI GL. |

|

|

|

|

|

WhitE LighteR

|

Jan 8 2018, 11:33 AM Jan 8 2018, 11:33 AM

|

|

QUOTE(ben3003 @ Jan 8 2018, 11:24 AM) i takut i terpakai the money  i see the market reports still positive and msia market will up at least until after election, so still got abit potential. Most likely gonna topup Ponzi 2.0, KGF and EI GL. U can always park it first in CMF to avoid using it. Anyway there is no right or wrong answer coz in the long run most likely still going up |

|

|

|

|

|

funnyface

|

Jan 8 2018, 11:35 AM Jan 8 2018, 11:35 AM

|

|

hmm....Based on current rate, the bull is not sustainable...  Smell correction a.k.a big discount coming soon...  |

|

|

|

|

|

ruffell

|

Jan 8 2018, 11:53 AM Jan 8 2018, 11:53 AM

|

New Member

|

QUOTE(yklooi @ Jan 8 2018, 12:09 AM) 2017 was a good year for EQ and yet you lost 4% with your 20%FI:80%EQ? mind telling what did your portfolio consisted of and how many % each? I guess you gung ho into gold and mineral  My 2017 equity port Eastspring dinasty - profit Interpac dana Safi - profit Gold - big negative Eastspring Japan dynamic - negativel Yes you are right about gold. Have to cut the loss and lick my wound. Now licking wound. But I see it as learning |

|

|

|

|

|

T231H

|

Jan 8 2018, 11:54 AM Jan 8 2018, 11:54 AM

|

|

QUOTE(funnyface @ Jan 8 2018, 11:35 AM) hmm....Based on current rate, the bull is not sustainable...  Smell correction a.k.a big discount coming soon...  That is what TA investment also mentioned..... Healthy Profit Taking Consolidation Should Ensue January 8, 2018 Author : TA Investment Management Berhad "......its steep rally in the last two weeks needs consolidation before trending up further to prevent a sharp pullback." https://www.fundsupermart.com.my/main/resea...sue-8-Jan--9275 |

|

|

|

|

|

WhitE LighteR

|

Jan 8 2018, 11:55 AM Jan 8 2018, 11:55 AM

|

|

QUOTE(ruffell @ Jan 8 2018, 11:53 AM) My 2017 equity port Eastspring dinasty - profit Interpac dana Safi - profit Gold - big negative Eastspring Japan dynamic - negativel Yes you are right about gold. Have to cut the loss and lick my wound. Now licking wound. But I see it as learning Maybe try to avoid gold. It's very volatile |

|

|

|

|

|

MUM

|

Jan 8 2018, 01:48 PM Jan 8 2018, 01:48 PM

|

|

|

|

|

|

|

|

funnyface

|

Jan 8 2018, 05:24 PM Jan 8 2018, 05:24 PM

|

|

Wah, 0% SC for investment fair participants only  |

|

|

|

|

|

spiderman17

|

Jan 8 2018, 05:30 PM Jan 8 2018, 05:30 PM

|

|

QUOTE(funnyface @ Jan 8 2018, 05:24 PM) Wah, 0% SC for investment fair participants only   ..then must attend... like a full work day 8.45am-4.45pm.. didn't mention if lunch provided? >> ok, saw it. food is not provided This post has been edited by spiderman17: Jan 8 2018, 05:34 PM |

|

|

|

|

Jan 7 2018, 09:27 PM

Jan 7 2018, 09:27 PM

Quote

Quote

0.0227sec

0.0227sec

0.25

0.25

6 queries

6 queries

GZIP Disabled

GZIP Disabled