QUOTE(jwgs0010 @ Sep 26 2025, 07:17 PM)

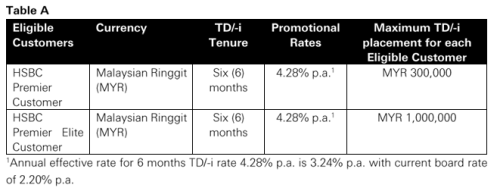

1) What does that 3.24 p.a effective rate mean? This is pure FD that does not bind with other investment or earmark savings right?

2) The criteria is to place 300k fresh fund to open Premier account, then another 50k minimum up to 300k for FD account? Or just 300k in the Premier account then eligible for the FD from the 300k in the Premier account?

I tried asking cs but different cs gave me different interpretation...

Also, I read their branch queue is awful, anyone have experience? Do I need to expect 2 hours+ to get this done?

Thanks

There is no requirement for with bundle Investment products for the 4.28% rate. Bundle with Investment products will entitle to other benefits as well.

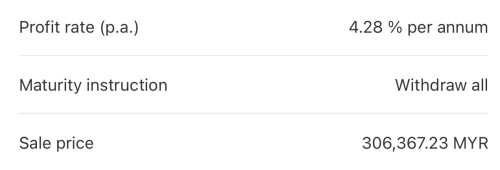

The quoted effective rate of 3.24% is as per explanation by kyleen. Well, one can withdraw FD after 6 months maturity.

Just need minimum 300k fresh fund to qualify.

Can use to open CaSa account n transfer to FD .

Actually, their so called Premier account is not a specific account but more of a status tagging. I have an old saving account with RM10 balance. They just tagged it ‘premier’ , so no need to open another account.

To avoid the long wait time, just tell them you want join premier banking, you’ll be assigned a RM who will process documents bery efficiently

Effective date of FD will be on cheque clearing date

Sep 25 2025, 08:42 PM

Sep 25 2025, 08:42 PM

Quote

Quote

0.0287sec

0.0287sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled